A little bit of green

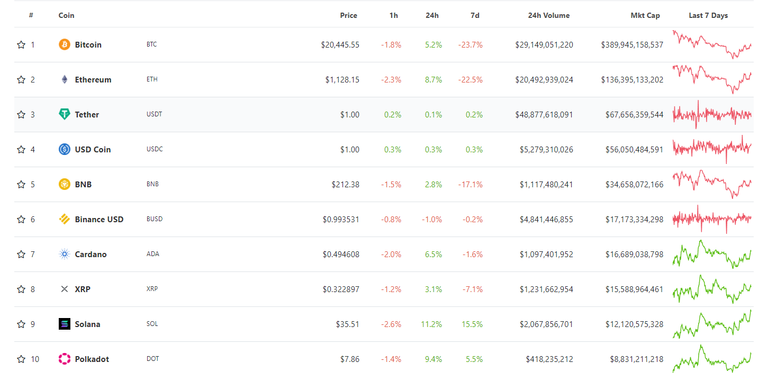

Market overview

This is the furthest thing from financial advice. It is and always will be simply my opinion. Please DYOR.

I'm not sure if anyone read my last post but if you did it's time to have a look at how everything has played out and have another look at what might happen going forward. Firstly I'm sure everyone is glad to see some green across the board as most of the crypto market has had a weekend pump before starting to move back down again. As we can see all coins other than stable coins are up between 2 and 11% when looking at the top 10 coins. But I can't see this lasting, especially considering the stock market will be opening again tomorrow.

BTC 4H

Now let's jump to the BTC chart on the 4h to see what has happened since my last update.

When last we let off I was concerned about the hangman that was developing as a potential signal that we could be moving lower however a single candle can't be taken as an indicator of the upcoming movement as we can see. We continued to move up due to the bullish MACD cross and the rising RSI as well as the Bullish engulfing candle that preceded the hanging man. I said that if we continue up we will be seeing a bounce on the 34ema at around 20.8k to 21k, as we can see it wicked just above that range to 21011 before being rejected and it has now begun to pull back as it flips 21k from support to resistance. We also can see that the RSI is beginning to retrace along with the price, holding that 34ema. The MACD however has remained in the bullish territory as it is a lagging indicator in comparison to the RSI so I would expect it to begin moving back down again soon as sellers continue to use this chance to get out of their positions above or around 20k

BTC dominance

Now moving to the BTC dominance we can see that there has been a break of the trend line followed by a retest in the next 4h candle as well as a MACD cross however we saw a move down from the 34ema just like BTC. To me, this says that despite the relative strength that alts have had we are going to see a bigger move towards BTC given all the bullish signals in the dominance.

ALT markets

AVAX

AVAX has continued its move up after the break of the trend before rejecting the longer-term trend line that was talking about yesterday at just above 17.50 forming a lower high after bouncing up from the lower low, The RSI is also beginning to move down and I have entered a short at 17.45. I expect it to move down to retest the up trend it started before breaking down and continuing lower to test the broken trend again further down. However, this depends on the movements of BTC going forward and I will be keeping an eye on it.

FTM

After my update on AVAX, I'm going to be checking out FTM as I've noticed that it has managed to break out of a downtrend that has been going on for almost 30 days seeing a drawdown of 60% followed but an upcoming test of the trend line. The MACD is bullish however the RSI is oversold and moving down so I expect it to continue down to test the uptrend intersection with the downtrend of the break before continuing up. I will be looking to potentially open a spot trade with FTM for a longer-term hold here

Conclusion

Thanks to the stock markets being closed we've seen a bit of a rally from crypto, this is by no means a bottom, in my opinion, it is simply a bear market rally or relief bounce that will continue moving down shortly. So I would be on the lookout for a move back down to 18k perhaps lower as I don't see us returning to a bull market until we have a shift in the macro situations.

@ecosaint Please bless this post 😀