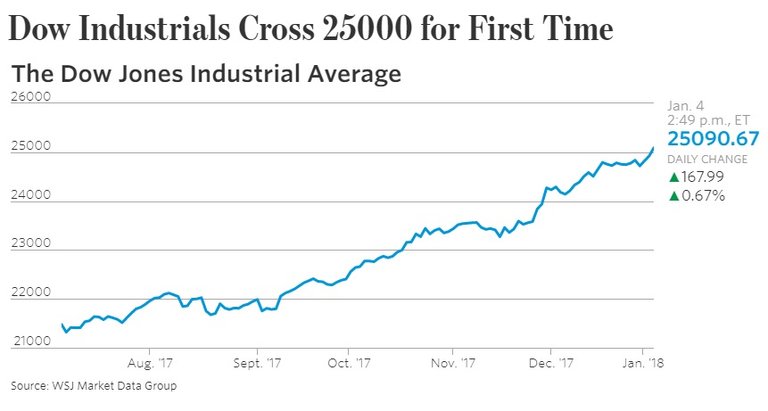

NEW YORK — The nearly viewed Dow Jones modern normal topped 25,000 focuses out of the blue Thursday, proceeding with a run that lifted stocks by more than 20 percent in 2017.

The bellwether measure crossed the notable breakthrough soon after the begin of the day's exchanging. The most recent surge comes as Wall Street examiners raise their gauges for a wide assortment of organizations, wagering they will profit by the quality of the worldwide economy and a move by Congress to cut business charges. Innovation and vitality organizations drove the charge this week. Asian and European securities exchanges were all up overnight too.

For the Dow, including 30 substantial traded on an open market organizations, achieving the 25,000 point of reference holds more representative than handy esteem. It has risen relentlessly since 2009, however has checked 2017 by over and again walking through record levels. The Dow passed the 20,000 limit days after President Trump took office at that point continued climbing, posting 71 record highs a year ago. It passed 24,000 on Nov. 30, influencing the most recent 1,000-point to run the speediest in its 120-year history.

Economy and Business Alerts

Breaking news about financial and business issues.

Join

[Stocks wrap up greatest year since 2013 as speculators disregard awful news.]

Trump has frequently indicated the record-setting ascend in stock costs as proof of the adequacy of his organization's approaches. Recently, Trump estimate the Dow achieving 25,000, an accomplishment, he stated, "few idea would be conceivable this soon into my organization."

In the same way as other experts, Chris Zaccarelli, boss venture officer of North Carolina-based Independent Advisor Alliance, said he anticipates that the Dow will climb further.

"I do trust we'll see 30,000 preceding the buyer showcase closes."

[Here's the organization that conveyed the Dow to its record]

Be that as it may, some market examiners forewarned that the stocks might rise too quick. "At the point when markets climb this much and this quick, they regularly require time to take a split and let basics get up to speed with the new valuations," said Brad McMillan, boss speculation officer for Commonwealth Financial Network. "In this way, appreciate the festival and drink the champagne. However, recollect this: 25,000 isn't really a sign that everything is tantamount to the features propose."

In reality, the S and P 500 hasn't dunked 3 percent in over a year without precedent for late history. A few speculators give off an impression of being disregarding the typical cautioning signals for expect that they could pass up a major opportunity for more benefits on the off chance that they offer now, advertise examiners said.

Those signs incorporate rising U.S. pressures with North Korea, a monetary log jam in China, the aftermath from Britain's choice to leave the European Union and even an extraordinary prosecutor examination concerning Russian interfering into the 2016 race have neglected to shake markets. Stocks have kept on climbing even as the Trump organization undermines to renegotiate exchange bargains that could start striking back by mammoths like China.

North Korean ballistic rocket need to do with the rising cost of gold?]

Some market examiners say, when stock costs definitely start to fall, the decrease could be more emotional and speedier than it has before. In the event that the assessment charge does not create the sort of monetary development Republicans expect, for instance, it could incite financial specialists to trade out their benefits. Financial specialists, up until now, likewise have overlooked the potential market instability that could correspond with Federal Reserve Chair Janet L. Yellen venturing down one year from now, they say.

A possible amendment could "remove a portion of the foam from the market," said Mark Stoeckle, CEO of Adams Funds. "That could be something worth being thankful for a long haul financial specialist."