The cryptocurrency market deserves B+ grade in 2018, while expectations for Bitcoin seem to be only increasing. Or vice versa? Let’s consider the main trends that influenced the market this year, and also list the predictions for 2019.

Institutional Investors

Institutional investors – investment funds, pension funds, insurance companies, banks, or any other legal entity. Despite the fact that the participation of an institutional investor in the crypto market can be explained by quite reasonable reasons, for example, the search for new opportunities during the crisis, the media, and some market players interpreted them in another way. Now an institutional investor is some mysterious person who probably owns or will own smart money; this person is quite strong, since (as it is expected) will have a significant impact on the market, so that the retail investor may be slightly afraid of it, but, its presence in the market will be positive.

EXPRESS: institutions STILL bullish on crypto

Donna Redel identifies what attracts institutional investors into Bitcoin

Coinbase president: 2019 will be a great year for crypto institutional investment

Why does an institutional investor have such properties? Because, probably, the institutionals have some secret knowledge or control lever, according to which this market participant will be able to buy cryptocurrency cheaply and sell at a high price. Thus, an institutional investor acts as a trigger of the next bull run. It combines the figure of a savior and a big brother, although initially, it looks somehow detached in relation to cryptocurrency market, being a representative of traditional financial or social institutions.

Wide Adoption

The idea is supported by the expectation that the use of cryptocurrencies will soon be popularized. The creation of the Bakkt platform and the participation of such major companies as NYSE, Starbucks, Microsoft, and others, became the main argument of this concept (although Bakkt is often discussed in terms of institutions’ arriving). This assumption has been and also remains good because it is practically unrelated to the price of assets, and is more aimed at widespread adoption of cryptocurrencies among the population of the earth. And if this does not happen thanks to Bakkt, the otherpatent, the use of the blockchain by large firms, it will most likely happen through the use of dApps.

Such a forecast remains extremely constructive, even if it is not true. The ability to focus on the "ordinary" customer or user helps the industry to develop, producing more ideas and applications. At the local level, the idea encourages to invest, including in new projects. This is probably the point where the ICO is still alive. But here, however, everything is difficult, both at the level of investor interest and at the level of regulation of coin offerings.

Predictions & Analysis

News publications, traders and analysts make a lot of cryptocurrency forecasts every day. At the same time, many of them use predictive models of traditional markets. Sometimes these approaches work, sometimes not. In addition, some forecasts are based on the market structure and take into account the interests of various players, as well as algorithmic trading, which also causes interest.

🚀My @CNBCFastMoney $BTC indicator is saying go long here for #Bitcoin.

Jacob Canfield 🔥I Love Crypto YouTube Channel (@ILoveCrypt0) August 21, 2018

📈Average return on bearish tweets = 30%+ Profit.

📊If the indicator holds up, we should see #BTC price rally to $8500+.

🙏Share away, but make sure you follow and tag me.

👇LINK:https://t.co/djElEzroZn pic.twitter.com/mW5EGUG7Rf

)

)The most popular topics of discussion were the so-called bull, bear traps, and the dead cat bounce, some abstract models that probably took place or have a chance to happen in the conditions of the cryptocurrency market. Alternative methods that have been considered this year were Google trends and other sources, the movement of funds between large cryptocurrency wallets and other.

Hacks

Losses from hacker attacks increased in 2018 and can be approximately estimated at $1 billion. Coincheck, one of the popular cryptocurrency exchanges in Japan, has been attacked by hackers in January 2018. The cost of loses estimated at $534 million, which is greater than the Mt.Gox incident in monetary terms (in accordance with the old prices). In September 2018, Zaif, another local exchange, lost $60 million as the result of another attack. Later, Coincheck, Zaif and Mt.Gox hacks became triggers for strengthening the security requirements to cryptocurrency exchanges by the Japanese government.

195 ($170) million attack on BitGrail, Italian cryptocurrency exchange, Losing 17 million NANO is not what users expected from the service; the occasion provoked discussions and some theories also, according to which the exchange ended as exit scam. In June, South Korean Coinrail lost more than $40 million in NPXS tokens. And, recalling this event, we can’t say if it was a case of exit scam or something else. Starting from this point, Then, Bithumb, the largest local exchange, loses $31 million in another hack. Korea will also worry about ensuring the security of cryptocurrency exchanges, although market manipulations here are of prime importance.

Startups And Development

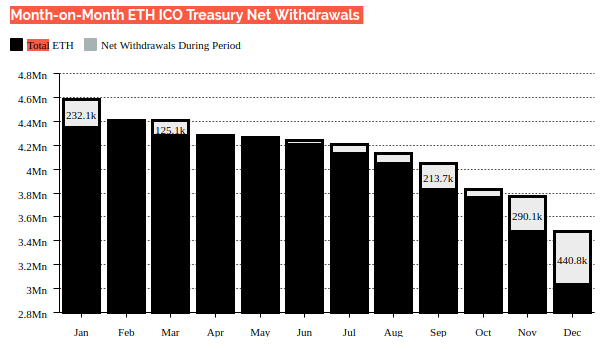

Today we have more than 1,000 coins of various quality, price, and popularity among investors. It is worth noting that most part of all the coins have been issued through ICO, and now the number of offerings has decreased. As the main asset, Ethereum, declined, ICOs liquidated over 420,000 ETH only in December, according to the latest data by Díar, so the last month of 2018 become the biggest withdrawal period of the year. In January, the total amount of ETH stored in ICOs estimated at 4,623,148 ETH and currently, this number has been reduced to 3,052,168 ETH. The rate of decline is about 2.5% per month.

ETCDEV (Ethereum Classic), Sirin Labs, Steemit and many other teams have cut their costs. First of all, the platforms reduced the number of its members (employees). The same, by the way, is partly happening throughout the industry. The prediction has come true.

Technology

The use of blockchain and cryptocurrency 2018 is supported by both individual users and private companies, but what’s interesting, many state institutions and banks are actively supporting cryptographic tools. The biggest thing here is probably Quorum, JP Morgan’s blockchain network based on Ethereum, which also becomes a basis for other blockchain networks. Such companies with high influence on the industry as IBM, Microsoft, Amazon launched their newest platforms and products, as well as registered a number of patents related to the blockchain technology.

However, private companies are reluctant to use blockchain for alternative payments or something similar, meanwhile, they still find it pretty useful to integrate blockchain as a security instrument. According to some forecasts, this trend will continue in the future. In fact, so far the cryptocurrency world is difficult to estimate from the demographic or another side, as much as its current impact on SMB is still not evaluated. Most of the studies are focused on the findings like "about 200 out of 300 companies surveyed would not refuse to use blockchain", which is presented as rthe eadiness of economy for mass adoption. Of course, it’s still early to say this.

Tightening Of Regulation

In general, global trends regarding cryptocurrency regulation can be evaluated as tightening. In 2018, ICOs, money laundering, other illegal activities and market manipulations led the list of formal reasons for regulation`s tightening. However, the interest of some institutions in a more complex approach to digital assets still has more impact on crypto than anything else, and 2018 only proved this.

So, at the end of the year, CCN writes that "Jay Clayton [the SEC’s chairman’ is coming under fire from Republican lawmakers amid growing concerns over his harsh approach to regulatory enforcement" and "Jay Clayton has shown the industry that he lives in an ivory tower" [law firm Seward & Kissel], while Forbes noticed that "In the spring, crypto regulation had brief moments of bullish sentiment emanating from Washington", but the situation became worse overall, starting this fall.

As for other countries, here the trends are generally the same. Regulation of cryptocurrency in Europe is controlled by the influence of the European Union, although some members, for example, the United Kingdom and France, are much more active in this area. "The crypto crackdown" also continues in China, where, according to Nasdaq (based on the TipRanks data), "yuan transactions make up barely 1% of the cryptocurrency’s global volume, and a majority of the mining operations are hosted in Siberia".

Alternative Assets

Some see derivatives as an opportunity to increase profits, but derivatives are also seen as a sign that the “traditional world of finance” accepts digital assets and even bets on them. Although derivatives retain only one property of cryptocurrencies, its speculative nature, futures, expected ETFs products and so on also affect the underlying market, namely the cryptocurrency market. This year such new derivatives as swaps, ETNs, various indexes have been issued, but media also reported on the possible release of Ethereum futures (and that the US CFTC is actively studying the issue), and, of course, Bakkt, Nasdaq, and ErisX’ Bitcoin futures launch caused a lot of noise.

Quite recently, it was reported that crypto derivatives platform Huobi DM breaks $1 billion. Meanwhile, OKEx launches Bitcoin perpetual swaps. In this context, retrospective studies were conducted: there are different opinions on how futures (and other products) influenced the cryptocurrency market, and how deeply this influence is.

2019 Predictions

These predictions look much better than what the crypto community expected before 2018. Cryptocurrencies may appear on NASDAQ already in 2019, SEC is legally obliged to decide on a number of issues, not to mention the fact that many new platforms are already preparing to enter the market. Predictions about Bitcoin price vary, so it is not known whether there will be any changes in the new year, and if so, which ones, and whether January will contain a piece of flat if try to model the future market.

High Prices Will Come Back, New ATHs Are Yet To Come

That is, "the high prices/the hype" will come back again over time. The pattern was trendy until about the middle of this year and was supported by a fairly wide number of investors. Psychologically it could be perceived as the second coming. During this period, the media were broadcasting images of prophets and faith. By the way, 2018 is the first year in the Bitcoin’s history, when the price of an asset compared to last year was in the red. At the same time, it is still in the green zone compared to all previous years.

On the other hand, the year was full of extremely negative forecasts that were not fulfilled ($2000 for 1 BTC, $1,500 for 1 BTC ...). Market players who supported negative forecasts also participated in the discourse on Bitcoin beliefs and expectations, but this part of the crypto-community, unlike believers, expressed extreme disbelief in the further growth of cryptocurrencies. They look like the other side of the same coin.

- PWC is waiting for institutional investors to come in 2019

- BlockTower Capital believes that 2018 would be the end of crypto’s "distress cycle"

- Sheila Warren: "A cooling crypto market will bring change we need"

- Michael Novogratz: BTC breaks $10K "by the end of the first quarter of 2019"

- Fundstrat: $36,000 by the end of 2019

- Jeremy Allaire: it is certainly going to be worth a great deal more that it is today

- Erik Finman, the guy who brought BTC at $12 when he was twelve, actually doesn’t believe in Bitcoin long-term strategy anymore

- Dovey Wan: "bloodshed in the markets we’ve seen in 2018 is likely to continue into 2019"

- Elly Zhang: "we need a dose of realism"

- Mr Ayre: BTC will be "worthless and have zero value" in 2019

- Bitcoin falls as technical indicators point to more pain in 2019

- Vitalik Buterin: "days of 1,000-times gains in crypto are over"

Cryptocurrency news this week (24.12-30.12):

👉 Bitcoin Core 0.17.1 released l Bitfinex will be offline on 7th January 2019 l Kraken enabled BCH/XRP margin trading l Crypto volatility returns

💱 Huobi launches EOS-oriented exchange l OKEx launches ETH perpetual swap l Binance launches ALTS market

🏛️ Japan publishes rules for crypto services l US DLA thinks there’s a lot of potential in blockchain l Bank of America fills for blockchain patent

👁🗨 90,000,000 XRP transferred from one wallet this week l Bitcoin Private covertly minted its supply