Regular daily update on BTC ta analysts opinions.

**My summary - short-term (next 24h) sentiment: bearish ** (last: bearish)

We dropped blow to 7'000.

Bear in control for now.

Very intense time ...

Update today very focus on key messages as I have limited time today.

It seems in the war of the bears and bulls we are entering another battle: Can the bulls create enough FOMO to create distance to the lows and overcome major resistance levels? If so we are not going to see the current levels for a long time.

Or do the bears lead the bulls into a trap and than smashing hard to the downside. That would create a lot of frustration and might lead to the capitulation which you would expect to be necessary to call the bear market over.

Bull scenario*:

- This down move is "only" wave 4 turning back up above 6'800.

- That confirms a higher low.

- In the following wave 5 we go higher than last swing high to around 9'100 area overcoming the death cross.

- Volume needs to increase.

Bearish scenario*:

- We dropped from the death cross making a lower high.

- We are going down further and stay clearly below the swing high 8'500.

- After breaking 5'800 a significant drop towards new lows in the range of 4'975 and 4'300.

*scenarios based on daily-candles - so around 4-14 days timeframe. See also definition section

Summary of targets/support/resistance of TAs

Short-term overview

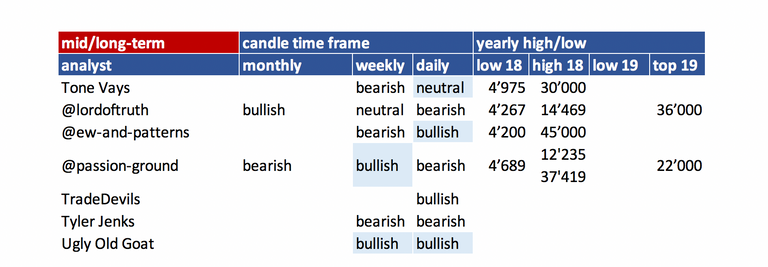

mid- and long-term overview

- please refer to definition section for time-horizon.

- be aware that mid- and long-term is mostly my interpretation of what analysts sentiment is as they not always clearly differentiate those time-frames. To interpret that consistently is very hard so please be kind with my interpretation.

- you can easily spot which analyst did an update

(block writing - grey ones don't have an update today).

Their changes are in light blue.

Helpful statistics:

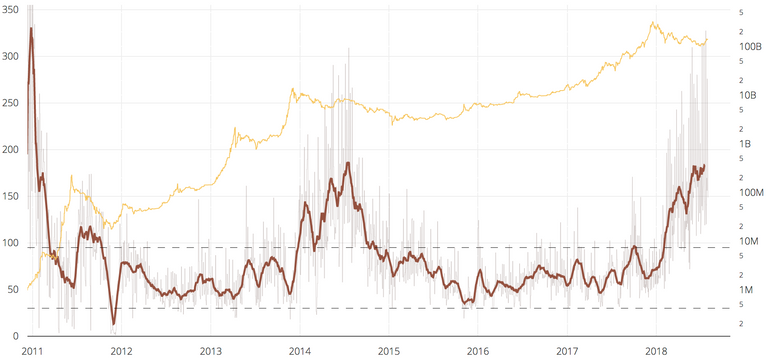

NVT ratio

Last high: July 2014 at 185.7

December 2017: 91.8

July 2018: 177.9

So the NVT is moving up to extreme levels. For those believing in this ratio this is seen as an sign of bitcoin being strongly overvalued.

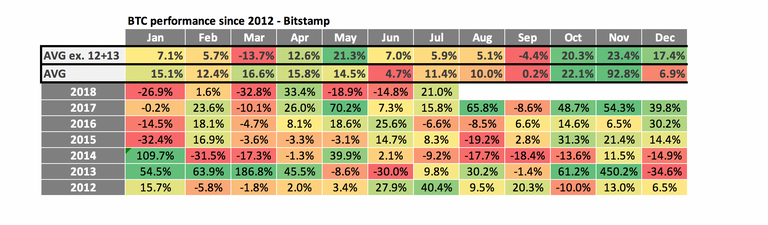

monthly performances

July was a rather decent month with +20% up - not correlating with July of other years.

August seems to be another mixed bag - lets see how it turns out.

News about the blog

- Added NVT ratio from

- if you are not familiar with it see definition section below.

- Forflies: I added him not knowing him too well - that is why his logo is in grey box - meaning under evaluation.

Analysts key statements:

Tone (bearish):

Monthly: We got rejected by 7 month MA (about the 200 MA daily). TD flipped colors. We backtested 0.618 fib and their is a > 50% chance that we now drop towards 0.764 at 4'789.

Weekly: SAR point are bullish. Bollinger bands- we are above midline last week but like before we might close this week already below.

Death cross reversed us. We made a lower high and he assumes that we are going to see a new lower low. He is waiting for us to trading and close below last weeks candle. That is his confirmation that the lower high is in.

Only chance we put in a higher low above 6'500.

-Add on: 6'315 setup trendline - if this one is broken it gets ugly.

Daily. We are on a 4 of 9 - so plenty of room to the downside.

12hr: We are on a 9 - he is expecting 1-4 candle correction sideways or to the upside before dropping further.

@lordoftruth (slightly bullish):

on holiday until August 5th.

TBitcoin price fluctuates above 8'000 barrier, trying to resume the

main bullish trend ( The trend is slighty bullish as long as the price above 7'650 ) supported by Stochastic Positivity.

But the price appears to be faced some bearish pressure ( As we expected in our previous post ) before the Major Resistance at 8'642 and might be forced to retreat from the climb, to test 7.650K before the moving ( In absence of another set of positive developments to sustain the climb ) towards 38.2% FIB level near 7.050K, supported by RSI Negativity.

Todays trend is Slighty Bullish. Trading between 7'650 and 8'280.

@ew-and-patterns (bullish):

Don't panic. If this alternate count is true, this is an expected panic sell, but there is no need for panic at all. At least not yet.

My primary count will be invalidated @ 6790 though. But this count will not be invalidated until 5777 breaks.

If it bounces @ 6825, 6666 or 6400 (or somewhere in the middle of that), then white wave 1 and 2 are already in! This panic sell fits the character of a wave 2 correction, fast and deep.

The next levels to watch for a big bounce are 6825, 6666 and 6400... If this is indeed already white wave 2, then white wave 3 is next! Target at least 10800, but potentially much higher.

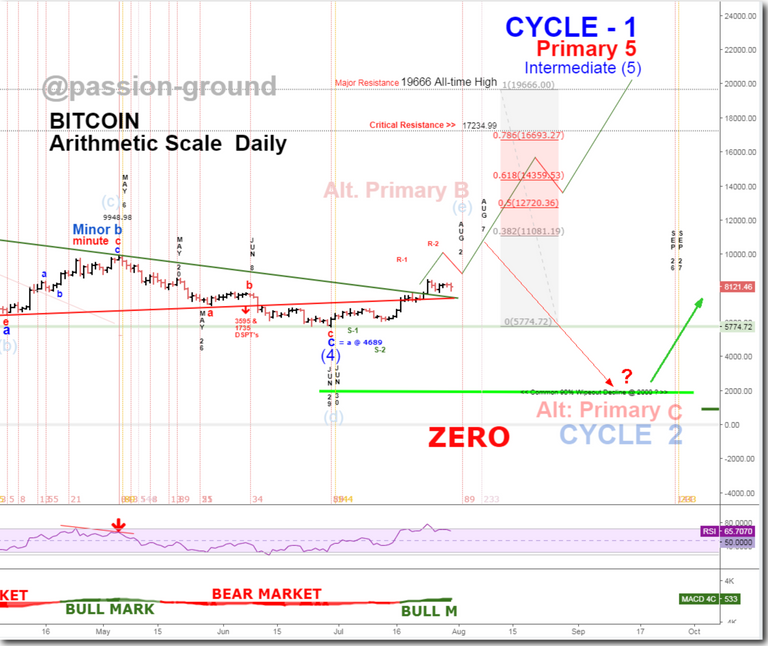

@passion-ground (neutral):

Financial markets of every stripe are like “Spinning Wheels” to one degree or another. BTC and cryptos are no different. What goes up must come down. And so on, and so on, and Scooby doo-bee doo-bee! Keep your “Blood, Sweat, and Tears” in check while riding these painted ponies – and let the spinning wheel spin!

Turn month August is upcoming. That could reverse our uptrend.

Daily: Bear Markets are dominating (MACD) - currently we are still in a bull market according to this indicator on that timeframe.

If we fall below red trendline we get a sell trigger to 3'595 - 1'735.

The most bullish count we are going up to Primary 5, Intermediate 5 to complete Cycle 1 at ATH.

The most bearish count is that we are in Cycle 2 and we come down to much lower level to complete it. Cycle 3 would have than a very bullish outlook.

TradeDevils (neutral):

He sees a long play at 7'310 turning to the upside. Set stop tight.

If we break below he sees next support at around 6'900.

UglyOldGoat (bullish):

Again, I define a trend as up when trading above 2 week highs. . . so trend was up at 6850. . . today we took out last weeks lows . . . so I am now a buyer after exiting at 8000+ . . . I missed the short play . . . but I am a buyer on a scale down.. . . use your timing indicators.

Hope this helps.

UOG

Crypto Cred (bullish):

Quick peek at the H4 chart.

- Blue Resistance

3 touch broken support turned resistance + very clear cluster just above it.

Confluence of resistance up there.

I’d be looking for bearish price action (break in market structure most likely on M5-M15 timeframes) to get short.

- Orange Cluster

This is the clearest intraday structure within the 6.8 area that everyone and their grandmother is looking at.

You could just box out the whole consolidation before that massive candle up and use that.

- Orange S/R Level 6300s

I actually like this level quite a bit.

Clean 2-touch broken resistance turned support, and it’s a lot less crowded than longing 6800s.

Froflies (bearish):

He sees us turning best case at 6'900. Next support levels are the new uptrend at around 6'600 and than support at 6'400.

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 03. Aug | here |

| @lordoftruth | 26. July | here |

| @ew-and-patterns | 04. Aug | here |

| @passion-ground | 23. July | here |

| @tradedevil | 03. Aug | here |

| Tyler Jenks | 18. July | here |

| UglyOldGoat | 03. Aug | here |

| CryptoCred | 31. July | here |

| Forflies | 04. Aug | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- The forecast time horizon of candles can be compared with approx. 4hr = 1-2 days; daily = 4-14 days; weekly = 4 - 14 weeks; monthly = 4 - 14 month.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

- NVT Ratio = (Network Value to Transactions Ratio) is similar to the PE Ratio used in equity markets.

Educational links:

- From @ToneVays: Learning trading

- From @lordoftruth: Fibonacci Retracement

- From UglyOldGoat: How to achieve the same results of a professional trader without taking the inherent risks

- From CrytptoCred: Several great educational videos - very structured and helpful

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

Hello! You are very professional. Thank you for the useful information. It will help many steemians. Have a great time @famunger.

You are saving me so much time!

damn these bears are strong

Great idea summarizing others expectations! I've subscribed.

very nice - I think the bears will dominate short term too