What is Technical Analysis?

Technical Analysis focuses on trend, support and resistance, and momentum through the use of chart analysis to benefit investors and traders get into and out of higher probability trades.The principles of technical analysis are derived from hundreds of years of financial market data. Some features of technical analysis started to seem in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century.

What is Relative Strength Indicator (RSI)?

The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. RSI was introduced by Welles Wilder in June 1978 and its computation is described in detail in his book “New Concepts in Technical Trading System”. RSI is a very popular tool because it can also be used to confirm trend formations.The RSI is a momentum oscillator that analyze the speed and change of price movements. RSI is similar to the stochastic in that it identifies overbought and oversold conditions in the market.

RSI oscillates between “0” and “100”. Usually, RSI is considered overbought when above 70 and oversold when below 30. Signals can also be produced by looking for divergences, failure swings, and centerline crossovers. RSI can also be used to recognize the general trend.

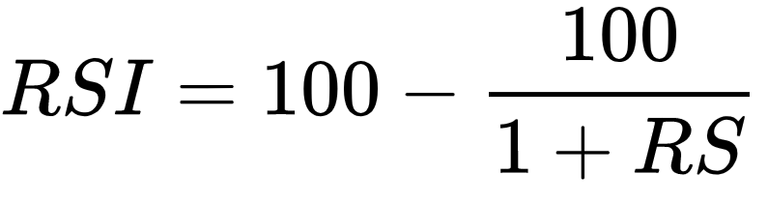

RSI Calculation

To make things easier the calculation clarification, RSI has been fragmented down into its basic components: RS, Average Gain and Average Loss. This RSI calculation is based on 14 periods, which is the default recommended by Wilder in his book. Losses are expressed as positive values, not negative values.

The very first calculations for average gain and average loss are simple 14-period averages.

- First Average Gain = Sum of Gains over the past 14 periods / 14.

- First Average Loss = Sum of Losses over the past 14 periods / 14

The second, and subsequent, calculations are based on the prior averages and the current gain loss:

- Average Gain = [(previous Average Gain) x 13 + current Gain] / 14.

- Average Loss = [(previous Average Loss) x 13 + current Loss] / 14.

Interpretation

The RSI is existing on a graph above or below the price chart. The technical indicator has an upper line, typically at 70, a lower line at 30, and a dashed mid-line at 50. Wilder recommended a smoothing period of 14

Image Source

*Wikipedia

*Pixabay.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:relative_strength_index_rsi