If you've been in the cryptocurrency space for a while now you have no doubt heard of forking. Forking is a term used in software engineering when developers take a copy of source code and start independent development on it. In the case of cryptocurrency this results in giving coin holders on the original chain an equal amount of their holdings on the new chain. This does not affect the original chain but market prices may be influenced by the events. There have been many forks throughout the history of cryptocurrencies. Every fork has a different story but one thing is for certain, these forks can have a major impact.

What's a double fork?

With Bitcoin Private (BTCP) we saw the first double fork in cryptocurrency history. Many were attracted to the idea of getting rewarded BTCP for their Zclassic (ZCL). This of course being a double fork means you will also get BTCP for your Bitcoin (BTC) holdings as well. Given ZCL is far cheaper, even with rise prior to fork, the ratio was in your favor to hold ZCL if you wanted to get the most BTCP possible. So this seems like a really enticing deal, if you believe bitcoin private will have future value. However, given most traders keep their coins on exchanges, the question is: What kind of support will exchanges provide for this fork?

Can you fork your way onto an exchange?

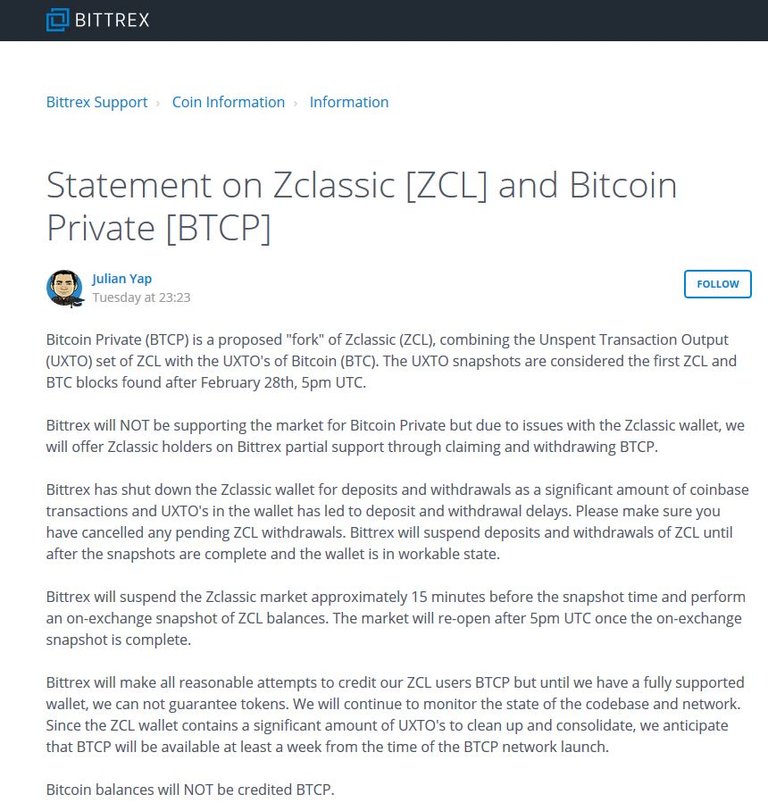

An interesting question that this event has brought to mind is "Can you fork your way onto an exchange?" It is important to note that with most exchanges you don't control private keys, the exchange has those but allows you to control your coins through their interface. This means that when a fork happens, it is up to the exchange to give you your newly forked coins by either sending them to a new wallet address you provide or by just adding the coin to the exchange. Exchange owners are pressured by the new coin's supporters to list the new coin and that often does happen. However I think we are reaching a point where this might not always be the case. Given the ease of performing a fork, this might become a new trend and exchanges will have to make decisions on which coins are legitimate enough to list. In the case of BTCP, some exchanges will list and others will not. The largest exchange, Bittrex, has decided to provide partial support by allowing users to claim and withdraw BTCP from their forked ZCL holdings. However, they have stated they will not be crediting BTCP for BTC holders.

https://support.bittrex.com/hc/en-us/articles/360001271272

Snapshot Chaos

The fork was set for February 28th at 5:00pm UTC but that was not the exact time of the snapshot. The snapshot occurred on the first block generated after that set time, uniquely on each chain. Before the snapshot there were many people scrambling to move their coins, and a few exchanges had withdraw issues leading to backed up transactions. With all of this happening so fast, many traders were in a panic. Given the circumstances and having seen the results, it was quite obvious that many people had the same plan of holding ZCL up until the snapshot and selling it all off after it was taken.

https://btcprivate.org/

The ZCL Dump

I'm sure a lot of people predicted this to happen. After the snapshot was taken a large number of ZCL was sold on Bittrex and the price dropped to the $30 range down from around $100 before the snapshot. At the time of this post all markets are back up and ZCL is now trading at around $17 average. It is likely that a lot of people lost money on this bet, but we will not know the damage until BTCP goes live and we have a market price on it.

https://coinmarketcap.com/currencies/zclassic/#charts

So who came out on top?

Not everyone lost money of course, if you had the ability to "predict" the future there was an opportunity to make a lot of money. ZCL was trading for under $2 back in early December. If someone were to know that these events were to take place, they could have bought at $2 and sold in the highs which were above $200 at times. Also, given the extreme volatility over a 3 month period, swing trading could have been very lucrative during this time.

The future of forking

While we have yet to see the outcome of Bitcoin Private and what will happen when the network goes live and trading begins. I think this series of events has brought to light some very interesting observations and questions. I think the community as a whole should be very cautious of the possibility for scandalous behavior using a fork as an unethical tactic for financial gain.

I want it to be clear I am not making any accusations against Bitcoin Private, I am simply making observations on current events and providing warning to the community. I am very passionate about the adoption of this technology and unleashing it's amazing potential. I do not want to see the cryptocurrency space be polluted by greed and unethical behavior. I hope these tactics are not currently in play and do not become widespread in the future. I look forward to engaging in a healthy discussion over this topic.

Thanks,

Joshua

Congratulations @unitus! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!