While trading on cryptocurrency exchanges is great for the average trader, it's not always a viable option when looking to trade large amounts. You might have heard about people making big money from bitcoin or ethereum. But the truth is that, compared to other financial markets, the volume being traded is still very little. That's especially true in Australia.

At the time of writing, the Australian dollar (AUD) saw volumes of AUD $857,277, or 97 BTC over a 24-hour period. So if you're trying to buy around AU$50,000 at once, it can result in drastic market price movement, and the buyer paying more for coins as the order moves down the book. The current exchanges aren't geared up to handle such big trades. As a result, it can be quite restrictive to large customers. Not to forget, some exchanges cap their maximum daily trade limit to $10,000 or $50,000 per day.

Because of these limitations, those looking to purchase a high volume of cryptocurrency would need to make several smaller transactions over a period of time until they've purchased the amount they want. This isn't ideal in any sense given the high volatility of the market.

As a result, many turned to Over-the-counter (OTC) trading platforms. Although OTC services can bridge the gap for the ever-growing demand of high volume trades, their price discovery is murkier, and there's higher settlement risk. Besides, OTC trades are not reported and independently audited, which means you'll never know if you're actually inadvertently helping launder illegal funds. If you aren't aware of the severity, you may risk having your wire transfer rejected by banks.

Meanwhile in Australia, on April 11, the government announced new laws to regulate cryptocurrency exchanges that operates in the country. These businesses must now register with AUSTRAC (Australian Transaction Reports and Analysis Centre) and meet the government's AML/CTF (Anti-Money Laundering/Counter-Terrorism Financing) compliance and reporting obligations. At the moment, there are only three exchanges that are licensed to run their business operations in Australia, and Blockbid is one of them.

What's so special about Blockbid?

Melbourne-based startup Blockbid has been granted permission to legally operate as a cryptocurrency exchange according to Australian law. That's a great validator for the company, which aims to become an active, worldwide cryptocurrency exchange for investors to trade crypto on a safe, transparent and compliant platform.

If we look at the other two AUSTRAC license recipients and major exchanges in the global market, Blockbid provides the most complete offering of crypto trading on one single exchange platform. They plan to be ultra-secure —95 percent of deposits are stored in an offline vault and fully covered by cybersecurity insurance. They also charge ultra-low, fixed transaction fee of 0.1%.

The Coinrail hack that amounts to as much as $40 million loss tells us one thing — providing insurance is going to be necessary in order to protect users against any potential cyber-attacks. That's why I fell in love with Blockbid.

Recently, the company also stepped up their game and combined strength with LexisNexis and ThreatMetrix to increase fraud prevention security and add bank-grade know your customer (KYC) solutions. This strategic move is a competitive differentiator when it comes to unmasking fraudsters and other bad actors like money launderers and terrorist financiers, who threaten the cryptocurrency space.

At the moment, the beta version that was launched on 16 April this year, already supports crypto trading with four currencies — USD, AUD, JPY, and Euro. They plan to add at least three more fiat currencies in the next 6 to 12 months following the beta launch.

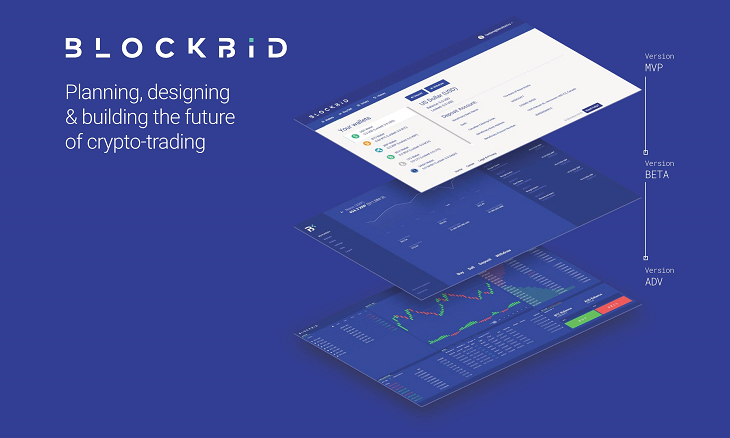

Blockbid is rolling out their beta version in three progressive phases:

Version MVP

This is limited to a closed group of participants, who will initially explore the platform without trading real currency. It's like a playground environment for users to test the features and provide feedback. Blockbid will then work through iterative patches and implement the next stage of design based on user feedback.Version BETA

At this phase, the beta version is improved and made publicly available with access to a selection of the world's biggest cryptocurrencies:- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin Gold (BCG)

- Litecoin (LTC)

- Ripple (XRP)

Version ADV

Titled "Advanced Beta" - this last phase will conclude the beta launch and additional tokens are introduced at this stage:- Ethereum (ETH)

- Dash (DASH)

- NEM (XEM)

- Digibyte (DGB)

- Nano (NANO)

- Bytecoin (BCN)

- Nexus (NXS)

- Iconomi (ICN)

- Cajutel (CAJ)

- Jetcoin (JET)

- ASTRcoin (ASTR)

- Fincoin (FTB)

- Trezarcoin (TZC)

- Unify (UNIFY)

- LanaCoin (LANA)

- TajCoin (TAJ)

- I/O Coin (IOC)

- NETKO (NETKO)

- Fujicoin (FJC)

- Unitus (UIS)

- Bitether (BTR)

- Decision Token (HST)

- DNotes (NOTE)

We can definitely see Blockbid's commitment in perfecting the exchange platform design for the future of crypto trading — to facilitate the highest volume of trades for the most cryptocurrencies with one single exchange platform. If all goes well, the full-scale launch of Blockbid is expected to be in late Q3 this year.

Pros

- Licensed with AUSTRAC and fully compliant with Australian AML/CTF guidelines

- Wide variety of cryptocurrencies on a single platform than any other exchange

- Support multiple fiat currencies for more diverse trading

- 95% of all crypto asset deposits stored in an offline multi-signature hardware vault

- Competitive 0.1% transaction fees

- Each Blockbid token offers 100% discount off transaction fees for a 30 minute window

- Easy-to-use regardless of your trading experience

- Scalable up to 1 million transactions per second

- Fully covered by cybersecurity insurance

- Unlimited deposit and withdrawal

- Free coin listing for blockchain projects

Cons

- Still being developed and tested

- Fierce competitions in a crowded space

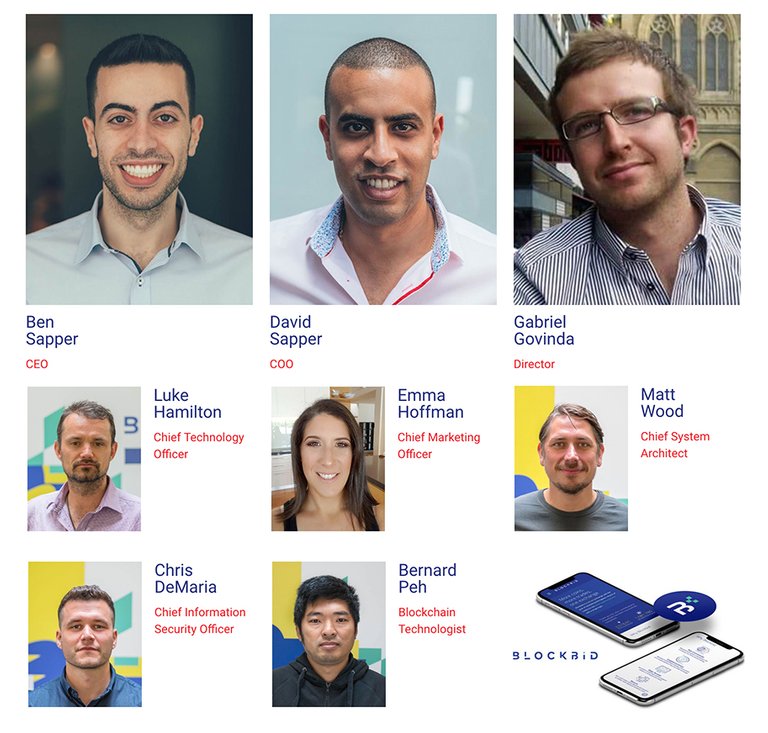

The Team

Ben Sapper, CEO

Linkedin

Ben is an accomplished entrepreneur who has founded many successful companies, including a facilities management company called Driven Facilities Management. He's experienced in Facility Management, Asset Management, Quality Assurance, Planning, and Financial Advisory.

David Sapper, COO

Linkedin

David is a growth hacker who's great at building high performing teams to penetrate new markets, disrupting the commercial landscape with technology. He has successfully exited two other previously founded tech startups.

Gabriel Govinda, Director

Linkedin

Gabriel is a highly respected Australian stock exchange member and former owner of a popular stock market research website. Most recently he has been an avid investor for tech startups.

Luke Hamilton, CTO

Linkedin

Luke is a solutions architect and senior software engineer with a plethora of experience leading technical teams. Prior to joining Blockbid, he was involved in full stack and mobile development, as well as solutions architecture for over 20 years.

Emma Hoffman, CMO

Linkedin

Emma is a marketer and serial entrepreneur who has founded and co-founded several startups. She's listed as one of the Top 50 Australian female entrepreneurs under 40. She has accumulated an extensive experience with B2B, B2C, O2O, SaaS and sharing economy business models during the various marketing positions held throughout her career.

Matt Wood, CSA

Linkedin

Matt joined the team four months ago as the Chief Security Architect. Before that, he was heading the trading and research technology of GLG Partners. He has over 15 years of professional expertise in team leadership, project development and systems architecture design.

Chris DeMaria, CISO

Linkedin

Chris also joined the team recently (three months ago) as the Chief Information Security Officer. He spent most of his career working on systems and network security, cloud solution architecture with Bendigo Telco. He's passionate and always eager in learning new concepts and technologies.

Bernard Peh, Blockchain Technologist

Linkedin

Bernard is a senior software developer and blockchain expert who has developed technology for some of the world's largest companies (Telstra, BP, Defence Force, BUPA, ANZ bank, Mazda, AGL and many others). He has held the lead developer and senior developer role recently, and is the founder of Whale Tech, a company focused on promoting blockchain adoption.

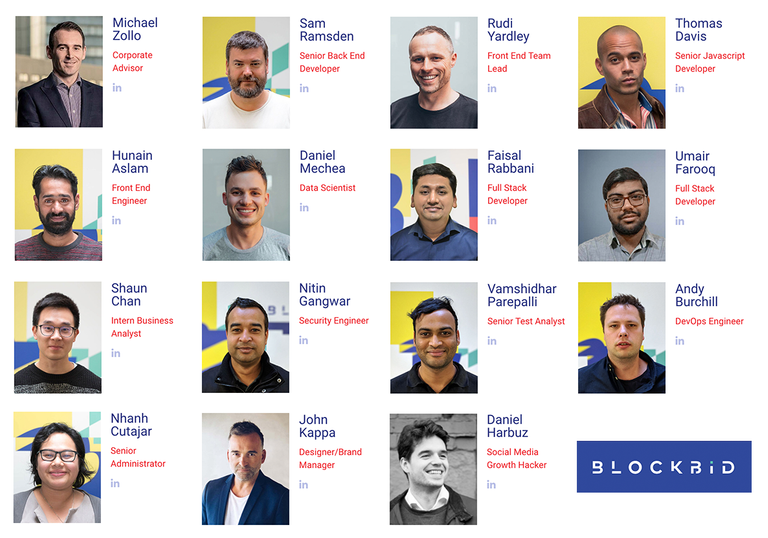

Overall, the team of experts has been carefully hand-picked, comprised of industry leaders in their respectable fields with over 150 years of combined experience. They also have a solid team of advisors coming from diverse background, including but not limited to blockchain, brokerage and tech delivery.

Partners/Affiliations

In order to drive growth and enhance competitive positions in the market, Blockbid forms partnerships and alliances with the most promising and innovative companies that strategically align with its vision & direction:

Tomorrow Ads

A digital advertising agency with reach to millions of organic users, on a global scale.Webing Marketing

An international social media marketing company specialised in growth marketing, social media campaigns and community management.HTA Advisory

Specialist accountant and business advisory focusing on delivering actionable insights.White Light Digital Marketing

Data-driven SEO and digital marketing company focusing on increasing page rankings, organic traffic and conversion online.Attribution Digital

Data-driven specialist agency for business performance optimisation.Konverto

Business and marketing consultancy company with more than 12 years of expertise in building startups, leading marketing teams and creating growth hacking strategies.Studio MASS

Leading UI/UX design company specialised in building digital products and services through observation, research, design thinking, branding, and prototyping.ThreatMetrix

An award-winning risk management giant in the digital identity space, providing end-to-end platform for digital identity intelligence and trust decisioning.Enterprise Ethereum Alliance

A non-profit corporation connecting Fortune 500 enterprises, startups, academics, and technology vendors with Ethereum subject matter experts.The Blockchain Association of Australia

A non-profit membership-based association connecting the global industry leaders and best practices to educate, develop and empower the blockchain community of Australia.

My Verdict

Australia may not be the biggest market for bitcoin and other cryptocurrencies, but it's definitely a growing one. At the time of writing, Australia is ranked 19th globally for BTC volume by currency. Although its market activities pale in comparison to Japan's, but globally, they are a rather large player.

I expect Australia's crypto trading volume to rise through the ranks once Blockbid is fully launched either late Q3 or early Q4 2018. As a fully licensed and insured, ultra-secure crypto exchange with ultra-low trading fees, it won't be surprising that many people will onboard the platform and start trading cryptocurrencies.

Soon, crypto traders around the world could take advantage of the unlimited deposit and withdrawal (pending KYC verification), as well as have access to more coins and more fiat trading pairs. This should, as a whole, increase the market activities globally. I believe it's a matter of time before they outshine Binance, which after much struggles, only offers a Euro pair in the latter part of the year.

So will it be the right crypto exchange platform for your needs? Try out their beta version and let me know in the comments or you can reach me at my bitcointalk profile.

Website: https://blockbid.io/

Telegram: https://t.me/Blockbid

Twitter: https://twitter.com/blockbid_io

Facebook: https://www.facebook.com/blockbid

Reddit: https://www.reddit.com/r/Blockbid/

Hello mrblueberry,

@SteemEngineTeam would like to take the time to thank you for

We plan to give back to our community members, so have an upvote on us!

Thank you.