The Trend is currently DOWN in ALL Time-frames.

…Key Statement:

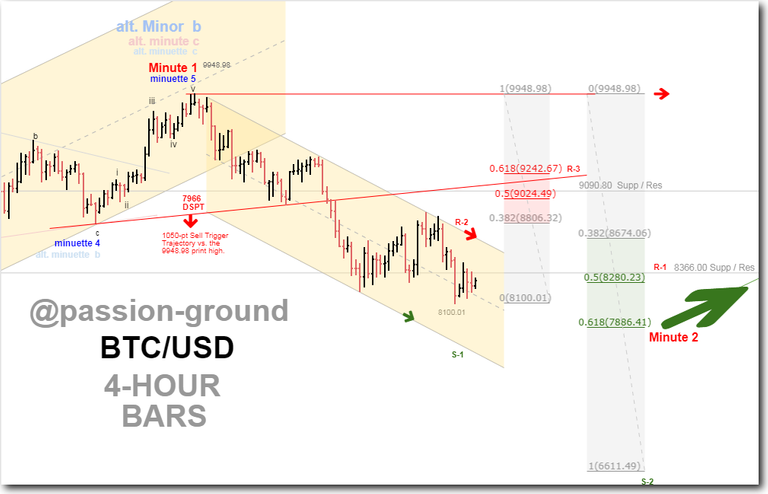

Although (basis the 4-hour chart) a bearish 5-wave impulsive decline off the recent 9848.98 print high has manifested, it by no means “guarantees” another leg down following any modest upward retracement of sorts. From the current pullback low of 8100, the 9,243 level (a .618 retracement thereof) becomes critical to observe relative to any meaningful move up off said pullback low.

If BTC is able to bullishly rally and “sustain” trade above 9243 from here, it would then become highly likely that 8100 would mark an interim low, and that we are on our way to riding a bullish 3rd wave up at the minute degree of trend (see daily chart in video.)

In contrast, however, further bearish rejection and a failure to reach and sustain bullish trade above 9,243, would then increase the likely hood of reaching the noted downside target of 7,966, or possibly lower before we mark the preferred bullish minute 2-wave down.

| Short-Term | Bias | Target | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|---|

| 4-Hour Chart | Bearish | 7,966 | 7,620 | 6,612 | 8,366 | 8,625 |

| Medium-Term | Bias | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|

| Daily Chart | Bearish | 7,796 | 6,428 | 9,456 | 11,688 |

| Long-Term | Position Bias | Date | Price |

|---|---|---|---|

| Weekly Chart | Bearish | 5-14-2018 | 8696.54 |

| SECULAR | Bias | Low 2018 | Target 2018 |

|---|---|---|---|

| Monthly Chart | Bearish | 5,920? | 12,235 min / 37,419 max |

…You Can’t Miss with Swiss-Chris!

Otherwise known as @famunger, Chris puts together a daily recap of all the top technical analysts across STEEMIT, and beyond. He does so in order to provide the community at large with the best possible forecasting guidance relative to the price of BITCOIN, and by default, the balance of the crypto-world at large.

In checking out @famunger’s daily recap, you simply can’t miss! His collective assessments of all the select analysts are akin to getting the very best snapshot of what the near and long-term future is likely to hold for those with a vested interest in BITCOIN and the multitude of coins, tokens, and alternative currencies that BITCOIN clearly paves the way for.

…BTC Update

Right Click and open in new tab to view full size image.

…Video Update

Select HD and “Full-Screen” for the utmost clarity in viewing this video update.

I trust that the preceding analysis and proof of work herein are generally objective, explicitly actionable and informative, and of relative and meaningful value for all those who perceive such analysis as a backstop to their individual ends.

Until next time,

Peace, Love, and Justice for All

In closing, I’d like to impart the following shout-outs to all of my fellow analysts here on the STEEMIT platform and beyond:

They are in no particular order:

To Tone Vays for his incredible energy in producing a wide variety of valuable content along with his proprietary version of Tom DeMark’s sequential indicator.

To @ew-and-patterns for inspiring me to get back into TA, and for his level of professionalism and balance in sharing his views with the community.

To @lordoftruth for his always awesome graphics and his undeniable commitment to report on his latest sentiments with regard to the price of BTC.

To @philakonesteemit for his honesty and in-depth look at market structure via order-books, short-term trading dynamics, EWT, and the like.

To @haejin, despite the seemingly never-ending flag-wars associated with his account, he nonetheless imparts a measured assessment of BTC market dynamics relative to EWT theory that is worthy of consideration – in spite of anything else that might be going on with regard to the ongoing controversy surrounding “reward pool” dynamics.

DISCLAIMER: This post and all of the analysis contained herein serves general information purposes only. I am not a registered financial adviser. The material in this post does not constitute any trading or investment advice whatsoever. The trend-following strategies explained herein are for example only, and should not be construed as trading or investment advice in any way. The same thing goes for anyone subscribing to the Long-Term Trend Monitor. The subscription simply shares with subscribers what several automated trend-following systems are doing, and that’s all. The bullish and bearish alerts provided therein are for information purposes only, and they are not to be construed as advice to buy or sell. At the time of this writing, the author holds a small position in BITCOIN and several other crypto-currencies. Please conduct your own due diligence, and seek counsel from an accredited financial advisor before making any trading or investment decisions. Should you decide to mirror or copy any investment or trading examples from this or any other related source, the decision to do so is entirely your own - as are the inherent risks involved in doing so. I am not responsible for any of your losses. By reading this post, you acknowledge and accept to never hold me accountable for any financial losses. Thank you.

Great work my friend. You have the cleanest charts on the internet. Mine are all marked up with all kind of lines. 😊

haha... Thank you, my friend, for such a kind compliment! Hey, that's why there is a delete/remove button... You can clean that stuff up in no time... :-)

hey dude. by chance, do you speak Spanish?

I do not, however, I'm very good with Google "translate." :-)

hahahaha excellent, I am also very good. I hope we can continue to interact. our best friend google will help us :D

Very good that information @ passion-ground. A hug my friend!

Thank you, Pipo my brother!

Time to buy in when it is down.

No doubt about it... There is no better time to speculate on entry points or "add" points than when a given market is under pressure...

Awesome for sure.