Have you created a Collateralized Debt Position (CDP) yet?

That's a mouthful. Explaining what a CDP is can be tricky, but creating one isn't.

My first experience with CDPs was using Maker. The first iteration was a bit technical, and required numerous steps to convert ETH tokens into WETH, then PETH, to borrow DAI tokens (the ETH acts as collateral, so it's a bit like putting ETH in a bank and borrowing against it).

It has since gotten easier, with the intermediate steps smoothed out. Now, you can just deposit your ETH and withdraw DAI.

Super easy, barely an inconvenience!

Really!

As DAI has been proven to hold its value very close to $1, and the global Covid-19 pandemic has caused a huge rush to the USD, now is a great time for expressive blockchains to allow CDP creation. Kava is doing this on Cosmos.

Kava

Cosmos blockchains work differently from Ethereum. Instead of one blockchain with all the tokens on it, Cosmos is an interconnected network of many chains that are designed to be interoperable.

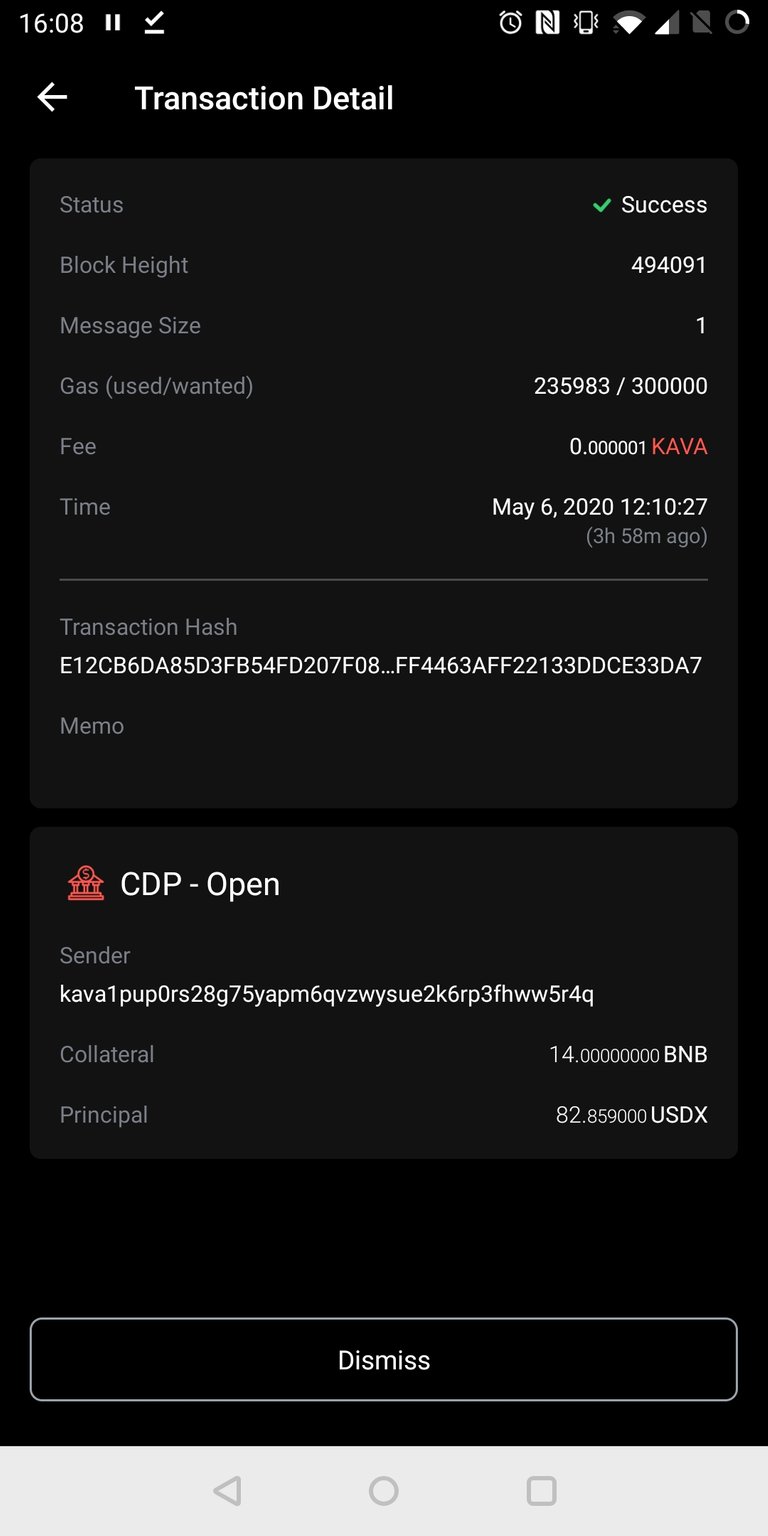

With that in mind, Kava can now be used (in testnet) to create USDX, which will be their CDP backed stablecoin.

Unlike DAI, which uses the native blockchain token as collateral, Kava uses BNB. One can stake BNB tokens on the Kava blockchain (you have to get them from the BNB blockchain first and send them to the Kava blockchain) to create USDX. Unfortunately, you need two tokens to create USDX, and I do think that makes it harder compared to DAI.

The process isn't terribly difficult, but those extra steps do matter. Will creating CDPs ever go mainstream? I don't know. If so, it will need to be simpler. People generally don't want to be their own banks. On the other hand, stable coins are easy to use and a minority of holders can create the majority of tokens that others will use without thought.

Just like most of us using the dollar have no idea about M1, M2, M3, &c.

I'm not convinced BNB is the best choice for the primary collateral, as it is not decentralized like Ethereum is, but that should change over time.

Getting Started

The nice part is you can do all of this for free. Here's a great tutorial to follow from the Kava team. It costs you nothing but a few minutes of your time; there is a Kava faucet and a BNB faucet to get free testnet tokens. Cosmostation is a nice app and it is pretty easy to use overall.

I'd love to hear your stories of CDP creation. Have you made DAI with ETH, or USDX with Kava? Have you made anything else?

-Jeff

P.S. Obviously none of this is investment advice. Creating actual stablecoins, such as DAI and (future) USDX carries risk.