There is a theory and a common refrain that people heard during the crypto crashes of 2013, 2017, 2020 and now again in 2022. That is, the bear market is a test of resilience for crypto projects - the ones which are not substantive and based purely on hype, or are outright scams, will fail as investors become more skeptical and more reserved with how they invest in crypto. Those projects that remain will be the more utilitarian, substantive projects making the overall space more healthy and less scammy.

If the idea were true though, why didn't it happen... all those times it should have before?

Theory outside of Crypto

The idea has similarity to the concept of malinvestment in Austrian economics. During a boom time, money is easy. Money is easily attainable for companies, meaning that even if they don't operate a tight ship, they can continue doing business, perhaps even at a loss. When a recession comes along, customers and investor money dries up, and so only the companies with a healthy cash flow can continue, based on the soundness of their business. In addition, the failure of the less efficient business frees up capital (eg. machinery and skilled/educated employees) to be made use of by the companies that are already in better shape.

Dotcom Bubble

A historical example of this is the dotcom bubble. In the 90's and early 00's, there had been a huge bubble of investment in early internet and web-based companies. The DotCom bubble is a well known story of irrational exuberance, where anyone with a website could create a multi-million dollar company, with or without any real customers or business. The vast majority of these were wiped out in the 2001 crash. A list of the top dotcom stocks shows almost none that are relevant today.

Yet the basic premise of the Dotcom boom, that the internet and the web would change business and commerce forever, was not wrong. Some Dotcom businesses such as Amazon would go on to become massive several years later, and others just starting or started shortly after are among the largest companies that exist today (eg. Google and Facebook).

There are other examples of industry crashes that resulted in a "clearing out of garbage" that went on to become huge such as the video game crash of 1984. Even in the crypto industry itself, the bubble and crash of 2013 can be considered a positive example. The end of the Mt. Gox did indeed lead to a much healhier ecosystem of exchanges, and a culture of personal ownership of crypto keys.

Why is crypto different?

The most important point about all of the 'successful' examples where bad companies and businesses were removed by a recession, is that in all those cases - businesses were allowed to fail. While there are some few exceptions, by and large crypto projects are never allowed to fail.

1. Crypto projects by their nature are resilient

It doesn't take much to keep a blockchain going. Usually there only needs to be a few people interested in keeping it alive, providing capital by speculation, and the network itself is usually extremely inexpensive to run overall. Even the bigger and more expensive projects will automatically adapt and reduce their costs as there is less money in the system. See: difficulty readjustment.

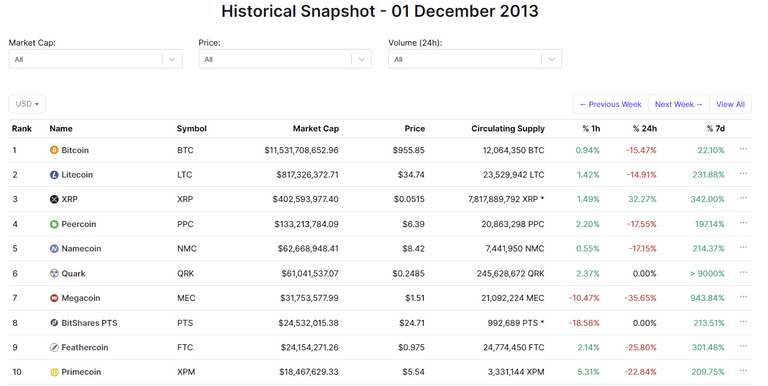

https://coinmarketcap.com/historical/20131201/

While most are not so relevant today, all of the crypto projects in the top 10 at the height of December 2013 bubble are still going today. Not one of the above has stopped altogether (Bitshares proto-shares went on to become BitShares proper). Indeed, generally if you held onto these ancient cryptos, despite lack of relevancy, you still would have been able to sell for a profit during a later crypto boom (though they did not all beat their 2013 peaks).

A consequence of this is that it is fundamentally challenging to remove bad ideas and bad actors from the crypto space.

2. Exchanges as Casinos

Crypto exchanges face a dilemma. If they succeed at bringing about a world where we all use crypto - their purpose largely disappears. That's not a viable business long term.

It's much better for crypto exchanges to act as a kind of casino, where speculators gamble on the latest fad or penny stock. Just moving your fiat into crypto is not enough for ongoing revenue, but if you keep playing the game of crypto trading and speculation, they've made a customer for life.

Crypto exchanges have a vested interest in keeping the scammy, gambling aspect of crypto alive as opposed to a utilitarian system where we simply switch to a new kind of money during a transitional period while fiat still exists.

3. TetherUSD

The truly massive elephant in the room is TetherUSD. From 2017 at the latest, TetherUSD formed the majority of trading volume across crypto exchanges. Exchanges that embraced TetherUSD also grew faster than those which did not. Almost all crypto trading and pricing is in TetherUSD as opposed to directly in USD or even BTC. The major exchanges today are deeply embedded in Tether.

Despite having demonstratively lied about their reserves and being known to be insolvent at times, TetherUSD was never allowed to fail. Tether is essentially a money-printing scam which has helped to keep known Ponzi scams such as Celsius going when they were on the brink of failing.

The existence of Tether keeps bad projects and scams alive.

Conclusion. Can this time be different?

Maybe. If

- A major crypto project fails - blocks actually stop coming through for a significant period of time and the project collapses - such that the investing public learn that simply "hodling" any crypto for long enough is not going to always work out.

- The current batch of exchanges-as-casinos start to fail. And

- Tether collapses.

Then maybe we can have the healthy clear out we have been hoping for. Otherwise we may be doomed to another cycle of the same old memecoin shit.

Been around for all those crashes and can't say I was smart, though I'm a little ahead. People have short memories and get dollar signs in their eyes without understanding the risks. Dumb money greed. It'll happen again and no amount of regulation can stop it. Such cycles are necessary to clear out the deadwood.

Looks like BTC is back to where it was at the end of 2020, so a load of people who bought in since then must be worried. The old guard will not worry so much. As with the web boom there is a lot of hype going on around crypto. People will chase 100x gains, but maybe they should be happy with 10x on a more credible project. It's always a fun ride.

The rewards earned on this comment will go directly to the people(@demotruk) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I not sure if BTC will touch the lows of couple of years ago. I think once this starts steady itself, then we get another bull run that's more substantial. Maybe 3x is welcome and more acceptable !