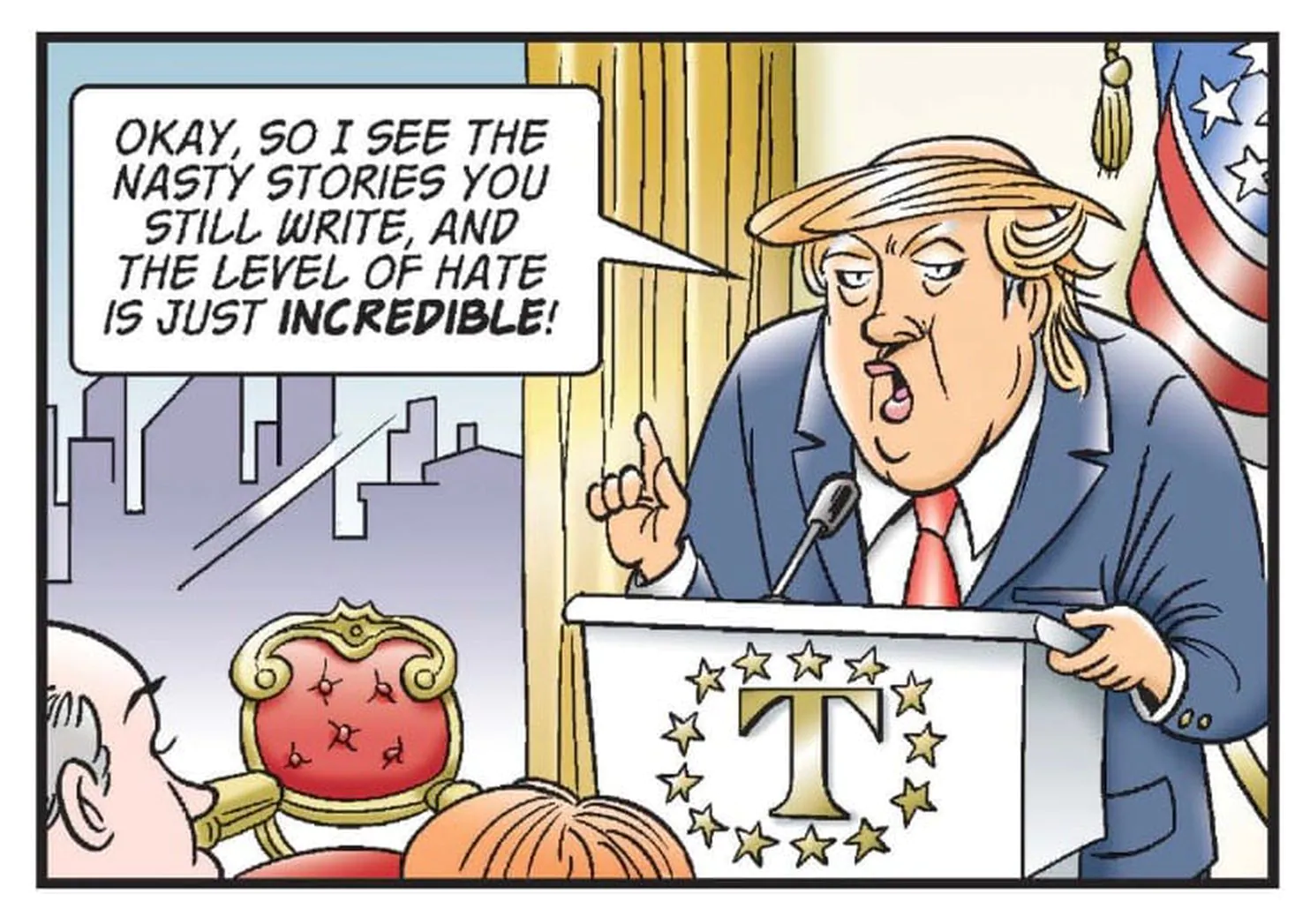

I have a feeling that before it's all done for I am going to end up being disliked more for my I told you so's than having lost all desire to be a Trump supporter. Having spent the last eight years of living in the Longest Running Episode of the Apprentice Ever, the comedic value in these new comedies of errors is just way to hard for me to resist, though I am often known to be doing things regardless if they have my best interest at heart, I am just simply unable to help myself when things are just to irresistible to resist. Especially after having been tarred and feathered beyond any means of recognition over the multitudes of times I pulled out something seen as negative toward Trump. Which, of course, is labeled as hate.

Far be it for me to hold out on the announcement of the External Revenue Service but somehow putting in the words Great People capitalized in the middle of a sentence is all it takes to escape some people that the announcement means they are going to stick it to you going or coming.

“For far too long, we have relied on taxing our Great People using the Internal Revenue Service (IRS). Through soft and pathetically weak Trade agreements, the American Economy has delivered growth and prosperity to the World, while taxing ourselves,” Trump wrote on Truth Social.

“I am today announcing that I will create the EXTERNAL REVENUE SERVICE [ERS] to collect our Tariffs, Duties, and all Revenue that come from Foreign sources.”

Todays ravishments comes from none other than Crypto czar David Sacks, who announced that meme coins and non fungible tokens are collectibles, you know, like trading stamps or baseball cards, and not securities or commodities like some think.

Non-fungible tokens and memecoins are neither securities nor commodities, according to White House crypto czar David Sacks. Instead, he defines them as “collectibles.”

“It’s like a baseball card or a stamp,” Sacks said in an interview with Fox Business on Thursday, referencing Trump’s explosively popular memecoin. “People buy it because they want to commemorate something.”

The famous venture capitalist’s comments touched on a long-running debate about the crypto industry in general: how exactly to treat different digital assets. Some argue that digital assets are securities, which are tradable financial assets like stocks. But others say they’re commodities, or raw materials that can be bought and sold, like gold and wheat. The classification differences have vast regulatory implications.

There's that nasty word that crypto holders love to hate, regulatory. Not the kind of word you were expecting to hear when your hopes have been build up they were going to blow the whole goddamn financial system to pieces and out of the ashes would rise a whole new wild, wild west of decentralizing while envisioning themselves on horseback, armor intact helping them burn the whole goddamn thing to the ground. The nightmarish version of having sugar plums all dancing in their heads.

"The long running debate" which essentially amounts to if you can't beaten, join them but exactly how do you put a value on something made out of thin air.

“There’s a few different categories here, so defining the market structure is important,” said Sacks

Which intuitively they have. When I read "defining the market structure", it's like pieces that all start to flow together. I can even envision them all sitting around an office somewhere devising the plan. You devise a plan that will bring the pubic focus on how just about anyone, including a child, could make a fortune off a meme coin before the big send off that will spike in global headlines, like Trump's thirty billion meme coin recently did. Wella, right there, is the defining moment of necessity for regulatory control. But, as Joe Hall, a capital markets attorney pointed out, there's no regulatory control for collectibles under US security laws and that Sack's comments “suggests a viewpoint that it would not be appropriate to regulate these things the way we regulate securities.” That is where defining them as collectibles come in. There is already a legal definition for collectibles under US tax laws, which applies to things like arts and antiques, according to Patrick Sigmon, a tax attorney, and for tax purposes, your capital gains rate is materially higher.

Honestly, I can't quit giggling, I know, I know, forgive me crypto lords for I have sinned.