Round 2: Everyone Gets Emotional at Some Point

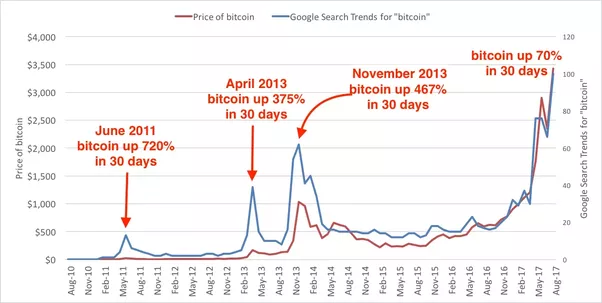

Consider all the examples shown in Round 1 and now look at how the cryptocurrency market is currently behaving. It does look similar to a bubble burst, doesn’t it?

–disclaimer: my opinions and views are not financial advisements. I have personally invested in projects mentioned in this article–

https://coinmarketcap.com

More than 70% of the market value was wiped out in just a few days. There is one really great aspect about all this: the market is still there and most companies are still here (with a few exceptions of course). The meaning is, cryptocurrency does not have the same behaviour as other markets due to the fact anyone can easily participate (no KYC, regulation, etc) and even though currencies like bitcoin take hits of -70%, they still exist and they grow past to new price record levels.

Who were the most notorious sellers?

Take a guess! Yes, dumb money, so small investors who bought at high prices and due to the crowd feeling scared, sold at lower prices.

All the above reasons are more than important for predictive analytics and crowd sentiment analysis platforms to exist and help investors making better, more informed decisions. Below are some questions, you as an individual investor should ask, when investing in projects. Imagine how hard it can be finding the right information without the power of AI and machine learning, analyzing both open-source data and the sentiment of crowds:

Are news generally positive or negative regarding each coin?

Are people posting positive or negative comments regarding a certain coin?

What is the market cap vs funding spending?

What are the reviews and ratings for each ICO?

What is people’s sentiment towards the team?

How engaged is the community around the project?

What industry does the coin affect?

Are there many similar coins?

These are just some basic questions many investors ask themselves when deciding to re-allocate funding or investing into a new company. Sanbase-low, for example, might help by analyzing important emotional information from crowds as well as financial indicators like projects ether burn rate, market capitalization vs burn rate and other financial data.

ICO are really tough. Great potential but insane risk