| Dear Hiveans | Liebe Hiver | Queridos Hiveanos |

|---|---|---|

| Today I'd like to share my favourite excerpts from Hayek's "Monetary Theory and the Trade Cycle" (goodreads, you'll get it free here) from 1933. Hayek was an Austrian economist, perhaps THE Austrian economist. According to Tyler Cowen he is one of the greatest economists of all times (see here). Cowen writes "Hayek’s three best articles are better than any three articles from any other economist. They might be better and more important than the five best articles from any other economist." | Heute meine Lieblingsauszüge aus Hayeks "Monetary Theory and the Trade Cycle" (goodreads, hier kostenlos zu erhalten) aus dem Jahr 1933. Hayek war ein österreichischer Ökonom, vielleicht DER österreichische Ökonom. Laut Tyler Cowen ist er einer der größten Ökonomen aller Zeiten (siehe hier). Cowen schreibt: "Die drei besten Artikel von Hayek sind besser als drei Artikel von irgendeinem anderen Ökonomen. Sie könnten besser und wichtiger sein als die fünf besten Artikel irgendeines anderen Ökonomen." | Hoy me gustaría compartir mis extractos favoritos del libro de Hayek "Teoría monetaria y ciclo económico" (goodreads, lo conseguirás gratis aquí) de 1933. Hayek fue un economista austriaco, quizás EL economista austriaco. Según Tyler Cowen es uno de los más grandes economistas de todos los tiempos (ver aquí). Cowen escribe: "Los tres mejores artículos de Hayek son mejores que tres artículos de cualquier otro economista. Podrían ser mejores y más importantes que los cinco mejores artículos de cualquier otro economista". |

| And I just got to 1900 followers 😊 thanks to all of you. | Und ich habe 1900 Follower erreicht 😊 danke Euch allen! | Y acabo de llegar a los 1900 seguidores 😊 gracias a todos vosotros. |

Even as a means of verification, the statistical examination of the cycles has only a very limited value for Trade Cycle theory. For the latter — as for any other economic theory — there are only two criteria of correctness. Firstly, it must be deduced with unexceptionable logic from the fundamental notions of the theoretical system; and secondly, it must explain by a purely deductive method those phenomena with all their peculiarities which we observe in the actual cycles. Such a theory could only be 'false' either through an inadequacy in its logic or because the phenomena which it explains do not correspond with the observed facts. If, however, the theory is logically sound, and if it leads to an explanation of the given phenomena as a necessary consequence of these general conditions of economic activity, then the best that statistical investigation can do is to show that there still remains an unexplained residue of processes. It could never prove that the determining relationships are of a different character from those maintained by the theory. […] Often statistical analysis may detect phenomena which have, as yet, no theoretical explanation, and which therefore necessitate either an extension of theoretical speculation or a search for new determining conditions. But the explanation of the phenomena thus detected, if it is to serve as a basis for forecasts of the future, must in every case utilize other methods than statistically observed regularities; and the observed phenomena will have to be deduced from the theoretical system, independently of empirical detection.

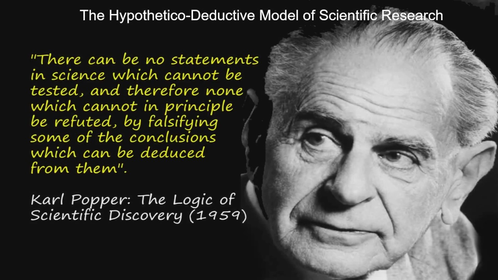

- this reminds me very much of Karl Popper and David Deutsch...

The prevailing disproportionality theories are in agreement in one respect. They all see the cause of the slump in the fact that, during the boom, for various reasons, the productive apparatus is expanded more than is warranted by the corresponding flow of consumption; there finally appears a scarcity of finished consumption goods, thus causing a rise in the price of such goods relatively to the price of production goods (which amounts to the same thing as a rise in the rate of interest) so that it becomes unprofitable to employ the enlarged productive apparatus or, in many cases, even to complete it.

Instead of showing why prices — and in this case, particularly, the price of capital, which is interest — do not fulfil, or fail to fulfil adequately, their normal function of regulating the volume of production, it unexpectedly overlooks the fact that the extent of production is regulated on the basis not of a knowledge of demand but through price determination. Assuming that the rate of interest always determines the point to which the available volume of savings enables productive plant to be extended — and is it only by this assumption that we can explain what determines the rate of interest at all — any allegations of a discrepancy between savings and investments must be backed up by a demonstration why, in the given case, interest does not fulfil this function.

| Summarized: if the volume of savings is big, the interest (which is the price of credit or capital) is low, thus enabling the extension of production plant. | Zusammengefasst: Wenn das Sparvolumen groß ist, sind die Zinsen (der Preis für Kredit oder Kapital) niedrig und ermöglichen so die Erweiterung der Produktionsanlagen. | Resumiendo: si el volumen de ahorro es grande, el interés (que es el precio del crédito o capital) es bajo, lo que permite ampliar la planta de producción. |

Once we assume that, even at a single point, the pricing process fails to equilibrate supply and demand', so that over a more or less long period demand may be satisfied at prices at which the available supply is inadequate to meet total demand, then the march of economic events loses its determinateness and a range of indeterminateness appears, within which movements can originate leading away from equilibrium. And it is rightly assumed, as we shall see later on, that it is precisely the behaviour of interest, the price of credit, which makes possible these disturbances in price formation.

The question we have to ask ourselves is: What new price-determining factor is introduced by the assumption of a credit supply which can be enlarged while other conditions remain unchanged — a factor capable of deflecting the tendency towards the establishment of equilibrium between supply and demand? Whether we necessarily accept that answer which, to my mind, is the only possible one depends on whether we agree with a certain basic proposition, which could only be briefly outlined here and whose full proof could only be given within the framework of a complete system of pure economics; namely, the proposition that, in a barter economy, interest forms a sufficient regulator for the proportional development of the production of capital goods and consumption goods, respectively. If it is admitted that, in the absence of money, interest would effectively prevent any excessive extension of the production of production goods, by keeping it within the limits of the available supply of savings, and that an extension of the stock of capital goods which is based on a voluntary postponement of consumers' demand into the future can never lead to disproportionate extensions, then it must also necessarily be admitted that disproportional developments in the production of capital goods can arise only through the independence of the supply of free money capital from the accumulation of savings; which in turn arises from the elasticity of the volume of money.

Every change in the volume of means of circulation is, in fact, an event to be distinguished from all other real causes, for the purpose of theoretical reasoning; for, unlike all others, it implies a loosening of the inter-relationships of equilibrium. No change in 'real' factors, whether in the amount of available means of production, in consumers' preferences, or elsewhere, can do away with that final identity of total demand and total supply on which every conception of economic equilibrium is based. A change in the volume of money, on the other hand, represents as it were a one-sided change in demand, which is not counterbalanced by an equivalent change in supply. Money, being a pure means of exchange, not being wanted by anyone for purposes of consumption, must by its nature always be re-exchanged without ever having entirely fulfilled its purpose; thus when it is present it loosens that finality and 'closedness' of the system which is the fundamental assumption of static theory, and leads to phenomena which the closed system of static equilibrium renders inconceivable.

The argument of the foregoing chapters has demonstrated the main reason for the necessity of

the monetary approach to Trade Cycle theory. It arises from the circumstance that the automatic

adjustment of supply and demand can only be disturbed when money is introduced into the

economic system. This adjustment must be considered, according to the reasoning which it most clearly expressed in Say's Theorie des Débouchés, as being always present in a state of natural economy.

For us, the only point of importance is that the effects of an artificially lowered rate of interest, pointed out by Wicksell and Mises, exist whether this same circumstance does or does not eventually react on the general value of money, in the sense of its purchasing power. Therefore they must be dealt with independently if they are to be properly understood. Increases in the volume of circulation, which in an expanding economy serve to prevent a drop in the price-level, present a typical instance of a change in the monetary factor calculated to cause a discrepancy between the money and natural rate of interest without affecting the price level.

The notion that the increase in circulation is due to arbitrary interference by the banks owes its origin to the widespread view that Banks of Issue are the exclusive or predominant agencies which can change the volume of the circulation; and that they do so of their own free will. But the Central Banks are by no means the only factor capable of bringing about a change in the volume of circulating media; they are, in their turn, largely dependent upon other factors, although they can influence or compensate for these to a great extent. Altogether, there are three elements which regulate the volume of circulating media within a country — changes in the volume of cash, caused by inflows and outflows of gold; changes in the note circulation of the Central Banks: and last, and in many ways most important, the often-disputed 'creation' of deposits by other banks. The interrelations of these are, naturally, complicated. As regards original changes in the first two factors —that is, changes which are not set in motion by changes in one of the other factors — there is comparatively little to say. It has already been pointed out that, in principle, an increase in the volume of cash, occasioned by an increase in the volume of trade, also implies a lowering of the money rate of interest — which gives rise to shifts in the structure of production which seem, though only temporarily, to be advantageous. […] Of course, it is possible to assume, with Professor Mises, that the Central Banks, under the pressure of an inflationist ideology, are always trying to expand credit and thus provide the impetus for a new upward swing of the Trade Cycle; and this assumption may be correct in many cases.

What interests us is precisely the question whether the banks are able to satisfy the increased demands of business men for credits without being obliged immediately to raise their interest charges — as would be the case if the supply of savings and the demand for credits were to be in direct contact, without the agency of the banks (as for example in the hypothetical Savings market of theory); or whether it is even possible for the banks to raise their interest charges immediately the demand for credits increases. Even the bitterest opponents of this theory of bank credit are forced to admit that there can be no doubt that, with the upward swing of the Trade Cycle, a certain expansion of bank credits takes place. We must not, however, be satisfied with registering the general agreement of opinion on this point. Before passing on to analyse the consequences of this phenomenon we must ask whether the causes which bring it about that banks increase their deposits through additional credits in periods of boom and thus postpone, at any rate temporarily, the rise in the rate of interest which would otherwise necessarily take place, are inherent in the nature of the system, or not.

The fact, simple and indisputable as it is, that the Elasticity of the supply of currency media, resulting from the existing monetary organization, offers a sufficient reason for the genesis and recurrence of fluctuations in the whole economy is of the utmost importance — for it implies that no measure which can be conceived in practice would be able entirely to suppress these fluctuations.

Once this is realized, we can also see how nonsensical it is to formulate the question of the causation of cyclical fluctuations in terms of guilt, and to single out, e.g., the banks as those 'guilty' of causing fluctuations in economic development. Nobody has ever asked them to pursue a policy other than that which, as we have seen, gives rise to cyclical fluctuations; and it is not within their power to do away with such fluctuations, seeing that the latter originate not from their policy but from the very nature of the modern organization of credit. So long as we make use of bank credit as a means of furthering economic development we shall have to put up with the resulting trade cycles. They are, in a sense, the price we pay for a speed of development exceeding that which people would voluntarily make possible through their savings, and which therefore has to be extorted from them. And even if it is a mistake — as the recurrence of crises would demonstrate — to suppose that we can, in this way, overcome all obstacles standing in the way of progress, it is at least conceivable that the non-economic factors of progress, such as technical and commercial knowledge, are thereby benefited in a way which we should be reluctant to forgo.

For, eventually, a moment must inevitably arrive when the banks are unable any longer to keep up the rate of inflation required, and at that moment there must always be some processes of production, newly undertaken and not yet completed, which were only ventured because the rate of interest was kept artificially low. […] The value of capital invested in processes which can be continued, and, still more, that in processes where continuance is impracticable, will shrink rapidly in value — this shrinkage being accompanied by the phenomena of a crisis.

| Boom and bust. As the rate of interest has been kept artificially low over the last 15 years (partially via QE) I expect a commensurate bust to come (deflationary period). | Boom and bust. Da der Zinssatz in den letzten 15 Jahren künstlich niedrig gehalten wurde (teilweise per QE), erwarte ich einen entsprechenden Bust (deflationäre Phase). | Boom and bust. Dado que el tipo de interés se ha mantenido artificialmente bajo durante los últimos 15 años (en parte a través de la QE), espero que se produzca una caída proporcional (periodo deflacionista). |

| Hayek is some heavy stuff, but there is much to learn with his treatises. | Hayek ist ein harter Brocken, aber man kann aus seinen Abhandlungen viel lernen. | Hayek es un pesado, pero hay mucho que aprender con sus tratados. |

Have a great day,

zuerich

The trade cycle must have really been so much demanding

Legendär der Mann. Kennt jeder Bitcoiner.

!LOL

lolztoken.com

Because they have two left feet.

Credit: marshmellowman

@zuerich, I sent you an $LOLZ on behalf of holovision.cash

(2/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP