Due to the recent astronomical growth of cryptocurrencies, I’ve often been asked by non-technical friends to tell them more about this weird new technology.

They’ve heard about it on the news, on the radio, or simply from other friends, but have never looked further into it.

As opposed to telling the same story and walking each of them through the whole process ad infinitum, I’ve decided to put all the effort into a series of articles and tell the story as it should be told.

This piece talks about the background, history, reason for being of cryptocurrencies, money, banks, governments, as well as how to get started in the crypto world and stay safe.

I sincerely hope this will be an informative, enlightening and easy read that helps you make the leap into the exciting world of bitcoin and virtual money, and thus take a small part in shaping the future of human society.

Welcome to a new and exciting world!

Contents:

- What are Bitcoin, cryptocurrencies and all the weird jargon?

- What’s the purpose of cryptos, how did they come to be?

- What happened in Greece in 2015?

- What happened in Greece will never happen to my government, so why would I care?

- How do cryptos work in contrast to traditional currencies?

- Why should you consider joining the cryptocurrency bandwagon?

- But isn’t it scary and risky?

- But isn’t Bitcoin only used for money laundering and buying drugs?

What are Bitcoin, cryptocurrenciesand all the weird jargon?

I know it can be daunting to figure out the first steps, but it’s not all that complicated. Once you know a few basic terms, you’ll be able to figure out the rest. My aim is to exclude any superfluous details until you get comfortable with the basics. After that, you can do your own research.

You’ll see terms such as coins, tokens, cryptos and altcoins being used, but I’ll use cryptos as a term for the remainder of this book to refer to them, for the sake of simplicity and clarity.

They all refer to decentralized virtual money that you can use for various purposes, one of which is the transfer of monetary value to another person or organization.

Traditional currencies, however, are referred to as fiat currencies.

Fiat money is a currency without intrinsic value (just as cryptos are, unlike gold or silver) established as money by government regulation or law. The term derives from the Latin fiat (“let it become”, “it will become”) used in the sense of an order or decree.

Fiat money started to dominate in the 20th century. Since the decoupling of the US dollar from gold by Richard Nixon in 1971, a system of national fiat monies has been used globally, with freely floating exchange rates between the national currencies.

What’s the purpose of cryptos, how did they come to be?

One of the first attempts at virtual currencies occurred in the Netherlands in the late 1980s.

In the middle of the night, the petrol stations in the remoter areas were being raided for cash, and the operators were unhappy putting guards at risk there. But the petrol stations had to stay open overnight so that the trucks could refuel.

Someone had the bright idea of putting money onto the new-fangled smartcards that were then being trialed, and so electronic cash was born. Drivers of trucks were given these cards instead of cash, and the stations were now safer from robbery.

At the same time the dominant retailer, Albert Heijn (a big grocery chain), was pushing the banks to invent some way to allow shoppers to pay directly from their bank accounts, which became eventually to be known as POS or point-of-sale.

In the mid 90s, PayPal came to be, and it was among the first systems to allow people to send money online directly to each other. Eventually, it has become known worldwide as a safe way to pay for goods online, without worrying about your credit card details being stolen by websites.

People have been attempting to create digital money since the 90s, but the first true cryptocurrency is Bitcoin, created in 2009 by a mysterious person or group called Satoshi Nakamoto.

This currency works directly between its users, without any intermediaries such as financial institutions.

Bitcoin’s story is strikingly similar to the one of the operating system Linux, created by a Linus Torvalds (aged 22 back then) in his dorm room in the 90s as his thesis project, a project he released online for free and for everyone to copy and change as they pleased.

Right now you are most likely reading this book on a Linux-powered device, or if you bought it online in paperback, your order has been received and processed by Linux-powered computers.

Likewise, Bitcoin has been created and distributed freely and openly online to everyone’s benefit. Such technologies have true means of changing the world for the better.

To better understand some of the reasons why cryptos are sparking curiosity all over the globe, I’d love to share some stories next.

What happened in Greece in 2015?

Story time: Greece and how capital controls changed life

It was June 2015. The Greek government, led by SYRIZA, was for the first time responsible for the fate of the country, in an extremely difficult situation for it. We were all anxious to see how the IMF and the EU would “welcome” the new government that was rather “hostile” against the economic policy the two organizations were suggesting (or enforcing if you prefer; since 2009). That was when the crises started in Greece.

photo source: https://usilive.org

The Greek government decided to make a referendum in Greece; ask whether the people wanted the government to follow the measures requested by the EU and IMF, or allow the government of SYRIZA to maintain a harsh position and negotiate more.

The latter could mean that the country would be on its own. The risk of bankruptcy was more visible than ever before.

A sudden change in a day

However, I remember it was Saturday and banks were of course closed. Then we heard on the news that the country would not be getting any more funds until the negotiation was over.

That meant that banks would not be opening the following week. Furthermore, capital controls were suddenly introduced, which meant that there would be a limit of 60 euro withdrawals per day from ATMs.

Everybody panicked, including me of course.

People rushed to withdraw money from bank ATMs. Most of us thought that it would be all over, that bankruptcy would be unavoidable. There were literally millions of people gathered outside banks waiting in turn to get money from the ATM.

They would wait for 3 hours or more to find out eventually that there was no more money in the ATM. They would have to wait more for the banks to put more money in…

Supermarkets and places that guide people that are in need for healthy nutritional therapies made record sales that day.

Not even dog food was available until the evening. Any kind of food just disappeared from the shelves in a few hours. Shelves were simply left empty.

To tell you the truth, me and my family didn’t go to buy stuff. But we went to an ATM during the night. Things then were a bit better; and we got the 60 euros we were allowed. This kept happening for at least 10 days.

Fortunately, food, fuel and medicine stocks lasted for many more days because Greek companies faced a real difficult situation.

Of course banks were closed, as I said. This meant that they had no access to their capitals. They were not allowed to send money abroad or to make imports of any kind. Also, they could not cash out cheques.

Parents were not allowed to send money to their children who were for example studying, since no funds at all could leave the country during that period.

Only e-banking services were available, but strictly between accounts in Greece and not abroad. Older people had far more problems. This was because most of them did not have credit as well as debit cards to withdraw money from ATMs. They came to realize that all their money and pensions were “frozen” for at least a week. They didn’t even have the option to go to a bank to issue a card.

I still remember the time when I was seeing the news about Greece in the media and thinking gosh, I’d hate to be in their shoes right now. Are we really in 2015?

So what’s the catch? What does any of this have to do with cryptocurrencies ?

At the moment, there is no other electronic cash system in which your account isn’t owned by someone else, and that’s a risk for you.

Take PayPal, for example: if the company decides for some reason that your account has been misused, it has the power to freeze all of the assets held in the account, without consulting you.

It is then up to you to get in touch with PayPal to regain access to your funds, and it is still up to them to reconcile your case, which might even take up to a few weeks and a lot of effort on your behalf.

As you’ve seen in the story above, this can and has happened in the past over an entire country for an extended period of time.

With cryptocurrency however, you own the keys and have full control over your money. No one can take that away from you (unless you lose the keys yourself, or host keep the money in a web-based wallet service that loses it for you).

Cryptocurrencies are a means for people to control what is rightfully theirs: their hard earned money, as well as a means for sending it without restraint to anyone they choose to send it to.

What happened in Greece will never happen to my government, so why would I care?

Strong governments might provide a false sense of security. Although they do have their merits, they aren’t too big to fail either. Due to globalization, the world is so tightly knit together that things have a high potential of falling apart as dominoes.

“In this world nothing can be said to be certain, except death and taxes.” (Benjamin Franklin)

You might be among the lucky citizens in this world who are safe from failing governments and currencies, and are free to use their hard earned money any way they please (unlike the Greeks in the previous story).

Look, before you start thinking that cryptos are the be-all and end-all solution to financial trouble, just take a deep breath.

They are probably not the panacea that’s going make us all rich and prosperous… but they do have their merits, and they are very likely to change the world for the better.

Back to people in trouble…

I’d quickly like to share an example of how Venezuelans have found cryptos useful in 2017:

Demand for digital coins is soaring in Venezuela amid an escalating political crisis that has protesters demanding that President Nicolas Maduro step down.

Inflation has spiraled to the triple digits, debasing the bolivar and depleting savings, while citizens struggle to find everything from food to medicine on store shelves.

Venezuela’s currency has become nearly worthless in the black market, where it takes more than 6,000 bolivars to buy $1, while bitcoin surged 53 percent in the past month alone.

But it’s not just about shielding against the falling bolivar, as some Venezuelans are using cryptocurrencies to buy and sell everyday goods and services.

Digital coins as a way to escape currency controls and inflation isn’t a new phenomenon.

Argentina saw a spike in bitcoin trading after former President Cristina Fernandez de Kirchner banned dollar purchases, and China is one of the main sources of bitcoin demand as traders use the digital currency to skirt capital controls.

OK, I can almost hear you saying “yeah, but Venezuela is like a poor 3rd world country, and they’re lazy” (no offense to the hard working Venezuelans out there, hat tip to you).

Either way, I believe we can all agree that everyone is entitled to survive if they have a job and bring their contribution to society.

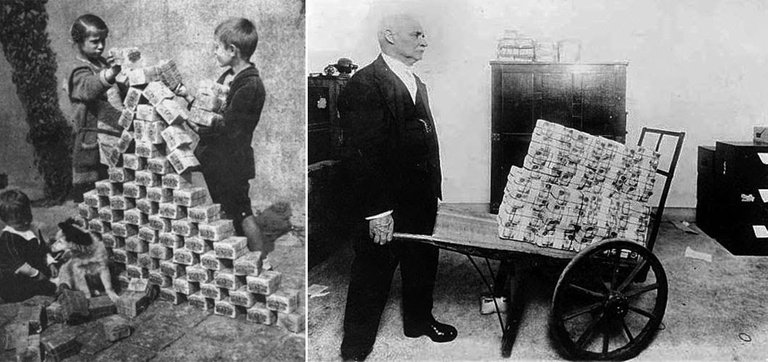

Further, I’ll share the image of 1920s Germany (a country known for its hard working people), and now I can hear you saying “yeah, but that was ages ago. Surely it can’t happen anymore”.

You might be right, but history also tends to repeat itself, as people learn from their mistakes too slowly, if at all.

Germany’s hyperinflation-phobia

The deutsche mark-dollar exchange rate rose from 4.2 to one in 1914 to a peak of around 4.2 trillion marks to the dollar by November 1923.

Yes, you read that right. In 1923, 1 USD was about 4.200.000.000.000 Deutsche Marks.

At its height, prices were rising so fast that waiters had to climb on tables to call out new menu prices in restaurants every half hour.

Banknotes became sufficiently useless that workers had to bring wheelbarrows with them to work to collect their daily pay, and bundles were given to children to play with, being cheaper than actual toys.

Paper Money by “Adam Smith” (George J.W. Goodman) has a few tales of people who lived through the Weimar hyperinflationary period:

“My father was a lawyer, and he had taken out an insurance policy in 1903, and every month he had made the payments faithfully. It was a 20-year policy, and when it came due, he cashed it in and bought a single loaf of bread.” Walter Levy, an internationally known German-born oil consultant in New York

Menus in cafes could not be revised quickly enough. A student at Freiburg University ordered a cup of coffee at a cafe. The price on the menu was 5,000 Marks. He had two cups. When the bill came, it was for 14,000 Marks.

“If you want to save money,” he was told, “and you want two cups of coffee, you should order them both at the same time.”

A factory worker described payday, which was every day at 11:00 a.m.:

“At 11:00 in the morning a siren sounded, and everybody gathered in the factory forecourt, where a five-ton lorry was drawn up loaded brimful with paper money. The chief cashier and his assistants climbed up on top. They read out names and just threw out bundles of notes. As soon as you had caught one you made a dash for the nearest shop and bought just anything that was going.”

photo source: rarehistoricalphotos.com

In essence, neither traditional currencies, nor cryptocurrencies are backed by anything other than belief, or trust.

However, one key difference between central bank issued currency and cryptos is that while the former has a potentially unlimited supply (i.e. unlimited potential for inflation), the latter most of the times has a fixed supply by design, and is almost written in stone within the algorithm that governs the network.

For example, Bitcoin has a limited supply of 21 million coins that can ever be created. At the time of this writing (Feb ’18) there are 16.8 million Bitcoins already created (i.e. virtually minted), with an annual inflation rate of 4.33% that continues to drop over time as the network grows. By 2020, it is expected to drop to about 1.73% annually.

During rough times when governments act against the best interests of their people, cryptos can make a difference and help provide for an alternative means of exchange.

How do cryptos work in contrast to traditional currencies?

All cryptos are built on a technical foundation called blockchain, which is essentially computer code that runs on thousands of machines all over the world, which come together as a network over the Internet.

You can think of the Blockchain as a huge Excel sheet that contains all transactions ever made. Once a transaction is saved and acknowledged by the entire network, it cannot be changed in any way.

All of this sits on the shoulders of modern cryptography (hence the name cryptocurrencies or cryptos), a scientific discipline that sits at the intersection of mathematics, computer science and electrical engineering.

Cryptography itself has played a key part in World War II with the advent of computers, and is nowadays pervasive in our everyday lives, even though we don’t think much about it, if at all.

Perhaps the most important aspect of a blockchain network is the fact that there is no single organization, person or location where you can find it.

In contrast, your bank has an office and a phone number you can call, ATMs they manage, and an IT system to manage accounts and transactions. Their IT system is managed by their own team and runs in buildings called data centers, which are architected specifically for that use purpose.

Go ahead and search for “bank data center” on Google images if you’re curious, and then Google “bitcoin mining at home” again on Google images to get a feeling of the difference (it can be messy).

So does that mean that banks operate a clean and professional system whereas cryptos don’t? Not at all. The strength of the crypto network is in numbers, so the more people spread as far and wide around the world support the system, the stronger and more robust the system is.

Think of it like the power grid. We are used to getting electricity from a power plant over power lines into our homes. As such, the availability of electricity to our homes depends on a single source, the power plant.

If it breaks, we’re going to have to light up some candles. Now picture an alternate scenario: you and your neighbors all have a bunch of solar panels on your rooftops, windmills, you name it, and are connected to each other with power lines.

Even if half of your neighbors’ sources are broken, everyone still has electricity in their homes from the remainder of the neighbors who are still operational.

In fact, the fictional example above is not that fictional… as people are already experimenting with just that. For instance, a company called LO3 Energy launched a peer-to-peer transaction system called Brooklyn Microgrid in New York (see more at http://brooklynmicrogrid.com/), which allows users to sell excess energy directly to their neighbors. This creates a peer-to-peer market that allows people to buy locally generated green energy.

Why should you consider joining the cryptocurrency bandwagon?

I’m going to assume you’ve at least heard about Bitcoin, but there are many other digital currencies and assets out there, of all shapes and sizes.

The most popular ones such as Bitcoin, Ethereum and other cryptos have soared in price and adoption over the past few years and are still growing at a head spinning rate.

Some reasons for you to join:

- Putting away some of your savings into a profitable financial instrument in order to make passive income or simply save away for retirement

- Transferring money to friends and family while avoiding the steep fees and long delays such as with traditional banks or even PayPal

- Investing in early stage companies that choose to get funded through cryptos

- Being on the bleeding edge of technology by paying for your day to day goods and services using cryptos

But isn’t it scary and risky?

Yes it is, but it’s really not as bad as you might have heard.

Fear typically comes out of lack of understanding, but honestly you don’t need to know the inner workings of cryptos any more than you need to know how a bank transfers dollars to a friend overseas when you order a wire transfer or even when you pay for a cup of coffee with your credit card.

Since cryptos are so new, they are still figuring out their way into the world. I have two hard rules for you to follow, and they’re not news:

1 Do not invest any money that you can’t afford to lose in part or even completely.

2 Never ever invest borrowed money.

These rules are simply meant to alleviate the potential stress inherent with financial investments, and are the same as with traditional currency exchange (i.e. forex) or even the stock market.

So don’t sweat it. Keep it cool and do it rationally. No pressure means little to no mistakes on your side. In the end, the rewards are more than worth it.

But isn’t Bitcoin only used for money laundering and buying drugs?

Pretty much all new promising technologies are first picked up by criminals since regulators are slow to catch up.

You’re using the Internet every day, and if you have children or friends far away, you are likely using a video call service such as FaceTime, Skype, or others. But one of the reasons that these technologies have matured is porn. Yes… PORN.

Internet connections in the 80s and 90s were terrible, unusable, and nerve wrecking. I still remember waiting a few minutes for a dial-up modem to connect, and my whole subscription was limited to 15 hours a month.

Pornography demanded, however, much better Internet speeds in order to deliver. Images and video eat up a lot of bandwidth. Many estimates suggest that sexual content represented as much as 80 percent of traffic on the pre-World-Wide-Web Internet.

Right around the corner are virtual reality and augmented reality technologies. They are expensive and not ready for mass adoption yet, but pornography is probably there again helping these technologies move forward, until it’s ready to move aside and let the rest of us enjoy meeting with friends and family in a virtual reality setting.

During the early days of Bitcoin, it has been more widely used the hidden Web, to avoid scrutiny. One could buy drugs and whatnot on darkweb-only websites such as Silk Road, but the authorities have since taken down such services and arrested the individuals involved.

Nonetheless, Bitcoin might have failed to survive were it not for these early adopters, whoever they were.

There are other coins that provide a higher level of anonymity online, but Bitcoin is not necessarily one of them. The authorities do have tools to track down who’s behind transactions and wallets if provided with the incentive to do so.

While it’s less straightforward than a bank account or credit card, it’s far from impossible.

One anonymous source at the USA Department of Homeland Security told CNBC that Bitcoin has become “a lot more legitimate” than many believe:

“We’re getting a lot better through law enforcement tracking those [criminals] and holding the exchanges more accountable,” the Homeland Security official said. “I think [bitcoin]’s a lot more legitimate than people give it credit for.”

Another cybersecurity expert who spoke with CNBC stands by the fact that bitcoin’s illusion of anonymity is just that… an illusion.

“Bitcoin basically introduced a situation where we could bypass the money mules,” said Rickey Gevers, cybercrime specialist at RedSocks Security, which detects and fights against malware.

But, Gevers said, “in the beginning [bitcoin] looks very anonymous, and in the end it doesn’t look very anonymous.”

So there you go, bitcoin and most cryptos are a poor choice for criminals nowadays. There are some cryptos that have gained in popularity among these groups, but you don’t have to get involved with them.

Where do I go from here?

Learning never ends, and the markets never stop moving. I’ve just scratched the surface of cryptocurrencies with this first part of the guide.

Come back here in a couple of days and you’ll be able to find the next part of our road through cryptocurrencies. It will be focused more on the basics of investing and the tips, tricks and tools needed to do it.

Until then, if you decided to start investing or already are, check out our Cryptocurrency Research and Analysis platform on https://coincheckup.com

This article was first published on CoinCheckup.com

References:

Griffith, K. (2017). A Quick History of Cryptocurrencies BBTC — Before Bitcoin — Bitcoin Magazine. [online] Bitcoin Magazine. Available at: https://bitcoinmagazine.com/articles/quick-history-cryptocurrencies-bbtc-bitcoin-1397682630/

Russo, M. (2017). Venezuelans Are Seeking a Haven in Crypto Coins as Crisis Rages. [online] Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-06-15/venezuelans-are-seeking-a-haven-in-crypto-coins-as-crisis-rages

Economist.com. (2017). Cite a Website – Cite This For Me. [online] Available at: https://www.economist.com/blogs/freeexchange/2013/11/economic-history-1

Commanding Heights : The German Hyperinflation, 1923 | on PBS. [online] Available at: http://www.pbs.org/wgbh/commandingheights/shared/minitext/ess_germanhyperinflation.html

Bitcoinblockhalf.com. (2017). Bitcoin Block Reward Halving Countdown. [online] Available at: http://www.bitcoinblockhalf.com/

Cryptography [encyclopedia on-line] Wikipedia: The Free Encyclopedia; (Wikimedia Foundation Inc., updated 27 August 2017, 08:37 UTC). Available at: https://en.wikipedia.org/wiki/Cryptography;

Maack, M. (2017). Behold the hippest tech on Earth: Blockchain for peer-to-peer solar energy markets. [online] The Next Web. Available at: https://thenextweb.com/insider/2017/04/20/blockchain-helps-building-peer-to-peer-solar-energy-markets/

Jacona, A. (2017). Porn industry, the Internet innovation engine we (prefer to) ignore. [online] The Web Observer. Available at: https://thewebobserver.it/2013/06/04/porn-industry-the-internet-innovation-engine-we-prefer-to-ignore/

Cheng, E. (2017). Dark web finds bitcoin increasingly more of a problem than a help, tries other digital currencies. [online] CNBC. Available at: https://www.cnbc.com/2017/08/29/dark-web-finds-bitcoin-increasingly-more-of-a-problem-than-a-help-tries-other-digital-currencies.html

Tienes razón! este dinero virtual, ha contribuido muc

mucho, tal es el caso de nosotros en venezuela, nuestra moneda está super devaluada. En particular me he ayudado con este dinero, sobre todo para comprar comida y medicinas. muy positiva tu información. gracias.