General Tone:

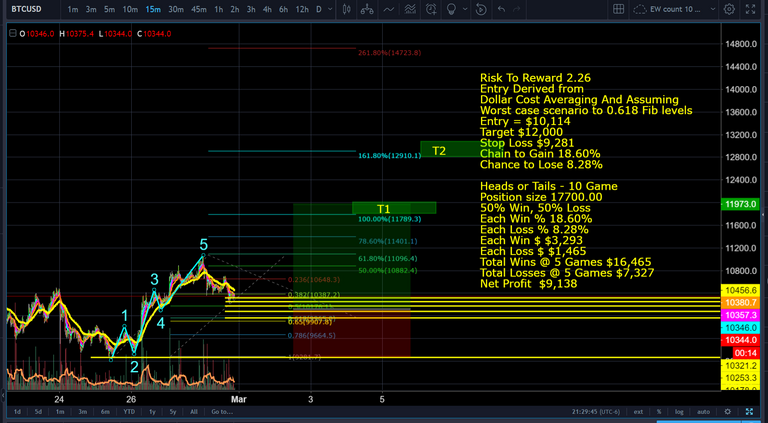

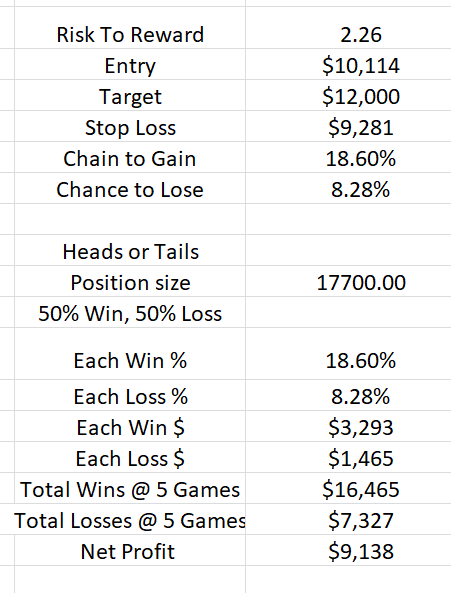

With proper risk management, I see highly acceptable R:R Ratios of 2.26+

We may bounce between the 0.382 and 0.5 fib regions

Swing low support near $9,291

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Neutral

Short Term Bias (Today) - Neutral

Long Term Target Prediction - Primary Wave 3, $35,000+ by 2019

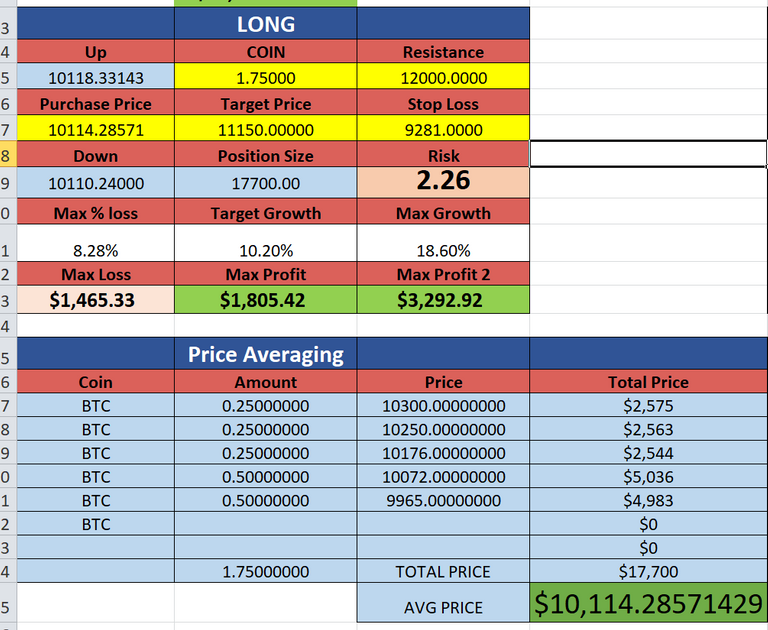

With proper dollar cost averaging and laddering our buys, assuming a bounce with a swing low of $9,291 support range, we can see a great set up. This also assumes a worst case scenario of possibly heading to the $9,900 range. Though buying on strength to average cost is recommended if the uptrend is confirmed

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Lesson 23 - Fibonacci extension, Fibonacci Retracement, Elliot Wave, Shorting, Playing Downtrend - Summarizing Feb 21 BTC + ETH

Lesson 24 - Customize RSI Alerts & Multiple Charts, Pro Features of Trading View

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If you think I've helped you tremendously, donate crypto to my dog's tequila / vodka problem.

BTC: 3FYAk7kMXP21S2hFvr7GrANAEDwxknCjCS

NEO: ANNmGUDAoFZs52dEkckQoL1vw34sxiV4Ey

EOS: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

Ethereum: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

LTC: LPHXW5WGSSES6RkZ9VXQe76YdLPCUWH1Ev

Bitcoin Cash: 1MaR7nSeVTbu894Xf8gLTNK6xvKZ2hNpbx

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 2640750089

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

Thanks for dine great info.

Thanks Phil - I upvoted this one.

Upvoted ☝ Have a great day!

@philakonecrypto take your upvote back from @hotpacks he says this on every single post and he doesnt even upvote them

Learn a TON from you!!

Thanks!

Champ as always upvoted too as I'm finally on Steem!

<3<3 nice to see you here.

great job Phil

So good to see you back at it!

Thanks and upvoted. How come your post's payout is only a couple of bucks while the other guys has few hundreds dollars? Is it based on vote count or something else?

Whaaaaaaa this was so good! Love it

shakalakaboom! hehe philakone4life

Yess! More risk management!

What the fuck, this is such good shit. Honestly, thanks dude.

I have donated to the crypto piggy and upvoted. However I believe perhaps a kidney donation might be in order being that I have two. Holla at me if you are ever in need of one or if you just wanna sell it on the black market.

The legend is back! Thanks a lot for all the work :)

Count seems really hard at the moment. After the 5th wave high at 11050 ish, the C wave correction is really bothering me. It just doesn't feel like wave 3/3 in the C is long enough and that would seem to be what's leading you @Philakonecrypto to expect a further 5th wave on 3/3 like you did in your video (as most of us were). That it has bounced back to test the upper resistance has surprised me. So now I'm wondering if there could be another big fall before resistance is finally decisively broken. What do you think? Is the C wave really over?

@philakonecrypto Thanks for more great content as usual! About the monetization...why not use affiliate links? Remember, it's not shilling if it's actually helpful and is a great product. I know in one of your recent videos you talked about tradingview. I am looking to start a subscription and would gladly use your affiliate link.

Thank you

I tracked down the excel sheet- but the google drive link doesn't work anymore? Is it because of the hack?