1 – Introduction

2 – What is futures trading?

3 – Problem Statement

..3.1 – Solely centralized exchanges

.....3.1.1 – High trading fees

.....3.1.2 – Funds stored on exchanges

..3.2 – Solely decentralized exchanges

4 – DIGITEX

..4.1 – What is DIGITEX?

..4.2 – Features of Digitex

..4.3 – How does Digitex work?

.....4.3.1 – The Digitex Protocol Token (DGTX Token)

.....4.3.2 – Decentralized Governance by Blockchain (DGBB)

5 – Solutions to current futures exchange challenges

..5.1 – Solutions to challenges of solely centralized exchanges

.....5.1.1 – Zero-fees

.....5.1.2 – Decentralized Ethereum based wallets

..5.2 – Solutions to challenges of solely decentralized exchanges

..5.3 – Digitex’s already achieved milestones

..5.4 – Where I see Digitex in years to come

6 – Applications and Use Cases

..6.1 – Application and Use case for individual futures traders

..6.2 –Application and Use case for brokerage firms

..6.3 – Application and use case for Investment banks

7 – My video on Beam

8 – Conclusion

1 - INTRODUCTION

The 21st century financial sector has experienced a revolution in the way transactions are being conducted, primarily due to the invention and consequent adoption of the blockchain technology in its financial transactions.

The decentralized nature of the blockchain technology has made it possible, through these cryptocurrencies, for people to be in full control of their moneys, making the exchange of money easy and quick, and also providing high security while making these transactions. These qualities are not prevalent in centralized systems.

However, when cryptocurrency futures trading becomes the focus, decentralized systems alone can’t be efficient. This is because there is a need for more than just secure and quick transaction mechanisms. An efficient futures trading platform has to possess efficient real time trading, have high scalability and reliability, have complete privacy, and so on. These qualities are more prevalent in centralized servers, as opposed to decentralized servers.

Also, in line with the quest for achieving an efficient cryptocurrency futures exchange, common sense will tell that an exchange that has developed a way to adequately fund operational costs without collecting any fees from the traders, will most likely be much more efficient than an exchange that does.

We can hence draw a conclusion that to get a truly efficient cryptocurrency futures exchange, there is a need for that exchange to be a zero-fees exchange, in addition to being a hybrid of both decentralized and centralized systems.

2 – WHAT IS FUTURES TRADING?

Have you ever asked yourself why the price of cereal cornflakes stays the same price day to day, yet the price of corn can change daily, sometimes by a few cents and other times by a lot more?

This is made possible, partly because of futures trading.

Futures trading is a legal contract between a seller and buyer of a commodity/financial instrument, agreeing on a predetermined price to be paid for that commodity/financial instrument at a future date. If the price of that commodity/financial instrument drops, the sellers gains, and if the price increases, the buyer gains.

In the corn and cornflakes instance I gave above, futures trading is used to keep the price of the cereal cornflakes stable, since the farmer and cereal maker come to an agreement on the price to be paid for the corn even before they are harvested. With this, the price of the harvested corn covered by that agreement remains stable even if the price of corn generally changes. This in-turn keeps the price of cereal cornflakes stable.

3 - PROBLEM STATEMENT

3.1 – Solely centralized exchanges

The qualities that cryptocurrencies possess are highly desirable, and hence have been applied to various sectors of the financial industry, from trading, to payments, to financial transfers, and so on.

In its application in futures trading, cryptocurrencies provide tremendous benefits mainly because of its decentralized nature. Nevertheless, we have to acknowledge the fact that solely centralized platforms like GDAX.com, BitMEX.com, and so on, have done some pretty good jobs at providing futures trading environments for traders.

But despite their various achievements, there are still some shortcomings and challenges that these futures trading platforms possess, which if addressed, will lead to a highly efficient futures trading exchange.

These challenges are as follows:

High trading fees

Funds stored on exchanges

3.1.1 – High transaction fees

When digital currency exchanges render services, they incur some operational costs, which include, support costs, development cost, security costs, marketing costs, and so onSource. As the number of trades increase, these operational costs also increase.

In order to fund these operational costs, these exchanges have to include transaction fees when processing buy and sell orders. These transaction fees are usually a stated percentage of the total amount being traded.

When the volume of trade is small, the fees can be insignificant, but when they are large, the fess become large. These large fees are deducted even before the trader begins to make profits, meaning that these traders are in loss right from the beginning of the trade. Hence, for the traders to truly make profits, they have to make gains over and above the transaction fees.

Because of these fees, traders who use low profit margin futures strategies to trade huge volumes of transactions are at a disadvantage. The fees they are charged cancel out any profits that they could possibly make, and could even make them experience loss.

As a solution to this problem, there is a need for a futures trading platform that would not charge traders any transaction fees, but rather develop another strategy for funding operational costs.

3.1.2 – Funds stored on exchanges

Exchanges have hot (online) wallets where they store the funds of traders online. The aim of this is for the exchange to have easy and quick access to user’s funds when processing trades. Despite the advantage of easy access to funds, there is the risk of having funds frozen or withheld by exchanges, or even stolen by hackers. User’s funds are at the mercy of the exchange and hackers.

There are numerous cases online of exchanges that have been attacked by hackers, and funds of users on those exchanges were stolen away with no refund. With the knowledge of this risk, cold wallets (Hardware wallets) may be the quickest recommended that comes to mind, since they don’t have funds stored online.

Despite the fact that cold wallets store funds off-line and hence are safe from hackers, they lack the easy access that hot wallets (online wallets) have, hence making user’s trade one advantage for another. Digital currency trading is one that is time dependent. Trades are conducted in seconds, and any delay in access to funds can lead to a loss of that trade.

There is therefore need for a storage mechanism that can provide users with both easy and quick access to their funds, as well as high security for funds.

3.2 – Solely decentralized exchanges

Despite the tremendous benefits that decentralization provides, it still is deficient when solely used to operate an exchange. Some of these deficiencies are as follows:

- Decentralized blockchain exchanges experience latency (delay transfer of data experiences before it is being processed), which in-turn prevents real time trading.

- Decentralized blockchain exchanges are not absolutely private, and could lead to leak of information that can cause front running (the prohibited practice of entering into an equity trade, option, or futures contract, to capitalize on advanced, non-public knowledge of a large pending transaction that will influence the price of the underlying securitySource) on large orders

- Decentralized blockchain exchanges charge higher fees than centralized exchanges.

- Scalability and reliability is still a prominent challenge of blockchain based platforms, including decentralized blockchain exchanges.

- Decentralized blockchain exchanges don’t have margin trading capabilities.

From the analysis of solely centralized and solely decentralized exchanges above, we can see that despite the strengths these exchanges have individually, they are still not perfect at providing efficient cryptocurrency futures trading.

There is therefore need for a new cryptocurrency futures exchange platform that will provide solutions to these challenges, and providing these solutions at zero transaction fees will automatically put that new platform in a class far superior to other exchanges.

4 – DIGITEX

4.1 – What is Digitex?

In the futures exchange market, there exist numerous exchanges built on solely centralized and solely decentralized systems. These exchanges were built on these systems to harness the various qualities that they individually possess.

Unfortunately, because centralized and decentralized systems individually have shortcomings despite their strengths, these exchanges built exclusively on any of these exchanges also experience shortcomings. They are not efficient at providing adequate futures trading services. These exchanges have high fees, low security, low privacy, and so on.

Digitex is a brand new revolutionary cryptocurrency futures exchange that is redefining and reinventing the way futures contracts are being traded. Digitex is a highly secured zero transaction fee cryptocurrency futures exchange that is a hybrid of centralized and decentralized systems. Digitex achieves this by seamlessly combining centralized servers with decentralized Ethereum based wallets.

Since decentralized systems are highly secure by virtue of the fact that users are in complete control and possession of their funds, while centralized systems are highly scalable, reliable, and fast, the efficient combination of these two systems makes Digitex an exchange with phenomenal potentials, and equipped to take futures trading to the future.

4.2 – Features of Digitex

The Digitex system consist of the following features:

- Zero Trading Fees

- Decentralized Account Balances

- Highly Liquid Futures Market

- Automated Market Makers

- Digitex Native Currency (DGTX)

- Token Issuance Revenue Model

- Bitcoin, Ethereum & Litecoin Future

- One Click Ladder Trading Interface

- Large Tick Sizes

- High Leverage

- No Auto Deleveraging

- Sub-Millisecond Order Matching

- Off-Chain Price Discovery

- On-chain settlement

- Decentralized Governance by Blockchain

- Complete Privacy

- Blockchain DrivenSource

4.3 – How does Digitex work?

The Digitex exchange operates 3 futures markets, namely BTC/USD, ETH/USD, & LTC/USD. To trade these future contracts, intending traders have to purchase the Digitex token (DGTX) on the Digitex platform, by exchanging either Bitcoin, Ethereum, or Litecoin, for DGTX.

These futures contracts are traded in portions called tick sizes. These tick sizes are made large enough to enable the system eliminate noises during volatile markets. Also, these tick sizes are dominated in DGTX tokens, so that trades, profits, and losses are processed in DGTX tokens.

Now that the trader has DGTX tokens, he can carry out futures trades through the one-click ladder trading interface, where bids and offers move up and down a central price ladder. By clicking just one button, futures trades in any of the three markets can be activated.

Since the Digitex exchange is a zero-fee trading platform, the moment the trade is activated, the trader is not in loss, as opposed to other exchanges where deduction of fees puts traders in loss even before profits begin to come in. With Digitex, the trader has all his profits raked in, without any deduction of fees.

Furthermore, DGTX tokens of traders are not stored on the Digitex exchange, but rather stored individually by users in their own decentralized Ethereum based wallets.

When a trade is to be conducted, Digitex communicates with the decentralized wallets of users through decentralized smart contracts, hence carrying out checks and balances between the Digitex exchange and user wallets. Through this process, futures contract trades are highly secured and fast, hence combining the strengths of both centralized and decentralized servers.

4.3.1 – The Digitex Protocol Token (DGTX Token)

DGTX token is an ERC-223 protocol token based on the Ethereum blockchain. It is the native currency of the Digitex exchange. To provide zero-fee trading, Digitex uses a DGTX token issuance system, where operational costs of the exchange are covered by issuing new DGTX tokens.

In other exchanges, active traders (those who trade frequently, and hence contribute to the liquidity of the exchange), are being punished in the form of fees payment for trading frequently. Rather than being rewarded for contributing to the liquidity of the exchange, the exchanges take money from them.

Contrary to this, Digitex rewards active traders in the form of increased token value. When a trader wants to trade on the Digitex platform, the trader has to purchase DGTX tokens with Bitcoin, Ethereum, or other accepted coins on the Digitex platform. When the trader conducts trades, he/she is not charged any fee.

To cover operational costs, new DGTX tokens will be minted. The amount of these tokens to be minted depends solely on a democratic consensus reached by the current holders of DGTX token.

This minting of new DGTX tokens will obviously have inflationary consequences on the current DGTX tokens. But because the Digitex exchange is a zero-fee exchange, other traders will be attracted to the exchange, leading to high demand, which in-turn will lead to increase in the value of DGTX tokens.

This increase in value will far outweigh the inflation caused by minting new coins.

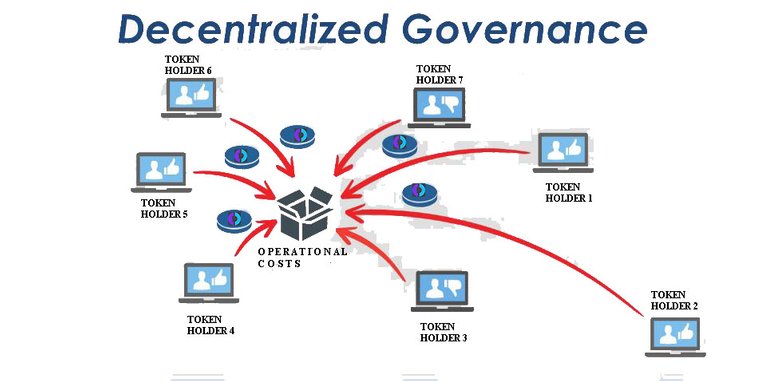

The democratic process of deciding the amount of new DGTX tokens to be minted is called Decentralized Governance by Blockchain (DGBB).

4.3.2 – Decentralized Governance by Blockchain (DGBB)

It would be totally unfair to mint new tokens without taking into consideration those who would be affected by inflation caused by the minting process.

This is where the concept of democratic governance comes into play. The DGTX holders submit propositions on the amount of DGTX tokens they think should be minted to cover operational costs. Since they are aware of the inflation consequences of minting new coins, whatever decision they will take will be taken with their interest in view.

For DGTX holders who will not be active on the platform, they can delegate their voting power to trusted persons who can vote on their behalf.Source

--

5 – SOLUTIONS TO CURRENT FUTURES EXCHANGE CHALLENGES

5.1 – Solutions to challenges of solely centralized exchanges

5.1.1 – Zero-fees

Traders are the most active users of an exchange. This activity of theirs makes the exchanges highly liquid. But the unfortunate thing is that traders are punished for bringing this high liquidity to the exchange by imposing fees on them. This has one way or the other reduced the amount of trades that would have otherwise be made by traders, hence affecting the liquidity of the exchange.

To solve this, Digitex has developed a strategy that can enable them operate a commission free trading platform, where traders can conduct trades at absolutely zero-fees. This strategy uses minting of new DGTX tokens to cater operational costs. This will encourage more traders to join the platform, hence increasing the liquidity of the platform and also the value of DGTX tokens.

5.1.2 – Decentralized Ethereum based wallets

Storage of funds on exchanges is a highly risky means of keeping trader’s funds. Because these funds are online in a central storage, they are prone to hack.

Also, keeping of funds on storages put them at the mercy of the owners of that exchange. This means that the exchange management can choose to freeze or withhold these funds whenever they choose.

However, these problems can be averted through the use of decentralized Ethereum based wallets. Traders can personally store their DGTX tokens in decentralized ERC-223 wallets stored on the Ethereum blockchain, away from the Digitex exchange. Only the traders themselves have the private keys of these wallets, hence preventing theft from hackers and confiscation from the Digitex management.

Whenever a trade is to be executed, the centralized server of the Digitex exchange communicates with the decentralized wallets of traders through smart contracts.

5.2 – Solutions to challenges of solely decentralized exchanges

An exchange that stores order books, settles trades, and runs machine engines on centralized servers, in combination with the usage of decentralized Ethereum wallets, is better than solely decentralized exchanges in the following ways:

- Centralized servers operate very fast, which is a necessity for real-time trading

- Centralized servers have high scalability.

- Centralized servers have high privacy levels, hence preventing illegal acts like frontrunning.

- Unlike decentralized exchanges, centralized server carry out margin trading and leverage services, giving traders better opportunities to make more profit.

- Transactions on centralized servers are off-chain, and effectively free Source

5.3 – Digitex’s already achieved milestones

Since its inception, Digitex has achieved some milestones in its quest to be the first-ever user-friendly, commission-free cryptocurrency futures trading platform. These milestones are as follows:

ICO sold out in 17 minutes: Digitex had her ICO sold out in 17 minutes Source

3rd Biggest gainer on coinmarketcap.com: Despite the bearish run experienced generally in the cryptocurrency market, Digitex not only gained, but was the third highest gainer on the website.

Plasma technology incorporation: It’s not news that the Ethereum blockchain has scalability issues, but with the help of plasma technology, the Ethereum network will be able to scale limitlessly. Digitex is one of the apps that will implement this new technology on its exchange.

Listed on 4 exchanges: DGTX token has already been listed on the following exchanges: Mercatox, ExRates, OOOBTC, and Radex.Source

5.4 – Where I see Digitex in years to come

In the nearest future, I see Digitex getting high public appeal, achieving the following milestones:

Being a commission-free cryptocurrency futures trading exchange, this will draw majority of futures traders to the platform, hence increasing the value of the DGTX token.

In addition to the 3 futures market being traded on the platform (BTC/USD, ETH/USD, LTC/USD), Digitex will add other cryptocurrency combinations like XMR/USD, XPR/USD, ZEC/USD, and so on, to further increase the liquidity of the exchange.

We can’t deny the fact that the crypto space is clustered, hence the need for aggressive marketing strategies. I see Digitex employing a commission-based affiliate program, where traders that refer their friends receive a portion of the Digitex tokens minted to cater for operational costs.

As a brand that will be spearheading the spread of the futures trading market, I see Digitex expanding its brand awareness by conducting trading competitions that will reward traders with DGTX tokens for exceptional futures trading capabilities.

Digitex being a democratically user governed platform, will organizing meet-ups for its users, just like Steemit meetups (Steemfest), aimed at organically growing the Digitex community. Here Digitex traders can meet and share ideas on how to become better traders, and also how to contribute to the improvement of the Digitex exchange.

Finally, in addition to English language, the Digitex exchange platform will support other languages like Chinese, French, Spanish, and so on.

6.0 – APPLICATIONS AND USE CASES

6.1 – Application and Use case for individual futures traders

Application

The major reason why people trade futures market over other investments is because they can make profits faster in futures market, due to the fact that average futures prices change faster than stock prices. This shows that traders are in the futures market primarily for fast gains. Prior to Digitex, other exchanges charged transaction fees that indirectly reduced the amount of profits that traders could make. Traders paid these fees whether or not their trades made profits.

With the help of Digitex, individual cryptocurrency futures traders can now make zero-commission trades. They no longer have to bother about the amount of fees to be paid.

Use case

Ben is a short term futures contract trader. He trades futures on the GDAX.com exchange. He noticed that some of the trade loses he had were not because of wrong trade judgements, but rather because of exuberant trade fees. An example of such trade is shown below:

- Ben buys 1 bitcoin offered at $6500, and then sells it at $6510, making a profit of $10

- For him to carry out this trade, he must have 1 x $6500 = $6500 in his account.

- GDAX.com charges a fee of 0.25%, hence Ben’s fees for buying and selling this 1 bitcoin is as follows:

Buy: 0.25% x 1 x $6500 = $16.25

Sell: 0.25% x 1 x $6510 = $16.275

Total: $16.25 + $16.275 = $32.525

- Ben’s profit is $10, and fees is $32.525, meaning he actually has a loss of $32.525 - $10 = –$22.525 after paying fees.

On finding out about Digitex, Ben is marveled and immediately starts to use Digitex for his transactions. Conducting a similar transaction as the one above, the result was as follows:

Ben buys 100 BTC/USD futures contracts at $6500 and sells them at $6510, making a gain of $10.

The tick size of the BTC/USD futures contracts is $5, hence Ben made a profit of 2 ticks ($10/$5 = 2ticks). With 100 BTC/USD futures, Ben has a 200 tick profit (2 ticks x 100 futures = 200). 1 tick is worth 1 DGTX token, so Ben made a profit of 200 DGTX.

The current market price of 1 DGTX token is $0.03 (as at 17/9/18), so Ben’s profit is $0.03 x 200DGTX = $6.

Since the initial margin for futures trading on the Digitex exchange is 20 DGTX, For Ben has to have a balance of 100 x 20 DGTX = 2000 DGTX ($60) to conduct a trade.

Since Digitex charges no transaction fee, Ben’s profit of $6 after fee payment is $6.

From these, Ben recognizes that Digitex enables him make more profits ($6 as opposed to –$22.525), and at a lesser trade capital ($60 as opposed to $6500).

6.2 – Application and Use case for brokerage firms

Application

Most people who want to trade futures contract but don’t have the required knowledge usually outsource their accounts to brokerage firms to trade for them. When dealing with funds of other people, security of funds is as important as making profit.

This means brokers have to work with exchanges that provide high security for funds. But prior to Digitex, the exchange platforms available were prone to hack because of their storage of funds on the exchange.

With the help of Digitex, these brokers can now be rest assured that funds of their clients would neither be frozen by the exchanges, nor stolen by hackersUse case

Diamond brokers is a brokerage firm that trades futures on behalf of their clients. They operate on centralized exchanges that store user’s funds on the exchange. The brokerage firms are aware of the risks involved but have no choice because of the lack of other options.

On finding out about Digitex, Diamond brokers immediately begin using the Diamond platform, hence having funds of clients highly secured. Also, the no commission feature of Digitex enables the brokers make more profits for their clients.

6.3 – Application and use case for Investment banks

Application

Some investment Banks are beginning to get involved in cryptocurrencies. An article, which can be found here, shows that investment banking giant Goldman Sachs is one of a few large banks offering clearing of bitcoin futures offered by Cboe and CME exchanges.

Prior to Digitex, most of these large banks have avoided investing in the cryptocurrency futures market, with security as one of the reasons for thisSource.

With the help of Digitex, most of these large investment banks can be motivated to invest in the cryptocurrency futures trading market, because of the high security and zero-fees.Use case

After hearing about Goldman Sachs’ investment in futures market, JPMorgan Chase has been looking at entering into this market too. But because of the security risks involved, they held off doing so.

The Director of JPMorgan Chase gets to find out about Digitex, and is thrilled about its potentials. The Digitex exchange is adopted by JPMorgan Chase.

As an increasing number of traders join the Digitex platform because of its high security and zero-fees, JPMorgan’s investments begin to yield much profits.

7 – MY VIDEO ON DIGITEX

8 – CONCLUSION

The decentralized nature of solely decentralized exchanges gives them a huge security advantage over solely centralized exchanges, while centralized exchanges on the other hand are faster and more scalable than solely decentralized exchanges.

Hence for us to get the ideal exchange, we need a hybrid of both decentralization and centralization. That ideal exchange has to operate centralized matching engines coupled with decentralized Ethereum based wallets.

Digitex is that ideal exchange. It will provide maximums security by storing user’s funds on decentralized wallets on the Ethereum blockchain, and then execute trades through centralized matching engines. The decentralized wallets will communicate with the centralized matching engines by means of smart contracts.

Through Digitex, traders no longer have to bother about the amount of fees collected, or how secure an exchange is, but can now focus on what truly matters - TRADING

Road map

IMAGE SOURCE

It is only a company that knows exactly where its journey began from, that can know where it is going. Above is a road map of Digitex, clearly showing their Digitex 2018 Time Line.

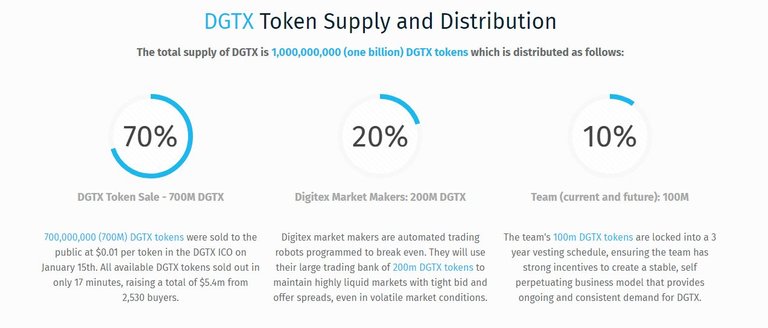

Token distribution

IMAGE SOURCE

The team

IMAGE SOURCE

The Digitex team is led by Adam Todd, a highly experienced futures trader, who has founded BetTrader (a popular ladder trading interface that has been online for 14 years Source). The other team members are also highly experienced in their various areas of expertise.

Advisors IMAGE SOURCE Digitex has the benefits of being advised by people with expertise.

If you need further clarification on any issue with regards to Digitex, just do well to drop your questions in the comment section, and I will make sure to promptly attend to it.

For more information on Digitex, you can visit any of the following channels:

. DIGITEX WEBSITE

• DIGITEX WHITEPAPER

• DIGITEX BLOG

• DIGITEX YOUTUBE

• DIGITEX TELEGRAM

• DIGITEX FACEBOOK

• DIGITEX REDDIT

• DIGITEX TWITTERTo participate in the contest, visit this link

Here is my Twitter link

digitex2018

digitextwitter

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Hello @lucyc, thank you for sharing this creative work! We just stopped by to say that you've been upvoted by the @creativecrypto magazine. The Creative Crypto is all about art on the blockchain and learning from creatives like you. Looking forward to crossing paths again soon. Steem on!

Thanks a lot @creativecrypto.

Thanks a lot @creativecrypto.