The descending dynamics of prices of bitcoin

During the past week, the price of bitcoin every day fell lower and lower. In General, over the past seven days, the first cryptocurrency has become cheaper by more than $1000.

If at the beginning of the week BTC was trading above $8000, then on Wednesday, August 1, the price began to actively test the strength of support in the area of $7450-7500. Soon the bulls could not resist the onslaught of bears — the price failed this level, rushing to the mark of $7000.

Currently, bitcoin is trading near this psychological mark. At the same time on the daily chart, the relative strength index of RSI is still far from the oversold zone, which indicates the presence of the potential for the continuation of the price fall.

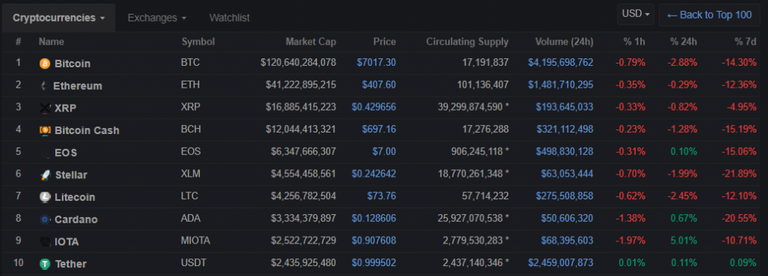

At the end of the week, the top ten of CoinMarketCap rating looks like this:

As can be seen from the table, the majority of "blue chips" cryptocurrency market over the past seven days have declined by more than 10%. It is also worth noting a fairly high trading volume of the tokenized us dollar (USD), which has become a regular top 10, and on average daily turnover is now second only to bitcoin.

Gloomy Outlook from Goldman Sachs

Goldman Sachs forecasts do not add optimism. Analysts of this financial conglomerate are convinced that the bitcoin rate will continue its downward movement. They are also calm about the global financial system — according to their estimates, the capitalization of the cryptocurrency market is only 0.3% of global GDP.

"We expect a further decline in the value of cryptocurrencies, as they do not meet the three main characteristics of currencies — they are neither a means of saving, nor a means of exchange, nor a unit of measurement. Digital currencies will not retain their value in their current implementation," the authors of the report believe.

New platform from NYSE operator

Not only negative news was saturated with the outgoing week. So, on Friday, August 3, it became known that the parent company of the new York stock exchange (NYSE) and one of the world's largest financial corporations Intercontinental Exchange (ICE) are working to create a platform Bakkt. The latter will allow users and institutional investors to buy, sell and store digital assets in the global ecosystem. Such giants as Microsoft, Starbucks and the Boston Consulting Group (BCG) are also involved in the creation of the new platform.

Ecosystem Bakkt will include regulated at the Federal level, stock exchange, custodian services, applications for merchants and users. The first crypto asset in the listing of the new platform will be bitcoin, which will be traded in pairs with Fiat currencies.

In addition, in November of this year, ICE plans to launch a bitcoin futures delivery, which involves calculations with the underlying asset, rather than the monetary equivalent (as in the case of CME or CBOE).

Soon it became known that the famous Starbucks coffee chain will offer customers the opportunity to buy a favorite drink for bitcoins. In this case, the cryptocurrency will be automatically converted to Fiat at the time of payment.

"This is very big news for bitcoin because people are asking where it can be spent. Now it will be possible in any Starbucks coffee shop — " said Brian Kelly, CEO of bkcm investment firm. "Starbucks sees the demand for bitcoin adoption, and their partnership with such a huge regulated institution as ICE is very positive news for the entire cryptocurrency space."

New steps in the development of the Coinbase ecosystem

On Thursday, August 2, the largest cryptocurrency company the company added the possibility of input/output of the pound sterling for British investors. The new option is available to both institutional and private investors.

The new system will replace the old way, according to which customers had to convert cryptocurrencies into euros, and only then into pounds. It usually took a few days, now the operations will be carried out almost instantly.

The next day, this us company announced the launch of the last phase of testing Ethereum support for the classic platform for the Prime blockchain wallet and blockchain wallet Pro, which should end before August 7.

On the same day, August 3, the company launched a plugin for the carousel platform. This e-Commerce platform will allow merchants to add cryptocurrency payment functionality to their websites. The company claims that 28% of all existing online stores use the woocommerce plugin.

On Saturday, August 4, it became known that the service focused on large investors from all guards is considering the possibility of supporting almost 40 new assets. Among them: Cardano, Zcash, Star LM, ripple (community), EOS, Moner, Neo, dash, nem, VeChain, Qtum, Bytecoin, Bitcoin, gold, Decred, on bitshares, Steem, Dogcoin, telegram (T), Filecoin and street.

"This is very big news for bitcoin because people are asking where it can be spent. Now it will be possible in any Starbucks coffee shop — " said Brian Kelly, CEO of bkcm investment firm. "Starbucks sees the demand for bitcoin adoption, and their partnership with such a huge regulated institution as ice is very positive news for the entire cryptocurrency space."

The TV with... of mining

In the past week, the Chinese producer of miners Canaan Creative presented the TV AvalonMiner Inside with the function of mining crypto-currencies.

The 43-inch display, 4K resolution, and built-in 16-nanometer ASIC a3210 chip can be controlled with voice commands and Android smartphones. The developers said that the performance of the TV is 2.8 trillion hash / sec.

"TV-miner" is even able to calculate the profitability of mining in real time. The extracted cryptocurrency during watching TV can be spent on the purchase of entertainment content or goods through the Internet platform Canaan.

Mass sales of the device are expected this month. The price of "crypto TV" is still unknown.

Vulnerabilities in Montero code

Several vulnerabilities have been found in the Monero cryptocurrency code. One of them allowed attackers to withdraw from cryptocurrency exchanges amounts significantly exceeding the initial Deposit.

This bug has spread to other cryptocurrencies using the Monero code base. So, hackers managed to withdraw coins ARQ-hard fork Monero-from the wallet exchange Altex. Among the victims from the bug turned out to be the cryptocurrency exchange Litecoin. The amount of damage to the trading platform was 15108 XMR (more than $1.8 million).

Other gods include the open vector for Ddos attacks to create an overload in the Monero blockchain and the vulnerability of the nodes to disable them with the help of a script.