BTC has had a good week. Even though it has not broken through the $11,800 level, it has outperformed the USD and especially the US stock markets. That is a sign of strength.

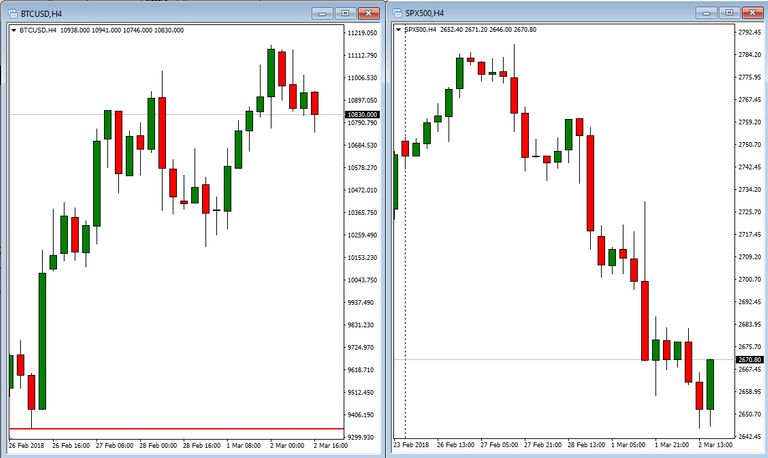

Consider these 4 hour charts of BTCUSD and S&P 500 put next to each other:

As we can see BTC bounced back from the drop last week and is at the moment up over $1400 from the weekly low. S&P 500 reached a high of 2788.00 on Tuesday and has since fallen hard. It has, in fact, dropped more than 1400 points!

So even though the rally of BTC is not that impressive it has relatively speaking been stronger than USD and much stronger than the US indices. In terms of macroeconomics that is a sign of strength, and it signals possible future strength. The fact that BTC did not follow suit with other markets against the dollar is promising.

USD calendar

Next week is the monthly job numbers week in the US. This can potentially move BTCUSD strongly, up or down depending on the numbers.

- ISM Non-Manufacturing PMI - Mon March 5 at 10 EST

- Non-Farm Employment Change - Fri March 9 at 8.30 EST

Happy trading!

This is not financial advise, everybody is responsible for their own trading. I am just sharing my own analysis of the markets.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by mariuse from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.