Born in confidentiality, cryptocurrencies are now worth tens of billions of dollars. In just two years, ether became number 2 on the market, a threat to the precursor Bitcoin. Between technological revolution and financial speculation, the fate of these virtual currencies is uncertain.

"Revolutionary": the word often comes down to describe the blockchain, this new technology behind the cryptocurrencies like the Bitcoin. Understanding the usefulness of innovation can be part of the fighter's journey for newcomers. Whether they are reassured, specialists are not sure where this is going to lead us.

One thing is certain: a lot of hopes are based on electronic currencies. Their value has exploded since the beginning of the year. Bitcoin, the precursor of the phenomenon, has long focused attention in a market with more than 600 currencies. But the Ether, launched in 2015, is experiencing an exponential growth that recalls the beginnings of the Bitcoin.

In February 2011, a Bitcoin was trading against a dollar. In early June, its price exceeded $ 3,000. Those who have hesitated to bet on this currency bite their fingers today and want to see in the Ether a replica of this success. Since the beginning of the year, the value of the Ether has been multiplied by more than fifty. For well-inspired people who have invested a lot and early enough, the rise in the price of cryptocurrencies is a real winning lottery ticket.

Initially, the young Russo-Canadian behind Ethereum, Vitalik Buterin, designed his project as an update for the Bitcoin ... reborn by the developers of the cryptocurrencies. "The Bitcoin was instead thought of as a coin, whereas the creator of Ether was interested first in the technology behind: the blockchain. And it has made it as easy as possible to program services on the Ethereum, " recalls Philippe Herlin, economist and author of: "Apple, Bitcoin, Paypal, Google: the end of banks?"

What is the blockchain?

To understand what Ethereum is, it is better to grasp what blockchain is, the idea that enlivens the environment of innovation for a few years.

Today, our banking data, social network content and e-mail are stored in centralized servers managed by large groups. This solution presents risks: the information is grouped and likely to be hacked by hackers, spied on by governments or operated by companies without agreement. Another disadvantage is that to give this data to a third party is costly.

Thanks to the blockchain, the storage is decentralized. Instead of being monitored by a single group, the data is scattered across a network of thousands of individual computers and each node in the network validates the operations performed. A technology that wants to be anonymous and ultra-secure. Ethereum speaks of a "world computer": a horizontal model that is more democratic, transparent and economical.

Large companies attracted

Ethereum blockchain has managed to stand out from Bitcoin thanks to smart contracts. Developers can use Ethereum to create a computer program that automatically executes the terms of a contract when certain conditions are met.

The interest of large companies in this technology is likely to encourage the exponential growth of Ether. In February, several IT and financial groups founded the Enterprise Ethereum Alliance to study possible Ethereum applications. Today the alliance includes a lot of well known companies:

A support to relativize since these companies often use an imitation of Ethereum to test its profitability. The big question for investors is whether or not they will then switch to the main network. Because we can copy the software but fewer people will make it work and its market value may be limited. If tomorrow these companies realize that their software works technically but it is very hackable because it does not have as many nodes as Ethereum, they can decide to return to the main channel.

But Ether's success could be tempered with a possible Bitcoin response:

The Rootstock project can shade Ethereum: it would allow complex smart contracts of Ethereum type without attacking the central chain of Bitcoin. If it works well there are far fewer reasons to use Ethereum because there is no need to go through a third party.

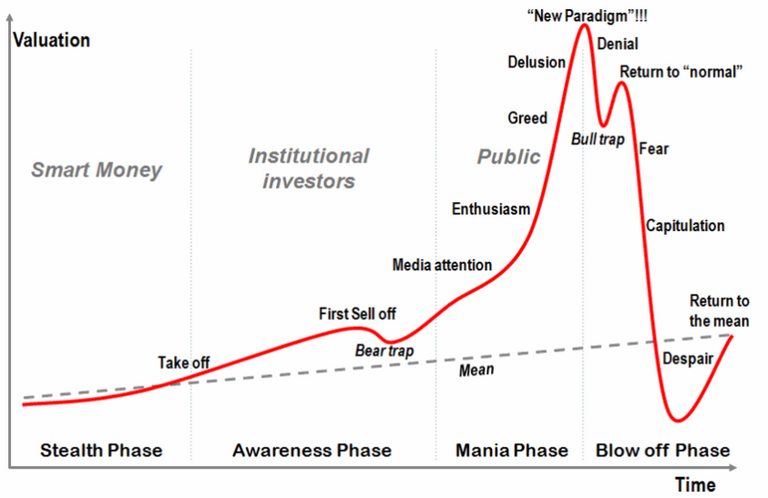

A speculative bubble around the blockchain

Start-ups are also interested more and more in Ethereum. These are the famous ICO (Initial Coin Offerings) that manage to raise the equivalent of millions of dollars in cryptocurrencies and this in record time. In June, the project of Brendan Eich, former Managing Director of Mozilla, received $ 35 million in less than a minute.

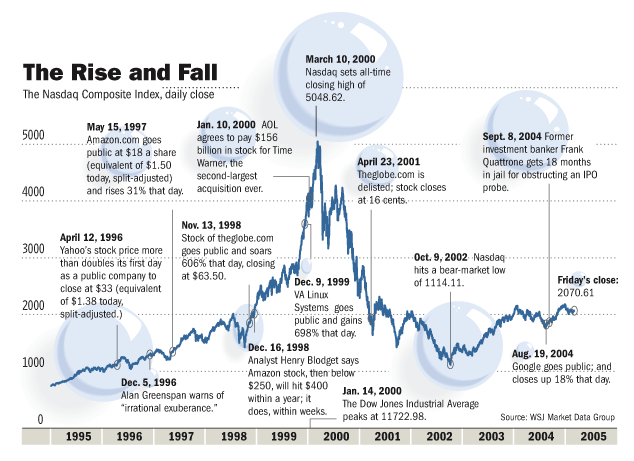

It's revolutionary. Do you know of any other place in the world where we can raise so much? There is a craze for deregulated operations, where it is easier to invest. Prices are exploding, a multitude of start-ups are seizing new technology and investments are raining: an excitement that reminds many bubble internet of the years 2000.

But I think that no concrete and large application is deployed for the moment from Ethereum. The crypto-traders are unanimous: this irrational bubble will explode but no one can predict when exactly. There will be a sanitation and this will be positive to overcome all this current fashion effect that generates too much runaway. Serious projects will remain, as was the case for the web. It will not be the end of those that have been in place for years. We must believe in the technological revolution.

The creators of Ethereum refused to see the Ether become a currency of speculation like the Bitcoin. But...

The ICOs and the rise of the course have brought in many new entrants. The day when there will be no more, there may be a decline in the course of the Ether with people who want to take their profit. If there is a big sale, it can lead to a chain reaction... The well known "panic sell", dump, crash.

What will become of the cryptocurrencies?

Bitcoin and Ether are often competed but the two cryptocurrencies may well coexist in the future if their technology is differentiated. In the same way, they could take more and more weight in relation to the dollar and the euro.

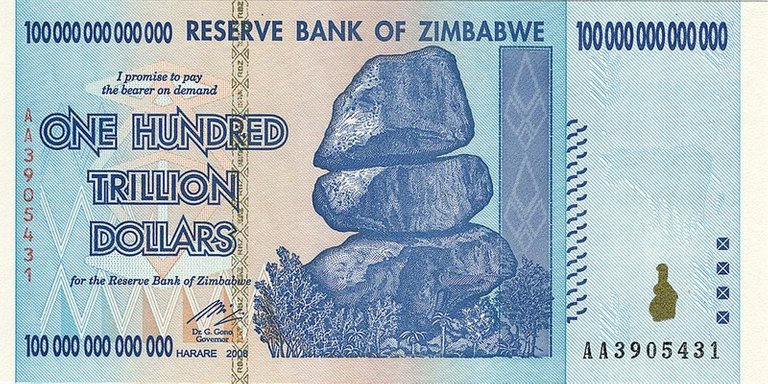

These currencies are not controlled by the financial authorities or the states. Let's take the example of Nigeria where the use of Bitcoin is more and more commonplace. For everybody, having a stable currency is a privilege. In most countries, currencies are experiencing shocks, particularly those that depend on commodities. In Nigeria, when the price of oil rises from $ 100 to 50, the currency also collapses, which poses many problems for businesses. The Bitcoin allows you to get through. It can be a currency of salvation for countries that are experiencing a lot of inflation.

Finally, I think that cryptocurrencies are unlikely to replace fiat currencies in the coming years. Because to spend Bitcoins, your need electricity, battery and network. And the whole planet is not networked, it is a problem that can later arouse the use of cryptocurrencies.

But in the upcoming decades, who knows?

Pictures Source: 0 , 1 , 2 , 3 , 4 , 5 , 6 , 7 , 8 , 9 , 10 , 11

@fapfap This is early days too. Most people are still highly skeptical about all types of cryptocurrencies. My concern for now is that money launderers and financial fraud carried out by hackers etc will get it banned or restricted. I know in New Zealand, our Inland Revenue Department is still very vague on tax laws around cryptocurrencies. When governments become more clear on where they stand, I think people will be more willing to accept them and they will boom like never before.

I totally agree with you. We also have the same issue here in Switzerland. The government still don't have a clear law about tax on cryptocurrencies gain. Let's wait some years, and see what happens..

Absolutely. Good article too :)

@originalworks

The @OriginalWorks bot has determined this post by @fapfap to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

img credz: pixabay.com

Nice, you got a $4.37 @minnowbooster upgoat, thanks to @fapfap

Want a boost? Minnowbooster's got your back!

This post has received a 2.81 % upvote from @booster thanks to: @fapfap.

This wonderful post has received a bellyrub 14.19 % upvote from @bellyrub thanks to this cool cat: @fapfap. My pops @zeartul is one of your top steemit witness, if you like my bellyrubs please go vote for him, if you love what he is doing vote for this comment as well.

Thanks to share@fapfap