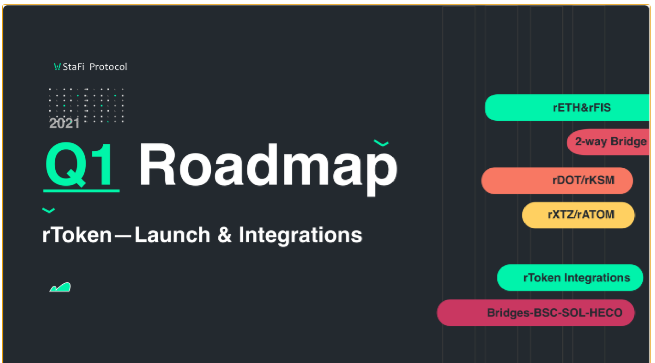

As for the Roadmap of the Q1 of 2021, StaFi protocol will specialise in the launch of many rToken merchandise and also the integration of rToken into multiple ecosystems. The audit of rETH and rFIS are going to be completed by mid-January. Stafi protocol is also working on the planning of Mint strategy and Uniswap liquidity incentives Program.Desegregation of rToken into totally different ecosystems, like Ethereum, BSC/Heco, Solona, etc., will be StaFi’s key work.

The details of Q1 are as follows:

1.rToken development

Including rETH, rFIS, rDOT/rKSM, rXTZ/rATOM, etc.

Among them, rETH and rFIS are already beneath audit; rDOT/rKSM is beneath development, and rXTZ/rATOM are going to be started in Q1. Additionally, the chance of developing Staking Derivative with several PoS public chains as well as Solana, Near, Avalanche, Nuls, CapserLab, Cartesi, etc. A step by step support of rSOL, rNEAR, rAVA and different rTokens in an exceedingly phased manner, creating the system of rToken additional flourishing.

2.rBridge development

Including two-way bridge, rToken bridge, BSC bridge, SOL bridge, etc.

Bridge is that the infrastructure through which rTokens enter totally different ecosystems. Of course, the bridge between rToken and Ethereum is staFi main focus. At present, StaFi has completed the event of the two-way bridge linking Substrate and Ethereum. After that, is the support of rToken Swap as desegregation rToken with BSC and Solana promises to be a stimulating try.

In addition, different ecosystems, like Polkadot, Near, and also the newborn Heco, have a requirement for fixed charge assets, that greatly facilitates StaFi's development for they're compatible with EVM. The aim of StaFi is to place totally different ecosystems all at once with rToken through rBridge.

3.StakingDrop development

Including rToken Mint incentives, Dex liquidity incentives

Mint can increase the amount of rTokens, and liquidity incentives can encourage the employment of rTokens, that are each vital for the StaFi system. StaFi is also actively exploring the chance of listing rTokens on Cex, besides Dex. If the liquidity of rToken is drastically improved, multiple application situations can emerge one when another.

4.Integrations

When the dealing of rToken has become a routine, then StaFi can explore the finance facet of it. As a replacement fixed charge quality, its presence in DeFi protocol can become a game-changer. Projects like Unilend, Easyfi, Dforce, etc., have expressed an excellent interest in Staking Derivatives , and that we can most likely reach a partnership with them within the future. Also, desegregation rToken into DeFi protocols, like Curve, Compound and Aave, etc., will be staFi focus. In the Polkadot ecology, there will be a study of the employment of Polkadot Parachain/Parahread, and to profer a liquidity answer for Parachain Slot Deposit for the project designed on the idea of Substrate. Speaking on this, we've got mentioned cooperation with comes like Plasm, Chainx, and Equilibrium.

Lastly, the operation of rToken can never be potential without the variety of OV (Original Validator) and SSV (StaFi Special Validator). For higher decentralization and the next degree of security, StaFi is going to launch an achievement set up within the future, and welcome additional glorious validators to join StaFi.

For more information visit https://medium.com/stafi/stafi-q1-roadmap-launch-and-integration-of-rtoken-79bc3ddf3343

Congratulations @wondermaey! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP