Welcome to the first week of Crypto Review! I am a College student and Crypto enthusiast and will be taking a look at 10 cryptos over the next 10 weeks. Today we will be looking at Monero.

Monero is a privacy coin designed to be fast, decentralized, and secure. Monero allows its users to spend funds privately and anonymously, without a public ledger informing the world of the receiver, sender, or amount sent for any given transaction. Monero enables its users to “be their own bank” and puts them in control of their financial wealth.

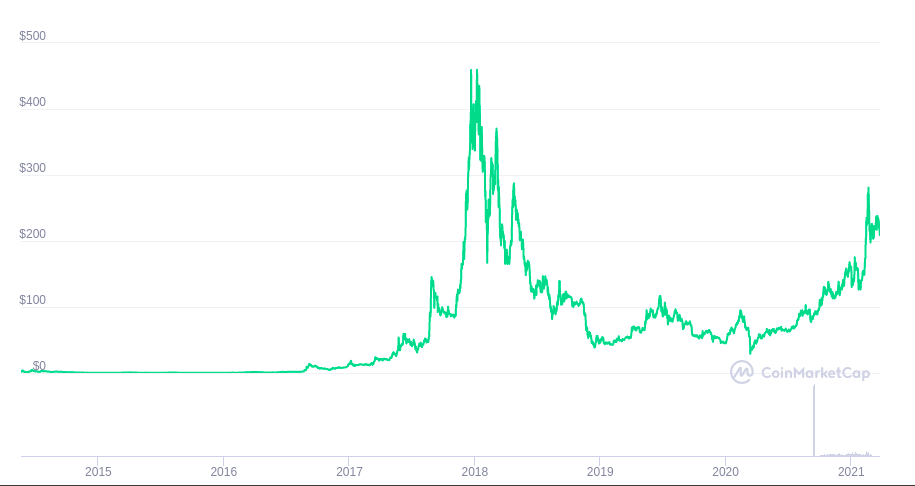

Monero was originally created in 2015. It gained popularity on the dark web initially and developed a cult following, rising quickly to almost 500 dollars in value per token during the bull run of late 2017. It survived the bear market of 2018 and has been steadily rising this current bull run, with its current price sitting at $209.79 at the time of this writing.

Development

Many of the Monero developers go by screen names, and it is no surprise that the developers of a privacy coin would want to keep their lives private as well. Monero’s core development team consists of the following individuals:

Ricardo “Fluffypony” Spagni

Luigi1111

NoodleDoodle

Smooth

Tacotime

Franciso “ArticMine” Cabanes

Monero is still being developed, with more updates planned for this year and the near future. We will go into those later.

Coin Economics

Monero’s coin economics are different than bitcoin’s, for those of you who are familiar with BTC. Although both are proof of work coins, each has different mining algorithms. Monero’s RandomX algorithm is ASIC resistant – forcing users to mine it using a CPU. The idea behind this was to encourage a wider distribution of the hash rate beyond large mining facilities.

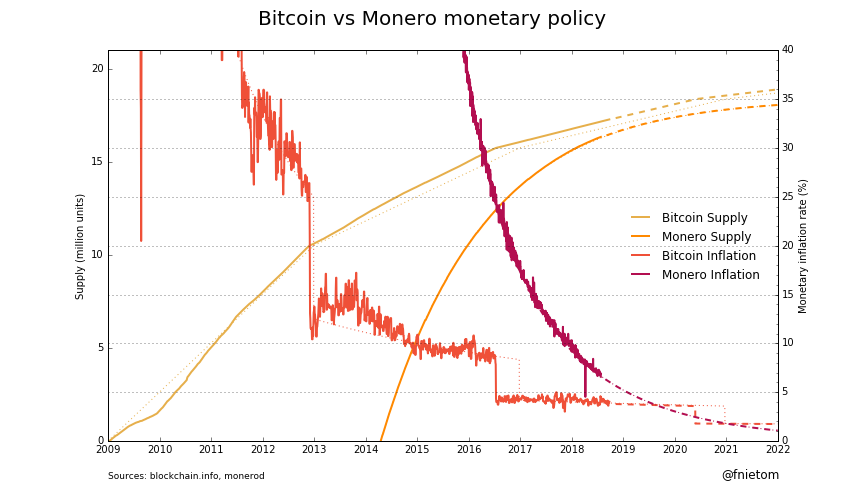

Another key difference is that Bitcoin has an immutable coin limit – 21,000,000 – that will ever be created and mined. This presents several upsides and downsides that we won’t go into here, however, Monero takes a different approach. The Monero team plans to create 18.4 million tokens and put them into circulation. After that, Monero will be emitted onto the network at a linear rate of 0.3 XMR/sec. This will create an asymptotically flat inflation rate. The Monero dev team has said this is to incentivize miners to continue mining – thus ensuring the continued security of the network.

Monero also does not have halvenings. Instead, it decreased its emissions consistently as time goes on.

Privacy Mechanisms

Now for the big question. How does Monero ensure user privacy? It does this in several ways.

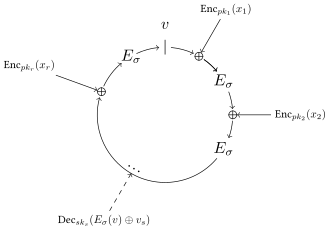

Ring Signatures

Monero uses RingCT (Ring Confidential Transactions) to ensure user anonymity when sending money to another user. Explaining the hard details of how it works is beyond the scope of this post – if you are interested in the hardcore research I will post this link for you https://www.researchgate.net/publication/311865049_Ring_Confidential_Transactions

Stealth Addresses

To hide receiver identities – Monero uses stealth addresses. These addresses are automatically generated for single use and create a public key on behalf of the recipient, acting almost as a “burner address.”

Bulletproofs

To hide the amount sent – Monero uses bulletproofs. This is a complex cryptographic concept to break down, but if you’re interested you can read more on it here - https://blockonomi.com/bullet-proofs/

Between these features, Monero is able to remain private and untraceable.

Use Cases (For Potential Investors)

Now, what about use cases? As a privacy coin, Monero’s main use case is exactly what is created to do, private transactions without any centralized oversight. Obviously, this could lead to illicit use, and it has, unfortunately, as we will discuss later. However, there are many legitimate uses for this currency. Many people don’t like the idea of sharing their private financial details with the world – this is a serious problem with open blockchains. By keeping transactions private, Monero can operate more efficiently as a currency. Another problem that Monero solves is fungibility. Many coins that use public ledgers are not fungible – and there have been incidents where exchanges refuse to take “tainted” coins. Monero has no such issue: just like dollars, gold, or any other asset, Monero is completely fungible.

But what about DASH, or ZCASH? Both of these coins also have privacy features, however, they are not private by default – like Monero. There are also differences in the development team, philosophy, coin economics, and privacy mechanisms.

Controversy

Monero has also had some controversial press. It is associated often with the dark web and illicit transactions – much like Bitcoin was in its early days. Some investors fear Monero will be regulated by centralized institutions due to the difficulty one has taxing transactions (it is relatively impossible). Were Monero to be regulated in such a way, the price would drop by some significant margin. However, due to its inherent value in creating private transactions, there would still be some who would use it even after it is banned. Monero is decentralized and would be incredibly difficult for a state government to fully “stop.” Thus, it is unlikely this cryptocurrency will ever go away, even if it is banned, at least not until something better comes along. That being said, the likelihood of it being banned is low as of the time of this writing. Monero can be bought on many exchanges in the US and internationally with no issues.

Planned Updates

There are several upgrades planned for Monero this year, among them an open-source hardware wallet (Termed "Kastelo"), and solutions to improve network speed and scalability. In the future, Monero will be adding secure return addresses, as well as atomic swaps. Atomic swaps could be game-changing and allow a whole new demographic to access Monero as a currency.

Conclusion

Monero is a cryptocurrency with a solid development team, vibrant community, and long history (relative to the history of cryptocurrency as a sector). It is a fantastic investment for people who believe in its philosophical case for privacy, those who want to use crypto without broadcasting their purchases to the world, or the investor who believes that privacy will become a bigger issue in the next 10-20 years. Whatever category you fall into, it's not a bad idea to have a few on hand. Just remember that there is some regulatory risk that could incur portfolio losses, however, as of today it does not look like these fears will be realized. In a way, much of the arguments made today against Monero today are the same that were made against bitcoin 8 years ago.

I hope you all enjoyed this content :) I will be posting relatively often so check out my blog

Congratulations @techoverlord! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: