Each time when a new disruptive technology appears on the trading exchanges (stock- or crypto-) it gets a controversial perception. From one point of view, the companies offering ground-braking technologies have a chance to simply destroy its competitors following traditional approach to the business by offering services /goods of higher value for a cheaper price. However, a camp of traditional technology supporters have a reasonable point – it is still unclear that this technology will be popular and gain mass adoption due to XYZ reasons.

We assume that the current cryptoboom is similar to a boom of railroads in 19th century (https://en.wikipedia.org/wiki/Railway_Mania + a number of other examples presented in this great article https://www.investopedia.com/articles/personal-finance/062315/five-largest-asset-bubbles-history.asp) or even the most recent one – DotCom companies boom in the late 90-ies.

But let's check the key bubble parameter - Total Market Capitalization of the sector. As of today (15 January 2018), Crypto market is valued at around 712 USD billions while the DotCom bubble at its heights had a figure of higher than 4 000 USD billions!!! Now let's add the factor of worldwide participation opportunity for the crypto sector, while DotCom was mainly a local US event! Then we have to assume a global market growth and monetary expansion during last 18 years. So, you can briefly imagine how big the REAL crypto bubble can grow! We would not be surprised to see 10 000 USD billions for the total market cap of cryptos in coming time. But please make your own scientifically reasonable guesses.

Let’s analyze the performance of stock of 2 giant companies – Amazon and Microsoft.

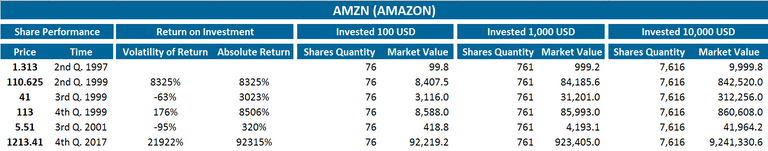

The Amazon example

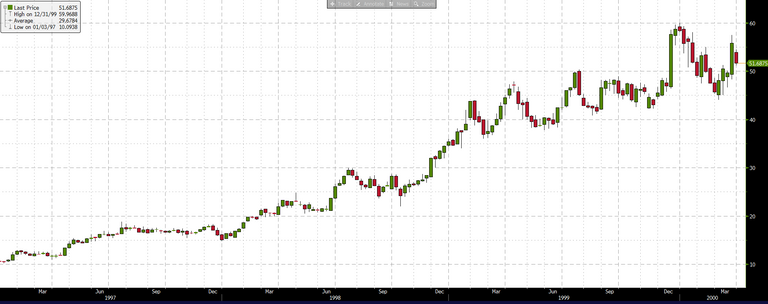

Take a look at the chart of AMZN stock price (weekly, June, 1997 – October, 1999):

- The price went up from 1.31 USD to 113 USD.

Take a look at the chart of AMZN stock price (weekly, January, 2000 – December, 2002):

- The price dropped from 91 USD to 5.51 USD.

Take a look at the chart of AMZN stock price (weekly, June, 1997 – December, 2017):

- Huge growth from 1.31 USD to 1213.41 USD.

Take a look at the projected profit rate for a given invested sum at the beginning of the cycle:

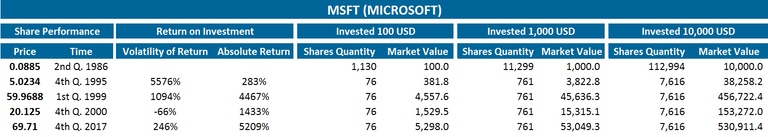

The Microsoft example

Take a look at the chart of MSFT stock price (weekly, March, 1997 – December, 2000):

- The price went up from 10.09 USD to 59.97 USD.

Take a look at the chart of MSFT stock price (weekly, January, 2000 – December, 2002):

- The price dropped from 59.31 USD to 20.13 USD.

Take a look at the chart of MSFT stock price (weekly, March, 1986 – December, 2017):

- Huge growth from 0.09 USD to 69.7 USD.

Take a look at the projected profit rate for a given invested sum at the beginning of the cycle:

Findings & Conclusion

What these 2 stocks had in common in 90-ies? They represented a disruptive sector – IT. Software development and Sales through the Internet. Initially, both these 2 companies were cash-flow negative (the basic P/E indicator also was non-existent for them). At that stage, investors in these 2 companies were betting on the growth of demand on IT services and products and a successful accomplishment of the projects by the teams of these 2 companies. Both of them have experienced gigantic volatility of own equities prices. Both of them have awarded their investors with outstanding returns. And guess which investment approach was the best to profit from this asset appreciation cycle? Obviously, HODL! Hodlers of AMZN and MSFT equities are currently driving their Lambos (and even probably stacking some quality crypto picks to ensure their future generations will enjoy the same prosperity level as they have now).

Just imagine, that you could constantly add (monthly) to your initial investment in the 90-ies and how big would be your portfolio now! XX XXX % returns!

Assets Gem picking

Of course there were numerous investment failures during DotCom bubble as majority of these projects completely bankrupted! But even this remark signifies an importance to find your own Crypto Gem for Eternal HODLingm, finding your CryptoAMZN or CryptoMSFT!

We have briefly covered our current portfolio of high-quality crypto assets in our article here: https://steemit.com/crypto/@p2port.com/crypto-portfolio-high-quality-crypto-assets-for-long-term-growth-created-on-11-january-2018

PS

Usefull links (CryptoExchanges):

- Kucoin: https://www.kucoin.com/#/?r=1Hsw5 (RLC, REQ)

- Binance: https://www.binance.com/?ref=11278187 (RLC, XMR, REQ, XMR, ICX, ZRX)

- Bittrex: https://bittrex.com/ (RLC)

- Changelly: https://changelly.com/?ref_id=f71be6090b43 (XMR)

Your P2Port.com!

What is your strategy, friends?

Coins mentioned in post:

@OriginalWorks

Grate post, resteemed!