Today is the 18th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

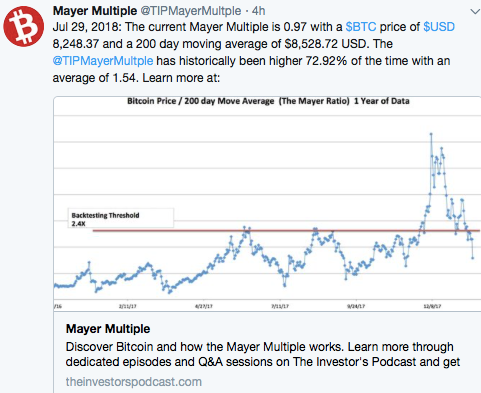

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

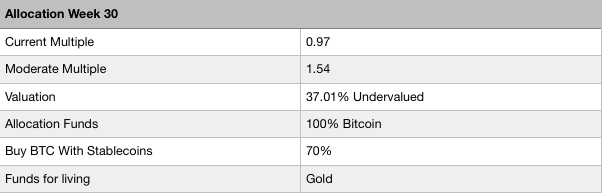

The current multiple

Weekly allocations of funds

The protocol will be slightly boring till we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 13,646 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

SEC denies Winklevoss Bitcoin ETF again

The SEC denied the Bitcoin ETF proposed by the Winklevoss twins again this week. The price tanked a little bit on the news, but recovered one day later. Fundamentally nothing has changed, this ETF was expected to be denied. The market is waiting for the decision on the ETF proposed by Van Eck, the outcome on this decision will be much more important for the market. The fact that the price recovered pretty fast after the event is bullish, it means that the market is not that depressed anymore.

https://www.cnbc.com/2018/07/27/bitcoin-loses-steam-after-sec-denies-winklevoss-etf.html

Biggest Lightning Node goes offline

Andreas Brekken, the CEO of Shitcoin .com just closed his Lightning channels and does not own the biggest node in the network anymore. Andreas came in the news a few weeks ago when he opened channels for 32 BTC and owned half of the value locked up in the Lightning Network. After he set up his node the total amount of bitcoins in the Lightning Network grew from over 60 to over 100.

Today, without him the count is around 80 and we are heading to 100 again. The closure of the node is good news since everyone expected that it was done to spread FUD about Lightning. It is still advised to not lock up big amounts of money in the Lightning Network, and the fact that nothing happened to his funds can be seen as a positive test result.

BTC has improved greatly in one year

The 1st of August it will be exactly one year ago that Segwit was implemented. In this year Bitcoin changed quite much, it has improved a lot. Through Segwit 2 MB blocks are minted regularly and exchanges created a lot of free blockspace by batching transactions. Also Lightning Network is growing exponential and becoming more reliable every day and Liquid is stealing use cases from Ethereum in a scalable and secure manner.

This all was possible because of the implementation of Segwit, that is making Bitcoin more efficient onchain and is the foundation for offchain scaling. If we maintain this pace of innovation for a few year the Bitcoin blockchain will be ‘the Internet of money’ and alt coins will be obsolete!

BCH below 0.1 BTC before one year anniversary

BCH is having it’s birthday the coming week, the 1st of August it is exactly one year ago that they forked off from Bitcoin. BCH was created to speed up scaling, but because almost nobody is using it they can only create 50 KB blocks while the capacity is 32 MB. Seen transaction count BCH is still heavily overvalued compare to BTC, LTC and even DOGE.

The price is on the edge of sliding under 0.1 BTC after a set of pump and dump events in the last year. The outlook can’t be seen as bullish at all, Bitpico is attacking the network in a stress test, a contentious hardfork is looming, a 51% attack is extremely easy and without Ver or Wu pumping the price it is slowly dying. The BTC community is looking forward to the halving because the supply will go down and thus the price up, for the BCH community it could be a nightmare because the halving will happen earlier in BCH and miners will leave to BTC because it is then WAY more profitable.

When no other pump and dump happens or the BCH price doesn’t get pulled up by bullish BTC sentiment it will probably end badly……………….

The Bitcoin price is up this week

The Bitcoin price rose from 7413 to 8220 this week. The sentiment is clearly changing to positive and important technical levels are broken. There was not really much deciding news this week, the still bullish sentiment created by the Blackrock announcement of the previous week is still pushing the price up. We are 3% under the 200 day moving average today, when we break through the Mayer multiple will be above 1 and many investors will claim that the bear market is over. This might fuel the next bull run!

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 27.08% of the time. Since the multiple today is 0.97 while the moderate is 1.54, there is 37.01 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Dapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table and an ETF is coming closer. Short term sentiment is neutral to bullish, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Coins mentioned in post:

As expected the weekend saw very slow movements within the crypto currency market, with prices ranging between $8,060 - $8,310. Price consolidated mainly around this area for the majority of last week, unable to breakout of this range and continue its movement. This could be a very good thing, as consolidation within a strong area can often mean price is slowly gain strength and will eventually breakout, which way is breaks out is still hard to speculate.

When we go down to the 4hr chart we can see the clear consolidation and range that price is ranging within. Late last week price broke to the downside but it was only momentarily, with price being rejected at the $7,800 region and quickly shooting back within the $8,060 - $8,310 range. I wont be actively trading BTC until it clearly breaks this range. If price can break to the upside and close above the major psychological level of $8,600 which i believe it will, we could see price take off towards the $10,000 region.

This crisis will exist because people are purchasing crypto currency therefore one is supposed to engineer ways if making money online

Nice work dude, following your work, please follow me

Your post had been curated by the @buildawhale team and mentioned here:

https://steemit.com/curation/@buildawhale/buildawhale-curation-digest-08-02-18

Keep up the good work and original content, everyone appreciates it!