Bitcoin analytics and the most likely scenario for the Bitcoin price movements in the near future.

In this post I applied the following tools: fundamental analysis, all-round market view, market balance level, volume profile, graphic analysis, trendline analysis, Kagi chart.

Dear friends,

Another week is over, and so it is time to update trading scenario for BTCUSD, the benchmark of the cryptocurrency market.

Check past BTCUSD forecast

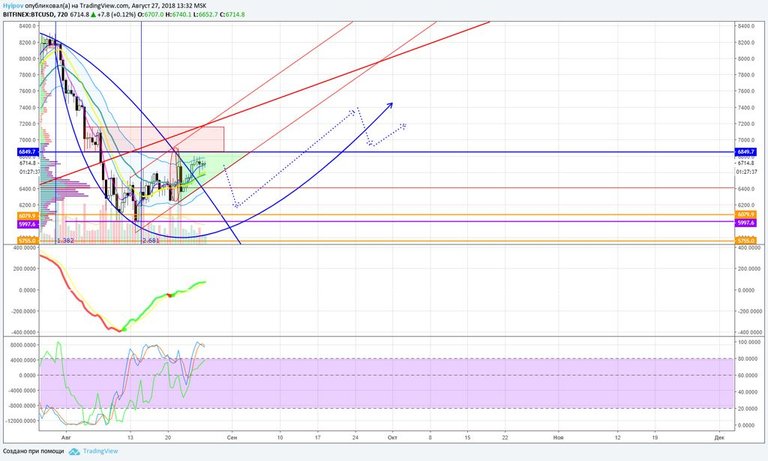

In BTCUSD price chart above, you see that the trading scenario last week was based on the development of the sideways trend and the emerging of the second bottom.

As it is clear from the Bitcoin chart above, the actual moves were different from the forecast. Finally, you see that the BTCUSD ticker is forming a rising wedge, which is a reversal pattern.

If the scenario, suggested in the previous forecast, worked out, the market would have a strong base for a natural steady growth. However, the manipulators decided to keep the market state unclear, when the price is growing on the constant verge of the overbought, forming bearish divergences and reversal patterns.

Of course, I can’t state for sure, but the BTCUSD price rise could be supported by the issuance of more Tether assets.

It is rather not about the direct influence of the digital coins issuance, but about the market psychology. As the Bitcoin market cap is about $125 billion, and the issuance of another 50 million or 100 million of USDT alone can’t influence the market so much. However there is a kind of unwritten rule that if new USDT are being issued, Bitcoin price is going up. Because so much attention is focused on the USDT issuance itself, this news bit alone can become the Bitcoin growth driver.

As it is clear from the BTC price chart above, the entire uptrend is accompanied with the issuance of new USDT. In addition, it occurs regularly, about once a week.

If they continue issuing more and more USDT, the BTCUSD price can well go up to 8000 USD or even higher.

Technical Analysis of BTCUSD

To find out, whether the market has the growth potential, let’s carry out the all-round view for Bitcoin technical analysis.

In Bitcoin monthly chart above, you see that Keltner channel is getting narrower, its central line is at 6153.9 USD.

In general, this pattern is typical for the sideways trend, developing inside the channel. The last August candlestick has formed a bullish hammer with a black body. To prove the reversal pattern, the current September candlestick must break through the previous high at 7756.1 USD.

In the BTCUSD weekly chart above, you see that the BTCUSD ticker has stopped at the Keltner channel’s central line at 7388 USD, having proved the zone to be the strong resistance.

MACD oscillators and RSI stochastic are bullish, and so, the ticker can well break through this level and go higher.

It is clear from the BTC daily chart above that the two trends have met. One of them was formed in July; another one has started from the current bullish wave.

At the place of their meeting, there is a narrow range, where the ticker is sandwiched between two trends. It is clear, that the ticker is being stopped by the stronger trend from above; and, taking into account the general overbought state (according to RSI stochastic), it will be easier for the manipulators to give up and move into a more convenient zone to go on bullish attack.

To analyze BTCUSD 4H timeframe, let’s apply the experimental Kagi chart (see the recent training article here).

As it is clear from the BTC chart above, the Japanese candlestick chart on the left indicates the bearish divergence with MACD indicator, and the MACD itself is painting a bearish rounding and a bearish tail.

It is important that the chart itself is in the local bullish trend, indicated by EMA.

The Kagi chart on the right is in bullish state. Both Kagi lines and MACD indicate the BTC price growth. Moreover, it is important that the level of the nearest waist in Kagi chart is at 6818.9 USD, and so, the bearish signal will be sent only after the level is broken through.

Summary of the Bitcoin price prediction:

Taking into account that BTC is supported by regular issuance of new USDT, and an extreme pressure, put on the market by both bears and bulls, the Bitcoin price is likely to be corrected downwards; but the correction will be inside the developing bullish trend. Therefore, the drawdown should stop near the upward channel’s bottom border, at about 6900 USD.

But in this case, the rising wedge will be broken through, and so, the bearish pressure will increase. That is where there will be an intrigue. Either the manipulators will support bulls and the wedge will be broader, or the ticker will form the left shoulder and the head and shoulders pattern will be complete, driving BTC down towards the pattern target at 6600 USD.

Anyway, we don’t have to wait for long. The final is soon and the situation is going to clarify at the end of the week, so that we can definitely state what will be BTCUSD trading scenario next.

That is my BTCUSD trading scenario. Go on following the Bitcoin price and staying informed on the cryptocurrency market. I wish my Bitcoin price predictions are useful for you!

I wish you good luck and good profits!

Regards,

Mikhail @Hyipov by liteforex.com