Introduction.

In year 2007, the world was on the receiving end of the whiplash of the errors of the traditional financial systems. The worlds economy was in a financial crisis, owning to haphazard policies and uncalculated risks. The global economic downturn was severe, and it crippled the financial backbone of the worlds economy.

With all proferred solutions failing to address the issue, the world was in a dire need of a bail-out plan to salvage the financial system from collapsing.

In 2008, Satoshi Nakamoto launched the Bitcoin, with a goal to foster a decentralized peer-to-peer exchange and payment network that would be independent of central authourity. With the aid of the blockchain technology, Bitcoin guaranteed safety of funds, privacy of users and exchanges in a decentralized ecosystem, free from third parties, custodians and central authourity.

This ushered in a new era of banking: DECENTRALIZED BANKING

Few years down the line, Bitcoin has taken the world by a storm, asides addressing the financial duress of the day, it sustains the infrastructure to replace the traditional banking system and hyas provided a springboard for the emergence of other cryptocurrencies.

However, despite cryptocurrencies addressing the financial constaraints of the economy and allowing mistrusting peers to trade securely without having to rely on a third party to oversee the proceeds of the trade, it has left a lot to be desired with constant loopholes that have remained unaddressed.

The Problem(s).

1.Cryptocurrencies are almost at the point of mainstream adoption, however It is no longer a secret that the major problem of cryptocurrency is SCALABILITY; The number of transactions a blockchain can process per unit time.

Cryptocurrency and blockchain has a long-term goal of replacing the conventional banking system, but when pithed against one other, in regards to transaction processing speed, cryptocurrencies fall below standard.

For instance Visa boasts of processing over 24,000 transactions per second, while Bitcoin and Ethereum boast of a meagre sum of 7 and 15 transactions respectively; this has resulted in queing and users having to wait for hours and sometimes days to see the completion of transaction processes.

This pitfall of scalability has hindered cryptocurrencies from being adopted on a mainscale. Some merchants have only allowed the purchase of few products online using cryptocurrencies, however thats only as far as it gets: cryptocurrencies have failed in its adoption at point-of-sale terinals due to their inability to complete multiple transactions at a fast pace.

2.Extra and Expensive Cost

One cannot turn a blind eye to the exorbitant fees of cryptocurrency platforms. Asides the mandatory membership fees required by most crypto-platforms from new users before granting access to its ecosystem, the non-negotiable fees levied on every transaction cannot be ignored.

Every user employing an exchange platform is required to pay a processing fee in order for the transaction to proceed, which are most times too exorbitant and rips off a large portion of the funds.

This has deterred loads of investors and traders from adopting cryptocurrencies especially when it involves transactions with low funds and high processing fees.

3.Lack Luster Offchain method.

In a bid to address the problems of cryptocurrency scalability offchain solution was proferred.

This involves processing transactions outside the blockchain and the bringing them back on the blockchain for onchain balancing.

Despite being a bright idea which solved scalability to a large extent, the offchain solution presented two pitfalls:

1. Crypto-investors and traders are required to provide extra funds as collateral before transactions are processed offchain. This poses a big problem, as users withour extra-funds to tender as collateral couldnt have their transactions taken offchain for processing.

2. Transactions taken offchain could not be balanced and are required to be imported to the blockchain for onchain balancing. Asides being expensive and jeopardizing the privacy of users, it also results in queues, as lots of transactions are waiting to be balanced

The Solution: Liquidity Network

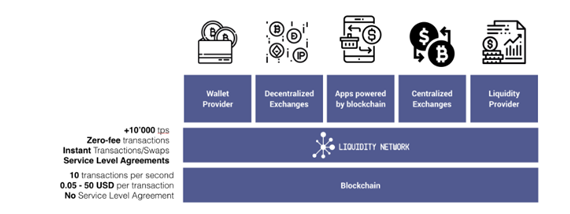

The Liquidity Network is an easy-to-use, scalable and transparent financial based ecosystem built on the Ethereum blockchain (guaranteeing security and privacy) which serves as a financial intermediary providing a link for fostering fast payment during cryptocurrency exchanges.

The Liquidity Network is a network of payment hubs which fosters the exchange of digital assets just like the traditional banking system, however it doesnt hold funds of users.

Liquidity Network is an off-chain solution for the scaling problem of existing blockchain: it can be incorporated into these blockchains to significantly improve payments, exchanges and reduce transaction costs to its barest minimum.

The Liquidity Network sustains the structure to accommodate large number of users spanning over millions and provide a platform for these users to access their allocated funds.

Liquidity Network Ecosystem

The Liquidity Network ecosystem is driven by two component platforms:

1. Liquidity NetworkNO-CUST Hub

2. REVIVE

1. Liquidity NetworkNO-CUST Hub.

NO-CUST means Non-Custodial

Liquidity NetworkNO-CUST Hub is a non-custodial peer-to-peer payment system that fosters offchain transactions without requiring collateral or deposits.

A custodian is a caretaker, he is entrusted with the custody and safekeeping of funds involved in a transaction.

By encouraging offchain transactions, the blockchain is decongested and millions of users can now process their transactions simultaneously without bothering about queues.

The Liquidity NetworkNO-CUST Hub hosts a network of different payment hubs where members are in charge of their private keys and the custodian of the funds involved in the transactions, this permits mistrusting users to send and receive payments across this network of hubs instantaneously, since no third party serves as custodian of funds.

2. REVIVE

This is an integral part of the Liquidity Network as it serves to eradicate the need of onchain balancing for offchain transactions.

By guaranteeing the offchain rebalancing of offchain transactions, the blockchain is given less load of work. This would eliminate queues and enhance scalability of cryptocurrencies.

Categories of Offchain Transactions.

Liquidity Network structures offchain transactins in Two-categories to suit the interest of different users on its platform.

They are:

1. Two party payment channels

2. N-party payment hubs

1. Two Party Payment Channels

This is employed mainly for Offchain transactions involving two parties. This channel has different types:

UNI-DIRECTIONAL- Here funds can only travel in one direction i.e sending and requires the beneficiary to make a collateral deposit that is equivalent to the amount being sent through the channel

BI-DIRECTIONAL- Here funds can move through the channels in both direction, hence both parties are required to make collateral deposits

LINKED PAYMENTS- This is employed when transacting peers are not directly connected and both parties are required to make deposit to the network. Linked payments topography is employed and transaction security, congestion balancing and route finding is taken into account

- 2-PARTY PAYMENT HUBS- This is an extension of the above mentioned two-party channels, however it varies slightly, as it involves more than two parties involved in an exchange*

2. N-party payment hubs

This has been structured to accomodate multiple users and encourage the employment of more offchain transactions within the Liquidity Network.

It is an upgrade on the Two-party payment channels as it requires less routing topology and less computational work in rebalancing collateral.

Liquidity Network Innovative Features.

Liquidity Network offers two unique features with distinct yet complementing characteristics:

1.Novel Payment Features

2.Novel Exchange Features

Novel Payment Features

- Allows the transfer of funds by member within the payment hub at zero transaction fees.

- Allows the ecosystem to operate simple routing designs void of complex routing topologies.

- Allows instant and offchain channel establishments without the intervention of a prior crypto

Novel Exchange Features

- Allows the execution of offchain exchange without holding on the user funds and is firewall for excessive onchain transaction fees.

- Provides allocation for the exchange to function in times of blockchain congestion.

- Guarantees fast trading that matches that of traditional centralized exchanges by ensuring instantaneous offchain exchanges.

The Advantage of Liquidity Network over Others.

- Micro-payments and Transfer of Small Value with negligible transaction costs.

- Improved transaction Privacy

- Instantanteneous payment and cryptocurrency Exchange

- Simple ecosystem void of complex routing.

- Transparent ecosystem ensuring audit of all transactions.

- Allocated funds are not withheld and can be employed to pay any member on the liquidity ecosystem.

- Enhanced Security powered by blockchain.

- Generic ecosystem, built on ethereum, compatible with any smart contract blockchain.

- Flexible Fees which is incured by either the buyer or seller.

- Decentralized ecosystem, which guarantees no one is the custodian of funds except the owner.

Centralized and Decentralized Features.

The Liquidity Network is a hybrid of centralized and decentralized systems, it possesses the infrastructure to handle multiple transactions at a fast speed just as it is in centralized platforms, however it incorporates the characteristics of decentralized platforms ensuring transparency, privacy and security.

One of the major reasons that has hampered the mainstream adoption of cryptocurrencies is the time taken to process multiple transaction, which is shamefully very slow. This has eliminated the opportunity of blockchain technology being employed at point-of-sale terminals with centralized platform taking center stage as the alternative.

Liquidity Network harnesses the potential of centralized platforms, by employing centralized servers to process offchain transactions at a swift rate, while its adopts the characteristic of decentralized platforms to guarantee security of assets.

This interoperability, makes Liquidity Network a unique ecosystem, as it solves the age long problem of crypto-traders having to shuffle the options of going with centralized exchanges in order to have faster transactions or stick with decentralized exchanges with more secure and private platforms.

The Benefit of Giving Full Control of Private Keys to Users

The security of assets is a big deal in the cryptocurrency ecosystem, although many made huge profits last year when Bitcoin reached an all time high in profits, Nevertheless, many still lost alot of their assets to theft and hacks.

Unwholesome practices of insincere platforms to rip off whales and investors is also a big problem, trust has now become a scarce commodity owning to recent events and happenings and as such the call to allow users have full control of their private keys as this would guarantee security of user funds and assets and reduce theft and hack to its barest minimum.

Asides the security of funds, granting full control of private keys to users would guarantee that transactions are initiated and completed much faster, as there would be no need to wait for custodians to release funds, which is one of the major causes of delay.

Liquidity Network Token

The LQD token is an ERC-20 compatible token and is the official token of the Liquidity Network.

The LQD token facilitates a competitive open market within the Liquidity Network for secure payment processing.

The LQD token allows users within the Liquidity Network to have access premium features and pay for auxilliary services.

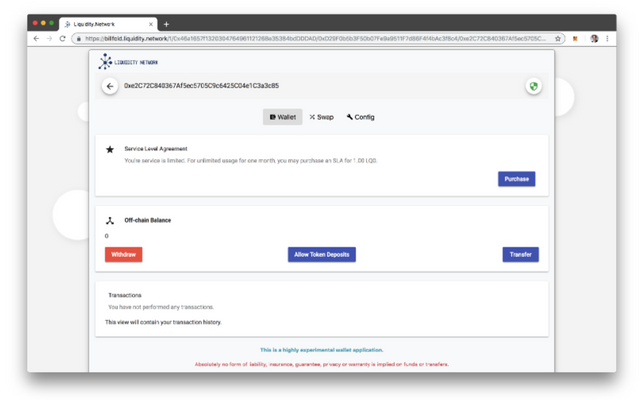

Liquidity Network Wallet

Liquidity Networks have developed an e-wallet that is compatible with mobile phones, as well as desktop devices. This wallet is available on Google Play Store and Apple App Store for Android and iOS devices respectively.

This is a bright and gladly welcomed step, as this would encourage quicker adoption and foster easier access from anywhere and with any device.

Desktop View

Mobile View

Liquidity Network Wallet - IOS

Liquidity Network Wallet - Android

Liquidity Network Roadmap

Liquidity Network Team

Liquidity Network Patners

Use Case

Ruby is a crypto-enthusiast and she runs a global gaming enterprise, in order to play her part in aiding the mainstream adoption of cryptocurrencies, she incorporates cryptocurrencies as a means of payment to her gaming world.

Gamers are required to employ cryptocurrencies in purchasing in game features and add-ons to enhance their overall gaming experience.

In recent times, Ruby's games have gained popularity and seen an improved influx in the number of gamers. This has posed alot of problems as gamers cannot quickly complete transactions on the blockchain to purchase in-game features due to congestion.

Ruby is worried and needs a bail-out plan, she is introduced to Liquidity Networks by a friend, now users can initiate and complete transactions instantaneously via the offchain transaction hub.

Conclusion

Liquidity Network is a timely innovation, unlike others it is not a modification of what is already existent, rather it is an upgrade that can be incorporated to pre-existing blockchain to address the long standing issue of scalability.

Liquidity Network is not the first to address scalability with Offchain payment channels, however it is the first to do it without routing complexities and exorbitant onchain rebalancing fees.

it would be a joy to see it being incorporated to every blockchain, with the very distinct features it offers.

Please watch this simplified video for more explanation

https://m.youtube.com/watch?v=xfxD2ZlBBQA

For More Information & Resources:

Liquidity Network Website

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store (IOS)

Liquidity Network Google Play Store (Android)

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

To participate in this contest by @Originalworks click here

Twitter Post

lqdtwitter2019

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!