I finally made some time to educate myself about DeFi. I already knew about DAI and thought that was a pretty complex project. Now that I learned about yearn.finance, I'm really scratching my head.

I understand that the price is exploding, but that doesn't work for me. I need to know why and I need to experience the benefits first hand. I understand that the "Earn" option of yearn.finance automatically updates to the highest return available on the market. That's an advantage, because updating it ourselves is time consuming and costly in transaction fees. So far so good.

Then I tried replicate some steps myself and bumped in the transaction fees of Yearn.finance. I have to approve 2 transactions. First a transaction approval fee and than another transaction fee for the smart contract. The first fee used 44'106 GAS at a gas price of 240, corresponding to ~USD 4.50.

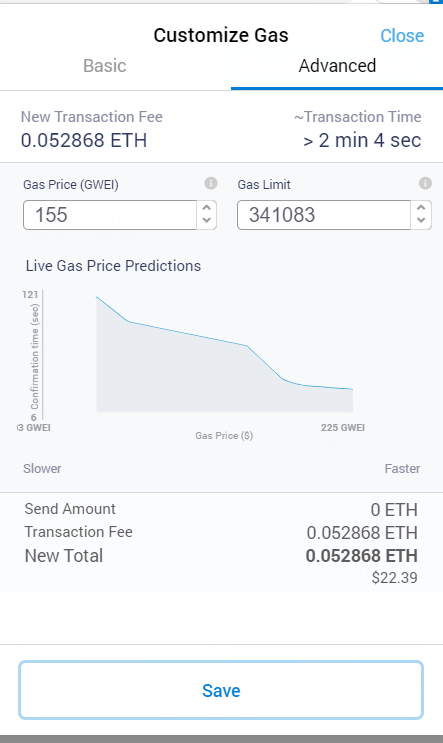

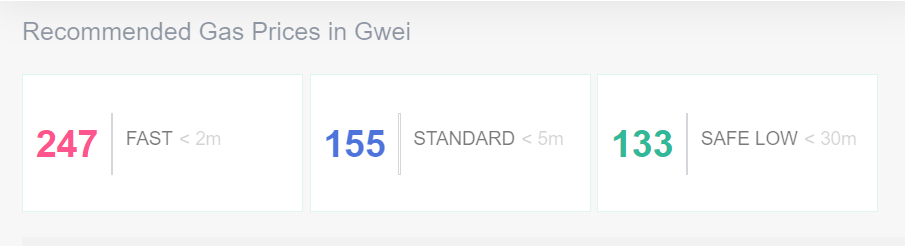

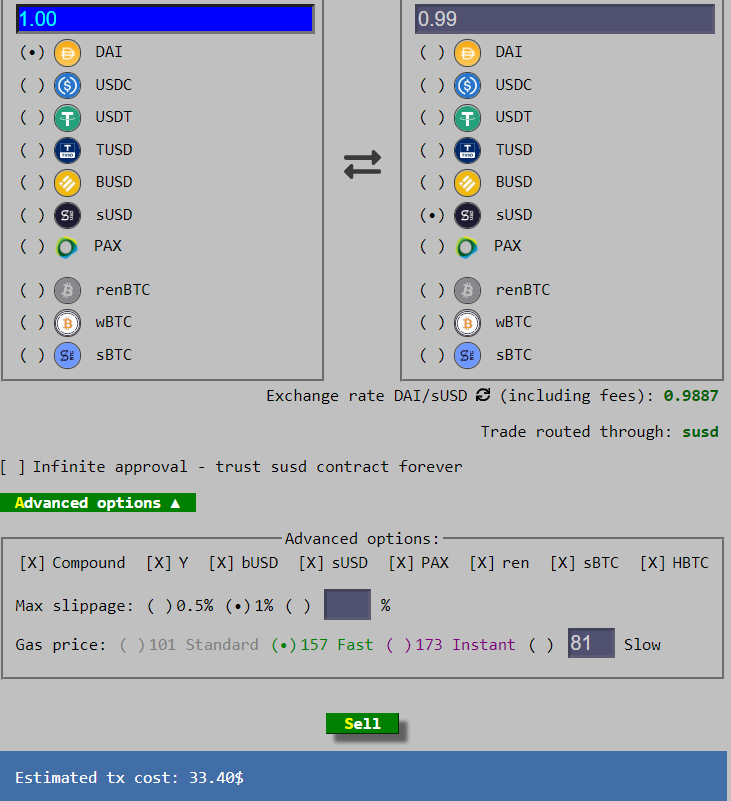

The second fee is a lot higher as you can see in the below screenshot. The limit is set at 341'083 GAS, which at a gas price of 155 translates to ~USD 22. Now my worries are that I need to make more transactions. I have some DAI and the APR on DAI is 4.75%. The APR on sUSD is 38.75%, so I obviously prefer that. But when searching for pairs of DAI - sUSD, I found that this transaction would also cost me something like USD 33.

Then I can provide liquidity to a liquidity pool in Curve.fi under the deposit option. The idea is that I receive CRV tokens for the deposited balance and earn Lending Pool (LP) tokens for providing this service. That's awesome, but for each deposit, I'll have to go through 2 transactions again. Then I can lock CRV tokens for voting power in the DAO, which again costs transaction fees. Then I can claim CRV and deposit yCRV in the Vault to earn interest of currently 90.50%. Apart from the confusion, this takes a lot of transaction fees. And for withdrawals I expect the same.

So my conclusions are:

- yearn.finance says "This project is in beta. Use at your own risk." So we should only use small amounts, but it seems to be very popular and there's currently more than USD 1.3Bn deposited in Curve.

- There are multiple layers of transaction fees to get in and out of each of the smart contracts. At the current cost of GAS, it only makes sense to use this service when trading with large balances, which goes a bit against item 1.

- In addition to compound interest, there's compound technical risk. If any of the smart contracts has a vulnerability, then all hell breaks loose.

Under current circumstances, with 180 DAI to put at risk, I currently don't think this is a good option for me. But please correct me if any of the above is wrong.

Resources:

https://docs.yearn.finance/faq