To protect our adopters and clear potential ambiguities ORCA wanted to make sure our tokens have a sole purpose of a utility unit within ORCA platform ecosystem. And who can better give clarifications on such topics than the Central Bank.

So, we delegated our legal expert Darius to contact local regulator with a formal request to evaluate ORCA token. It wasn’t as strenuous task as might have been expected: ORCA Alliance core team maintains a close dialogue with local authorities.

The cryptocurrency space is still very unregulated and filled with legal uncertainty. We’re putting a lot of effort to anticipate potential threats and take action at the present moment to circumvent them.

Four weeks later after submitting the request, supervisory office has provided ORCA Alliance with an official response categorizing ORCA tokens of upcoming crowd sale to have the function of a utility token and NOT to be classified as a security, derivative or any other financial instrument.

To quote the official response from the regulator: “…we hereby are informing that given that the Coins [ORCA Tokens] issued do not provide to the holders thereof any property or non-property rights with regard to the revenue or control of ORCA Alliance, ORCA Alliance does not assume any obligations with respect to the holders of the Coins [ORCA Tokens] , does not provide the possibility to receive profit or income and in the future the Coins [ORCA Tokens] cannot be converted into securities, the Coins [ORCA Tokens] of this type should not be treated as securities or any other financial or derivative financial instruments”

To give the full picture, it should be known that local regulator clearly notified it does not evaluate, approve or endorse the economic benefit of cryptocurrency-related projects when answering formal inquiries and focuses solely on the question at hand.

Also, the regulatory authority formulates opinions based on official policy, submitted information and regulatory environment.

The the official answer letter should not be treated as an endorsement of the ORCA Alliance project in any way. The regulator merely provided an institutional position regarding the classification of ORCA token based on given information.

ORCA Token use cases

Tokens distributed by the ORCA Alliance project will be the internal fuel of the Open Banking platform. To give an analogy, the tokens will work as energy within the platform’s ecosystem. ORCA user will need to have some tokens in order to perform operations inside the application.

Users will use ORCAs to add and unlock apps and services, perform purchases and settle operation or transaction fees incurred using the ORCA platform. Also, early contributors and active members will be rewarded through the Loyalty Program and will have the chance to participate in exclusive deals coming from ORCA Alliance partners. There’s even a catch for developers — they will be able to create and deploy apps in ORCA platform’s ecosystem to be paid in ORCAs. Of course, only if people will use deployed apps.

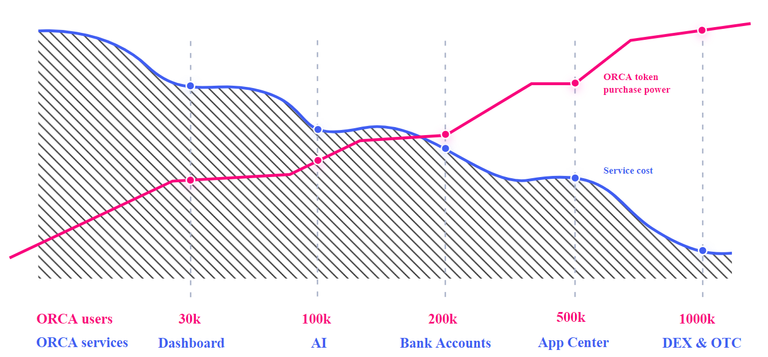

Platform’s internal dynamics is structured to provide user benefits along the way. Besides the Loyalty Program, with increasing platform user base ORCA’s negotiation power will increase and network effects will enable to attract new partners from the financial world. In exchange for good rates, ORCA Alliance will give access to a vast group of the target audience for payment service providers.

ORCA Alliance whitelist is open, you may book your spot by registering at https://orcaalliance.eu

KYC compliance is a must in order to participate in ORCA crowdsale. Spare a few minutes now to save time later.

Follow ORCA’s social pulse on social media.

Twitter | Reddit | LinkedIn | Website | Facebook | Bitcointalk