On Tuesday afternoon, bitcoin will essentially split into two in an event known as a “hard fork” that has divided the virtual currency’s online community.

Two competing strands of bitcoin will emerge after some of its leading backers disagreed on the best way to take it forward.

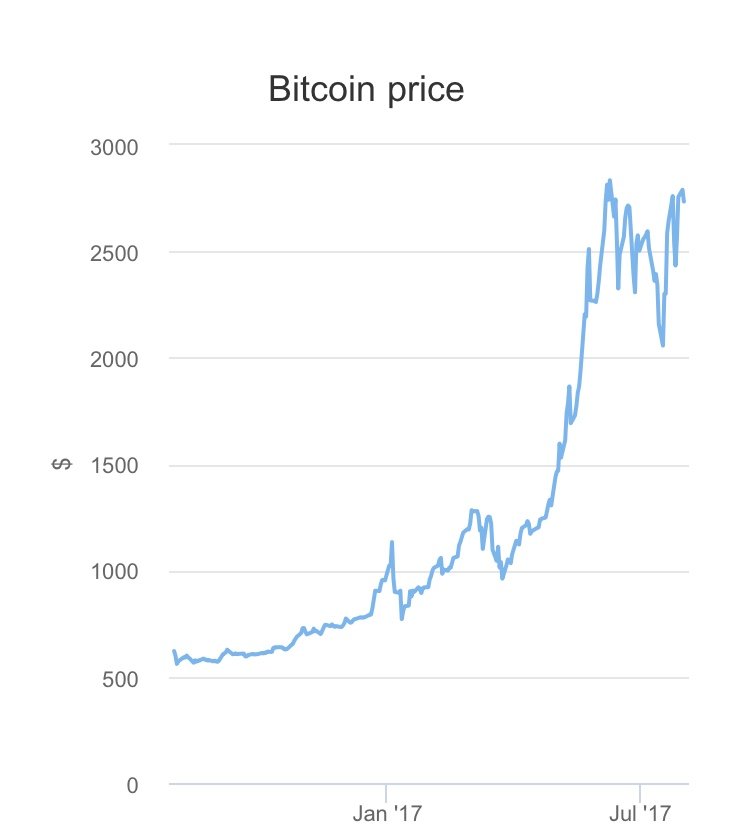

The price of bitcoin has been relatively unaffected so far, but traders are unsure what will happen after the fork officially takes place. Here’s what you need to know.

What is happening and when?

Last week, key miners and developers of bitcoin agreed to adopt a new way of operating the cryptocurrency: since the technology is open source, changes are made to its underlying code if agreed by a consensus of users.

The new technology, called Segwit2x, has gradually been adopted by key players in recent days and appeared to avert a “civil war” over how to move forward.

However, a rival system has gained traction in recent days called Bitcoin Cash. Later on Tuesday, at 12:20pm UTC (1:20pm BST), it will be launched.

Why is the technology changing?

Bitcoin, now almost a decade old, is struggling to cope with a recent surge in popularity that has seen its price jump from about £750 at the start of the year to over £2,000 now.

This has led to a boom in the number of bitcoin transactions that the existing technology is struggling to cope with.

Bitcoin transactions are completed when a “block” is added to the blockchain database that underpins the currency, but at present blocks are limited to 1MB every 10 minutes - or seven transactions per second. This compares to 2,000 per second for Visa and means that at peak times bitcoin transactions can take hours to be fulfilled, inhibiting the currency.

The two rival proposals - Segwit2x and Bitcoin Cash - are both seeking to solve this problem in different ways.

What is the difference?

Segwit2x proposes moving some of bitcoin’s transaction data outside of the block and on to a parallel track to allow more transactions to take place. After that happens, blocks would double in size some time in November.

Bitcoin Cash does not propose moving transaction data outside of each block, but wants to increase the size of each to 8MB. Its backers are sceptical that the Segwit2x plan will follow through with doubling the block size later on.

Segwit2x has been adopted by enough of the bitcoin community to proceed, but in recent days more have signalled their support for Bitcoin Cash, saying the rival proposals do not go far enough.

What will happen to my bitcoins?

Most people store their bitcoins in online wallets or exchanges, rather than downloading them onto a physical hard drive. The majority of these sites have said they will proceed with the mainstream Segwit2x proposal.Online wallet Coinbase said on its website that it “is hard to predict how long the alternative version of bitcoin will survive and if Bitcoin Cash will have future market value”. Blockchain, another online wallet, said it has no plans to support Bitcoin Cash but that if it ends up becoming the more popular version it will.

Those who hold their coins by downloading the entire bitcoin code will end up with both bitcoins and bitcoin cash.

How much will each be worth?

The bitcoin price has remained stable in the run-up to the hard fork, but it remains to be seen what will happen after the split.

The offshoot, Bitcoin Cash is currently expected to be worth just a fraction of the £2,000 bitcoin price, at around £206, according to futures trading.

However, this is a very speculative value. Bitcoin Cash will only have value if traders continue to use it.

How do I get my hands on some Bitcoin Cash?

If you store your bitcoins online you might be a little too late - the bitcoin network is trading in massive volumes in the run-up to the hard fork and many exchanges are warning that transactions will be delayed.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.telegraph.co.uk/technology/2017/08/01/bitcoin-cash-time-bitcoins-hard-fork-does-mean/