At times, the cryptocurrency movement can feel like a ubiquitous and inevitable move toward the future of finance and technology.

Its supporters are, to say the least, very supportive, and new headlines continue to appear on news feeds that show improving institutional, enterprise, and governmental interest in both digital tokens and its underlying technology, the blockchain.

To be sure, all of these things are true.

At this month’s Consensus conference in New York City, Steven Quirk, an executive vice president at TD Ameritrade, noted that the company has tens of thousands of people interested in crypto-related financial products. Moreover, he commented attendance has been “off the charts” at the company’s Bitcoin training seminars.

Meanwhile, the world’s fifth largest electrical company recently announced a partnership with an Ethereum-based dApp, iExec, for a project test.

Perhaps most notably, Facebook, the most used social media platform in the world, is building its own cryptocurrency-based payment system that will utilize a Facebook initiated digital token.

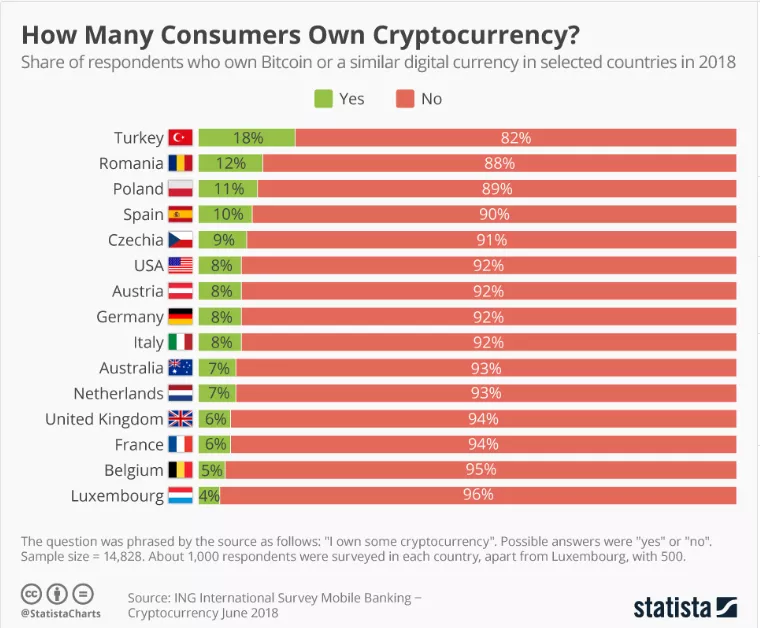

However, despite all this movement and an incredible amount of buzz, crypto adoption is frustratingly slow. In most countries, less than 10% of the population own Bitcoin or other digital currencies, and actual real-world experiences with digital currencies are similarly restrained.

Of course, this disparity naturally begs the question: why is crypto adoption so slow? If the technology is so promising, the tokens so useful, and the digital ecosystem so ready, why aren’t more people using cryptocurrency.

While there is no single answer, there are several factors that are contributing to crypto’s slow adoption at every level.

Volatility Isn’t Good for Usability

It’s impossible to have a conversation about crypto adoption without including Bitcoin. The first and still most valuable digital token carries the most widespread brand recognition and it dominates more than half of the crypto market.

It’s also hilariously volatile, capable of incredible price increases and sudden retreats that can leave users clamoring to understand how to best utilize their currency.

What’s more, most people don’t understand the sometimes complicated and sometimes arbitrary factors that contribute to its volatility.

Bitcoin isn’t the only token that regularly experiences extreme volatility. This malady similarly impacts all of the major tokens.

In fact, for crypto’s most ardent supporters, this volatility has become a critical part of the communal ethos. Sentiments like “HODL,” internet parlance based on a misspelling that encourages investors to hold their positions when market turbulence challenges their resolve, help define the crypto movement.

This might be catchy on discussion boards, but it doesn’t elicit confidence from casual users who just want a seamless monetary experience.

In an attempt to keep the technological underpinnings of digital currencies, a slew of stablecoins have come to market that try to balance the erratic price movements of other tokens by maintaining a more steady value by peggings its price to a traditional currency or another asset.

For example, Xank offers a platform that balances the investment potential of digital currencies with the desirability of a pegged token, creating a market-based solution to the issue of volatility.

Even as more products like this come to market, it can be challenging to overcome the dominant narrative that cryptocurrencies are too volatile for mainstream adoption.

Digital Payments in a Digital Age

As cryptocurrencies grew in popularity throughout 2017, Bitcoin was subsumed in a dueling identity. Some saw the token as a speculative asset, more akin to digital gold than to modern money. Many like crypto evangelist Mike Novogratz hold this position.

Meanwhile, others wanted to use Bitcoin as a payment mechanism, something exemplified in the annual celebration of Bitcoin Pizza Day, which marks Laszlo Hanyecz purchase of two pizzas using 10,000 BTC in 2010.

The lesson is clear. To spend Bitcoin at checkout is to use an appreciable asset with tremendous future upside on a temporary object. It’s akin to coughing up gold for new golf clubs.

Few would find this to be a good idea.

However, there is a clear need for improvements to our digital payment infrastructure. In February, the total market share of purchases at online retailers overtook general merchandise sales for the first time, netting nearly $60 billion in sales, according to CNBC.

These changing trends have also brought their share of unintended consequences. Cybercriminals are targeting online retailers with things like the Magecart payment skimmer wreaking havoc on millions of users.

At the same time, privacy is increasingly a priority for users, and divulging extensive amounts of personal information at checkout grinds against this ethos.

All of this makes digital currencies an extremely enticing payment methodology, something that stablecoins are uniquely positioned to accomplish. Perhaps most importantly, stablecoins allow users to enjoy the benefits of cryptocurrencies without the regret of spending an appreciable asset on a temporary purchase.

As TechCrunch observes, “The need for stability is not unique to cryptocurrency. Any currency needs to be stable in order to be used as a trusted medium of exchange. The more that prices rise and fall, the more ordinary people will shy away from using the coins for everyday transactions”

Therefore, Xank, the world’s first free-floating free-floating cryptocurrency, is a modern expression of digital money that can be used both to complete transactions and as an investment asset. It’s the only cryptocurrency to achieve both, and it offers a uniquely simple asset for navigating the digital age.

The security and privacy of the blockchain can create a trustless interaction between retailers and consumers, ensuring that they aren’t compromised while participating in the online retail environment.

The process can be incredibly simple. As IBM notes, “There is no post-transaction processing required as with conventional payment systems today.”

To put it simply, stablecoins will play a critical role in the future of finance as the entire operation, from banking to retail, becomes increasingly digital.

Bad Actors Have Big Influence

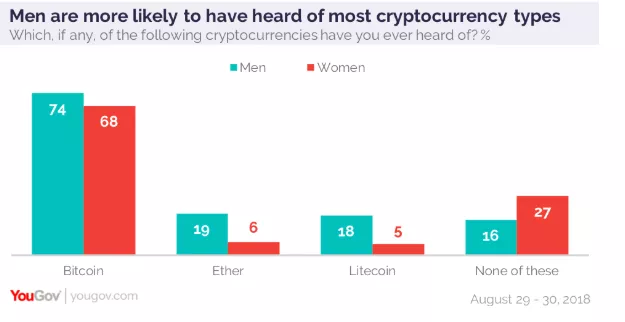

For instance, a 2018 survey by YouGov found that nearly 80% of Americans have heard of Bitcoin, but only less than 20% have heard of Ether or Litecoin, two other top digital currencies.

At this point, the majority of people have heard of Bitcoin. However, brand awareness beyond that is significantly lacking.

This is incredibly problematic for crypto adoption. Bitcoin alone can’t fulfill all of the possibility of the crypto movement. Instead, it’s up to the hundreds of other platforms to meet the diverse and divergent demands of the modern institutional, enterprise, and governmental use cases.

In fact, Bitcoin might be better off as an ambassador for the technology, rather than its ultimate fulfillment.

Therefore, until the broad crypto economy cames better brand awareness, adoption for things like decentralized gaming, dApps, and other initiatives will continue to be slow. The same can be said for digital and mobile payments.

Buyers have demonstrated a continual willingness to innovate their payment methodologies as things like Apple Pay, Venmo, and PayPal have quickly become normative.

However, until more people become aware of the possibility, adoption will continue to lag behind optimism.

Regulation & Oversight Elicit Confidence

Perhaps most obviously, nobody is going to go all-in on a technology that remains in regulatory limbo.

Despite many of the obvious and inherent benefits of digital currencies that are perfectly timed for the digital age, broad adoption requires more people to experience the benefits themselves, something that is unlikely to happen when a shifting regulatory landscape could disrupt the process.

It’s possible that some oversight might be coming sooner rather than later. The Financial Action Task Force is poised to offer global regulatory standards that could make meaningful progress toward establishing norms that can usher in higher levels of adoption.

Like any new technology, adoption is slow while skepticism abounds, and cryptocurrencies are no different. In this regard, growth begets growth, and we are likely looking at a future that is, in part, defined by crypto’s role in the financial system. The extent of that role is still being determined, and too slowly at that.

This is absolutely insightful, we need to adopt more privacy projects like veil, monero etc. Without privacy alot of scams and hackers will destroy exchanges which will reduce investors from coming in. Privacy which will bring closer monitoring to upcoming projects and also to reduce hacking and dumping of coins.

There is risk involved of course. But the main goal is to break the monopoly on currency held by governments and central banks. These institutions are Evil criminal enterprises extorting and plundering the world and enslaving humanity. Crypto’s will help to free the world eventually as adoption grows.

Posted using Partiko iOS

I don't agree with the word " monopoly". Governments do not have a monopoly over cryptocurrencies

They don’t have a monopoly on cryptocurrency, but over traditional currency

Posted using Partiko iOS

That's the point. Lots of people have heard about Bitcoin, but they don't even get what it actually is and how it works. If we want to adopt Bitcoins, Litecoins and other cryptocurrencies, we have to explain what it's all about to people.

Large scalability and increment of potential use cases may help us to adopt more crypto and volatility may be decrease after mass adoption

Posted using Partiko Android

A great treatise on adoption in this space.

Posted using Partiko Android

Bitcoin! Actually, this adoption is really the number of people willing to sell fiat and hold bitcoin. So we can't really see what the future is. more applications sure need to come for reliable operation of btc.

True. Totally agree with you mam

Most of the economic analysts and cryptoanalysts predict a considerable change in crypto is coming as a result of institutional money enters the crypto market. . Some predict that all that crypto needs is a verified exchange traded fund (ETF). An ETF would definitely make it easier for people to invest in Bitcoin,

You got a point !

True !

Even though most of these points are obvious it was a nice read.

Thanks.

Even though most of

These points are obvious it

Was a nice read. Thanks.

- pardonx

I'm a bot. I detect haiku.

Not a good haiku lol. nice try.

Unfortunately, even today many companies/businessman do not find bitcoin or other cryptocurrencies as a legal and trusted way. It's very clear that these cryptocurrencies are very effective online in currency exchange , and very safe and fast, very little fees; hopefully this will change with time

The main issue and slow down on cryptocurrency is the high rate of scams which resulted to lost of trust and high dump through hackers. The best approach to solve this challenge is by imploying good security measures. Im really happy to see projects like veil and monero. There tools are incredible. We need privacy like thier wallets.

We're already beginning to see "tokenized" pricing models for SaaS. Cryptocurrencies need business adoption.

I could see a large push for crypto in the digital gig economy, where developers are globally dispersed but offer comparable levels of skill. Crypto would be a normalizing factor in compensation regardless of what the local fiat currencies are. (That being said, there are plenty of crappy developers who overprice themselves... so assessing talent quality will be an issue)

Congratulations @hoaxtik3!

Your post was mentioned in the Steem Hit Parade in the following category:

When referring to the data you have provided in the article we can see that Turkey, Romania, and Poland are the tops 3 countries when considering crypto consumers. That is a point where we can get an idea.But my idea is we can't actually get an idea about crypto holders, I think Asia is way ahead

I believe with time, cryptocurrency will surely go mainstream or adopted by many but as you mentioned the issue of high volatility needs to be tackle because it causes a lot of panic.

I believe the issue of hacking or cybersecurity can be reduced with the integration of privacy protocols used most of the privacy coins like Monero, veil, pivx etc which can make transactions untraceable and anonymous.

Gradually it will reach mainstream.

Here is why: Because it has no use. Steem/sbd dollars must be the only coins used for something. Too risky to use as a store of value.

You are not going to use crypto to buy anything, where would you use ETH XRP etc etc? Just to speculate, not even bitcoin, because you have way simpler payment methods like, CREDIT CARds lmao.

Its up to the several houses to come up with platforms where their tokens can be used. There are huge oportunities in glambling and online gaming, maybe some diferent apps could incorporate something like that.

I think we have seen more crypto adoption this year than in the past year. With this rate, I see cryptocurrency going mainstream. All that is required is good projects with potentials, like Ethereum and other altcoins Veil, Harmony, Ripple, etc.

What are your thoughts about Solve.Care or MediBloc taking that first step to show the use cases of blockchain in healthcare industry? https://blog.kucoin.com/blockchain-use-cases-in-the-healthcare-industry-sk-st

Great read. It will take time until the total population of planet earth adopts to cryptocurrency. Blockchain technology is the future. its internet 2.0

Barriers of entry for sure. Media, banks and corporate giants working against it. No matter what gradual is better. I just saw a chart showcasing the rate of adoption of the internet and in the first 10 years it looked quite similar to this chart. except America was the top of user rate with huge diference for a long time until china took over. Interesting to see that as of 2018 turkey had the largest percentage of population using crypto. Smart of them to protect themselves from what is happening to the Turkish Lira.

Patience is the key. This year has seen an improvement in cryptocurrency adoptions and there are more to come. Meanwhile, I look forward to more project developments that will usher in such adoption we yearn for. We need more valuable projects like ethereum, Ripple, Veil, Harmony, Litecoin and others.

Even wirh the challenges facing cryptocurrency its is still getting widely recognised and people are mote eager to know what cryptocurrency is all about and great projects Bnb, Veil, xrp should be an insight to them

Very true. What I see is bitcoin just started. only a few percentages people on the planet use or involved in it. But see the impact. It is huge. So what I see is it will take few more years to see how bitcoin will upside down this economy,.

I totally agree with this one "Bitcoin alone can’t fulfill all of the possibility of the crypto movement. Instead, it’s up to the hundreds of other platforms to meet the diverse and divergent demands of the modern institutional, enterprise, and governmental use cases. " We can see now a lot of Alt's coming forward very successfully. Lie ETH, NEO, TRON, BTCH, etc. And because of this IEO treands, most of the ALT blockchains will be more stable

Flagged for using therising bid bot. Lol why don't you just make a post and get natural rewards?? Oh well eventually you will all learn.