With Bitcoin dropping below $6000 I couldn't be more excited! Welcome to Capitulation! I've been waiting on this all year!

Capitulation is here

If you've been a regular follower of mine you know that I've been predicting a drop below $6000 for most of this past year and despite it being a bad thing in the short term, I'm highly excited about it finally happening! Despite it happening later in the year than I expected, this current down-turn is completely according to my own expectations and plan. Finally we are seeing some true capitulation-action. And believe it or not, capitulation is actually a good thing.

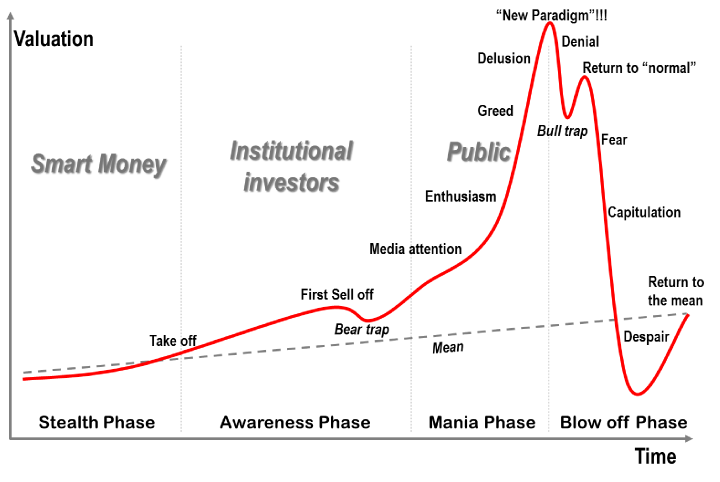

Let me pull up some charts from my post titled 'Welcome to Anxiety & Fear - Capitulation is next' to which this post is the spiritual successor. It all boils down to the well-known below chart:

After hanging in uncertainty for most of the year, I believe we have now finally crossed over from Anxiety & Fear into Capitulation. The latest fat red candle on the Bitcoin price charts is finally the volume spike that I have been waiting on all year, and which we still hadn't had yet. This is the last and final phase of the bear market when the last so-called 'weak hands' will be shaken out.

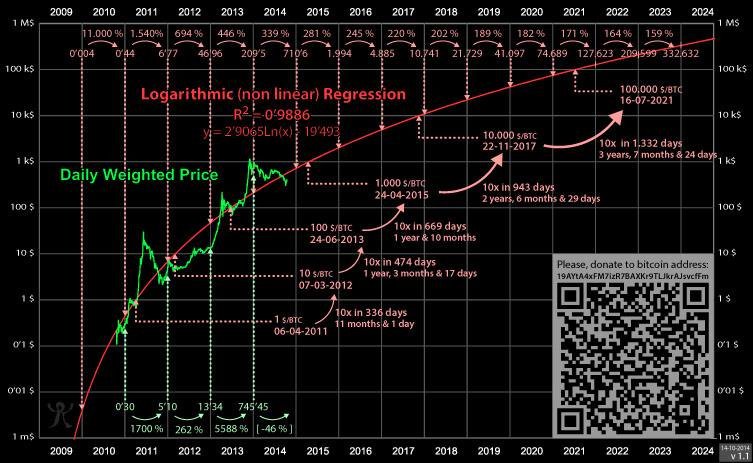

My updated chart below will show where I believe we are approximately in the Bitcoin price-cycle:

What follows next is an uncertain grind to the downside in the search for the true bottom. If the same trajectory as last time is hit, as Bitcoin is prone to do, this would indicate a potential 50% drop from where we just dropped off from. That puts us at approximately $3000 per Bitcoin for a potential bottom. If you pull up some charts you'll find that $3000 furthermore offers some rather significant other supportlines as well.

It's sad that it has to happen, but unfortunately it's necessary that Bitcoin goes down further. This is how markets work (see the above chart again about market cycles), and unfortunately how psychology works. In to understand that you must understand what it means to hit the bottom. The bottom of the chart is where Bitcoin is so despised and distrusted that nobody feels like it is a good idea to buy it. Not you, not me. Because if it were worth buying, it wouldn't be at the bottom. The bottom is an expression of the desirability of the asset in question and in order to be at the bottom the asset will have to be the least desireable.

As such, the market sentiment of 2018 confused me greatly, but now it makes sense again. I just couldn't understand how we could have bottomed out while sentiment was still so high. While people were still "waiting to buy Bitcoin for the next bullrun!". I'm sorry, but no. As long as there are hordes of people waiting to buy, it's not the bottom. But now, now we're finally looking better. Now we have true fear and capitulation. You need only look at social media such as Reddit to see the posts of people throwing in the towel, selling their BTC and taking their losses. That is what capitulation means: the last remaining believers loose the last of the hope they still had while the red candle smashes all their hope of recovery.

If you manage to HODL now, congratulations, you'll finally be a real HODLer in the sense that most veterans of the 2013/2014 bubble always mean. Crypto winter was bad thus far, but it's going to get worse yet before it will get better. The good news, however, is that because this leg down is fully expected it also strengthens my belief in the all-important logarithmic predictions for Bitcoin. As long as we stayed hovering around $6000 I wasn't sure about the future, but if we drop down and bottom out at $3000 (or heck, even $1300 at the lowest) then I consider everything to be going as plan and I am so ready to go neck-deep into buying in a few months. Because if we bottom out then, what comes next will be the biggest bull-run that the world has ever seen and it will lead to new all-time-highs far exceeding $100K.

When, though? Not for a bit yet. In my earlier predictions I called for a 2019 Q1/Q2 potential reversal but as capitulation has been delayed I now think it may be wise to stretch those dates a little bit ahead to Q2 and Q3 of 2019. By then it will look nothing like a bull-run, and we may find us in the next 'Denial' stage where we slowly but surely take off again. Sometime in the spring, seems like a good time to me.

The Logarithmic Chart

I love the logarithmic chart so much, it's almost getting to be like a religious belief to me. It's just so darn spot-on everytime. The below chart was made back in 2014 and as you can see it has held up pretty well so far. It places us at somewhere between $20K and $100K in 2019-2020.

If you take today's logarithmic BTC chart, you can discern somewhat of a channel as in the chart below:

If you draw the trendline straight it would indicate a drop down to perhaps $4000, which is a little better than my previous predictions of $3000. This is due to the prolonged stagnant period of BTC around $6000 which allowed the bottom trendline to travel higher. However, keep in mind that in logarithmic charts due to it's logarithmic curve (see the black log prediction chart's curve) drawing a straight line is not entirely fair. As such, it is perfectly reasonable to fall below the drawn support line by a bit. It would have been better if we had fallen before though, so it would've been easy to reach the support of $3000 at the same time as the trendline, because the both combined would have offered better support than just one of the two.

Although I'm sure many are panicking, I'm not worried in the least. This is how the Bitcoin rollercoaster goes, you ride it up and then you ride it down. After a while ,you get a feeling for when the tides turn and which way they go. I'm happy to see Bitcoin drop, because after not breaking $6000 for so long I was getting worried that I wouldn't get a chance to buy BTC for cheaper anymore. I even bought a small amount of BTC a short while ago because I was getting anxious. Now, I can return to keep comitting myself to my original plan - which is to wait until the perfect moment and then buy in big time.

Please, give me more blood on the streets. Sell your Bitcoin, the end is nigh....!! The sooner we get this over with, the better!

Now in the meantime, I'm going to go read more about this Bitcoin Cash drama and how Craig Wright is doing us a great favor breaking down the $6000 barrier. Thanks Faketoshi!

I'd honestly be pretty excited to see Bitcoin in the 3000-5000 range for the next year/18 months... that's another year of me converting small monthly amounts from fiat to crypto... and it would shake out all the speculative "investors" who don't actually care about the tech, they just want to make a quick buck (ironically).

Exactly, and honestly it went this way last time too which is why I think it will happen again. It's just a matter of psychology.. there's only like 15% of the investors who end up being 'true' hodlers during a crypto winter. But the last remaining weak hands to be shaken out it takes a while to really wear down their faith.

My other theory is that those weak hands being shaken out now, are the ones who will eventually propel Bitcoin to new all-time-highs when they return in 1-2 year from now when Bitcoin hits the news again. By then they will have their experiences from this bubble, coupled with their regrets of selling, and a newfound conviction that Bitcoin is indeed the phoenix that always resurrects. In my estimation one's faith in Bitcoin increases exponentially with the amount of bubbles one has seen it go through.

Not sure if it's going to take another year to reverse, I am hoping for sooner, but I'm ready for anything and I too see it as some breathing space to accumulate. Not at all rich in RL so my ability to buy in has been limited, and some extra time is not at all a bad thing.

Well.... I work in IT... so around Nov/Dec/Jan last year, everyone was talking about Bitcoin, but they honestly didn't really understand what it was all about... I became a bit of a defacto expert and I told anyone who asked not to buy in at those prices.... but I know some guys that did anyway... and a few of them spent $5k or more when prices were super high... and have obviously been depressed all year.

As far as I know, they haven't sold their crypto... but I'll start checking in with them more regularly to see where they're upto... they can be my 'normal person gauge' (which I think is pretty much the exact same as being aware of what CNBC is reporting).

I honestly have no idea on timing... so I'm happy to just cost average in until it starts to get crazy again.

If they really spent like $5K on it at ATH's and are still hodling, kudos to them for having pretty strong hands (or having enough money so that 5K is pocket change to them)

But the REAL crypto winter is really depressing. Right now is only a taste of it..

I mean, I talk a big talk about being a hodler since 2013 but the truth of the matter is that the main reason I hodled was because the price was so low that I couldn't be bothered to figure out how to sell to fiat... I just figured.. meh. Crypto and prices were so depressing that I kind of lost track for a large part of 2016. I lost all hope of recovery and probably would've cashed out my measly few hundred dollars worth of crypto if there were an easy way back then. Because for all intents and purposes Bitcoin had died and from the looks of it, it was never coming back or at best stay a really small niche thing.

I think the depression will get a lot worse still. I hope is for a 3K bitcoin bottom but I am keeping a $1250 bitcoin in mind too. And while it sounds nice today, if it really goes that low then something will have happened that will make all of us think that it's a terrible idea to still invest in bitcoin... like throwing away money. And it's going to stay there for a damn long boring time too.

It's so damn hard to actually buy low, because if it's low then there is a reason it is so low (maybe banned, maybe overtaken, etc.) and the psychology works completely against you

I was the speculative investors, sadly, in 2015. This year I HODL. My meagre savings will turn out to be something, and I've paid for the education.

@pandorasbox Your post make a lot of sense. I am of course also not interested in selling anything, but I want to know if it would be worthwhile to power up once the bottom has materialized? We don't have funds to buy, so I think that powering up is the next option? Blessings!

Oh! And just "Followed"

If by power-up you mean powering up the 72 STEEM in your account to add to your SP, and you're not interested in selling it, then sure why not?

If by powering up you mean using the SBD you have to purchase STEEM, then I guess sure, right now the ratio SBD/STEEM seems pretty darn interesting.

But both choices really do depend on one assumption, which is that STEEM will survive the bear market and the price will not go lower than today and eventually recover to it's previous higher levels. That essentially is still a gamble/speculation, obviously, and carries risks.

That being said, I am neither powering up nor powering down currently. I don't have as much SP as you do though, so it is easier for me to be emotionally detached.

If I were in your case then I would likely wait with spending my SBD just a little bit, or perhaps start converting it to SP slowly in small increments (dollar-cost-averaging over the timespan of several weeks). Because there is still a very very big chance that the entire market is going to see another huge downturn and altcoins will suffer more than Bitcoin will. Staying in SBD , since it is more or less kept stable, should in theory be safer than in STEEM.

It will be interesting to see if this is the final bear blowoff which would mean an incoming bullish bounce or just a continuation of the downward/bearish trend.

Whatever the case may be excited for the rounded bottom into the next bull market.

I think it's the start of more bearish action and probably a downward slide with some bumps of people who believe they have caught the new bottom. The actual bottom will show itself after a few months I believe, when we touch down on it for the second or third time. Plenty of time to wait and no reason to go rushing in to buy now IMO

when that time comes do you think its a good strategy to sell your alts to jump the bitcoin wagon or not?

The time to sell was long ago. Selling now is risky since you do not know the bottom. Selling alts, I wouldn't dare to say. Normally if BTC drops they drop further, but this ratio has been lessening compared to the past. Truthfully, if you were going to hodl the best would have been to be totally in BTC for a while now.

That being said, I am still more than 50% in alts too. I am riding it out, but I am expecting significant losses still

Indeed BCH is becoming a bad joke.

Good post despite, as you know, I’m a little more optimistic...I think Q1 of 2019 is the time for bitcoin spring 😉

Posted using Partiko iOS

Q1 only works if we have a super tiny bottom phase of the bear market and that would be very different than it was last time. Not saying it is impossible but historically the botom phase should last for a few months. The earliest I can see us climbing out is late february/march but that's practically Q2 anyway. And it would be the most optimistic scenario I believe..

Nice post. I agree with your logic, but don’t think it will take quite as long to turn bullish. I think the first quarter of 2019 will be the start of the largest bull run BTC has seen yet. In the past, very few new what bitcoin was...much less wanted to buy. Now, all eyes are on it. Institutional money will likely start entering in mass after ETF approval...which I’d bet would happen in February. Before that, if the SEC makes any type of positive statement, the public my interpret it as ETF approval being a near certainty. You’ll then see many new buyers rushing in, attempting to "get in early”.

I feel things are moving exponentially faster than they have in the past. Of course I could be wrong...but I’d be surprised if we weren’t at all time highs by spring.

Well... It is despair all right... But I'm hanging on!

If you can hodl through the coming dip, you will be able to hodl through anything that ever comes after that!!!