Ethereum is a very interesting and exiting project at the first glance, but I am quite sure that it will fail eventually. The Ethereum community made a few critical mistakes that can’t be repaired and will lead to failure one day. Failure of the Ethereum network can happen tomorrow, but it can take several years too. Since the market is mostly driven on hype, most investors don’t fully understand the tech yet and most financial products will include ETH the price could do very well in the short and medium term, but I think a crash of the network in the long term is imminent.

The hardfork made Ethereum senseless

The roll back of the Ethereum blockchain after the DAO hack was a HUGE mistake. The theft was done in line with the rules of the ETH network, but a flaw in the badly coded Dapp was (mis) used. The people who invested in a bad piece of code were bailed out by the leaders of Ethereum through a chain roll back.

Let this sink in: The consensus reached by the entire group of miners that created the block wherein the hack happened was simply overwritten by a powerful group of individuals. This means that these individuals have the final say in what should and shouldn’t be included in the blocks and the miners are actually useless. Did you ever consider what this means?

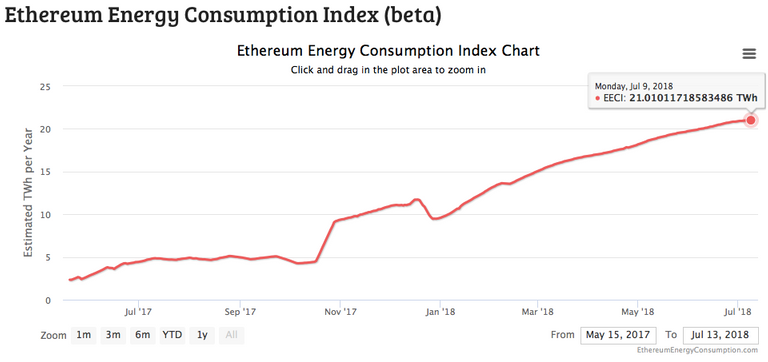

21 Terawatt hour per year is wasted to write blocks that can be overwritten by a group of individuals

The miners currently burn 21 Terawatt hour per year to reach decentralised consensus through PoW every block, and since this can easily be overwritten it is burned without any real purpose (except for giving a false sense of security and decentralisation) and thus pure waste. Bitcoin is burning even more electricity, but since a rollback on Bitcoin is near impossible and consensus of miners is law it gives the extremely valuable features like censorship resistance, immutability and extreme security.

21 Terawatt hour per year is being burned to write a history that can easily be overwritten by a group of individuals. The entire case for having a blockchain is heavily undermined.

Ethereum can’s scale

The use of a blockchain is not only senseless when a centralised entity can overwrite it because it is wasting a lot of electricity, but also because it is extremely inefficient. The entire ledger have to be stored and updated on the computer of every participant in the network to maintain decentralisation while in a centralised system the ledger only have to be stored and updated on one server (and some backup servers). Ethereum became centralised by executing the roll back, but still has the disadvantages of a decentralised system.

There is no blocksize limit on Ethereum and complicated code is directly integrated in the main chain, so the total package of data that every node have to store is growing day by day and creates a bigger and bigger load on the full nodes. The requirements and costs to run a full node are increasing fast, so nodes start to fail to synchronise with the network already and drop off. When this continuous the network will finally crash or be heavily concentrated in a few centralised data centres. This creates a single point of failure or to attack / compromise.

Blockchains simply do not scale easily on the main chain. When the blockspace is limited the maximal amount of transactions is limited too, and when the blocksize is increased it will kick off full nodes and finally lead to centralisation or failure. 2nd and 3rd layers scale much better because only the final settlement have to be registered on the blockchain.

It is key to use the main chain as efficient as possible by keeping the code simple and attract high value use cases because only then you can reach an optimal security level because miners can be paid maximal despite the limited capacity. More complicated features can be build on 2nd layers while benefitting the optimal security of the main chain. Bitcoin has the most compact transaction format and the highest value use case (store of value) on the main chain, so 2nd layers on Bitcoin will always outperform 2nd layers on other blockchains the features are the same.

The Ethereum network is hardly used in the real world and when a Dapp becomes popular it almost crashes the network (Cryptokitties). This will only get worse over time and the only way out will be 2nd layers like plasma. However, since 2nd layers on Bitcoin can do exactly the same as 2nd layers on Ethereum but way more securely it doesn’t make sense to use it. 2nd layers on Bitcoin will always be superior because the level of security and decentralisation is much higher while the other variables are the same.

PoW to PoS

The plan for Ethereum is to switch from PoW to Pos and this may be a release for some of the above described issues, but the process will not be easy and PoS is very insecure. Miners will not support the hardfork because it will make their expensive hardware obsolete and a split will be very likely. Since hundreds of platforms are build on the network I think this could be very messy.

To execute a 51% attack you need 51% of the voting power. ETH is designed to use in smart contracts and thus only a small part of the ETH will be used to be staked. When only 20% of the total amount of ETH is staked an attacker needs just over 10% to do a 51% attack. I think it is very possible that the consortium already owns this share (if not it will happen over time because PoS makes the rich richer).

Regulation WILL hurt Ethereum

There will probably be an era in the future where governments and banks feel threatened and tighten their current tolerant stance against cryptocurrencies. There is nothing they can do to stop Bitcoin except making it some harder to use by restricting centralised onramps, but they can literary destroy Ethereum by arresting the leaders and disallowing the consortium. Bribing or blackmailing of the important individuals can even give an entity like a central bank or government total control over the network without people even remarking it.

Most ICO’s don’t make any sense

For most of the Dapps it doesn’t even make sense to be decentralised. When you register physical assets like gold or property on the blockchain and tokenise them the physical aspect remains dominant. When you buy a few tokens that represent a part of a property and this property is destroyed in a fire or confiscated by the government the blockchain tells you that you own the value but in reality you don’t. You will still need to trust a centralised party to proof the backing.

When the entity that has the final say in the geographical area where the asset is located updates the ledger in a centralised way the result will be exactly the same, but without inefficiency that comes with a blockchain. For digital assets it does make sense to register and trade on the blockchain, but this can be done already extremely securely and traded instantly without counterparty risk on the Bitcoin network through Liquid and Lightning Network.

Conclusion:

Ethereum made two fundamental mistakes. They added complicated code to the main chain and gave up decentralisation with the hardfork. This made the entire consensus mechanism senseless. The network will not be able to scale when real adoption happens it will probably collapse under it’s own load. This means that these two outcomes are very possible: Or Ethereum will not be adopted or it will be adopted and crash because it is not build up properly. Here another post about how a blockchain should be build:

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

We are in a huge mining bubble, when over 50% of the market cap can't scale.

Watt is already per second, no need for an extra per time.

Either TWh per hour or just Terawatt.

In my opinion all alt coins are overvalued (in a bubble) and Bitcoin is undervalued. Hype is created by marketing teams of alts while BTC get mostly negative attention, and exactly there is all the real innovation. Thanks for the correction! I edited it.

Bitcoin core is crippled by Blockstream, to make money with extra services and can not be used as money.

The real innovation comes from alt-coins, but this is no problem, because we have a market to sort this things out.

Really? The only service that makes money(made by Blockstream) is the liquid sidechain and it only the monthly fee. Blockstream will hardly make money off the LN and RSK so?

Ethereum from a technical standpoint stands zero chance at defeating Bitcoin and becoming sound money. The flaws are unbearable and the project can't rebound from them fast enough.

Great post. You did not pull any punches. Lets see what ethereum does to fix its problems.

This post has received a 27.96 % upvote from @booster thanks to: @michiel.

u r right

I would like to contact you but I can't find anything.

Do you have a discord or telegram account?

This things I didn't think it through, but yes, maybe you can be right :(

The fall of the second competitor sound sad :(

I´m a fan of ETH, at least I was, until I read this post. Every project can fail at any moment but ETH is testing the concept of luck.

Personally I invested earlier this year in ETH, but eventually I ended up selling, for new projects with higher ROI. I guess this reflects the hype around big coins(I was controlled by that hype).

I for one like the idea of the LN based tokens and complex Ln smart contracts(that in work in progress from what i heard but theoretically possible).

Here a prezi of how LN based tokens will work:

https://prezi.com/liaz6nsa_cwo/building-on-bitcoin/