Announcing the First U.S. Federally Regulated Exchange and Clearing House for Digital Currency Derivatives

LedgerX Receives U.S. Federal Government License to Trade, Clear and Settle Digital Currency Contracts

NEW YORK, July 24, 2017 (GLOBE NEWSWIRE) -- LedgerX, the New York-based institutional trading and clearing platform for digital currencies, receives approval to operate the first U.S. federally-regulated exchange and clearing house for derivatives contracts settling in digital currencies.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/eafba6f5-a1ce-47da-81a0-0aaacfe7caef

LedgerX will be the first federally supervised options venue for bitcoin

Participants in the LedgerX venue will be able to obtain and hedge bitcoin and other digital currencies using exchange-traded and centrally-cleared options contracts. Initially, LedgerX anticipates listing one to six-month options contracts for bitcoin (BTC). Other digital currency contracts such as Ethereum (ETH) options, are expected to follow.

Regulated by the CFTC, an independent agency of the U.S. Federal Government, LedgerX will provide the surveillance and transparency institutional investors require. Eligible participants in the LedgerX venue will include registered broker dealers, banks, futures commission merchants, qualified commodity pool entities and qualified high net worth investors.

“A U.S. federally-regulated venue for derivative contracts settling in digital currencies opens the market to a much larger customer base,” states Paul L. Chou, CEO, LedgerX. “We are seeing strong demand from institutions that previously could not participate in the bitcoin market due to compliance restrictions against unregulated venues,” added Chou. “In particular, there is a desire for fund managers to hold financial instruments that are not correlated with the broader equity market, and digital currencies meet that need,” concludes Chou.

“These are exciting times to have a new digital asset class emerge,” comments Mark Wetjen, who sits on the board of directors for LedgerX’s parent company, Ledger Holdings. “I hope that the effort LedgerX put forward in the U.S. can set the stage for a global approach to this new digital asset class,” adds Wetjen.

“LedgerX’s registration is a historic milestone for derivatives and for digital currencies,” said Gary DeWaal of Katten Muchin Rosenman LLP, which assisted LedgerX during its CFTC application process. “To me, it is equivalent to the launch of currency futures back in 1972 that heralded the beginning of exchange-traded and cleared derivatives based on financial products,” concludes DeWaal.

The CFTC granted LedgerX a Swap Execution Facility (SEF) registration on July 6, 2017. LedgerX is a limited liability company registered in Delaware with its primary place of business in New York, New York, U.S.A. www.LedgerX.com

Dcorp is doing the same thing and is well underway.

https://www.dcorp.it/

More Good News )) Thanks!

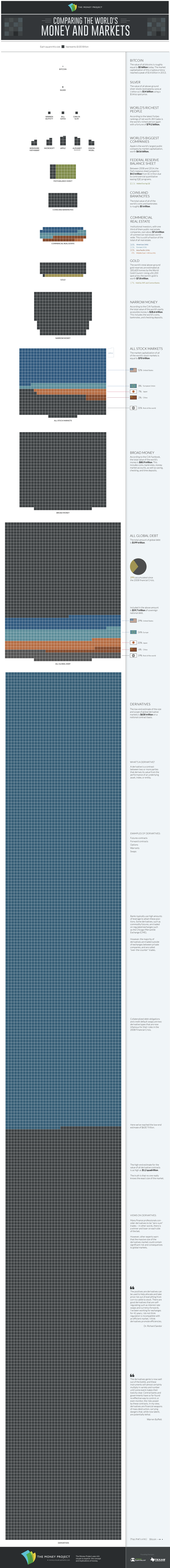

This is huge. Derivatives is a trillion dollar market. Here's a graph for perspective:

Yep,this will change the game!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.finanznachrichten.de/nachrichten-2017-07/41279468-ledgerx-announcing-the-first-u-s-federally-regulated-exchange-and-clearing-house-for-digital-currency-derivatives-252.htm

Thanks

That's crazy news !!!!

Yes , i think it's time to hold your cryptos )

Subscribed.

Hi, we are planning new ICO for Ai and data-science startup - GraphGrail Ai.

If you are interested, check please our announcement post, we have done $5000, you can check wallet. 30% bonus:

https://steemit.com/blockchain/@gromozeka/pre-sale-usd5000-done-graphgrail-ai-tokens-presale-you-can-buy-tokens-now-1-day-left

I'll check it up . Thanks