I’ll analyze how Bitcoin affects altcoins on the example of Ethereum price moves and update my middle-term forecast for ETHBTC.

In this post, I applied the following tools: fundamental analysis, all-round market view, oscillators, key levels, trendline analysis.

Dear friends,

I continue my series of forecasts. Anyone, who has trades in in the crypto market, faces hard times; many are just tired of waiting when this crypto nightmare will end and altcoins will at last start growing in price. Today, I’d like analyze Ethereum, and see how Bitcoin affects ETH price.

Taking into account the recent extreme price jumps, featured by all altcoins, I’ll try to study ETHBTC pair not just as a trading instrument, but also as an indicator of altcoin market state.

From the fundamental point of view, all cryptocurrencies are pressed now by Bitcoin that serves a transit window for many unsuccessful investors, who are disappointed in the cryptocurrency market and want to withdraw what is still left.

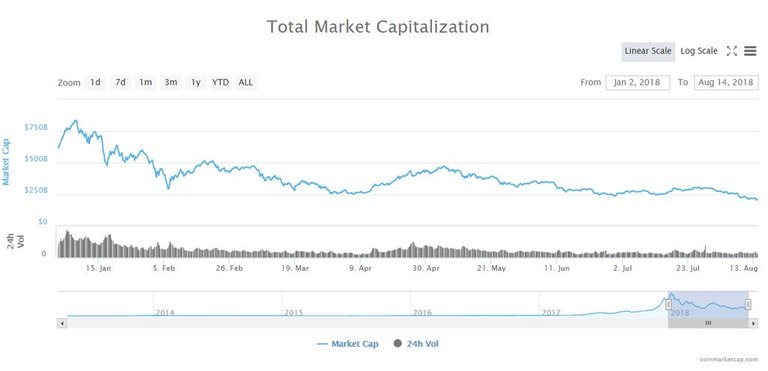

You are likely to have seen this chart of cryptocurrency market cap, but I’ll present it once again.

As you see, since early 2018, the market cap is down from 800 billion USD to 200 billion at the moment; it means, first of all, lower prices for cryptocurrency assets themselves, and second, less amount of money in crypto economy.

Amid the ongoing crypto collapse, there was a very typical news bit that Tether issued another $50 million.

For those, who are not that good at economic sciences, I’ll explain that a cryptocurrency price is formed according to demand/supply ratio. In the current crisis, many are escaping to the cryptocurrency that is backed by fiat money.

Growing demand for USDT results in deficit of these coins. Therefore, Tether has two options now: either set USDT rate free and let grow, following the demand, or cover the deficit by means of issuing more assets.

As you understand, in the first case, the USDT close link to to real USD will be broken, and so, Tether, in fact, just can nothing else, as it doesn’t have anything to cover the deficit.

Increased demand for USDT amid the reduction of cryptocurrencies market cap is a sure sign of panic in the market and escaping from risks.

That is why altcoins look so weak, compared to BTC. Bitcoin serves as a passage between the cryptocurrency world and the Fiat, and many exchange altcoins for BTC only in order to withdraw their money.

Ethereum situation is worsened by big proportion of coins, held by ICO owners. You shouldn’t forget that companies, conducted initial coin offering, are startups or operating businesses, which were raising funds for big expensive projects.

Having acquired large Ethereum stacks, it would be reckless to dump everything at once in the market. However, general negative cryptocurrency context and fueled pessimism make investors go away from risks and exchange the budget, completely or partially, for USD and other fiat assets.

I think this factor to be one of the main fundamental reasons for Ethereum weakness.

On the other hand, Ethereum one of the top coins for mining. And now, when ETH price is breaking through all support levels and goes down directly, without any rebounds, even the advanced miners can give in to panic.

In the chart above, there is alternative.me Crypto Fear index. It is a rather complicated tool that takes into account volatility and trading volume in the market and the sentiment from social networks and other media.

In the chart above, you see a line chart for BTCUSD. If you compare it to the Fear Index line, you can see an amazing regularity, when each new Bitcoin low wasn’t followed by new lows of Fear Index.

How this signal can be interpreted?

In common technical analysis, this phenomenon is considered to be a bullish convergence and is a pivot signal. In our case, this situation can be explained by that people are getting more confident in the idea that the last BTCUSD low is local, and that there won’t be second bottom.

Unfortunately for Ethereum and other altcoins, even if Bitcoin price is growing, there still risks that the downtrend extends, instead of a reversal and a bullish rally.

It explained by Bitcoin dominance in the crypto market and the general trend for accumulation BTC positions.

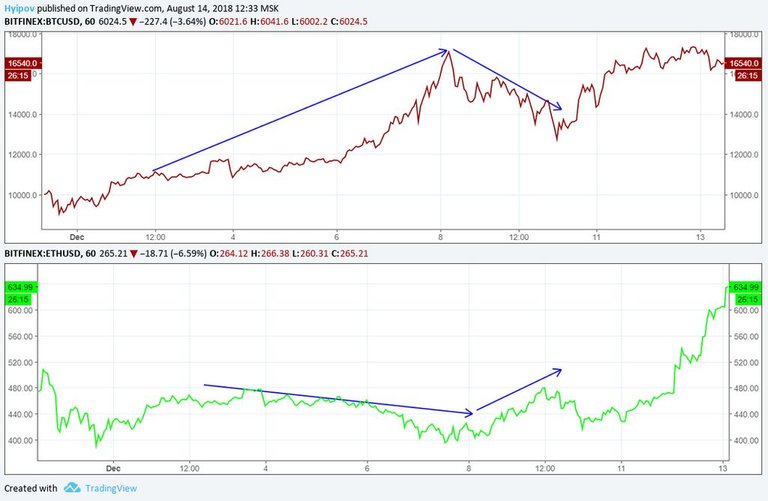

In the chart above, you see the capital is flowing from altcoins into Bitcoin at full power. The last local peak of Bitcoin dominance was as early as in December, 2017. Everybody, who remembers that time, knows how the market was going mad, as the common following bitcoin by altcoins was replaced by completely opposite situation; and when BTCUSD price was flying up, altcoins not only didn’t grow in price, but, on the contrary, their prices were corrected downwards, or staid still, at best.

The chart above quite well shows this situation. In the first half of the chart, you see that up to its dominance peak, Bitcoin price was rising, Ethereum was staying almost the same or even falling down; after the that, the things were going on in the opposite way; Bitcoin downward correction was followed by Ethereum price rise. It was the same for almost all altcoins at that time, and was explained, first of all, by the fact that Bitcoin has lost logical link with the rest of cryptocurrencies, and continued increasing in price without any corrections. An internal driver, pushing Bitcoin price up, was obvious. AS it became known later, it was Tether that was issuing more and more USDTs, which, at first, were pushing BTC up, and then, we re-distributed among all altcoins.

It was a paradox. Now, the situation is the same, only the trend is bearish.

Bitcoin dominance is increasing, market is moving without any redounds, and new USDTs are being issued.

All of these suggest that the situation may repeat, when the capital inflow to Bitcoin and issuing more and more new USDTs due to the panic demand will result in BTCUSD going up or, at least trading flat; and all altcoins will be falling down or breaking through lows.

In ETHBTC monthly chart this situation is quite clear. You see, Ethereum price to Bitcoin has broken out the key level at 0.054. The next support level for Ethereum will be 0.029.

Oscillators in ETHBTC one-week chart don’t suggest any support to the ticker. According to these signals, Ethereum is likely to continue falling down against Bitcoin.

In Ethereum daily chart, there also no strong support levels. The ticker broke through 0.232 Fibo and went down; lower, there is only Keltner channel’s bottom border at 0.0297 December, 2017 low at 0.0239 BTC.

Summary:

ETHBTC price is flying down. According to technical analysis, there are no supports, that is, ETHBTC is likely to continue falling down after a short consolidation. The scenario can be changed only by a sudden buyout of Ethereum, if its price goes higher than 0.0543 BTC. But, taking into account the angle of drop and its strength, I don’t think it is likely.

That is my trading scenario for ETHBTC

In general, the situation for other altcoins is similar; but some certain assets have their special features, which can be crucial in the future. Which assets and what features? You’ll learn from next posts.

I wish you good luck and good profits!

Mikhail @Hyipov