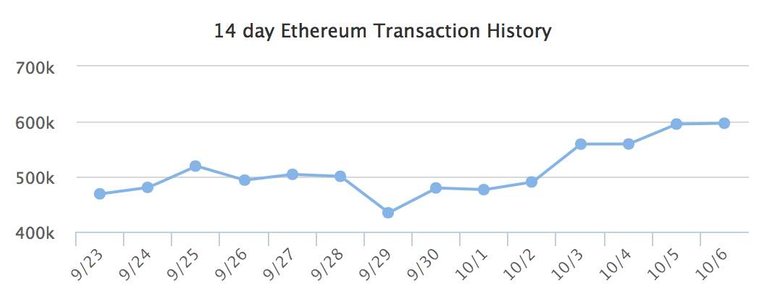

Ethereum's exchange numbers have ascended to pretty much 600,000 from an ongoing low of 434,000 amid a 24 hours time span.

They have now come back to the levels of early September, when ethereum's price was at about $300 after eth exchange numbers saw a sharp V spike since September 29th.

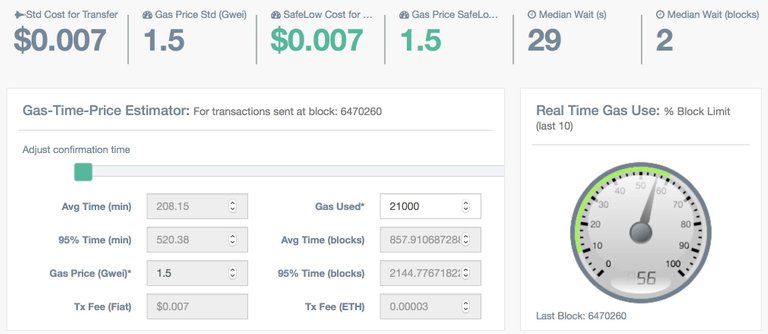

This expanded system action might be identified with the reality ethereum is currently running at pretty much half limit.

That has sent expenses to its most minimal level for the year, underneath 1 penny, even as around 600,000 exchanges are made ordinary for as far back as two days.

Exchange numbers are known to correspond with price, despite the fact that whether it is a main or slacking pointer is misty, with one hypothesis being they move simultaneously.

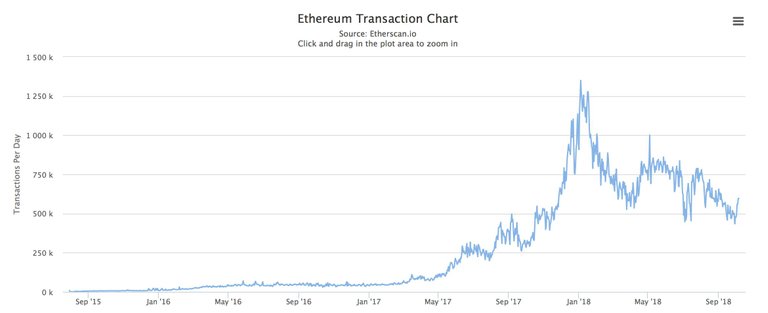

In the event that we take a gander at the noteworthy exchange levels for ethereum, you can perceive how effortlessly the chart can be mixed up for price itself:

The ongoing sharp V spike appears to be intriguing on the grounds that price hasn't in like manner seen a sharp V hop. It has recuperated somewhat since it achieved a low of $167 on September the twelfth, however from that point forward it has remained at around $222.

Since September 29th, for instance, ethereum's price has remained in a genuinely straight line, while exchanges have forcefully hopped.

One clarification might be that the ascent in eth exchanges is maybe more identified with this recently accessible limit that has as of late showed up.

As you may know, ethereum presently has a constrained limit of around 8 million gas use multi-day which is known as far as possible.

It very well may be contrasted with as far as possible, yet that would be somewhat deceptive in light of the fact that to disentangle the 8 million point of confinement can become to with 1MB of exchange information similarly as with 100kb.

Shrewd contract exchanges devour more gas, in this manner meaning the breaking point would be come to with fewer exchanges. Such kind of exchanges was extremely pervasive in eth amid a lot of this mid-year as arbitrary token airdrops continued being completed.

Presently it shows up this airdrop use has gone, so ethereum has returned to its typical activities where a limit is at around 1.4 million exchanges per day, or around double the present level.

It might be that there was at that point interest for 600,000 exchanges yet because of limit limits it was not sharing. Since space has turned out to be accessible, we see this sharp ascent.

However, it might likewise be that some ethereans are returning. A bounty would have sold at the high in December-January, so they may now enter the market once more.

As you most likely are aware, there's a joke circumventing that nobody leaves crypto, with the exception of maybe briefly. Everything that fiat in this manner may look out for the line and maybe its first is being appeared on the exchanges chart.

The hypothesis here is that the more individuals who have eth, the more would execute. Similarly, the more that go to fiat, the fewer exchanges in light of the fact that there are fewer individuals who have etc.

You'd anticipate that anyway expanded interest will be thought about the price and in addition exchange levels, however, where price is worried there is the supply condition, so perhaps this exchange chart is disclosing to us something, or possibly not. We'll know soon enough.

Posted using Partiko Android