The bear market of the past few months has created some trying times for investors. I too have been struggling to HODL for the longest and have contemplated to cut my losses and move on for the time being. Then I thought of a story I read a while back about a guy that sold his Apple stock back in 1977 for 800 dollars and I decided to come up with a different game plan. Often times people seem to forget that the market is ruled by participants that are lead by their emotions and therefore the markets aren’t rational. Specifically in the crypto markets, investors let FOMO and panic selling get the best of them. The best way to get you some peace of mind is to come up with a strategic investment plan based on a logical and systematic approach. Before we get to that, let’s discuss a few very common mistakes beginning investors/traders often make.

First, they invest a sum of money that they can’t afford to lose in the hope to become rich quick. Sometimes they even put a large amount of this money in penny coins that they’ve researched for about 20 minutes (and by research I mean Googled: best coin to invest in 2018 and that’s it) and hope for the best. This approach can become financially lethal.

Another mistake is investing in something that they don’t understand. I will admit that I’m not the most tech savvy person but I do understand the ins and outs of (blockchain) technology to some extent. To be able to make the best decisions you should look within your areas of expertise, this will also increase the confidence you have in your investments and rule out irrational emotions. Like the great investor Warren Buffett said:

“Different people understand different businesses. And the important thing is to know which ones you do understand and when you’re operating within what I call your circle of competence”

With blockchain technology still being in its infancy this will be a bit difficult. The true value of almost every cryptocurrency has yet to be determined as most aren’t even fully operational. During the explosive growth in late 2017, most investors were just blindly investing their money in the top 100 cryptocurrency and even though that turned out good (if they sold their coins in early 2018), a similar mania is unlikely to happen again. With that being said, always do (your own) thorough research before investing.

Key Strategic Elements

An important point to remember is that diversification is key. You can diversify your portfolio in different ways. You can create a portfolio based on different cryptocurrencies or one that’s based on different types of cryptocurrencies. It will limit your risk and it can also do the same for your gains, however, it is a far better approach than playing all-or-nothing. This way you also increase your chances of holding a moonshot in your portfolio that will dominate the market later on. In an emerging market where billions of dollars are being poured in, competition will be in full effect. Every coin is fighting for a spot at the top and new players are surfacing by the day. First you had Ethereum as the platform for smart contracts and now there are tons of competitors eating away at that first mover advantage. With a diversified portfolio you can have a higher chance of holding that coin that can take Ethereum's spot in the future.

Additionally, you can diversify based on the type of cryptocurrency. I have a portfolio based on both diversifications.

- Transactional coins, think Bitcoin

- Platform coins, where you can build applications, like Ethereum, NEO, EOS, Cardano etc.

- Utility tokens, that are build on the platform coins

- Security tokens (too risky)

- Stablecoins, backed by an underlying asset (gold, fiat, etc)

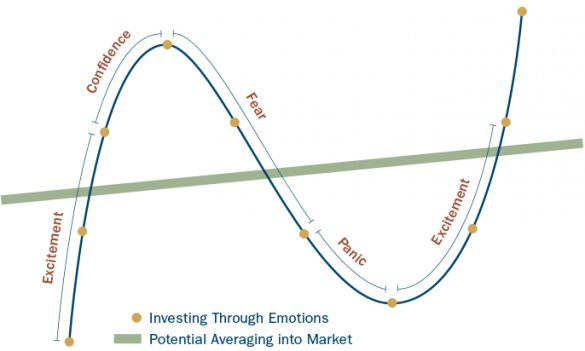

Just to be clear, this information is regarding longterm investments and not day trading. Now that you’ve put your portfolio together, it is time for the next step: buying in. Keep in mind, even the seasoned investors/traders rarely buy their assets at the perfect time for the best price. The goal is to buy at the best average price and the way to do that is by dollar cost averaging. Set up a buying schedule to keep your emotions from taking over. No matter what the market sentiment is at the moment, your buying schedule should determine the frequency and the amount of buying rounds. I’ve found this method to work best over the years, however, I should issue a disclaimer that I am not a professional financial advisor and this is merely what I’ve found to work for me personally.

Last in order but not of importance: the rebalancing method. This method prevents certain assets from overtaking your portfolio and dominating. Let’s use an example to simplify. You established a portfolio with 7 cryptocurrencies. Stellar initially has a 20% stake and Ethereum 30%, however, Stellar’s price skyrockets 300% and ETH falls by 5%, now you’re holding too much XLM. To keep your portfolio balanced and proportionally allocated you would have to sell a portion of Stellar’s profit and purchase more ETH to keep its initial balance and mitigate your risk. And so the circle goes on.

An old saying goes as follows: ‘A fool and his money are quickly parted’. Of course there is a chance that you can discover the next killer app that will dominate the blockchain industry 30 years from now and become filthy rich but people often forget that the opposite is more likely in a market like this. Finding this app comes with a lot of risk and we are all in the same search.