What happens when you reference Google's trends database for public interest in cryptocurrency against de facto cryptocurrency price performance?

You get some very interesting correlations

If we consider how markets operate, they are essentially a form of public price opinion consensus polling. Thus, much of the time, opinion polling which is not per se connected to price signalling can also be a useful source of data.

Check out this comparison.

The top chart shows Google search queries for the term "Bitcoin" while the bottom graph is a BTC/USD chart referenced from Bitfinex.

There is a striking correlation here.

Even more striking is the way that the price and the google query results mysteriously diverge and cease to follow each other around about March 2018 (I have roughly marked the point of divergence with a black lined labelled "X").

This to me says that price signalling after the first quarter of this year is being driven by a source which is very different to that of the previous boom.

And so, I ran a bunch of different queries through Google trends to try to find something which fit with the market performance.

Eventually, I did a search on "LocalBitcoin".

Bizarrely, out of all the searches I had run, the graph for this term fit the actual price performance most closely without showing severe divergence.

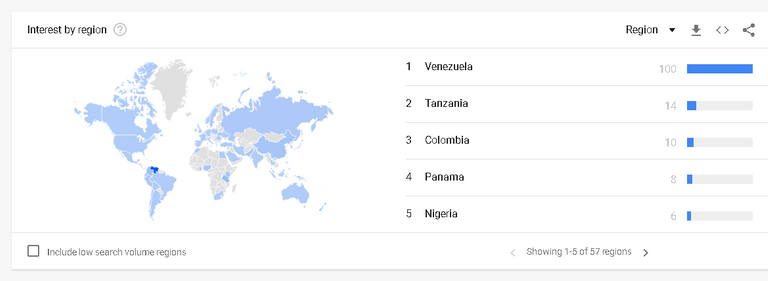

Then I looked at the "Interest By Region" data for that particular trend.

The primary driver for this particular search trend happened to be from Venezuela.

So could trade volumes from Venezuela therefore be helping drive the price of the BTC/USD pair then?

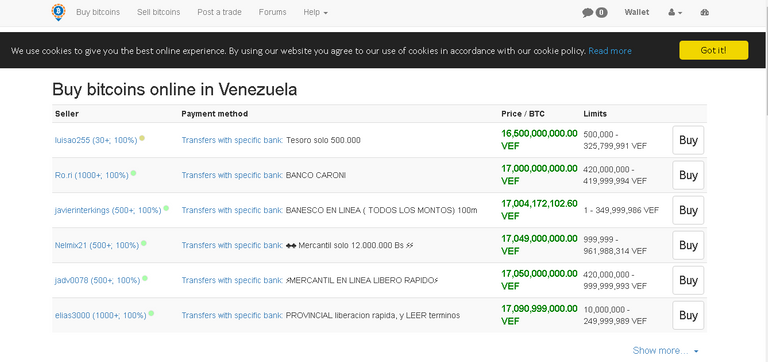

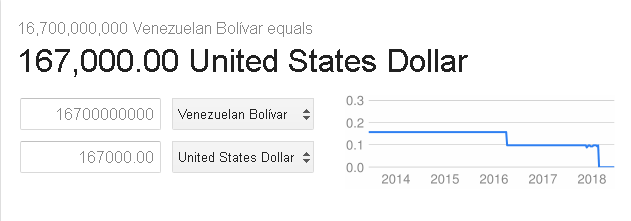

I decided to have a look at the Local Bitcoins site for Venezuela and I discovered that local prices for BTC against the Venezuelan VEF have exceeded 16,000,000,000 VEF

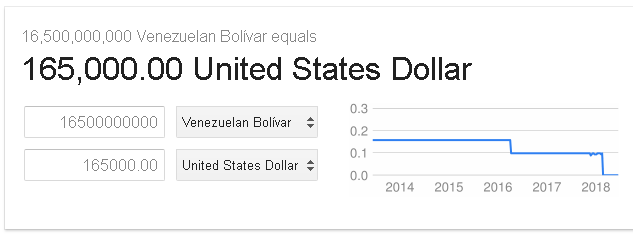

Okay, so how much exactly is that in USD considering the collapse of Venezuela's national currency? I had no idea.

Upon googling, I discovered that it comes to more than $165,000 US Dollars per bitcoin.

Was this just a quirk of the P2P marketplace, or is BTC really worth that much to Venezuelans?

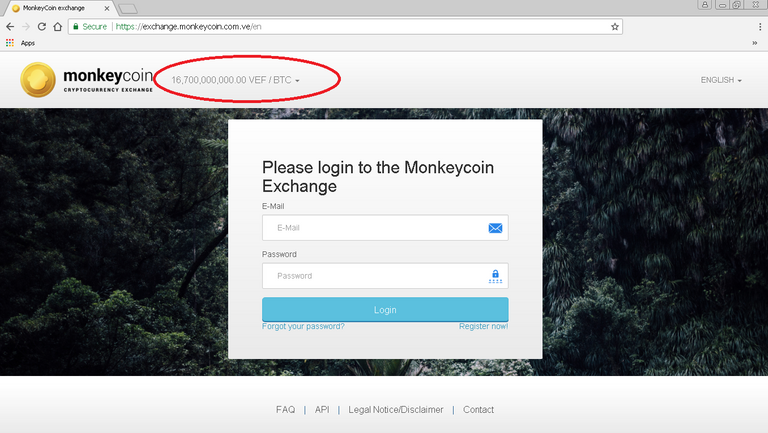

I decided to look around further and came across a platform called MonkeyCoin which claimed to be Venezuela's first approved cryptocurrency exchange.

The price on this exchange is quoted at 16,700,000,000.00 Bolivars per Bitcoin.

Which comes to $167,000 USD.

Think about this for a moment. Venezuelans are paying the equivalent of more than $150,000 USD per bitcoin.

This MUST be having an impact upon the market and price signalling.

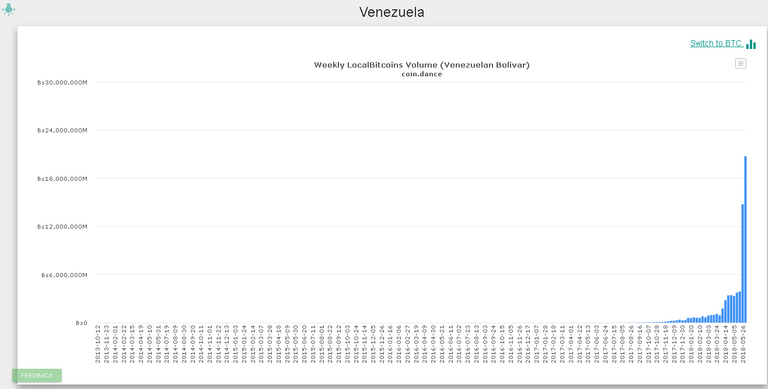

The volume throughput of Venezuela's LocalBitcoins site also began to spike since the beginning of Q2 this year.

This influx of Venezuelan volume correlates very nicely with the last wave on the western BTC/USD markets. Coincidence?

I will be writing more on this subject in the near future.

I will be investigating this further. In the meantime, I would strongly suggest that people watch both the Google trends data and the fledgling cryptocurrency markets in Venezuela.