The only reason money has value is because we believe it has value. The U.S. currency was once backed by Gold, and now it is backed by the Federal Reserve. Congress created the Federal Reserve to monitor, analyze, and administer money. They set interest rates, which in the most basic sense is the price of borrowing money. The Federal Reserve looks for that "sweet spot," where the interest rates maximize employment.

Economic Recessions = Lower interest rates = Easier capital acquisition

Economic Inflation = Higher interest rates = Harder capital acquisition

Problems with the Federal Reserve's Centralized Authority

First things first, the word "Federal" is a misnomer designed to foster the impression that it is purely owned by the Federal Government.

The Federal Reserve is both private and public, but the 'public' part is ambiguous. Let us take a deep dive into the mysteriously shrouded institution.

The "public" part consists of Seven members of the Board of Governors that are nominated by the President and confirmed by the Senate.

The "private" part consists of Banks set up exactly like private corporations. The Banker's Bank. Commonly called the Four Horsemen of Banking:

- Bank of America

- JP Morgan Chase

- Citigroup

- Wells Fargo

- Exxon Mobil

- Shell

- BP Amoco

- Chevron Texaco

"The Federal Reserve Banks are not a part of the federal government, but they exist because of an act of Congress. While the Board of Governors is an "independent" government agency (chosen by the President,) the Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve. Banks and earn dividends."

Government & Banks: a Revolving Door

The 2008 Financial Crisis was not a surprise to anyone who followed the money. Everyone points fingers at each other and blames the mysterious, yet omnipotent market.

"The single greatest contributor to the financial crises is the Federal Reserve manipulating interest rates in ways that distort the true price of capital."

Deregulation of the financial industry was the root cause of the Great Recession. The Banks created too much money.. but wait, are we talking about Banks or the Federal Reserve?

Unfortunately, during these swampy Trumpian times, Congress is trying to repeal the Wall Street Reform legislation that was passed in 2010. Their goal is to roll back the Dodd-Frank act that regulated the financial industry. Through deregulation, they are repeating history.

Louis McFadden, the Chairman of the House Banking and Currency Committee in the 1930's spoke with clarity and honesty - "Some people think that the Federal Reserve Banks are United States Government institutions. They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.”

Governments like to know where the money is, who has it and what you're doing with it.. but there is light at the end of tunnel via technology.

History no Longer has to Repeat Itself, Blockchain will Disrupt the Banking Industries

Banking is the most profitable industry sector, and its business model is relatively simple. It provides financial services to companies. Banks are so profitable because they are at the crux of every business. Banking is a data business, and money is represented in financial systems through data. Global Banking is a $134 Trillion industry.

We are witnessing a decentralized revolution that is changing monetary policies, business, and eventually the world. In 2017, we saw Bitcoin explode. At one point in time, a single Bitcoin was worth over $15,000.

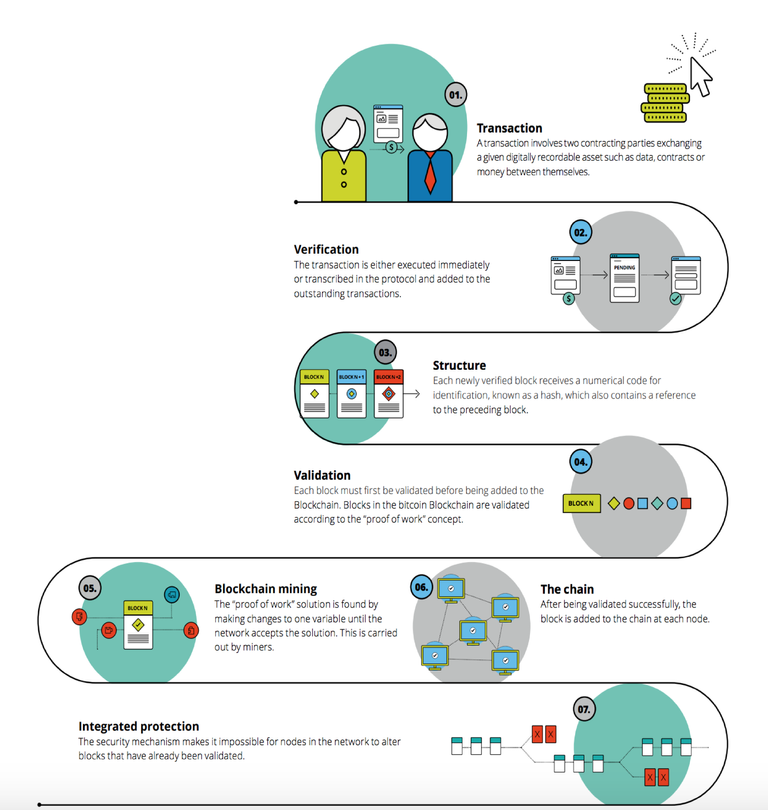

The World Economic Forum defines blockchain as "a distributed ledger technology(DLT) that enables data to be exchanged directly between differing contracting parties within a network that does not involve intermediaries." People interact with encrypted identities (anonymity) and each transaction is added to the chain and distributed to all network nodes.

Blockchain is the underlying DNA of cryptocurrencies which eliminates intermediaries, i.e. Banks from transactions.Blockchain is fundamentally changing market structures. Dan Tapscott, the Author of Blockchain Revolution says "the first generation of the digital revolution brought us the internet of information. The second, powered by blockchain will bring us into the age of value, which will reshape the world of business and transform the old order of human affairs for the better."

Blockchain is rooted in trust and transparency. Banks are subject to corrupt and leaked data.

Blockchain Fundamentally Disrupts These 5 Core Banking Principles

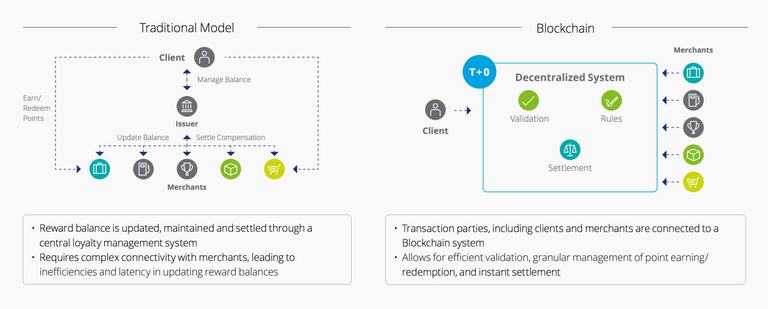

- Payments - Blockchain removes the Bank's 'cost per transaction' fees like hidden exchange rate markups. Banks make a good chunk of money from these hidden fees. In addition, blockchain technologies are much faster than traditional banking transfer times.

- Fundraising - Startups and other companies are able to immediately start fundraising through ICO's, or Initial Coin Offerings. In which they sell small shares of their prospective business to prospective investors. ICO's are more beneficial than raising traditional capital through banks because it is global, online, anonymous, and gives companies immediate liquidity access - something Banks cannot provide.

- Settlement Systems - Moving money around in the archaic banking institutions is slow. It can take up to 3 days to move money around the world; because the payment gets muddied in the banking system's structure. Instead of relying on Banks, transactions can be directly settled on the Blockchain.

- Loans and Credit - Centralized systems continue to provide inaccurate credit score reports and expose important credit card information. The FTC estimates 1 in 5 Americans have received a credit score error. And not to mention the Equifax hack which resulted in over 145 Million affected people. In typical fashion, Equifax only received a slap on the wrist. The Settlement was only for a mere $70 Billion, the estimated loss in consumer information and data is worth much more and will cause harm for a number of years.

- Security - When selling or buying assets, financial systems use a complex chain of mediums like exchanges, brokers, and custodian banks. Blockchain technology will foster a decentralized database of digital assets that are encrypted and unique.

very well explained and well put. This is a really good article, worth a tweet and a resteem.

Many many people even here on steemit don't understand what blockchain is and how it can change things. and its not only in the banking sector, just look how the STEEM blockchain is changing social media.

What I am loving most about learning crypto and blockchain are the use cases that are now emerging and the products coming to life

Thank you, and you're absolutely right. People know crypto and blockchain are good, but need a little more background substance.

I am very excited for what 2018 holds, but also worried that this will be the year we see collective Government and Corporate pushback towards Crypto and Blockchain.

Time will tell! Regardless, exciting times

Your article is really very informative! Thanks for that.

I don't think, that we'll see some kind of collective pushback, cause now nearly all the governments worldwide realize, which impact the blockchain technology will have in the future. But, they will be trying to do something like: "This stuff is not legal, until we organize & controll it" - stuff.

yes, good summary to get people orientated to the general concepts

Great article! I was just talking about this kind of stuff today and then I saw your blog post and very highly agree with the sentiments. Thanks for sharing!

Haha thank you! Glad the article resonated with you. And that's what it's all about, having constructive conversations with people about our future. It really is ours after all

Coins mentioned in post:

Like your post

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Toddoto from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.