Summary of the 11th month of the 111 month challenge.

100 Month to go..

11 Month have passed, 100 more to go. What started as a general idea to retire at the age of 55, slowly transformed in a real plan with the following elements worked out:

- Defined a target crypto portfolio;

- Established 2 participations, generating work and income after retirement;

- Started to work on community involvement;

- Defined a roadmap with milestones to reach the final goal.

Summary

#111/11 Scorecard

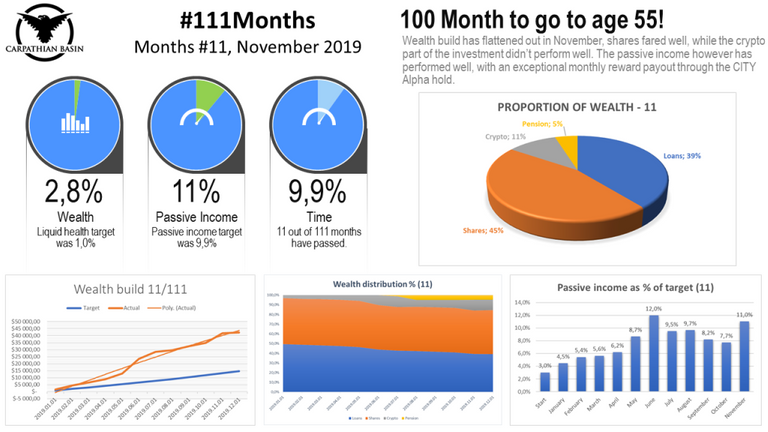

Both passive income and liquid wealth targets are ahead of schedule, although wealth didn’t show a significant growth.

Passive income

My position in all passive income generating entities is continuously increasing. Both in Crypto: CITYUPTAKE, CITY Alpha, WINk and in conventional shares: Unicum, AbbVie and Altria.

CITYUPTAKE has initiated being KYC and Tax compliant, which decreased the paid out amount of income but prevents future offsetting through local taxation. As the amount of CITYUPTAKE held increased, also the weekly rewards are increasing. CITY Alpha delivered a record return, which offset the low value of $TRX completely. Returns in WINk are low, but accumulation is ongoing for future rewards.

The trading profits in shares have been used to increase the position in AbbVie and Altria.

With all of this, passive income is now at 11% of the final target, supporting a quicker accumulation, creating a boomerang effect.

Staking in Cardano (ADA) will start delivering some additional regular rewards

Loans

Loans still make up 39% of total wealth and are continuously decreasing. In 4 months time one of the mortgages will expire, which will create additional free income, to speed up repayments of debt for the future

Stocks

Again during the month of November two stock flips could happen creating profit too increase the hold of AbbVie and Altria.

Crypto

A position of more than 30k $ADA was build up to be ready for testnet and participate in the Cardano staking which will start in the first half of December. After snapshot a part was converted into CITYUPTAKE to increase weekly rewards.

When $BTC was at a level of $7200, the size of the $BTC bag was increased as well. Besides that daily 0.0025 BTC is purchased to build a strong position.

For the near future, $BTT is cheap and accumulation will be expedited also $ADA will be in focus to build up again as I have high expectation on $ADA performance in the second half of 2020. Also BTFS will do some magic for $BTT.

Once all targets below are achieved, focus will shift from Crypto to regular stock market, but before doing so a major correction of stock market has to happen first.

Crypto targets.

100 Months to go….