How to know when to sell?

When do I sell?

I often get the question from people as to when to sell when you're in a trade. The question can be answered into multiple categories. I'll talk a bit about the pros and cons about the different methods of selling.

Systematic selling

Systematic selling means that you sell based on a system, just like the name tells us. There are various systems on how you could sell and I am going to tell what I think are the pros and cons of each of them.

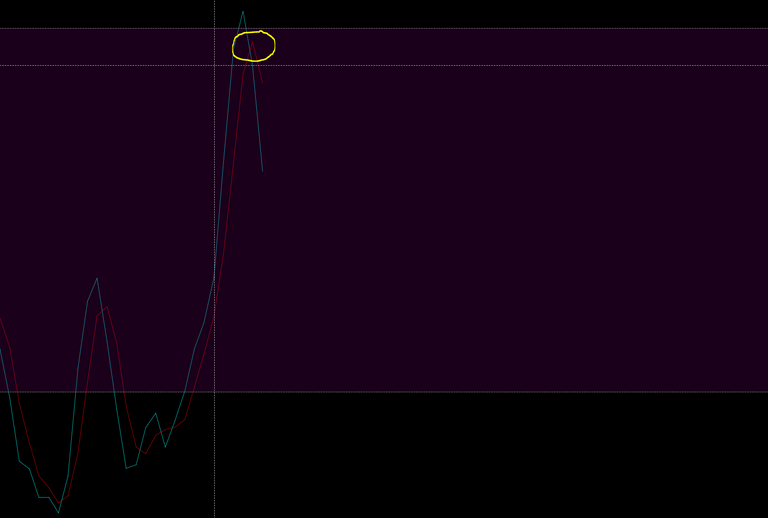

Stoch RSI is an indicator that tells you whether a coin is over bought or over sold. When the Stoch RSI would cross to the down side (Bearish) on the oscillator then you know it's most likely going down. This is however a puzzle, you need to always look at different time frames. The higher the time frame the stronger the signal. The pro of this is that you will most likely sell when a big sell off is about to happen. The con is that you will almost never sell the top, since indicators are lagging and therefore are delayed.

Percentage based selling is selling based on a certain percentage you have made in a trade. Before you enter the trade you will already tell yourself "I am going to sell at 20% or 30%". The pro of this is that you either sell there or it simply won't get to it and it might stop you out at break even. The con however would be that if the coin you're in goes higher than the 30% you would miss out on that.

Target selling, this method is in my opinion the best way to sell. This is however also the hardest way to sell because you need to have some knowledge regarding market structure, Elliott wave theory and Fibonacci. The way I get to a target is by for example using Fibonacci extensions based on previous run ups in coins. This will get you the most bang for your buck because the exit will always be higher than the 2 above mentioned methods. So the way this works is when it hits target you don't sell immediately yet, you just stay alert and are ready to sell whenever you think it's good. Right now you will wait for the FOMO (Fear of Missing Out) to kick in on most people. This is when all the really big green candles start appearing on the lower time frames, it's people quickly jumping in that think they will go to the moon. You sell into that. The pro of this method is that you have a target in mind the moment you enter and you will patiently wait for that target to get hit or you get stopped out at break even, don't forget to put your stop as soon as you're let's say 5-10% in profit and are on a new support level, so that if it breaks down you don't keep losing. Having a target in mind gives you a mind of ease on top of having that stop then you know you can't lose anymore and that is why I love this method of selling. The con of this method is that it might not hit that target and stop you out or you get stopped out with profit on a lower level than the target, I personally always move my stops up when the price keeps getting higher, there is no reason not to put the stop under a new support when a new support is being formed.

Always stay patient and wait for your entry and try to exit at the right time