Black Scholes is a mathematical formula devised in the 1970's by Fischer Black and Myron Scholes. Their objective was to devise a simple formula which could calculate the true and fair price of an options contract at any point in time, simply by knowing the stock's current price.

The History of Black Scholes

There had previously been a number of theories which had been developed to model options trading, including Paul Samuelson and Louis Bachelier, who wrote “++The Theory of Speculation++” which compared seemingly random fluctuations in the stock market to ++Brownian Motion++, which is the random motion of particles suspended in fluids.

However, almost all of these earlier models however were highly complex and often relied upon unrealistic assumptions, such as stock prices becoming negative.

It seemed as the 20th century went on that nobody would crack the subject of how to objectively find a model which could accurately and fairly price options contracts, despite the explosion of interest in options trading.

That is until Fischer Black and Myron Scholes published their seminal work “++The pricing of Options and Corporate Liabilities++” in 1973.

In 1997, Black & Scholes were jointly awarded the Nobel Memorial Prize in Economic Sciences, alongside Robert Merton who is also credited with contributing to its development.

What is the Black Scholes pricing model?

The Black Scholes pricing model is used to determine the theoretical value of European-style options. European options differ from American options because the former can only be exercised on the expiration date whereas the latter can be exercised at any time up to expiry.

Several factors are taken into account in the Black Scholes model:

- The current price of the underlying asset

- The strike price of the option

- The time until expiration

- The risk-free interest rate

- The volatility of the underlying asset.

How Black Scholes Is Used

The Black Scholes model is widely used by options traders, financial institutions, and market makers to manage the risk associated with options contracts.

The purpose of the Black Scholes model is to calculate the fair price of an option based on the assumption that the price of the underlying asset follows a ++lognormal++ distribution. Using this calculated price, the model then determines whether an option is overvalued or undervalued in the market.

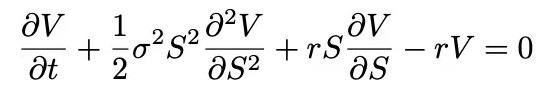

What is the Black Scholes Equation?

Brace yourself… If you have a good background in maths, you’ll love this bit. If you don’t, well maybe skip to the next section:

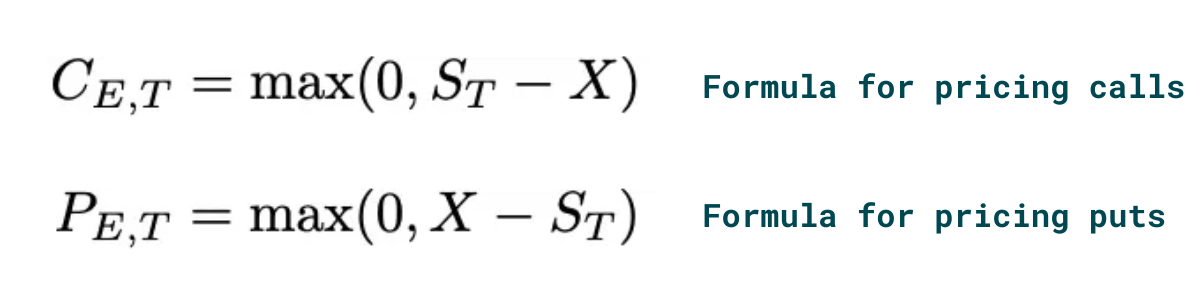

Ok, that’s the equation, then there’s the formula which is the solution to the equation, and which is used to actually calculate the price of calls and puts:

Got that? Hey, we could have added more, but thought we’d keep it simple. If you want to find out specifically about how the Black Scholes maths works, we recommend reading the extensive Wikipedia guide here.

Limitations of Black Scholes

Although the Black-Scholes model is widely used by traders in pricing options, there are a number of assumptions made by the model which essentially limit it’s ability to accurately predict price movements on a day-to-day basis.

For example, Black Scholes assumes constant values for the risk-free rate of return and volatility over the duration of an option, which may not remain constant in the real world. Additionally, the model assumes continuous and costless trading, ignoring the impact of liquidity risk, margin requirements, brokerage charges and (of course) tax levied on gains.

It also assumes stock prices to follow a lognormal pattern, ignoring large price swings observed more frequently in the real world.

Moreover, it assumes that no corporate dividend payouts will be made, and no early exercise, making the model unsuitable for American options.

Black Scholes cannot predict financial crashes

Extreme events, such as sudden market crashes cannot be accounted for in the Black-Scholes model.

For example, Black Scholes was unable to predict the 2008–09 market crash, the implosion of the crypto exchange FTX in 2022 and most recently the collapse of a number of banks in March 2023, including Silicon Valley Bank, Silvergate and Signature.

Criticisms of Black Scholes

As noted previously, options pricing is dependent upon volatility (that is the speed and magnitude of an asset’s price movements) and Black Scholes assumes volatility remains constant throughout the term of the option.

The reality, however, is that volatility is uncertain and changes due to a variety of market factors such as economic indicators, news events, and company earnings reports. Consequently, the Black-Scholes model doesn’t always provide accurate options pricing in highly volatile markets. Veteran investor Warren Buffett is not a fan of Black Scholes for options pricing and has repeatedly criticised it for this reason.

"Black-Scholes is an attempt to measure the market value of options, and it cranks in certain variables. But the most important variable it cranks in that might be subject -- well, might be a case where if you had differing views you could make some money -- but it's based upon the past volatility of the asset involved. And past volatilities are not the best judge of value." - WARREN BUFFETT, CEO OF BERKSHIRE-HATHAWAY

Black Scholes in Crypto

In the traditional financial world, sellers of options contracts set the prices for their contracts. Of course, some will use the Black Scholes formula to determine the premium they will charge, but this is not obligatory, and so options buyers are left with the problem of opaque pricing.

As the crypto world has evolved, so too has the need for risk management for holders, and this has led to the development of a number of crypto options desks, almost all of them being European-style cash-settled options platforms.

Generally in the crypto options world, the Black Scholes model is used to determine a fixed premium which buyers pay in advance. However, as we know, Black Scholes has severe limitations in pricing options in particularly volatile markets, and arguably crypto markets are among the most volatile in the world.

One further problem for crypto enthusiasts is that options do not protect the actual tokens you hold. In fact, you don’t need to hold any assets at all to play options. This means those users who have a large amount of crypto which they want to protect must find a significant amount of up-front capital to pay premiums to hedge against downside volatility.

A novel alternative to Black Scholes for crypto

DeFi protocol Bumper has a solution for crypto users which does not rely on the Black Scholes model and has the potential to disrupt all legacy risk management solutions, including options platforms.

Bumper works by allowing participants on one side to protect the value of their crypto assets from downside volatility by committing their crypto to an “asset pool”, and on the other side, liquidity providers deposit stablecoins to a separate “capital pool”. Note here, we are dealing with actual tokens, unlike on an options desk, which simply works based on where the price finishes.

Should a protected asset close under the chosen floor, then the protection takers exit claiming stablecoins from the capital pool, but if it closes above the floor, users simply reclaim their original protected asset. In both cases, the premium is deducted from their deposited assets, and this forms the yield paid to the liquidity providers for assuming some of the risk.

What makes Bumper different is that, rather than attempting to predict the future volatility of an asset in pricing the cost of protection, Bumper’s premiums are paid ex-post facto (in other words after the position closes) based on the actual volatility of the market during the protection term.

In some ways, this can be described as being charged for the volatility used during the term, rather than implied volatility calculated in advance.

This has been designed firstly to replace the need for attempting to calculate the fair value for protection by both sides, secondly by eliminating counterparty risk, and thirdly by providing a more price-efficient system which fairly spreads the fiscal value of risk, all managed by a smart contract. Furthermore, unlike options contracts, Bumper returns a synthetic token to the user which represents their position in the pool.

This ‘Bumpered Asset’ effectively represents the base asset (e.g. ETH) but with the volatility removed at the level of the floor. This means the user could use their Bumpered Asset as collateral against a loan, for example, knowing that its value will not go below the chosen floor value, and thus eliminating the risk of forced liquidation.

Working in conjunction with the world-acclaimed development team Digital MOB, the Bumper team have effectively developed a completely unique and innovative solution to risk hedging in the crypto markets which is slated for mainnet launch in 2023.

Learn more about Bumper by reading the project’s Litepaper, and join the community to gain more insights about the most significant development in risk management since the introduction of options trading in the 1970’s.

Congratulations @bumper-fi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!