EOS 2018 Playbook

EOS has been holding up substantially better than most of the other Crypto Big Gaps.

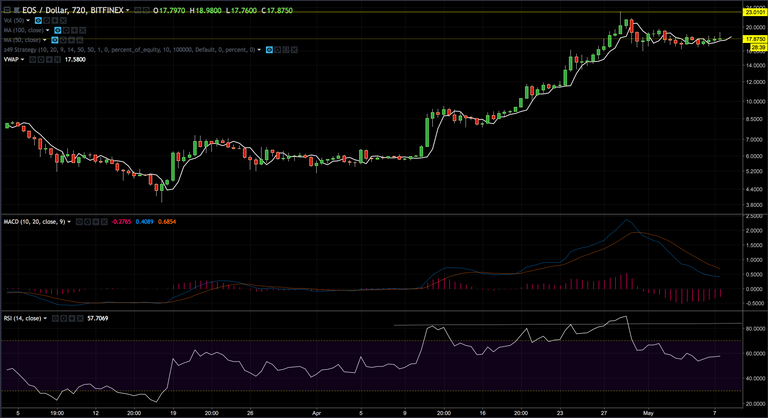

Notably EOS has had a massive run up to new all time highs from the March lows with a rather impressive move in April moving from the $6 range up to the new high at the $23 level in less than 20 days....This is nothing new for crypto.

A Catalyst

In looking forward, how do we move massively higher in the crypt space? As with any financial market we need a catalyst, and as EOS.IO Main Net gets closer to going live in June (25 days from the time of this writing) and 2 days away from Dawn 4.0 release notes people will be making decisions if they will be holding on to EOS and believe in the vision or take profits and run...AKA The Catalyst!

Currently the narrative is that as we are getting closer to the release of EOS that holders people will be piling in.

Thus Far

My strategy with EOS has been following, nearly perfectly, the ETHUSD Spring 2017 analog.

Analogs are less about trading patterns and more about reflecting the longer term psychology of an asset.

For example you can look at the 1920's - 1929 stock market crash and compare it to the 1980's to 1987 stock market crash beautifully. There are many more examples but for the sake of brevity I'll leave the examples to that.

So far the ETHUSD analog with EOSUSD is uncanny. Though the actual price differs and isn't identical, the pattern, the form and shape of the price action and more importantly the rate of change of price.

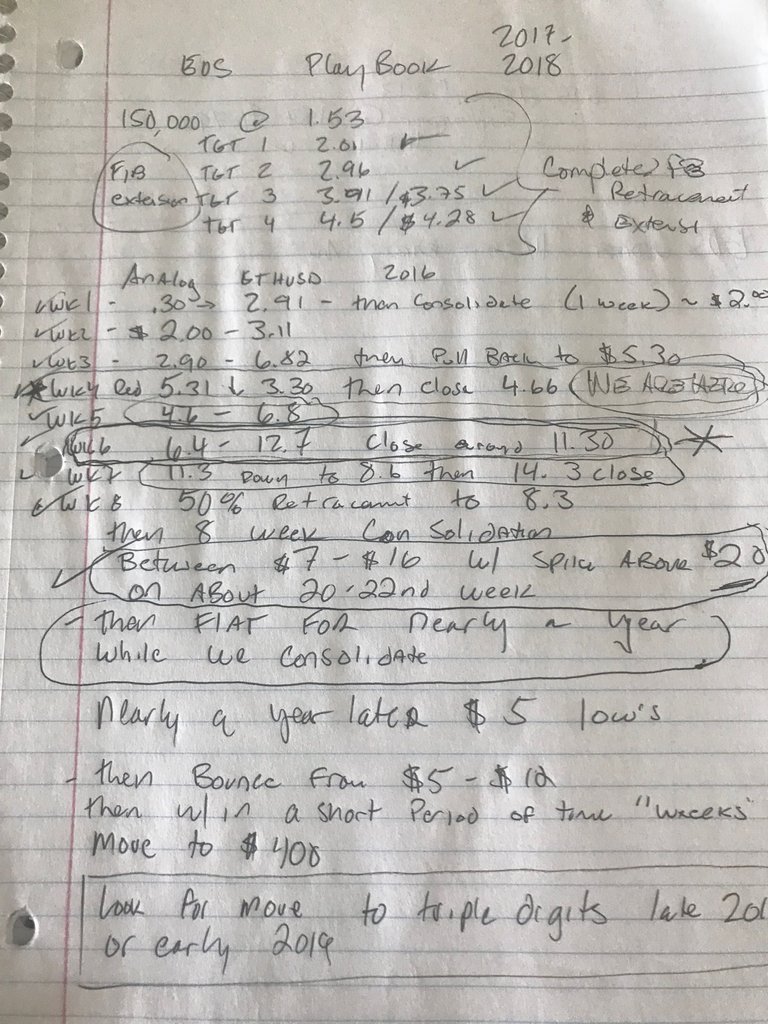

Back in October 2017 I wrote this EOS Playbook and so far it has done a fantastic job of keeping me on the right side of this trade.

It turns out the time frames weren't as accurate as I had written, but the price levels have been spectacular.

The EOS Playbook 2017 - 2019

Q4 2017

Move1 - .30 to 3.00 then consolidate for about a week at the 2.00 level

Move2 - 2 to 3

Move3 - 3 to 7

Move4 - from $5 down to $3 then close the week around $4.66

Move5 - $4.60 to $6.80

Move6 - $6.40 to $12.70 and close the week around $11.30

Move7 - $11.30 down to $8.60 then close the week around $14.30

Then we see a nice 50% retracement and an extended consolidation period

Then a move from $7-$16 with a spike above $20 about at the end of the cycle followed be a pullback down to the $5 levels, crypto winter.

This brings us to the March 2018 lows.

Off the sub $5 lows that we saw we move rather quickly from $5-$12

WE ARE HERE

Then within a short period of time (weeks) we could move to $400 level on EOSUSD

My analog has us currently at the March 9, 2017 "time in price" of ETHUSD, which was trading that day around the $18 price range on ETH. Everything thus far has traded in lock step with the ETH analog, and no surprise, we are currently trading at about the $18 price on EOSUSD at the time of this writing.

ETHUSD March 2017

EOSUSD May 2018

The potential upside from here based purely on the analog show's a tremendous amount of upside potential.

Yes $400 EOS seems ridiculous, and the market cap juxtaposition is the most obvious argument. Who could have imagined BTC or ETH would have market caps at these levels at the beginning of 2017, 2016, heck even 2018. That is to say, crypto is a very different animal, it is illusive and relentless.

This leads to a much bigger thesis I have on how we continue to grow the digital asset space in general, not just one big winner and a thousand losers, but create real value on-boarding the earth's population to a new, secure, place where everyone has access to banking, to protecting their own data, to a better version of the scammy, untrustworthy, version of technology that we suffer through today.

This analysis is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. The research utilizes data and information from public, private and internal sources, including data from actual trades. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. The views expressed herein are solely those of the author as of the date of this report and are subject to change without notice. The author may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed.

A bit about me and my trading Journey

How I became a professional trader

https://steemit.com/introduceyourself/@chris-d/how-i-became-a-professional-trader

Trading during 9/11 attacks

https://steemit.com/crypto/@chris-d/short-selling-when-the-world-is-falling-apart

A Day in the life of a professional trader

https://steemit.com/cryptocurrency/@chris-d/the-day-in-the-life-of-a-professional-trader

Pump it!

Well things certainly changed quickly there! New analysis to follow