World population figured around 8 billion has experienced a drastic and paid growth over the years. This figure is expected to increase even more in coming years. With 1.2 billion people living in the sovereign country of India, the country contributes about 15% of the total world population (a rather impressive figure) to become the world’s largest democracy. India has grown economically over the past decades becoming one of the fastest growing in the world.It is the world's sixth-largest economy by nominal GDP. With such a population, Indians boasts of a good number of her citizens living in diasporas for work or other purposes remitting money back home to family and relatives. With an estimated sum of $62 billion remitted into the country as of 2016, Indian claimed 10.9% of the total global remittance (wow). The Indian telecom sector which is in itself another booming industry with the 2nd largest subscribers base and internet subscribers in the world has being a huge facilitator in remitting cash sent from abroad into the country. The telecom industry in India has grown from merely being a system of just communication and connecting subscribers to empowering users with the ability to render financial services to Indians from bill payment (mobile and utility bills) to remittance of cash from urban to rural regions.

In fact, from a total sum of 103 billion USD generated from bill payment, about 70% of it were done in cash. This is a far cry from the gospel of running a cashless society being preached the world over. The world is currently an exodus from fiat transactions to making or carry out transaction using digital means one because its faster, safer, more secured and it allows for peer to peer transactions to be done eliminating the need for banks.

The two major Problems facing the Indian payment ecosystem are;

Inadequate number of Payment collection center: Some service providers have very limited number of recharge and bill payment center in the country. Its palpable to see as few as 2000 centers for a country of over 1.2 billion. This can create inconvenience for subscribers willing to renew their subscription and pay for bills. To curb these problems, they resort to making use of private mobile recharge payment providers whom they can trust to pay a bill or make a recharge in their presence. These small retail payment outlets however are still faced with certain challenges that mitigates their ability to perform at their peak. The major challenge is not having a central means of making payment across different service providers (TV and mobile network etc.). Usually, each retailer is usually provided with a special prepaid sim loaded with airtime/money with must maintain a positive balance at all time to cover all associated cost needed for the retailer to effective make a payment on behalf of a subscriber. Most times, a retailer have a sim card for every mobile operator/service provider and can have as much as 10 sim cards for making payment for each operator. A low balance on one sim means the retailer is out of business at that moment and cannot process payment until he tops up his sim card. The balances are not transferable to other sim cards as they belong to different operators. And to make matters worse, they had to wait the operators to collect the sim cards for recharge.

Unfriendly government policies and external pressure facing the remittance sector: Unfavourable government policies such as taxation of remitted funds, extra regularisation on foreign recruiting markets, unpleasant bank exchange rate etc. may force Indians to make do of the parallel exchange market or blank market where they can get a better bargain on remitted funds. This market is however risky and unregulated.

The Payportal solution.

Having been in the payment service industry since 1996, a group of international experts with resound knowledge and understanding on the industry came together to form the Payportal company in 2011. Payportal is a privately-owned company offering payment solution to the Indian populace. Payportal located in Delhi, India has a chain of distributors and retailers across the city through which they effectively help their customers make online recharge, bill payments and domestic money transfer in a very fast, convenient and secure way using their payportal wallet. They have been able to record success since inception processing more than 500 million rupees for their Indian customers.

The payportal is a centralized platform connects the service providers such as banks, Digital TV operators, utility companies (who had earlier provider their individual payment/bill processing through the use of their own special means) to the public through the payportal wallet. Transactions are as fast as possible carried out in seconds and makes it Payportal eliminates three

• The need for separate payment processing devices.

• The long period of waiting for collection.

• Lack of service providers in some areas.

The use of a blockchain.

Payportal is making a paradigm shift to the blockchain technology to take full advantage the technology has and how to leverage this advantage on the Indian payment industry. Some of the benefits blockchain has to offer includes:

- Decentralization: the ability to store user’s wallets data across of series of multifaceted devices and location all linked using a blockchain will ensures the safety of user’s data and makes it hackproof.

- Global linkage: the blockchain and the internet has been used in the past to process payment through the first cryptocurrency, the bitcoin. Using a blockchain will enable cross border transfer between Indian migrants in the diaspora and their families living in the country. The will eliminate the need for a black market means of converting remittance to local currency. A situation Indians were forced due to some external and government influence on the market. Payportal will make use of its own blockchain and cryptocurrency to achieve this.

Meet the Team.

.png)

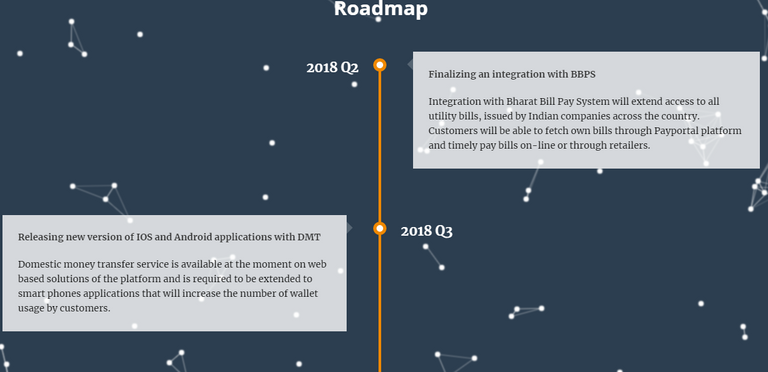

Roadmap.

.png)

.png)

.png)

.png)

The Payportal Token.

The payportal token is an ERC20 utility token based on the Ethereum blockchain (although they will later migrate to their own blockchain). The token will be the only means of interacting with the payportal blockchain and will be the means of making all payment transaction on the payportal platform.

Token Metrics.

Total PPTL Token supply is 20 000 000

We accept ETH

1 Token = 0,002 ETH

SOFTCAP: 3000 ETH, HARDCAP: 24 000 ETH

Token Distribution.

70% of the tokens allocated to the investors (14,500,000 PPTL)

15% for rewarding team and advisors

5% is used on Bounty program and marketing

10% for company reserve

.png)

ICO is started on the 18th of June, 2018 and ends today the 15th of July, 2018. Make do of this little time frame and invest in this wonderful project.

USEFUL LINKS

Website [https://ico.payportal.in/]

Whitepaper [https://ico.payportal.in/docs/White_paper_Payportal.pdf]

Telegram Link: [https://t.me/PPTLchat]

Fcaebook [https://www.facebook.com/PayPortalOfficial/]

Twitter [https://twitter.com/PayPortal_India]

Author Details:

Bitcoin talk URL : [https://bitcointalk.org/index.php?action=profile;u=2093652]