With the bullish digital currency prices, as well as the increasing social awareness of digital currencies and their increasing acceptance, the safety of digital assets has become the focus of every investor. After all, if your digital currency is stolen, it's not just the string lost! As many as a few million, as few as tens of thousands, which no one cannot face.

Small series recently visited the site, has seen a lot of theft of digital money from happening, including theft of bitcoin many. As a kind of hot digital money nowadays, bitcoin contains a huge amount of wealth that is unpredictable. Coupled with the growing number of investors involved in bitcoin transactions, it has also promoted the widespread circulation of bitcoin globally.

However, many bitcoin investors have been complaining about the frequent bitcoin theft. In many people's eyes, bitcoin trading is based on blockchain technology. The so-called "blockchain distributed ledger," which is open, transparent, traceable and can not be tampered with, is why there are frequent stolen events?

In fact, as a digital currency investor, the most important lesson is that we should pay attention to how to protect their bitcoin account security issues. The most important feature of bitcoin is its decentralization, and it's all about it, so bitcoin is not regulated by any intermediary. In fact, the frequently stolen incident behind, inevitably come from the following three routines:

1. trading platform custodial stolen

Many digital money investors rely on the trading platform to complete the bitcoin transaction, which will naturally place the bitcoin in the exchange account. This potentially puts the security of its own bitcoin assets in the hands of middle exchanges. However, most countries currently have no relevant regulatory endorsements for the Bitcoin Exchange, so once an exchange has taken a bad heart, the security of your digital currency will not be guaranteed.

2. Hacked

However, the trading platform is open to the public, after all, the operation of the exchange custody of stolen cases is a minority. More stolen events stem from hacking. As we all know, bitcoin's account address, key, etc. are a bunch of code ciphertext, so if the hacker successfully attacked the system, it will lead to a large area of leakage of these data, of course, your digital assets naturally will not fly It's.

3. User account was stolen

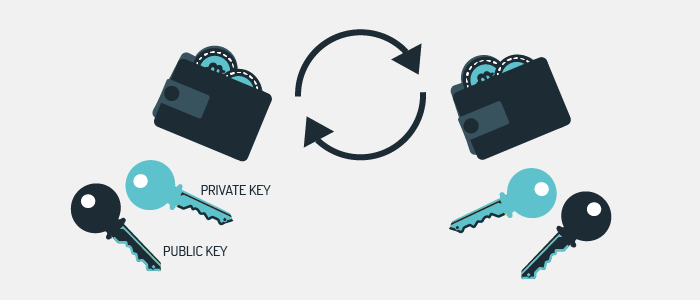

This is relatively well understood. We might as well compare a Bitcoin address to a bank card's account, which is likened to a bank card's password. If one day you lose your bank card to someone who knows your password, what else do you think is Cary's money? Perhaps many people think Xiao Bian grudges, it is not because the Bitcoin system is currently being refined, in fact, there are loopholes in the virus, which will lead to the exposure of bitcoin assets in danger.

In fact, bitcoin is essentially a string of codes, which is not as vivid as the real currency in circulation. Therefore, users can only declare their own digital asset security through the public Bitcoin wallet address and their own private key. It can even be said that whoever owns the private key owns the bitcoin asset in the address. Xiaobian order frequently stolen events recently is willing to give you investors sounded the alarm!

In February 2014, Mt.Gox, once the world's largest bitcoin trading platform operator, announced that 850,000 Bitcoin bitcoins on the trading platform were stolen, accounting for an estimated loss of about $ 467 million, resulting in the bankruptcy of Mt.Gox.

In July 2015, Bitstamp, the European digital currency trading platform, was stolen with about 20,000 bitcoins for hacking.

In June 2016, TheDAO, the blockbuster industry's largest crowdfunding project with about $ 100 million in assets, was attacked, leaving more than 3 million ether assets separated and losing more than $ 60 million.

In August 2016, Bitfinex, a Hong Kong digital currency exchange, was stolen by hackers for nearly 120,000 bitcoins, with a loss worth more than 65 million U.S. dollars.

In June 2017, Bithumb, a Korean digital currency exchange, was stolen, resulting in the loss of some 1 billion won.

In July 2017, Parity, a multi-signature wallet, suffered a security breach and stolen 150,000 Ethereum ETHs, worth a total of 30 million U.S. dollars.

In November 2017, Tether, the digital token, said its system was hacked and stolen about 30 million U.S. dollars worth of tokens.

In December 2017, Youbit, a Korean digital currency exchange, filed for bankruptcy with nearly 17% of total assets lost to hackers.

In December 2017, the liqui, the Ukrainian digital currency exchange, was hacked, resulting in the theft of 60,000 bitcoins.

In January 2018 Slovenian mining services company NiceHash was hacked and a total of 4,000 bitcoins were stolen, losing nearly 63 million U.S. dollars.

A series of stolen events shocking! Is it as an investor we can do nothing? In actual fact, we can improve our digital asset security from the following key points. Next. Xiaobian want to say is the key, we must firmly grasp these key!

1. The exchange should build a more systematic system

For the trading platform, in order to cope with the risk of theft, it should be more systematic to build fraud risk prevention and control system. The use of the current state of the art Internet technologies such as fingerprint verification, face recognition, location finding and other means to further reduce the risk of theft.

2. Vigorously enhance the security awareness of personal accounts

For our users, we should raise awareness of risk prevention. For example, changing the account key on a regular basis, not logging in to an account on a public computer, setting a complicated password, and enabling secondary authentication can all increase the account security level and reduce the risk of financial loss.

3 private key must be kept in save place

The Private key must be kept in save place, Three important things to say, because once the private key is forgotten, lost, stolen, your digital money will never be found again!

4. Try to avoid the involvement of third-party platform

It is true that third-party platforms provide investors with convenience, but as we have seen on many occasions of theft, third-party platforms can easily become the target of hacking. Therefore, as an investor, we should try our best to avoid Third-party platform involved.

5. Try to store bitcoin in hardware wallet (The best choice)

According to statistics, the safety factor of the hardware wallet is relatively high. Users can try to use hardware wallets to store addresses and private keys offline, minimizing direct hacking attacks.

Excellent Blog- I love crypto though these are the Dangers without doubt..some nice solutions..well done Sir! Upvoted..

In the world of virtual currencies, everyone has to protect their financial assets, Thanks for the support!

Keep up the great work- your followed Sir..

This post has received a 24.29 % upvote from @kittybot thanks to: @wailabdalla.

This post has received a 6.52 % upvote, thanks to: @wailabdalla.