June 20 (week 25) 2025 - Flat markets are good

- Flat markets are good

- June 20 Investment moves

- 2030 View and 2040 View

Flat markets are good

As a long-term investor, flat or down markets are good for two reasons.

- Give a 401 K-type investor using #DCA (Dollar Cost Average) more time to buy in at a "discount."

- #Option Trader (esp Seller or Options) can make money when markets are boring or FLAT.

The facts are that the US stock markets rise more than half the time. Using data that spans over 70 years, it is about 53% up days and 47% down days.

However, you need to zoom out and understand the data in the context of YEARLY results.

Up day: 53%

Down day: 47%

Up year: 68%

Down years: 32%

This means that the average investor is generally buying during an up market, or roughly ~68% when you view a 401K with a 30-year "Work History".

This is why when markets are Flat or DOWN, it is a good time to add more capital. It also a good time to make adjustment before the next bull cycle.

As an option trader, if you sell options, you make money with the passing of TIME (Time Decay). So that works best in FLAT markets, but can work when markets do not MOVE more than they EXPECTED. This is why I like to "overlap" my investment methods:

- #401K Investments (or IRA rollover): 100% LONG position with a 20-40 year view.

- Option Trading: I can be delta neutral or be a seller of options and make money on TIME DECAY. This can be done using OTM Covered calls, OTM credit Spreads on Calls or PUTS, or Iron Condor.

June 20 Investment moves

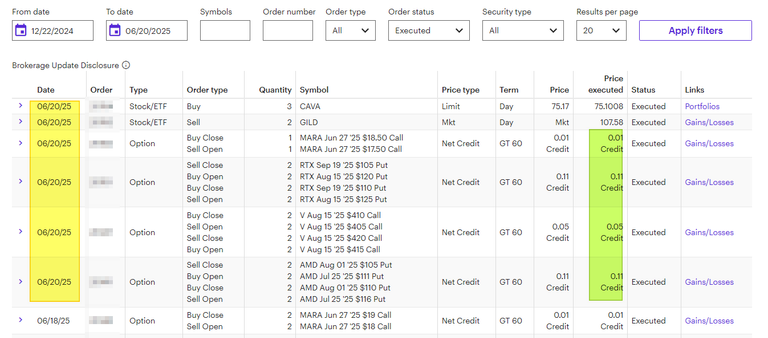

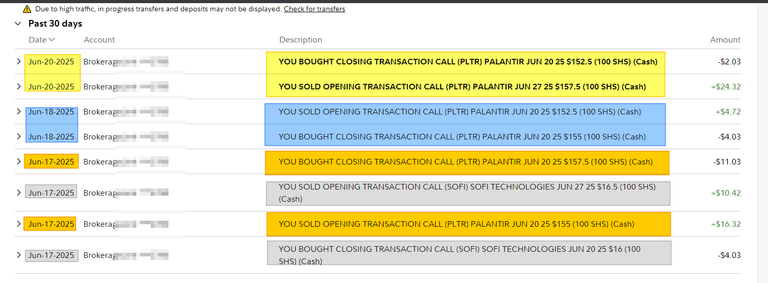

Here are my options trades for June 20 @ Noon (EST).

I sold some GILD stock and bought #CAVA. I'm starting to use my dividends to fund the new POSITION in this portfolio. This is part of asset rebalancing.

On a different account, I added OPTION trading, and here are the week trades:

I will like to use this account to first get one of my holdings to 100 shares so that I can start doing COVERED CALLS. That will add to my #NEE, #PLTR, and #SOFI #coveredcalls that I can do today.

2030 View and 2040 View

Why did I pick 2030 and 2040?

The answer is based on Bitcoin Price Predictions and aligned with Tom Lee's Predictions.

- By 2030, many folks expect Bitcoin to be worth closer to 1 million dollars per BTC.

At the same time, Tom Lee believes SP500 will be close to 15,000 (from today 6,000). - By 2038, Tom Lee thinks we could be near 20,000 on the SP500.

https://markets.businessinsider.com/news/stocks/stock-market-outlook-sp500-soar-400-percent-2038-millennials-economy-2021-6-1030497500 - By 2045, Michael Saylor will be worth 13 million per BTC.

What should you do with this information?

If you believe that the SP500 will continue to move up, then the obvious answer is to make sure you are at least MIRRORING these returns. That can be done by using a LOW-COST ETF like VOO, VTI, SPY, or the hundreds of other choices.

That is what I'm doing for my 401K plan and using a combination of Larget cap Growth ETF and SP500 Index ETF. In other portfolios, I use ETFs that follow Tech/Nasdaq 100 like QQQM, or TMFC.

On the Bitcoin side, you can use FBTC, GBTC, IBIT, or other ETFs.

These are the things that I'm doing. This might not be suitable RISK for your portfolio.

This is not investment advice, just what I'm doing.

Posted Using INLEO