| Many of us, more or less are familiar with Steem-engine.com and the concept of TRIBES. That being said, today I would like to ask one hell of an important question related to those topics. |

|---|

INTRODUCTION

.... So, this publication is directed to those of you, dear readers, who have some decent knowledge or have your own opinion/idea of launching your own token on SE.

Lately, we’ve all witnessed a new and interesting trend of so many new tokens being launched left and right on Steem-engine.com and currently there is no way to recognize even half of them. Last time I’ve checked I counted over 400. Most of them completely meaningless, without any sensible business model and sustainable economy that could create and support demand.

IMPORTANT QUESTION

I can hardly imagine that we would stop at this current stage, so there is surely more to come. And part of me believes that launching your own token may be more risky than most of us want to admit. It is really important to ask the question which seem to bother me a lot lately:

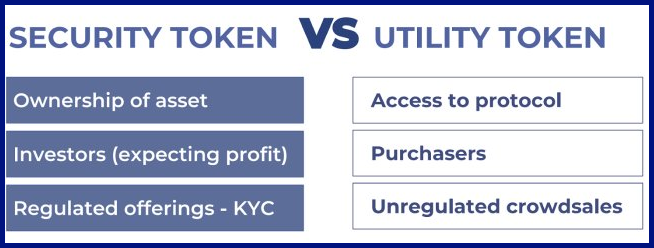

| HOW SAFE IS IT TO LAUNCH YOUR OWN TOKEN ON STEEM-ENGINE? From the legal point of view of course. Why would I be having my doubts? I’m simply not sure if we can and should consider all those tokens to be utility or security offerings. |

|---|

Up until a week day ago I didn’t even think about it and I’ve been excited to join PALnet and SteemLEO tribes, investing some of my resources (time and steem) into those two tribes. However, last week a good friend of mine (with years of experience as an investment banker) mentioned that some of the current Steem-engine tokens are nothing but security and the best way for founders to avoid trouble is to stay low under “the radar” and avoid raising to much funds (that could bring unwanted attention).

He also mentioned that the founders/team members who initially would be rewarded with part of a newly launched token would have to pay taxes for receiving them. Which kind of make sense. However, should we pay any taxes if we wouldn’t cash out all those tokens to FIAT currency? I’m not really sure.

SECURITY OR UTILITY TOKEN?

As far as I know, by launching an ICO and having one purpose – to raise money in order to set up a business – we would have to consider it being a security offering. Adding some utility (as most ICOs tried to do) may help and keep us safe, but I wouldn’t rely on it.

Now how would it look like if one of us would come up with some business idea, would create and launch his own token on Steem-engine and managed to attract solid investors. Some decent amount of STEEM would be raised (let’s say 100k) and it would be used to start up this business.

Should we consider this token to be security at this stage? Or should we not, since we would be receiving STEEM token, which is not a currency in the name of the law. STEEM is a utility token, so in theory receiving this kind of support shouldn’t be a problem. After all we wouldn’t receive any FIAT currency from our investors.

Also should founders be taxed if they initially received large amount of PAL/LEO? I can imagine that if they cashed it out and exchanged to FIAT, then taxes surely would have to be paid. But if they keep those tokens (or exchange to STEEM) and use them within STEEM blockchain (powering up or promoting posts, steem-bounties etc) then should we feel safe?

Source: https://www.coinreview.com/security-vs-utility-tokens/

SHARE YOUR OPINION

So far, those are some of the opinions and very important questions I have. I hope some of you are able to share your views and opinions with me. I fully understand that this industry is not fully regulated and the approach to currently discussed topics can differ depending on which country we’re living in. However, I would still love to hear what you all have to say, and hopefully other readers will benefit from this topic as well.

Note: I read/reply to all valuable comments. Thank you.

Yours,

Piotr

cc: @aggroed, @steemleo, @khaleelkazi, @organduo, @isaria, @neoxian, @bitcoinflood, @asgarth, @chesatochi, @ edicted, @neal.leo, @ cryptopassion

@crypto.piotr has set 5.000 STEEM bounty on this post!

Bounties let you earn rewards without the need for Steem Power. Go here to learn how bounties work.

Earn the bounty by commenting what you think the bounty creator wants to know from you.

Find more bounties here and become a bounty hunter.

Happy Rewards Hunting!

The security question is pretty simple, Piotr. There are 4 questions the SEC is allowed to ask given the result of the SEC v. Howey case:

That being said there are some S-E coins that would fail this test, I think, though I prefer to keep them nameless here.

Excellent.. finally someone referencing to the Howey test:

https://www.investopedia.com/terms/h/howey-test.asp

Another test is in simplified terms this:

If it looks like a dog, behaves like a dog and smells like a dog - it is a dog.

So actually you would have to consult a lawyer in the jurisdiction where you want to incorporate your venture and also a lawyer in every jurisdiction of a person living in you want to sell your token to.

Else you would not be able to get a reliable statement..

Having said this, this is what most likely will happen if you actually do this:

You will incur enormous bills from lawyers and you will get totally contradicting statements of those lawyers because this whole complex is still so new and fresh that there are no precedents or cases at superior courts you can reference to and also no clear cases of the big watch dogs as of this very moment.

So the only reasonable advice a non lawyer could give is:

do not do it!..

.. and if you still want to do it and take the possible risk, IMHO: abate the risk as much as possible.

Those abatement measures could be:

1.) Do not scam or mislead people! (this should be self explaining)

2.) Do not sell tokens for fiat

3.) Do not sell to people in certain jurisdictions as the likes of US/ UK / Japan / China / Kanada etc.

4.) Do not promise any "investment returns"

5.) Do not offer asset backed tokens but only utility tokens and explain the utility use of the tokens

6.) Stay small in regards of numbers of people you are selling the token to and in regards to overall volume raised

etc. etc. etc.

Dear @solarwarrior

Wow. This is obviously one of the most valuable comments I've read so far.

I absolutely appreciate your time and effort. RESPECT.

Yours, Piotr

Dear @shanghaipreneur

I cannot find a way to express how grateful am I for your comment.

I've been thinking: what if someone would like to create token on steem-engine, which would allow him to raise funds (STEEM tokens). Then he would use those tokens to grow his influence within STEEM blockchain and monetize it later on (by starting up digital marketing company).

And later on on monthly basis he would use part (let's say 20%) of real income in FIAT (taxed) to buy-back created token and burning it (decreasing supply and eventually buying back all previously "sold" steem-engine tokens)

Any thoughts on that kind of business model?

Yours

Piotr

Two questions I have there:

Dear @shanghaipreneur

Not by me. However let's I would use those raised steem for promoting purposes (mostly steem-bounties), perhaps to reward few people supporting my growth on daily basis (to avoid transfering funds I would bost their publications with upvoting-bots).

I would have my business legally registered and I would offer my services to Polish IT businesses looking for forign exposure (in english language). Those companies would receive invoices, taxes would be paid. And I would use part of profit to buy-back earlier realeased tokens and burn them.

This way whoever would purchase my token, would know that supply is constantly shrinking.

Yours

Piotr

Knock knock @shanghaipreneur :)

Hey there dear @Crypto.Piotr,

I do like the idea , yet personally I think You should have into consideration a way of making profit parallel that could allow some stability in a "down phase", but that might be me thinking ahead of time..About the %, maybe burning a lot less, making the burning phase last longer, allowing for more people to benefit of, both the tokens and the digital marketing company services, again, this is just my very limited view on the subject, there are many variables to take into account that are not known to form a better opinion, still, the idea doesn't seem bad at all..Ok, maybe a small percentage could be redirected to a trading bot, or traded manually to raise some of the overall profit instead of burning it at the ratio mentioned, I don't really know, just throwing out an idea =XAll the best,CyP.S.: Yes, I'm still awake x_D_

Dear @cyberspacegod

Thank you for your prompt reply. However I'm not sure what do you mean by "down phase"

ps. hope you rested a little bit. don't be a robot! :)

Yours

Piotr

Ohh, I mean, all tokens/coins are affected by some sort of inflation/deflation, according to what they are based upon, all of them are a form of exchange.. Pretty much like STEEM, with the ups and downs of BTC, the contracts in which it is used.. Something like that ^^)

All the best,Cy

Respectfully, I strongly disagree with your application of the Howey test.

Each coin and token is being treated by the various departments (SEC, FinCEN etc.) differently depending on how the coin or token is used. It doesn't matter how you or I view STEEM, it matters how the governmental department we are dealing with views it.

STEEM is used like money on a daily basis. STEEM is used to buy and sell things and on Steem Engine it is not SBD that is used but STEEM to buy and sell tokens. It is most certainly being treated as a "virtual currency" according to FinCEN.

This is shaky ground. I really don't know what to say on this one. There are lots of ways to buy "influence" on a network that does not result in you earning anything. That is not how the reward pool/inflationary model works exactly. While it is true that it does have the utility of providing increased visibility to you via self-voting, which is often looked down upon in the community, the cost vs. visibility ratio is terrible.

Additionally, it cannot be ignored that investment terms and suggestive concepts related to investing is all over the place on the Steem blockchain and the Steem Engine platform. Terms like "staking", "vesting shares" do appear like financial terms speaking to the investor mindset.

The Proof of Brain approach of "mining" for coins by curating content is not in itself any indication that a coin must be a security. And token sales make logical sense even by a project that is centralized so long as the token has an essential function for the product/service or ecosystem. However, arguing that "influence" is the utility of the token very much depends on how that token provides utility.

For a token to not be a security it needs to be a utility token, commodity or currency. If it is a currency then you must familiarize yourself with FinCEN and other currency managing departments and their policies. If it is a utility token that use of the token needs to be essential and its use in the ecosystem or product/service needs to be clearly conveyed.

Why can they argue "no" here?

That entirely depends on how the token is structured.

That’s why you have lawyers, bud.

Posted using Partiko iOS

Yes, having lawyers is nice, but those departments also have lawyers, many. My point is that you are making bold claims that are clearly not accurate. Why do I say that? Because I am familiar with the guidelines and the no-action letter cases by both the SEC and FinCEN.

The response:

Is a poor reply, considering the fact that what you are telling people can most certainly be construed as financial advice. You're playing a dangerous game telling people that STEEM doesn't count as money while FinCEN views cryptocurrencies as convertible virtual currencies.

It is not that I don't want to agree with you, but the problem is that I know that your opinion doesn't match with the positions of these departments. That means you either plan to take the SEC and FinCEN to court in order to establish the appropriate standards like DefendCrypto.org is trying to do now, or you don't mind letting people believe you and get into serious trouble.

I’m not a lawyer and this is not legal advice. It’s pretty clear I’m just offering my opinion about the law, which in the US is open to interpretation and based on precedent. In other words, the whole point of the law is it should be debated. I am looking forward to a new and updated version of Howey from the Supreme Court as it relates to digital assets. But for now, we are using a dull knife to deal with some very specific instances. But it is all that we have in the cupboard.

Posted using Partiko iOS

Indeed @shanghaipreneur

It's very clear that you're not providing financial advice and you're simply sharing your own knowledge and experience with us.

I absolutelly appreciate it.

Yours

Piotr

Dear @blake.letras

In my own opinion @shanghaipreneur isn't really "telling people". He is simply sharing (in form of comment) his own knowledge within discussed topic. That's very different.

Either anyone here is right or wrong - time will tell.

Yours

Piotr

Wow. What a mindblowing comment @blake.letras :)

Seriously I appreciate your time and effort. One of the best comments I've read in this topic; without any doubt.

Yours

Piotr

As someone from the EU, and thus who have a slightly different law to work under, the questionnaire for security would be:

There's also the thing with how important is it if it's security? Or a company share? In the US everyone will make a big fuss over it. From the standpoint of most of the world, it's "only troublesome for those who want to implicate the US" aka, for everywhere in the world, it just means they have to avoid the US. So I can understand that since you are in the US, it's a big difficulty for you, but I'm not sure about how it would go if you did that under your personal name since I don't know if the SEC consider people as capable to issue securities.

Yours,

@djennyfloro .

Thank you @djennyfloro for this amazing comment.

Your knowledge is simply mindblowing.

Yours

Piotr

Have you thought of doing an offshore company, and simply avoid the US? There's English-speaking business all over the world, and having that translated in spanis &/or french isn't that costly of an issue too.

What... I think people invest real money and expect them to rise to profit! lol Everyone buying these coins must be expecting them to go up, or at lease some of them right? As soon as the Gov decides to crack down you'd be surprised at just how many will fail. All we need is one big scandal and then we might all get in trouble? We'll see, time's a ticking!

beer!

!BEER

First thought coming to my mind: ...and so begin the cyberpunk wars.

I was considering these questions when I read the article of Dan Jeffries about Libra, Facebook's new coin in partnership with other corporations. The complexities we will facing with these new crypto-economy and its juridical & social implications are so new and big that they blow my mind.

Although I agree with the libertarian ideal against taxes and government control, I do understand that these issues cannot be simply overlooked. They will explode in the face of every person who wants to ignore them.

I think you briefly said the main things to be said about this. It is a game of interpretations, and this game will be played, as always, by big fishes and regulators.

We play this game analyzing the ways to validate our crypto-economy under the established rules. But, as history shows, when that happens regulators simply change the rules, and everyone will have to adapt to those new conditions and situations.

It's an everlasting game... a neverending story.

Some weeks ago, my country's government published an announce, expressing that it will accept the incoming transactions in cryptocurrencies to Venezuelan residents, but that they will have a limit and they must be made by means of the government's platforms.

That's because half the country already fled and those Venezuelans are sending money to their relatives using crypto, so that they could survive. That announce made me laugh. They destroy the whole economy and afterwards pretend to control every way created by the people to give themselves some freedom...

But, as old people say, that's the way of our world.

@spirajn:

Very interesting. So this shows several things:

1.) There is no way a government can control the flow of crypto

2.) Crypto flows into Venezuela are already meaningful and making an impact into the economy

Can you tell a bit more about this complex?

Any idea how they will try to implement the government crypto clearing platform and how they will force people to use it?

Sorry for the late response. It's difficult to stop and make time. Yours are very good conclusions: Governments cannot control the crypto economy, but the sad (and dangerous) thing is that they try... they'll keep trying and that means persecutions and abuses of authority.

When these laws didn't exist they put in jail so many friends because they were mining cryptos.

Now they cannot get all the Venezuelans into this... but they will try: if I would speak with the wrong person (an agent of government) about my way to manage the little money I can get, soon they'd send some agents for me, as if I am at the same scale of a scammer or a robber, though I am only an artist and intellectual.

But that's the nature of government. That's why I think this kind of subjects brought by @crypto.piotr are so important.

By the way, I like your account's name: @solarwarrior. It's cool.

!tip

Posted using Partiko Android

🎁 Hi @solarwarrior! You have received 0.1 STEEM tip from @spirajn!

@spirajn wrote lately about: Memories Of Ecstasy Feel free to follow @spirajn if you like it :)

Sending tips with @tipU - how to guide :)

Late thank you @spirajn for such an amazing comment.

God bless Venezuela

Have a great weekend ahead,

Piotr

Interesting this topic that you have chosen today, dear friend @crypto.piotr.

The conformation of tribes would allow Steemit users to access a specific content trend, where it is assumed that the publications would facilitate the attention of a qualified audience that could better appreciate it and contribute valuable feedback, rather than being accessed by simple users "curious" that perhaps would not add value to the development of the subject.

Being able to support more strongly the content creators of a tribe with a particular token would be at first sight a useful function. Since it would serve for growth and greater influence (power) within the niche or tribe.

Generally utility tokens fulfill a specific function within an escosystem and allow access to advantages or privileges.

So far the tokens in Steem-Engine only allow you to increase your "steem power" within the tribe. I have not seen any other application so far, so its useful feature is very limited.

Then maybe we should see them as security tokens as they are interchangeable in internal DEX. What would allow the investment and get ROI.

Maybe they are hybrid tokens?

You are incorrectly assuming that current SEC interpretation:

The law is very different in different countries and there are many different types of Steem-Engine tokens.

It is pointless and bad legal practice to make generalisations.

For example @jpbliberty's SUFB tokens on Steem-Engine are completely exempt from Australian securities law and are issued by an Australian company.

Hey my friend @crypto.piotr

The idea is to feel secure in this kind of business, So. I think regulations are coming with some different rules, and regulators and investors were asking the same questions and hesitant about this business.

But if any regulations change a little, it doesn´t mean to be scare about it, it means that something will change for a good one because regulators and investors are working and investing their own money.

I think that if your are thinking in investing 100k will be great for you and your business, because everything is a business here and you can obtain your contract very easy.

Another point and I´m pretty sure that it is about the content in your white-paper and the token you want to create... The explanation and description you give to your investors ....

If you know about it, some tokens have more value than the Steem, So, how is that...!!! ..? question on the air....!!!

Have a great time....!!!

Late thank you @edgarare1 for such an amazing comment.

Have a great weekend ahead,

Piotr

I think that is still a very early stage to no in which way that will go

I think if you use fiat to buy tokens to give to an entity for the express purpose of getting a return (whether over time or at some future time) that is greater than what you invest, then convert that back to fiat, it would be hard to claim it is free from taxes. But I believe you are asking about the case where you have accumulated tokens (in this context any cryptocurrency) with no clear traceability to fiat, invest those tokens, receive a greater amount in return, and retain the value in tokens without converting it to fiat. At this time, I do not believe there is any accounting mechanism available to a government that could assess you with a tax liability.

Assuming that such an ability does or soon will exist, it begs the question of where does mining crypto fall in to this, especially when it takes the form we have on steem (leomm, palm, etc). That is much harder to clearly track!

Dear @jdkennedy

I just realized that I never thanked you for your valuable comment.

Exactly.

ps. I've noticed that you didn't post anything in a while. Hope you're not giving up on Steemit.

Cheers

Piotr

I’m still here, just a run of activity the has been consuming my available time. I like my posts to be more thoughtful than not, but that presumes you first have time for thought! :)

It's a very interesting subject. I'm sorry I don't have many tools to contribute to the discussion.

for now, my opinion is that the creation of tokens in many cases is done without any basis. I believe that this can do damage to the ecosystem of the blockchain.

I actually suspect that lawsuits will be filed against some of the Steem-Engine token creator's but @aggroed has also setup, or is in the process of setting up, a legal team that can deal with the legal issues of token creator's in exchange for Fiat.

Whether or not that defense will be successful is another story @crypto.piotr but I personally reserved the token name "HUMANIST", and @emafe reserved the token name "PH" on Steem-Engine.

Neither of us have issued even a single token yet and we will wait until we have a legal team in place before we issue any and I'm currently planning on both of them being licensed securities.

Having said that, I will probably have to wait at least 2 to 3 years before lawsuits start getting filed against some token creator's, the moment of truth AND then the dust settling after that before every-thing is more clear and it's safe to launch a licensed security.

Dear @chrisrice

Thank you for your amazing comment.

Would you mostly expect those lawsuits to be coming from tokens users or from authorities?

Cheers

Piotr

I am guessing from authorities first but it's impossible to say since one bad apple in the batch of Steem-Engine tokens could potentially burn a lot of people and get people upset.

Having said that, I haven't seen any willful scams on Steem-Engine yet but I suspect that there will be some once there are enough success stories of token issuers via Steem-Engine.

It might be towards the peak of the next bull market when asset valuations are high since I don't think Steem-Engine tokens are big enough to attract the regulators yet, but the day of reckoning is coming, not just for Steem-Engine tokens but for many cryptos.

This is just a group of ideas though, not Truth 👍

Thanks for this amazing comment @chrisrice

Seriously appreciate

Utility!

It is generally discussed as a measure of usefulness.

business dictionary.com defines its as:

The key word here is maximization. This is precisely what Steem Engine is about. Whether it is chosen by lawyers to be classified as a donkey because it pulls a load, is regardless of the fact that a semi is called a truck in America.

Steem Engine pulls along a trailer containing tokens for the Steem blockchain. No one will ever dispute that; as should no one should ever dispute it as a utility for the blockchain.

However, the case for judging each token as an independent determinant of utility or security may remain in limbo for some time. Regulators simply may be too afraid to commit for years to come.

That said, I would dare venture that any token on S E could be considered a utility because it provides a gateway for interacting with the Steem blockchain.

Instead of over regulating, we should be thinking in terms of privileges. From a libertarian perspective, all S E tokens provide a utility service promoting Steem AND the few that could be regulated as securities should gain respect through elevated smart contract interactions with a STEEM-Regulator effort. No further regulatory requirement would be needed other than to meet the developer protocols as set by regulator smart programs.

To think otherwise is to set a brain on fiat.

Wow. What a mindblowing comment @machnbirdsparo :)

Seriously I appreciate your time and effort. One of the best comments I've read in this topic; without any doubt.

I've lost you here. Could you please explain it using different words please?

Yours

Piotr

Oh nothing other than being a transport mechanism for information or some app. Think the Medallion tokens for NYC taxi cabs. Steem Engine tokens can be considered an onboaring utility, or paying for network contacts. Don't take me word for word, but if S E tokens are not in themselves of value then intellectual property is being overlooked for platform influences like Google and Facebook.

Always a pleasure. Sry for the late reply. Been busy and I like to take my time with these.

I would never issue a SCOT token or an SMT of my own in my own name. The last thing the world needs is yet another shit token for laughs. There are too many out there already. If it were a serious token intended to have a use case and a real business model, issued with the intent to raise money, I wouldn't want to have to deal with all the legal headache resulting from issuing a token with the potential to be interpreted as a security. Issuing a token of that type would also raise tax and accounting issues I have zero interest in having to dealt with.

There is value in rewarding people with tokens though. I think a key mistake people are making is that all these token creators are trying to raise funds with tokens. It sounds like a nice use case (crowdfunding) and it is a pity the governments are not leaving the people alone and just focusing on blatant fraud cases.

However, tokens are useful without raising money as well. Tokens are great for customer acquisition and promotion. Tokens could be useful in a new coupon economy, where online businesses give out tokens that allow people to try things for free.

For example, let's say you created two separate businesses. One is a t-shirt store, and the other is a shoe store. The shoe store has a token called SHOE, and you gift anyone willing to subscribe to your newsletter with 25 SHOE tokens. You agree to accept SHOE tokens for shoes at your store or US dollars. This allows you to incentivize many people to subscribe to your newsletter and listen to news from your business.

Additionally, once they get the 25 SHOE tokens they realize that all the shoes in the store cost 250 SHOE or more, which means they can't use their 25 SHOE to get shoes. So, they can either sell their SHOE tokens for some STEEM on the DEX, or buy 225 SHOE from the the business directly, or they can power up the SHOE and join the business' community area and engage with others for upvotes and curation rewards until their total amount has accumulated to 250+ SHOE.

Now lets contrast that with your t-shirt store. How are you going to motivate people to subscribe to your newsletter? How are you going to motivate people to actively engage with others in your business' community? It will all be a lot harder. Tokenomics is a powerful change to business productivity online, and it might even turn product and service consumers/users into a job... Its a weird, yet interesting future coming due to blockchain.

I agree with all that. But it's still in a legal, regulatory and taxational gray area and as long as I can't afford a legal department of my own, I'll gladly skip it.

This is a complex issue that needs to be addressed jurisdiction by jurisdiction because the position varies from country to country. For the sake of our discussion, it would help if we discuss it with reference to the US jurisdiction only. As @eturnerx pointed out, the position in the US is governed by Howey Test. Although the test itself appears simple, its application isn't. I came across an article which articulated the issues pertaining to the Howey Test quite succinctly and since I can't do a better job than that I refer the readers to the same here.

In addition, there are a few useful comments made by @hobo.media and @themarkymark in this post by @holovision, which give some practical guidance on the issue.

Late thank you @devann for such an amazing comment.

BIG thx also for sharing that link

Have a great weekend ahead,

Piotr

I am not very worried at the moment. The USA or the SEC have no jurisdiction where I live and above all, they don't have the moral authority to regulate Crypto worldwide. Who do they think they are? The Kings of the World?

There isn't a blanket answer. It depends on the token.

Posted using Partiko Android

Very true @eturnerx

what would you say about PAL and LEO ? And do you know any token on steem-engine that you would surely consider being a security?

Cheers

Piotr

You heard about Howey test used in the USA?

"a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party,"

1946 Supreme Court case: SEC v. W.J. Howey Co., FL.

I don't know enough about LEO. The little I know about PAL leads me to believe it might not match the Howey test.

Additionally, you can argue PAL's a utility token; Can be spent for upvotes (utility) or staked to improve curation earnings. One wrinkle is that inflation granted to stakers might represent a profit from the effort of others.

No doubt PAL is an asset of a kind, and PAL earned (e.g. curation) is income of a sort.

Depending on where on lives, this is probably taxable. Doesn't make it a security though.

Posted using Partiko Android

I've never heard about that case @eturnerx. Thx for pointing me in that direction.

The thing that makes a token a security is pooling money as ownership in an asset.

Buying PAL is not a security. Your ownership interest is nothing beyond owning the token. That token does allow you to influence the distribution of future inflation, but that's not the same thing as owning a partial share of an asset.

Buying a token that represents a share of business? Security. The business equity is the asset and the token represents your contribution to the pool of funds.

IIRC aggroed put something in a recent post about creating a KYC layer or section to SE to allow for securities.

Yeah, you have to be real in order to own something. There needs to be an officially government recognized way to tie an account to your real identity for it to be a security.

Then there most likely needs to be another sidechain just for securities, as there will be all sorts of esoteric laws and restrictions that apply to bonafied securities.

I paid taxes for last year on the Steem I earned. I will do so again this year as well. I figure before it is over, here in the US at least, they will devastate many projects. The ones left standing will be targeted for as much tax revenue as they can squeeze.

As for the SE tokens, I would be wary with them. I keep seeing people say they are worth this or that, yet house odds are NONE of them will ever be listed on mainstream exchanges of any velocity. Yet, I can see the IRS using the claims of worth to demand payment for tokens that will be hard to impossible to sell.

Where this gets dicey imo, is with the SBD. I have seen it referred to by many as Steem currency with the effort to peg it at the dollar. Once again, I think that definitions used will be at some point utilized against participants in these projects. The beast of government is desperate to squeeze as much sweat from the citizen slaves as it can. Of course, they will probably tack on penalties and interest, even if it means more is owed that the value of the actual possession.

I know many believe that crypto is the means to escape their control. I just don't get how when one of the main arguments for it is it is a permanent record of every move you make on it. They might not tie one to a wallet this year, next year or 5 years from now. But if they ever do, the consequences could be devastating.

At least where I live the tax guidelines on virtual currencies are worded in such a way as to make it seem plausible that the Steem platform be interpreted as a Massive Online Multiplayer Game in which case any income generated on it would be taxable only upon conversion into fiat, goods or services or other virtual currencies. This is how earnings on any other gaming platforms are treated. I know others who have asked their local tax authorities how Steem income is to be taxed without getting any clear answers. To me, however, it seems plausible that interpreting the Steem platform as a whole as an MMOG - at least for now - would be a lot simpler.

If Steem income is to be taxed exactly when the earner gains possession of the earnings, then calculating one's taxes becomes very unclear and very complicated. How is Steem Power to be treated, for one thing? It is not liquid. Delegations? Autovoting? Without automated tracking of all transactions, calculating the fiat value of everything is an accounting nightmare. How is the government going to estimate the income generated when no tools to collect the data and do all the calculations even exist? Anyway, those people who earned tens or even hundreds of thousands of dollars worth of STEEM, SBD and Vests in 2018 after which the Steem price collapsed, could find themselves in a world of trouble if the tax authorities around the world start going after Steemians. To go about earning that much using an account easily tied with one's real world identity seems to me like an awful risk. There is little risk of that happening now but if Steem fulfills its promise and reaches a market cap in the tens or hundreds of billions many could be in for a nasty surprise.

By the way, I seriously think Steem has a snowball's chance in hell going mainstream unless most new accounts are completely cut off from the reward system and demonetized. First off, most people who use social media have absolutely no desire to earn anything by doing so. They will gladly fatten the giga corporations that monetize the user data provided to them for free. By not earning anything the user won't even have to worry about the tax implications.

Hi @anonsteve

I just realized that I never thanked you for your previous comment.

Followed you already.

Cheers

Piotr

Dear @practicalthought

Amazing comment. Thank you for taking the time to share your thoughts with me.

Ehm ... aren't you losing so far on your investment in STEEM? If you convert it to fiat then you surely invested more than steem would be worth now.

So ironic. Crypto and blockchain will make it even harder to escape any sort of control.

ps. I've also noticed that you didn't post anything in a while. Hope you're not giving up on Steemit.

Yours, Piotr

Yeah, my initial investment was a huge loss. However, when I was blogging I did better than many here I guess and traded most of it for a project I believe has more on the ball. I still have more left here than I had bought (I bought in the 1-2.00 ranges) that I consider house money on the off chance the project can be saved despite the motions from the top.

As for the taxes, I ate it out of pocket. There will be a lot of misery coming for those who didn't/aren't paying their taxes I believe, and I will not be one of them. Give unto Caesar etc.

So I log on still to cast my paltry votes in appreciation of the few blogs left (most that I followed have already left the platform, many long ago).

None of those things you said are safe tokens

So no institution is eligible to collect any taxes.

If there is an organization capable of managing/take over/handling accidents those tokens, he is eligible to Charge taxes.

Like some closed tokens,

After it shuts down,

if we can go to the management agency to exchange for US dollars.

That way, he is eligible to collect taxes.

Otherwise, he only want to collect taxes, but he is not willing to take care of any accident.

That he just a vampire

你說的那些都不是安全的令牌

所以沒有機構有資格收取任何的稅金

如果有機構能夠管理/接管/處理事故那些令牌

他才有資格收稅

比如某些關閉的令牌

在他關閉之後

我們可以去管理機構換回美金

那他才有資格收稅

否則只想收稅,卻不肯負責處理事故的機構

只是吸血的大老而已

!trendotoken

Congratulations @cloudblade, You are successfuly trended the post that shared by @crypto.piotr!

@crypto.piotr got 6 TRDO & @cloudblade got 4 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Token distribution bot developed by @ali-h

hello there my friend, I don't get what you meant about security. True that there are token that are meaningless and even me have no idea why they made tokens like that. But in my own idea maybe because they're just doing it for fun and not to mention. Did you know that some tokens can be burned and make it as a steem power.

Posted using Partiko Android

I consider all my tribe coins that I have invested in on Steem Engine as utility tokens because I can reward my community with better upvotes, if I have more stake. Security would be if I only held the stake without doing anything with it and hoping that it would appreciate in value.

Posted using Partiko Android

Hi @organduo

I just realized that I never thanked you for your previous comment.

Followed you already.

Cheers

Piotr

I think you should ask @detlev with his beer token and all those ones who started a new site @reggaesterm or @steemleo.

You never know what a token can make popular from one day to an other.

I think you want to start one for your project here?

If it comes to taxes I think it depends on the country and how you book the income out of tokens (or not).

💕

Posted using Partiko Android

In @detlev 's beer token case it is clearly a utility token... you use the beer token as barter for one or many beers and the utility next day is a massive overhang.. ;-)

If the beer is robbed or? You can also learn a lesson out of that, so far no overhang here. 💕

Posted using Partiko Android

no.. if you drink all those beers at once.. ;-)

no but seriously... if beertoken would be barter for actual beers.. and that's the ultimate goal as far as I understand... then it is clearly a utility token because not even the SEC would consider beer an asset.. ;-)

This is a difficult thing to ponder indeed. Taxes are a hell of a thing aren’t they? We are all trying our best to avoid paying the damn things. I think that as long as one doesn’t exchange money back to fiat then it’s utility but once you start converting to fiat it’s security.

Posted using Partiko iOS

@crypto.piotr, In my opinion there is no Regulations for these tokens then Tax aspect is not in the picture, but yes, as soon as Regulations are entered into the Cryptocurrency Space then everything will change and in my opinion then clear understanding is needed to process everything. Stay blessed.

I say to hell with the bloody crypto regulations. Multiple people I know say ask for forgiveness, not for permission. I believe the problem is everyone seems to follow crypto regulations no questions asked. I respond with this question why have security laws in the first place? Also, why force people to upload id for kyc when the id can and will be hacked. It's not a question of if someone will be hacked, but when. As for taxes, the government can not tax cryptocurrency unless if they can physically force someone to do so. Sorry, I am just ranting about USA regulations again as my posts do. Steem engine tokens are "utility tokens" not securities because I don't see any that are securities. I also say the whole security idea is a bunch of baloney that the US uses to control citizens. I am also tired when writing this. Rebel against the system. If the government can not control cryptocurrency/blockchain do whatever the hell you want. The government is nothing but thugs anyway.

Thank you for your comment @dm312

You seem to be very rebelious :)

Simply because people more powerful than us created this law to protect their own businesses.

Yours

Piotr

Hi @crypto.piotr.

I am glad to reread your good articles. Here is the link to my new post. https://steemit.com/busy/@arquiatra/mindfacturing-the-change-of-the-productive-model

Thank you for the support provided in the past tense, I hope to continue counting on that support

Late thank you for your kind comment @arquiatra.

I will check out this link provided right away.

Yours, Piotr

Dear Piotr, as i already wrote you, i think this steem-engine is not the right place where make serious business coins, there are too many trolls that play with people real money and good ideas...:(((

Hi my friend,

Once again, you ask a very interesting and challenging question. Unfortunately I don't know whether there is a satisfying answer to it. I think it really depends on the token that you want to create and what you write in your whitepaper.

Problems may arise if people invest in a token and the token goes belly up. As long as the investors are happy, they won't create problems I believe. I people feel they have been scamed they can ask for help from the law and then it might become problematic. Another point is the amount of money that is risen with a token. If you rise a couple of hundred bucks I believe nobody will be interested in coming after you. If you think more about 100'000k in steem, it might be another question altogether.

A token can be something funy but when the amounts are big, I believe it is still better to simply make a contract with the investors and not rely on a token in the first place. After the ICO wave and all the scams, I think regulators are keen in avoiding similar problems.

Best regards,

Achim

I read in one of the update of Aggroed that they still in the process of completing due diligence the legal documents and clarity of their business model. And they are also waiting for some developments on the regulatory stage as they speed up the internal development of their system.

I guess, for me, I will wait for the, development on the legal side of the SteemEngine platform itsefl before really pouring in more investments.

Consider ourselves in a beta testing phase.

I am neither lawyer, tax accountant nor financial adviser, thus all I can express (for the record) is an opinion here, and nothing I say should be interpreted as advice. Now that the obligatory disclaimer is out of the way (as I angrily shake my finger at the regulators and legislators of the world which make every step taken in online communications these days a perilous one)... my "opinion follows."

There is no "taxable event" if there is no "sale event."

Hi @jbgarrison72

I just realized that I never thanked you for your previous comment.

ps. I've also noticed that you didn't post anything in a while. Hope you're not giving up on Steemit.

Cheers

Piotr

Thanks @crypto.piotr, ...no, I'm not going anywhere. ^_^

Most of these tokens are waste of time. No direction no value attached to it. Even on the long run, they cant grow.

I often get irritated whenever I see a new trend of coin.

Posted using Partiko Android

Dear @Crypto.Piotr,

Honestly I have to say it in the most open way possible, the tokens are both things, it will just depend on the "backing" they have, there are some with "value" cause they have the support of some sort of service/contract associated to them, other on other hand are just "for fun", neither should be taken as granted, as any crypto currency may very well "disappear" from day to night (might mention FIAT in a little while, cause FIAT is the same thing, if not worse)Definitely there is much more to come, although I think not everything will be "flowers and candy", if You want to create a token, to assure in some way it will prevail somehow, back it by a service, something that actually have "value", You mention PALnet and SteemLEO, and from my point of view they serve the purpose of creating some more options beside Steemit, while remaining in the STEEM blockchain, they have different premisses and cover different topics..The "legal" point of view is something we should at this point in time have taken care of, and should not even care about, man-made laws are bullshit, forgive me for my language but it is what it is.. And have those doubts, that will keep You in check and probably help avoid being "scammed" by one of the too many "shit-tokens", and as stated before, from my view, they are both, depending on the backing they have =)I do agree to some extent with Your 'banker friend in respect of staying "low" because there are still in place the so called "laws", yet, I totally don't understand where did he got the idea of paying taxes over tokens (taxes = theft, one of the most ridiculous non-sense things people still accept..)And ICO or not, one thing is for sure, (and sort of quoting a great friend of mine, since I do share the same view, even way before crypto currency was created), money in any form or currency has only "psychological" value, it has no REAL value..Again, and I will never get tired of repeating it cause it's true, taxes are theft, whether over FIAT or Crypto currency..if You really want to "play" this system's "game" and feel "safe", invest in real estate, or in any other area where You create initially a big debt backed by the bank and don't work, have the money working for You, "assets & liabilities", always have assets over liabilities, else You'll be f#$%ed, the friend You mention can probably assure You about that and explain it in a little more depth, but I'll add a simple detail, the "poor" and middle class work for money to spent (liabilities), the rich and above, have money working for them (assets)..Please, don't take me wrong or take offence, it is not of my interest neither for the good of the blockchain, or even the community, it's my point of view based on more than 20 Years fighting against this shitty system/social paradigm we were born into, non-natural, anti any logic or common-sense, and these are my 2-cents about the topics, plus I'll add also that Your post in my opinion is very well written, presented in a very good way with very good questions, cause not everyone is aware of the details around this topic, and take it too loosely ending up loosing more than receiving..So, thank You very much, and until next one, In Lak'ech,Cy

Wow. What a mindblowing comment @cyberspacegod :)

Seriously I appreciate your time and effort. One of the best comments I've read in this topic; without any doubt.

ps. I'm about to start reading some bookmarked publications and your latest post is on my list :)

Yours, Piotr

Cy

It's me again :)

Are you sure? I've heard that taxes = redistributing money and ensuring some extra money flow within economy.

ps. I'm about to start reading some bookmarked publications and your latest post is on my list :)

Yours, Piotr

Hello again!! x)

Yeah, pretty sure, redistributing between who?Definitely not the ones who were stolen in the first place =XCy

On the tax side if this question, surely if you don't convert your coin to fiat. The tax would have to be paid in that coin. Does the relevant authority have the means to hold, let's say Palnet. Do they have an account on palnet that we could pay it to?

Posted using Partiko Android

Thank you for inviting me to this publication @crypto.piotr

Considering the current law in Poland, I think we shouldn't. But the process of establishing a sensible law regulating the Blockchain Industry in our country is pretty unclear process, so this may change.

That makes sense, but ICO's were mainly receiving Ethereum, which is also not a currency from the law point of view, but there still were some problem with SEC and similar offices. Therefore, receiving a big amount of Steem may also cause problems.

Hi @crypto.piotr

I also agree that classifying a token into security or utility category will depend on the law of every country. I think legal analysis should be conducted in a case by case basis by an expert.

Another topic of consideration is the jurisdiction of the "investor". I've seen that some exchanges or platforms do not allow US investors. I guess there is some legal reason for that.

Taxes also depend on the laws of every country and/or Double-taxation treaties, so case by case analysis is also important. Based on my knowledge of Colombian taxes, I think taxable income is generated in realized gains when crypto is converted to FIAT. Of course tax authority can think in a different way.

Finally, I've seen that many platforms are requiring KYC procedures to comply with regulators bodies. A token creation may be subject to KYC procedures. As mentioned before, it will depend on the country.

Late thank you @danielfs for such an amazing comment and for your resteem.

We're talking about Steem-engine tokens :) There is no KYC needed here (luckily).

Have a great weekend ahead,

Piotr

If you are buying the tokens with fiat hoping to profit from it, then you should probably pay taxes, but when you earn it from posts, or exchange steem for the tokens, I'm not sure that qualifies.

Posted using Partiko Android

I think that none of this is "money" until you take it out to fiat in some recognized currency. Then you need to have it come out at a level that reaches the taxation level for that currency. As long as it stays in crypto wallets or is small change when coming out, it is not real in the fiat world.

As far as starting your own token - make friends with people that already have done it so you can learn from their successes and failures before bashing in there yourself.

And finally - see who has muted you, @crypto.piotr. I think some of those you are calling out on your post probably have done so due to the wallet transfer spam issue. And now that you are using bid-bots, they are even less likely to come in to comment.

Hi @fitinfun

did you have someone in particular on your mind?

also any idea how to check who muted me?

Yours

Piotr

Pretty much all the big/old guys are against bid bots and wallet spam, @crypto.piotr.

Here is a place to check muting

http://steemit.serviceuptime.net/mute.php

I don't think I can contribute much as I don't have much knowledge in finance or ICO creation. However, it is interesting to see how difficult it is to create this type of company and the consequences it can bring if it is a success and if it is a failure too. It is a risk that runs who executes it. I guess all business start-ups are the same.

I suppose that in terms of cryptocurrencies, there are still no regulations stipulated globally, it still depends on the country where you are.

I think what gives a token its true value is its usefulness, like the Ether.

It's a very interesting post. 😊

Good one, Piotr, and some very important questions raised. As others have referred to the Howey test as one of the few measures we have today, I guess it provides some guidance. Sure, US is not be all end all but it's a big and important market for crypto. Unless you want to shut your US investors/buyers from your offering, you need to take SEC into account. This is even more true considering that many other jurisdictions are in a wait-and-see mode.

A simplified version of the Howey test is: if you're going to be use your token to sell stuff, ie an means of exchange for products/services, then it's a utility.

If you promise token holders to make money off of your offering (i.e. any reference to token value appreciation), then it's more likely than not that some regulators will consider it a security.

Even though it's an oversimplified version of things.

And no, generally you don't owe taxes unless you sell your tokens to fiat.

Finally, the industry is still in its infancy and things will get clearer as it matures.

Note: Not a tax or legal advice, obviously.

Keep it up and good luck. :)

Let me thank you @varioso for such an amazing comment and for your resteem.

Have a great weekend ahead,

Piotr

Absolutely my pleasure, @crypto.piotr. Keep putting out great content.

Thanks for the wishes, you too! :)

I know I have read some posts from @aggroed where he said that Steem engine has legal services that can help launch projects in accordance with the law with all based covered.

Of course, you could also just drop 100 Steem and make a fun token to throw around that will inevitably be worthless.

Posted using Partiko iOS

Dear @allcapsonezero

I just realized that I never thanked you for your previous comment.

ps. I've also noticed that you didn't post anything in a while. Hope you're not giving up on Steemit.

Cheers

Piotr

Friend @crypto.piotr

All your questions are totally valid,

more when you mention what your friend told you, who has experience as a banker, I tell you about the weaknesses of the ICO system

You should also be very cautious with this type of investment.

However, my grandfather always said "He who does not risk never wins, never loses." so we have to take a little risk and in this market just be prudent.

This question you ask yourself, I've also asked myself.

Now, undoubtedly, behind the creation of an ICO that is reliable behind, there must also be a team that generates that trust.

I hope to be able to read comments that help us to dispel your doubts and mine.

I send you a big hug and greetings from my Venezuela that fights for your freedom.

I don’t know if you are interested but I have a new project up and was wondering what you think about it

You asked really important question. Also I think that @ aggroed tried to do his the best to make SE secure and safety for tokens. About create or not your own token I think everyone should decide by himself. Coz we are not finashial advicers and only can share our thoughts and expirience.

Posted using Partiko Android

Security is the biggest issue in these days. Many big companies including binance hacked. So this may be a big problem is steemit. Thank you for your valuable sharing

Posted using Partiko Android

Those token will be the next great thing get as much as you can

Securities are highly regulated

Posted using Partiko Android

Good question indeed. I'm sure @aggroed knows all about this issue.

Today's a tough question. Need more anonymity in transactions.