Back in August, I wrote an article about the pump of Bitcoin after the Bitcoin Cash fork. I was right about the increase, but I was wrong about the price.

Between now and next month, we're about to get 2 new Bitcoin forks, yes two. Similar dynamics are in action, and I have reason to think the price will go to a new ATH. I decided to put my thoughts together in this article and to share them with you.

I'm not a professional trader, so please don't use this article for your trade.

Medium rare steak

Let's get started and let's see what meat is on the barbeque:

Bitcoin technology is stable, Segwit was implemented and most exchanges are activating the Segwit wallets.

The flood from Moby Dick is over (for now!?), mempool and fee are lower.

China FUD for the exchange ban is over: exchanges are going to be regulated and reopened.

Jamie Dimon FUD is over: this FUD was overrated to start with, Dimon has been shooting at Bitcoin every year starting 2013,

2014, 2015, 2016 and 2017.

Normally I'd say that Dimon is a candle maker talking about light bulbs, but this case is more complex: JPMorgan is investing in Blockchain at many levels, filing patents, taking partnership with ZCash, joining the Ethereum Alliance, and we recently discovered that a division of JPMorgan was buying Bitcoin somewhere in Europe. I've reason to believe that JP Morgan like other banks are trying to slow down Bitcoin, to enter at lower levels and to push their own cryptocurrency solutions.Morgan Stanley CEO tweeted "Still thinking about #Bitcoin. No conclusion - not endorsing/rejecting. Know that folks also were skeptical when paper money displaced gold.".

Goldman Sachs consider starting investing in Bitcoin . First, they ignore you, then they laugh at you, then they fight you... then some of them will join you..., then you win.

Bitcoin Gold fork: free airdrop money! Bitcoin Gold it was originated by Jack Liao founder of Lighting ASIC, a mining firm from Hong Kong. This fork may become unprofitable once out, so miners may fly away. Coinbase is going to offer any forks to their customers, according to Charlie Lee they have to. Because of this reason.

Bitcoin Segwit2x fork: Charlie Lee, Bitcoin.org and a lot of miners are against it. Roger Ver, Jihan and other Bitcoin figures who were for Bitcoin Cash are pushing now for Segwit2x. This fork may be eventually aborted, but considering how many forces are at work to make it happen, I believe it will happen.

What to expect?

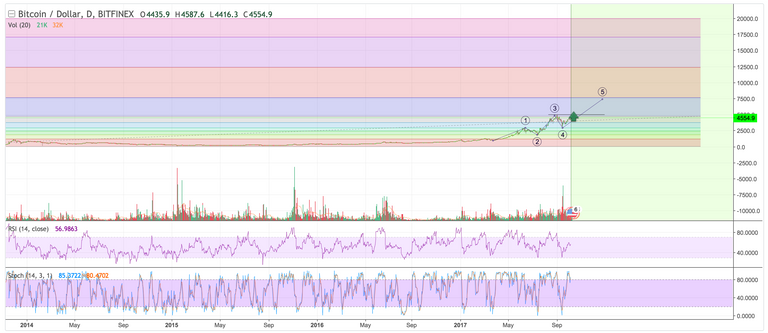

Most Trading Analysis of Bitcoin look very bullish with a target of $6000 or higher, in the following chart is $7600:

What will happen if we will see a 5 digit number, what if we're going to see even $15,000, like Masterluc predicted?

I know, I know, that's insane, but Bubbles are irrational, they're about hype and insane FOMO. In 2013 the price went up a 10 fold in just one shy month, from $120 to $1,200. The price from $5000 to $15000, is "just" a 3 fold, this doesn't even make it a bubble, so a crash of the price could be just a correction.

Theory explained

All these forks are pushing people to move their Bitcoin into the wallets, and a big percentage of these won't move back. This reduced amount of Bitcoin in circulation, which increases the price.

November is exactly 4 years from the previous bubble. We've similar trends to 4 years ago, numbers like this create psychological levels.

If the Segwit2X fork happens, it will create new money from thin air. This money will create a new influx and volume, which can FOMO push the price to the new ATH.

[Google searches are at ATH] (https://trends.google.com/trends/explore?q=bitcoin and news coverage increased.

The economic and geopolitical situation is pushing people toward safer assets, like Gold and Bitcoin.

Proof Of Fork

While many already panic sold. The only strategy that proved to be ALWAYS profitable with Bitcoin, is to *HODL for 3 or 7 years, and may waiting for more free coin from forks (POF).

A safer strategy is to sell some of your profit as the price goes up, do it for mental sanity and to reduce your risks, even Vitalik sold some his Ethereum early on.

Conclusion

However November will evolve, about one thing we're sure, it's going to be a very very interesting month for Bitcoin.

Please let me know what you think, share your trading analysis, and let me know what you think will happen to the Altcoin (I avoided that argument altogether).

*HODL: this is not one of my writing dyslexia, hodl is how everyone refers to Bitcoin holding, it came from an old Bitcoin forum post, here's a Reddit that explain the history of "hodl"

Follow me on steemit, twitter, linkedin.

Federico Ulfo

A creative software engineer into blockchain, wine and lot of other random things

OK, guys, a few things I forgot to add here:

I hope you're right! And I actually think you are. There's just one thing that worries me, and that's the idea of big countries banning crypto's. Russia is probably going to do so, which makes it likely that more countries will follow. Sure, it won't kill bitcoin, as people can still use it even if it's banned. What I'm afraid of is the price drop if exchanges are banned. It'll be huge. What are your thoughts?

Do we see a correction to this 5700 price?

After a small correction to 5300, today the price got to a new ATH of 6000. So what's next? Here's an interesting TA:

I came across this interesting post, https://medium.com/@pterion2910/bitcoin-pump-thoughts-9b76219ee390

According to this a safe exit is at ~10k, but the price may arrive to 12k, and top even 17k. I think the safest strategy is to take some gain out as the price go up. Keep in mind that, FUD may arrive any time, and the price can drop at any moment regardless the technical analysis. So hold, don't panic sell, and play safe.

Here's another very interesting point of view:

If Bitcoin follows the pattern of Gold as it did until now, we should see ~$10K in November and a 50% correction immediately after.

This post deserves an update, so here I am.

Bitcoin is at 11K.

Many good news:

...

$15K is at the horizon and it may arrive before the EOY. Everything looks so bullish that in 2018 we may see a 1 trillion market cap. What to do when that happen.

Let's do some risk management with your portfolio, several corrections may happen, and although we're still strong bullish, there will must be a reversal to a bear market, even for 1, 2 or even 10 years, a bear market still don't exclude Bitcoin long term vision of global adoption.

Board diary, December 6, 2017 - Bitcoin is trading at $14.900. We reached the $15K from Masterluc prediction.

He also predicted 40k - 110k by 2019. So brace yourself!