What is Tezos?

Decentralized blockchain that governs based on commonwealth. Tezos is designed to allow for automated upgrades in a decentralized manner, potentially solving a problem with governance experienced in systems like Bitcoin. This Proof-of-stake consensus system is amendable (upgradable) on-chain by the stakeholders (you the people).

Ecosystem features privacy, smart contracts, and an economic model designed to provide incentives to those staking.

Could this be a competitor to Ethereum?

In this article, we explore the facts of this exciting and highly

anticipated Initial Coin Offering (ICO).

- What makes it different from other blockchains?

- How the Crowdsale will function, and how to get invested.

- Key Players Involved.

- Controversy surrounding Tezos.

What differentiates it from other Coins/ICO/Investments?

- True "on-chain governance" allowing amendment of the rules governing the protocol development.

- In short, power of change isn’t centralized around large mining outfits or development teams, but by the stakeholders of the investment (you), as is the case plaguing other blockchains such as Bitcoin and Ethereum.

- Ethereum allows anyone to create a token (unique rules/usage), which Tezos allows but with expansion that can be added and voted upon by stakeholders.

- Future proofing ensure self-mending incentives and adaptability to innovations as required. By allowing stakeholders to coordinate on-chain, the network also allows for the creation of bounties to implement specific features or discover bugs.

- Tokens not only power smart contracts in the network, but also allow votes on protocol amendments

- Proof-of-stake algorithm affords better scalability and transaction throughput vs. Bitcoin style proof-of-work.

- Fresh code base focused on Security (formal proofs of correctness, upgradable) and Privacy (similar to Zcash’s proof of circuit protocol with modifications).

- Programming Language utilized is OCaml, a Machine Learning language with speeds comparable to C++ (learn more here OCaml.org )

- In contrast Ethereum uses Solidarity

- Usability with plans to develop light client libraries for other languages, and IDE

Please right or control click links and open in a new window

Deep Dive into the Code base

Deep Dive into the Principles

What should you be aware of, if participating in the Crowdsale?

- No cap in funding, only time.

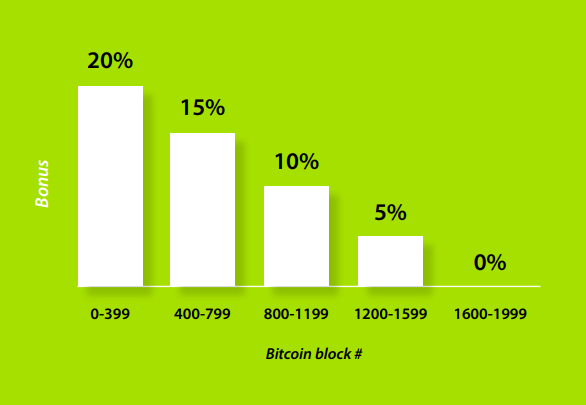

- Crowdsale will last for a period of 2,000 Bitcoin blocks, (1 XBT) will lead to an allocation of five-thousand tezzies (5,000 XTZ) plus a time dependent bonus

- Incentivized bonus outlined in the chart below

- This crowdsale will fund:

- Development/ engineering (currently annual cost of $900,000, four year projection 3.6 million).

- Research, legal services (headed by Doug Barnes of DLS), communications and marketing, business development (undetermined cost)

Crowdsale Incentives for early buyers

How to buy?

Do not purchase from anyone promising early admittance!

Go the following Tezos site, and provide your email for instructions.

Be prepared with bitcoin or ethereum

Please note: This following is a culmination of hours of unpaid research and careful selection of critical points in an effort to help the steemit community invest wisely. Being a small fish here, would really appreciate an upvote on this, if it helps you in anyway. Thanks in advance, and be sure and follow me, as it means more than the financial rewards (i.e. validation).

Who are the Key players?

Kathleen & Arthur Breitman (DLS) Founders -

- Arthur Breitman: Former employee of Goldman Sachs and VP at Morgan Stanley. Previously advisor in Zcash. Arthur Breitman medium feed: @arthurb

- Kathleen Breitman: Worked for Bridgewater Associates (hedge fund founded by Ray Dalio and Accenture), Wall Street Journal. Kathleen Breitman medium feed: @kathleenbreit

Tim Draper : Billionaire Bitcoin Investor as well as other known ICOs

What are the controversies / challenges?

- On-chain governance is a controversial topic (self-serving exploitation) (Tezos answers to this

- Founders (Kathleen & Arthur Breitman) get 8.5% of the fiat proceeds in cash in addition to 10% of the tokens through there controlling entity DLS. Along with the Tezos Foundation keeping 10% of tokens, plus fiat. Due note, this is addressed in the Transparency Memo with excerpts of the importants points* with a link provided below. (If issues were raised, SEC might step in and have a target to make example of)

- The Tim Draper angle has been heavily marketed outside of the organization, leaving some to feel it’s overhyped. Valuation will be difficult to determine.

- OCaml Programming language adoption is low, but may change if a profitable venture is utilizing it.

- Tezos launch may affect ZCash worthiness.

Except from Transparency Memo

Validates level of transparency this group provides.

Additional links for further research provided at the end.

Dynamic Ledger Solutions (DLS)

Founders: Kathleen & Arthur Breitman

Kathleen Breitman medium feed:

@kathleenbreit

Arthur Breitman medium feed:

@arthurb

DLS owns all of the Tezos-related intellectual property (IP), including the source code of the Tezos cryptographic ledger.

The Tezos Foundation:

Directors: Johann Gevers, Diego Ponz, and Guido Schmitz-Krummacher

As a legal entity, it operates independently from DLS, though DLS advises the Foundation closely on technology. The Foundation and DLS have negotiated a contractual agreement in which the Foundation will acquire DLS and release its IP under a free software license (MIT license).

DLS has taken proactive steps to limit the Foundation’s risk in this acquisition, specifically:

- The Tezos blockchain must launch and operate successfully as a public blockchain for a period of three months before DLS’ shareholders can receive any compensation for their shares.

- It must work substantially as described in our white paper and technical papers and be consistent with the features described to the community prior to the fundraiser.

Only at this point, and not before, DLS shareholders may exercise the right to receive payment for their shares.

Payment Structure

Payments to DLS are contractually prescribed via the following criteria

- No payment will be made unless and until the terms in the preceding section of this document have been met.

- Once met, DLS’ shareholders will receive 8.5% of the contributions made during the fundraiser.

- In addition, DLS’ shareholders will receive a 10% allocation of the tokens in the genesis block, placed in a smart contract that will vest monthly over a period of 48 months.

Informative Links

Again, thanks for the suppport with your upvote!

Interested in cryptocurrency? Check out my post on bitcoin price vs. value

its Awesome Thanks for sharing

''Keep Steemiting like this''

Upped your post

And hey ? if you want to know about cryptocurrencies? Follow my channel

Follow > Cryptoking

Nice updated collection of post, following ya!