This past weekend the whole cryptocurrency space lost around $40 billion dollars which represents about a 20% pullback. It could have been caused by the China ICO scare (which now appears to be more of a temporary stop until regulation gets put in place instead of an outright forever ban). It could also have been triggered by some whales with deep pockets who understood the three-day holiday weekend means those wishing to buy crypto won't be able to get their fiat money in quickly, so if they drive the price down with massive sell orders, they can turn the market and buy up more cheap coin before the banks reopen. It could also just be a normal correction based on the massive bull run we've had this year.

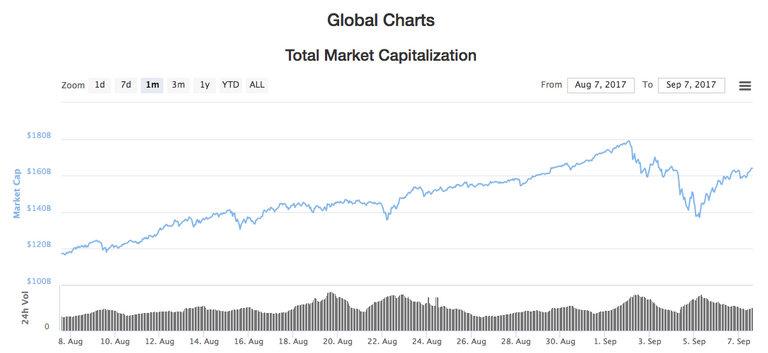

As I was thinking about it this morning, I took a look at the marketcap chart for the last month:

That 20% pullback that so many people were freaking out about... looks like a small blip. We've already recovered more than half of what was lost!

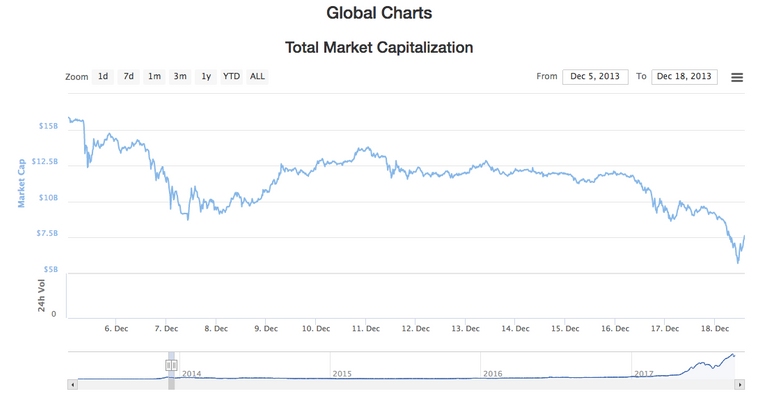

I've been involved in bitcoin since early 2013. Many others were involved even earlier. There's been an ongoing discussion about how an increased total marketcap will decrease volatility. When people see swings of $40B in a weekend, it's understandable to think that's crazy talk. However, when you think about it in terms of percentages, I don't think it is. Compare, for example, what happened in the end of 2013:

That was over a 60% drop in less than two weeks! I remember it clearly because I didn't sell. I HODL'ed. Yes, I could have sold and bought back in, but often things go up faster than they go down, and if you can't time it right (and very few people can, consistently) you end up losing more value than if you just held. Because I held, I was able to pay off my house this year.

So that brings me to my main question for you:

Are You Waiting to Buy Cryptocurrency?

Are you waiting for a big pullback? Are you second guessing buying in because "You could have bought when it was so much cheaper"? Are you letting psychological quirks like loss aversion keep you out of the game? What if this past weekend was your last best chance to buy in cheap?

I think there's a better way than constantly second guessing yourself or being concerned with the daily price. Instead, work your ass off to get out of debt, get some liquid savings together including diversified traditional retirement investments, and then free up some money to invest. Then, when you invest, do so rationally based on arguments you can get behind for the long-term.

When I first bought bitcoin, articles like this really impacted my thinking:

The Target Value For Bitcoin Is Not Some $50 Or $100. It Is $100,000 To $1,000,000.

That was written by @falkvinge in 2013, and I still think his argument is sound. He was right on the money with his 1000x return claim six years ago. He was thinking long-term.

So for me, it's not about small gains here or there, buying and selling with each dip or bump. To me, it's a rational course of action to transition into the new cryptocurrency economy uncontrolled by governments and freely traded by individuals as they see fit. Yes, there will be regulatory battles and issues with privacy and control. That said, I'm confident the free market of ideas and technological advancement can and will stay a step ahead of bureaucrats and regulators. They will do so by innovating new truly anonymous cryptocurrencies as needed (and many already exist today).

No one can predict the future, and it's still very possible we could see another major crash. That's where the whole "Don't invest more than you can afford lose" advice comes in. Also don't invest if you might be tempted to pull money out at the wrong time because of an unforeseen expense. Your car will eventually break down. Your roof will eventually leak. Your AC unit will eventually need replacement. These aren't unexpected events, they are things we can and should plan for. Your cryptocurrency holdings, if you can manage it, should stick around long term if you really want to change your financial life.

I'm not an expert. Don't act on my advice but learn on your own. I blog about my own irrational trading moves. That said, I'll continue to share my opinions and stories because when we combine enough stories together from various sources, we can hopefully gain some knowledge.

Related post from 3 months ago:

The Big Question: Should You Sell or Hold During a Market Correction

I've heard some say you shouldn't buy any cryptocurrency you're not willing to hold for at least two years. What do you think?

Personally, I think cryptocurrency projects like STEEM and BitShares which have active development going on and provide a very real service (not just a promise of a service sometime in the future) are great buys. That's why I'm highly invested in them.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

Buy EOS and BTS; hodl for 2-3 years; take 10% profit at each doubling; convert to BTC. Be happy. :)

Sounds fun, but in the future people may see no need to convert to BTC. In the future, currency may be like language, a form of expression, something we can seamlessly convert to and from.

Fully agree :) To me it's not a matter of short term investment or easy money, it is simply the future in all its forms, covering multiple functionalities.

The one crypto-mantra I keep repeating is this: inflationary fiat can't compete with deflationary cryptocurrencies over the long haul.

Every time you get emotional about gains/losses, just keep this in mind.

Agreed.

Great post! The ongoing market frenzy, maybe some fomo (fear of missing out), some cool trading activities.. i thinking similar, but because i'm learning every day of all the opportunities, some Steemians give me new insights or just by researching, i hop from time to time if i see a better investment. And nothing is easier in the cryptoworld. But i'm basically an long term HODL'er and will calm down until i'm more familiar with the market.

Valuation is another thing which cannot be applied so easy like in stock market from what i know and the concerns by Buffett are legitimate because there is so much buzz and guessing about and so less fundamental valuation of this market. And so i think it's high risk with also high return. The volatility like you draw in the historic chart has decreased. I think we'd recently a wave of people like me who are very serious about investing in the market and did also word of mouth to others because of the discover of that fascinating technology and also pure enthusiasm. I thought about that after a comment in one of my posts by @yoganarchista which was a good point. The latter is also a bit dangerous because it could be lead people without any knowledge in the market who are not aware of the risks. A friend asked me recently

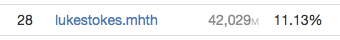

"Would you recommend to buy some cryptocurrencies?"

(it was at the alltime high of Bitcoin about $3.000 not long ago) and i said to him"No, i cannot recommend that, i'm invested but i would do no financial advice because it's always high risk! I can just say for me it's a great opportunity but i'm always looking into a crystal ball what's happens next day, week, month or year.. long term i'm very optimistic but you must decide for yourself.

That's very important for me, whether im enthused by that great shift happenening in my lifetime or not.Now you may say

"That's unfair! You hold him back from one of the greatest opportunities in lifetime!"

.. Yes that could be such chance or was already for some people in the past, but i'd recommended just that he has to decide for himself and i cannot responsible for that. And i thought about that after i'd said it to him, but i would do the same next time.As you can read in one of my recent articles i bought in at the dip and just hopped out 2 days later because i saw a better opportunity, in the end not really because it was partly based on the same currency, Bitcoin and for me it's always important to be part of that great development or in the market. Waiting on the sidelines is nothing for me because it's not necessary in my point of view in the current situation. I'm constantly trying to evaluate the crypto market, find measures with the help of sites like https://coinmarketcap.com/ and wrote about in my latest post.

Thank you!

Nice post. Though I follow you, I missed that one.

Yeah, I've told friends about investing as well. Some jumped in at the all time high in 2013/2014 and then sold for a lost. So sad. For now, I basically give the same advice you did, but I emphasize long-term thinking. The day to day price doesn't matter on that timescale.

yes i think of something like a hickup if we look 5 years later on the chart. I follow a german with the name Horst Lüning on youtube and he often said:

"Wir leben in exponentiellen Zeiten."

"We live in exponential times."

And i think that's so true and also fascinating and a bit scary at the same time because of the singularity theory because nobody knows exactly where this will lead us. Today i heard in radio about a new book which begins with a positive sentiment in the beginning because of the freedom with the information age, the social media platforms like Steemit and all the comfortable technology we use and shifted then to a dystopy where we all bear many tiny cameras with us and were just glassy human and ended with the question:

"What remains in the end if we gave everything of us, our innermost part, our privacy to technology?"

My 6 year old son looked at me with big eyes and i looked back the same.. and surpringly he said..

"nothing"

i only nodded, it was a bit scary experience, i felt it in my stomach, man 😲 but i'm optimistic that we do it to improve our lifes!

Where i'm also always a bit distracted is when it comes to implants or upgrades of the human body like shown in the video at 1:27 (he speaks english)

Is that just logical step up for us.. the funny thing it automatically leads to other topics, so i stop here. The thing is just, it's a very fast development and we surprise ourselves every day i think, just exciting times for me.. and it is already in the mainstream media.. ARD is a channel supported by state of germany.

Heh. Interesting video (though I could only understand the English part). I think many are afraid of transhumanism because it's unfamiliar. As soon as everyone has a chip or an enhancement, it won't be that big of a deal. This computer is an enhancement as is my smart phone and the glasses on my head.

Times are changing, but that's one of the few constants we can rely on. We'll change right along with them.

"Instead, work your ass off to get out of debt, get some liquid savings together including diversified traditional retirement investments, and then free up some money to invest." Well said! That's what I did for 45 years. Now I have what I want. The point to add is this: "Learn about saving and investing so you can invest wisely."

Warren Buffett sums it up: "work hard, spend little, save alot, invest wisely"

Don't save what is left after spending; spend what is left after saving.

Congrats on your success! Great quote.

I'm stackin for years to come 😬

You always be stakin. If you went against your brand, I'd be surprised! :)

Great article. I don't do any trading, I just try to buy on the dips which is crazy enough to follow. How low this time around? Should I buy on this dip? etc, etc.

Amazing post :-) Thank you very much. Upvoted and following.

Defnitely HODLing. I only ever purchase to hold long term, the two year rule you mention is very sound advice for anyone. 20% dips don't rattle you as much that way!

Time to buy

I think the drop was a combination of both "hitting the $5k ceiling" and "the China ICO regulations" <---Not really because of the government intrusion but because a lot of really bad writers wrote a lot of really bad articles about what was happening. --- Being most of them don't understand the Crypto-world they fear-mongered and basically said the Chinese Government was shutting down the Crypto-industry.

I have a different view than most when it comes to China's move. I'm for it because there were too many start-up coins gathering lots of money and just disaapearing with no intention of releasing any coin.

Other ICOs were over-spending on staff, offices, promotion, etc... and couldn't develop the coin.

It worked beautifully in Ethereum's case but many took this model and used it to scam the public, while taking advantage of the lack of regulations.

Anyway --- At this point I'm all-in for awhile and bought more Crypto when the markets adjusted in an upward trend.

I buy and hold 3 coins and I love when the they fall because I'm buying more cheap.

I'm happy when it's up.

I'm happy when it's down.

Peace!

Peace indeed! (And I think crypto will help bring it)

I wonder though... are government regulations better at protecting people than their own experience? It seems to me if people are doing stupid things and rewarding stupid scams (often because of their own greed), they will learn much faster than having some central authority telling them what they can and can not due. Yes, the scammers should be punished and found out for the fraud they are causing, but I think a free market system can also do that and do it well. Unfortunately, we're mostly programmed to rely on central authorities instead of taking on the responsibility ourselves.

I agree with what you're saying and I'm all-for keeping the government away from the crypto-world but....

As for the buyers - I think it's more than just greed - there's also a % of just plain-old stupidity. LOL And, of course the government has no business protecting the ignorant, so...

That would leave it up to people like you and I to educate the public on issues like bad-ICOs, scam-exchanges, pump-&-dumps, etc..., so I guess the point would be - we need to do a better job with it, and Steem would be the perfect forum.

Perhaps invent a category titled "Scam Alert" or something similar and list the companies under the microscope.

My utmost concern is the reputation of the industry and I think future-scammers hiding behind ICOs will think twice now - especially in Asia.

Have a great day.

John

I started investing in bitcoin at the peak at the end of 2013. Instead of a one time purchase, I setup a recurring purchase of less than $20 per week. That has worked very well and has added up to over 7btc.

I definitely recommend dollar cost averaging when investing in bitcoin.

Wow, that's awesome! Great job. Yeah, I've been wanting to do this for a while now, but instead we kind of sporadically buy in chunks based on the budget.

Dollar cost averaging by a weekly standing order sounds great. But how do you do this so it happens automatically?

Inspiring reflections on cryptocurrency. I am a new Steemer, thanks for providing some refreshing thoughts for me <3

I bought some crypto currency recently. I think it was a hasty decision at the moment)

Thanks for the valuable advice.

I am a newbie in crypto and learning all the trade through Steemit.

It is authors like you who give me belief that crypto is the future.

I am happy to me on the best site that give out insightful and in-depth crypto news.

So glad my content has been helpful to you!

Disclaimer: I am just a bot trying to be helpful.

Great read - I'm holding for the long term - the only thing I am waiting on to buy is corrections - I try to purchase more when the price plummets and then sit back while it slowly makes it way back up again - then I wait for another entry point... It's interesting watching other alt-coins to see what they will do to. Keep up the good articles - I'm following

Thank you!

Man you've summed up this philosophy so well, it's like you put into words what I've been trying to get my head around for most of 2017. I'll be linking a lot of people to this post in the future.

All of this energy people spend day trading, I think for most would be better spent creating real value. there are way bigger rewards to be had by building cryptocurrency into something great, than by trying to arbitrage it.

maybe you can help me get it... arent there too many cryptos now.. that they will have to centralize or have already via crypto bankers? i'm a noob forgive me if i just dont know

Give this a watch:

Money can be like language. A form of expression. There's no limit to competing currencies, no reason for centralization or control. Everyone can interact with whatever currency they prefer and seamlessly interact with any other currency.

After reading your article I gained insight on cryptocurrency. You are motivating to invest. Thanks @lukestrokes for the sharing.

I like your argument. Diversification is very important. However, investing can sometimes be a risky venture; you need to understand the market and be good on the timing. Thanks for the insight.

After reading your article I gained insight on cryptocurrency. You are motivating to invest. Thanks @lukestrokes for the sharing.

Great info! now I understand a little more, thanks for sharing.

I´m new in the crypto world and I´m starting to invest, sometimes I don´t know what to do but I´m trying to learn.

Greetings

@lukestrokes

Following you.

@lukestrokes

We're in an overbought and overhyped market, and there will be a huge correction and pullback just like in 2014-2015. This movement is unsustainable despite how bullish we all are on cryptos.

But a "huge correction" along what timescale? If it corrects back to $2k, for example, before hitting $10k or $100k or more in the future then is that really an "overbought and overhyped" market on that timescale? Based on trillions of dollars, how does this market compare with, say, the dotcom bubble in 2000? Also, based on that bubble, didn't we still get companies like Google and Apple? What if some crypto projects today are the Google/Apple of tomorrow?

my question is if these downticks caused by coindrops.... are a market indicator.. if there are market indicators does that meant that the market is null and void? if a bot or AI can out predict you or out manage your abilities what does decentralization even offer?

You're replying to different comments making it difficult to follow the conversation. Give that video I linked to a watch. Decentralization has a lot to offer, but explaining that involves going back to the late 1700's and the rise of central banking (more on that here, if you're really interested).

As to your question, no one really knows. By Coindrops do you mean ICOs? I don't understand your thinking in terms of "null and void". My recommendation: read from the experts like the person I linked to in the video from my other comment.

I continue to learn more about crypto every day and appreciate your insights. Thank you for sharing.

I jumped in and bought $100 Bitcoin, $100 Ethereum and $100 Litecoin on Coinbase back in May .... that small $300 is now $900.

Nicely done!

Wish I had more ....

I would like to convert some of my STEEM to Bitcoin but not sure how to do it.... Do I use Bittrex ? Blocktrades ? then send to Coinbase ?

Yes, you can send your STEEM to any of the exchanges which support it and you have an account with: https://coinmarketcap.com/currencies/steem/#markets

I would not recommend Poloniex for 3,000 reasons. Only reason to send to Coinbase is if you want to exchange back for USD fiat.

agreed - avoid poloniex like the plague. they tried to steal my ether but i didn't allow it!!

I've had good experience with @blocktrades and I recommend it. I use the private wallet software Electrum for Bitcoin and Electrum-LTC for Litecoin.

I wrote a post a while back about how I bought Bitcoin with STEEM. Hope it helps!

Thanks. I will try Blocktrades

So as follower of bitcoin from a curiosity perspective for quite a while, but new to wanting to actually get involved, what's your take right now on bitcoin vs ethereum? Which would be better to invest in today?

Been reading your stuff here on Steemit and just curious to hear a hot take from you on that.

I think EOS is going to be much more useful than ETH. For the most part, if you're investing in a crypto project that will be here many years from now, you're going to be fine. Both ETH and BTC will be here for quite some time, as far as I can tell.

Thanks Luke. I've finally decided to dive in and buy something with a few hundred discretionary dollars, just hard to step up and make a decision. This article was very appropriate; I need to stop waiting.

I think this constant thought of 'I could have bought in lower' leads to people missing out on the growth of crypto. People are looking for this huge pull back to buy in at $700 or something like that but I don't think it will happen.

You postponing when you will buy in will ultimately hurt you. I may be wrong and you will be able to buy in at a low price like how it recently dipped to $4200. However, those who bought in at $5000 don't need to worry as it will recover and keep going.

I remember when exyle's mum decided to buy into crypto when it was around $2000. People thought BTC was in a bubble and that we could not go any higher but here we are today with a thriving market (for most of the time) @lukestokes

I sold some at a recent all-time-high thinking it would retrace back and it didn't at all. It just went up a lot more. Thankfully, I didn't stay in non-crypto much at all and went right into some interesting alts that have done well.

I've canceled my 401k plan and instead of stocks started to by crypto from every paycheck

I've been tempted to do the same, but to keep @corinnestokes happy, we're still contributing to our ROTH IRA. Part of me wants to see how difficult it would be to move it into some crypto fund. I looked into it a few years back and it was kind of a mess. Part of me thinks any stock market based financial instrument is kind of pretend money while crypto seems more real to me. That said, it's always good to be diversified. At least with mutual funds, you're banking on those companies to continue making profits (because if they didn't, the whole economy would come down, probably including cryptocurrency).

I still keep all previously contributed money there and get dividends from but all new paychecks portions I send to crypto exchange

Also, I like the idea I can always cash back my current crypto without waiting years when I become 62

yea.. altdumps? can you check out my article or post and let me know. I have so many questions. Mostly... how are cryptocurrencies not pyramid schemes since there are now so many in competition for the same... mysterious constant?

That's a pretty big question, not one I can answer easily, but I have done many different posts on where the value comes from relating to cryptocurrencies. As to day trading strategies, I wouldn't be the one to ask.

if you find the answer please remember me :)

sorry forgot link: https://steemit.com/cryptocurrency/@auraculus/buyer-tip-are-alt-dumps-market-signifiers-for-buyers

do altdumps mean it is time to buy.. like was red monday a day to get in and should i just wait for the next?

Never wait to buy crypto :)

I love that. I was expecting the correction like we have seen. These always come. I was expecting the bounce back too but I held and didn't sold anything and try to buy back. That's not my thing.

I think the 100,000$ to 1,000,000 is sound too.

Some thing there is a lot more correcting to come, and they may be right, but if things really are going to 100k or 1M, then they may speed up before they slow down.

If I was looking to enter crypto with a budget, I would probably hedge by putting 50% of said budget into the top 20 coins/tokens by market cap right now. Public interest in the cryptosphere seems to be gathering pace very quickly (just look at Coinbase's stat on user growth over the last month). There's a strong possibility that even though we have seen some massive gains this year, that this might just be the very start.

The very start sounds good to me. :)

Congrats on paying off the house!

A lot of great advice here. Paying off debts is huge. I have done that. I recently began investing but I dont have a lot of extra to add.

My plan is to invest on a weekly or bi-weekly basis. But, I hesitated prior to the pullback and invested some when everyone was selling!

My enthusiasm is very high and it seems like I spend all my time researching. Every day feels like Christmas!

I remember that feeling very well! I got sucked into the cryptocurrency wormhole in early 2013 and have never looked back. It's a wild ride! Enjoy it!

Your sleep will suffer the more time you spend researching though. Heheheh.

@lukestokes - I am no expert in crypto but I have seen a lot of trade in typical stock and commodities market. Pull backs are common in any instrument that can be traded. Usually, the public sentiment of greed drives the price up and then profit taking drives it down. The profit taking is always accompanied by some panic selling by smaller investors. As such - pullbacks up to 38% are usually common. On more volatile instruments, even 50% pullbacks are seen. In crypto space, things are a bit more volatile because of the ability of whales to manipulate as you rightly point out.

In my viewpoint, there is no 'perfect time' to buy. What we need to have is a long term view point with belief that bitcoin will rise in price over long term (as you have pointed out) and then keep buying in dips as and when we have some spare cash to invest.

At least, that is what I am following. I have already seen 50% return on investment in 4 months. I will, therefore, keep accumulating slowly and not sell.

Thanks for your article which made me sit back and review my strategy (I find that I am on the right track :) ). Cheers. Upvoted.

Regards,

Glad to hear things are working out well for you. :)

Wow. You are up late !!

Lol. My crypto investments are meagre at this stage so it looks great in % terms for profit but it's hardly anything much. Proves my direction is right and hope to invest more in future.

That China thing recently.. man, FUD personified haha! You know how I feel about them, so I'll move on from that. As a Stokian, I continually try to be stoic during times like these, and even though I make baby steps, everything is still progress.

You know, I always narrate that story of you buying your house with Bitcoin whenever I tell people about it. So far, the majority of people I talk to have been converted and have bought some satoshis. Too bad they aren't as active on Steemit as I would hope, but yeah.

Really though, I think it's a matter of what weighs more for a person--FOMO or loss aversion. Personally, I think FOMO is worse because you had the opportunity, but still you didn't take it. Guarding against loss aversion is easy. As you always say, "don't invest more than you can afford lose."

Way to go putting in a Firefly reference near the end haha!

I wanted to watch Serenity last night but it wasn't on Amazon Prime or Netflix. I'm too much of a cheapskate to pay $3.99 to rent it (would rather buy crypto). So instead I watched Star Trek First Contact. :)

Way to have your priorities in order haha! Fortunately for me, I was gifted a complete set including Serenity about a decade ago so yeah haha!

Will still contact you for more information on Cryptocurrency.

Thanks

I think that there are still room for top coins and new solid project will come so best thing is to save some cash and invest in great coins. Thanks for this my buddy.

I referenced you in my latest post-feel free to see it. I wish you and your family a blessed weekend.

Thinking the same! I've set my target price and decided to sell when its reached, but then when I saw how many fluctuation is there... I decided to wait for a few months, or even years! All or nothing :)

Very interesting! I'm pretty new to all this, been on steemit for just over a month and didn't know anything about this whole crypto thingy. Like your way of writing about these things so someone like me understands it and what you say makes a lot of sense!

So glad it was helpful to you! :)

You never know what can happen. There is always the possibility of a advance hack and once the crowd starts selling their bitcoins the price can very well drop down below $1000

Hey Luke, nice insightful post. Actually, I AM waiting for some pullback of some sort to invest and I don't really get a lot about it, but there's one thing I want to ask and I don't get: Why do people criticise banks so much? I mean, do people not want banks? If there are no banks, who will offer loans to people? And even if people with crypto start offering loans, how will poor people in undeveloped countries without the technical know-how be able to get loans? I think that banks are necessary for the people.

Do bear with me if you think these questions are naive as I am new to cryptocurrencies but look forward to learning as much as I can 🙂

I did a presentation years ago you may find helpful for understanding why cryptocurrency advocates don't like central banks: Why Bitcoin May Be More Disruptive than the Internet. There are also plenty of interesting documentaries online like Money as Debt or All Wars are Bankers' Wars.

Loans can and do exist without banks. There are many cryptocurrency projects that specialize in this as well. A bank is a third party risk that is no longer technically needed.

Ah, you're the inventor of HODL! I saw your bitcoin post and then googled it. Nice to meet you! Saw this other post of yours then followed you and now reading this. Good stuff mate :)

PS, can't seem to be able to resteem this. Because its an old post, why?

No, I'm not the inventor of it. What gave you that impression?

*facepalm, sorry when you linked to the HODL post, I assumed it was your post. *facepalm again

Want to make profits? Trade long X100 btc/usd on bitmex!

https://www.bitmex.com/register/HJfZyC

Want to not annoy people? Don't post your affiliate links in comments!