After discussions at the World Economic Forum in Davos, world leaders are preparing to discuss crypto-currencies at the forthcoming G20 summit in March. Many leaders seek to regulate crypto-isolation, but if we examine the consequences of Chinese rules, we find that they were ineffective.

Traders based in China started trading on the cryptocurrency exchanges in Hong Kong. The Chinese government only increased the risk for its traders, because now they are forced to buy Bitcoin with a premium of about $ 1,200 compared to other exchanges.

Leaders and central banks, rather than blindly opposing cryptic currencies, must outline a strategy to cover them after discussion with cryptographers.

BTC/USD

Bitcoin bulls defended a mark of 10,000 dollars over the past few days. But they could not raise prices, which is a concern

The Crypto currency has broken out of the downward trend line, which indicates that the impulse on the lower side has decreased. We can expect a few more days of the restriction of the range between $ 10,000 and $ 12,000.

It is difficult to predict whether it will move up or down.

If the bulls manage to escape from the 20-day EMA, which currently stands at $ 12,218, the pair BTC / USD should rally to a downward trend line. Traders can wait for a break above $ 12,200 to withstand about 4 hours, and then buy from a stop loss of $ 9,900. The target is to move to $ 14,500.

On the other hand, if the bears break below $ 9,900, the sale is likely to intensify. The next stop on the lower side is $ 8,000.

Since we are not sure of the next step, we have found out both possibilities. We do not find any settings until the price remains within the range.

ETH/USD

After touching the intraday high of $ 1,102.2 on January 25, the currency fell to the bottom of the trendline yesterday, January 26. Now, if she manages to break out of $ 1,110, we can expect that it will rise to $ 1,174.36.

As soon as the pair ETH / USD leaves $ 1 110, traders should raise the stop-loss from the current levels of $ 840 to $ 950. This will reduce our risk. Partial profits can be booked at the level of 1170 dollars, and stops on the remaining positions should be increased.

BCH/USD

Bitcoin Cash has a history of entering small trading days, before a significant breakout or breakdown. We saw a similar model in August and October last year, 2017.

Currently, the price is stuck in a tight range of $ 1,479 with a lag and $ 1,700 in terms of growth.

Any breakout of this range is likely to face resistance on a 20-day EMA, a downtrend line and $ 2,072.6853.

On the other hand, support at the level of January 17 is $ 1364.9657 and $ 1141.

We do not find any traded BCH / USD pair

XRP/USD

"Ripple" continues to trade in the range of 0.87 and 1.74 US dollars with a downward slope. If the crypto currency breaks down at $ 1.09, it is more likely to fall to the lower end of the range.

The XRP / USD is trying to find any buyers. Therefore, we must wait for the Crypto currency to rebound from the lows of $ 0.87 before the start of any long positions.

The likely bearish crossover of the 20-day EMA and the 50-day SMA is yet another negative sign. We expect that the trading operations associated with the range will continue for the next few days.

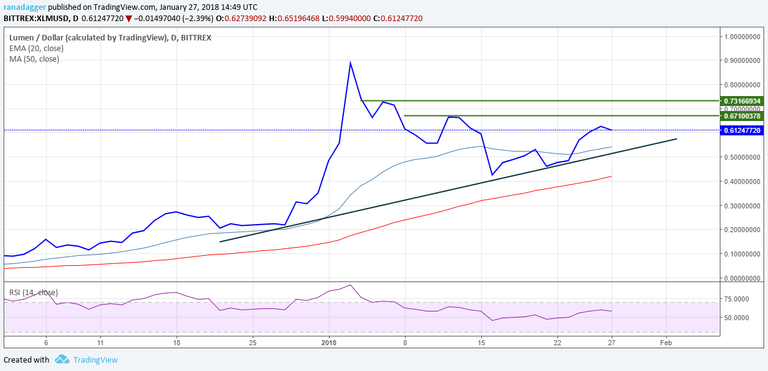

XLM/USD

Stellar is a relatively stronger crypto currency, because it quotes above both the 20-day EMA and the 50-day SMA, and both tend to rise, while most other major currencies are bearish crossover moving averages.

If the general mood remains subdued, we believe that the pair XLM / USD will face resistance at around $ 661. Currently, we do not have a suitable stop-loss, so it is better to wait for the correction of the trend line before any long positions start.

As soon as the Crypto currency is released from the level of 0.661 dollars, the movement to the highs, probably with a little resistance at the level of 0.732 dollars.

Perhaps it would be nice to wait for a low-risk trading opportunity to initiate new positions.

LTC/USD

What could be considered is that bulls can not push prices higher. If within a few days we do not get a massive range of growth, the likelihood that the bears will again try to drown out crypto-currency.

On the other hand, support exists at $ 140,001, which is an intraday minimum on January 17. If this level also breaks, the LTC / USD pair may drop to the next support level of $ 85.

If the bulls manage to raise prices higher, they will face resistance at $ 200 with a 20-day EMA and in the descending trend line of the descending triangle.

We must change our bearish view only after the price comes out of 225 dollars.

XEM/USD

Yesterday NEM fell below the level of 0.86 dollars yesterday, January 27, and made an intraday minimum of 0.775 dollars. However, the bears could not benefit from the breakdown.

Today we find some purchases at lower levels. Bulls try to break out of the descending line of the trend, which continues to be a serious resistance. Even if the price out of this, we expect that the pair XEM / USD will face resistance at $ 1 from both moving averages.

Crypto currency will become bullish if it comes out of level 1.21. We will wait until it becomes positive, before recommending any long positions.

ADA/BTC

The ADA / BTC pair is now likely to fall to the level of 0.00005, which should act as support. However, if this level breaks, the drop to 0.00004730 and then to 0.00004070 can not be ruled out.

We will wait until the Crypto currency is bullish before recommending new positions.