23 October 2017 | SUBSCRIBE

// BITCOIN BREAKS $100 BILLION MARKET CAP

Which doesn’t mean much. Theoretically, market caps are the total value of all the outstanding shares at the market price per share. But that just doesn’t follow for tokens like Bitcoin.

First, it is estimated that even up to 25% of the existing supply of bitcoin is irrecoverably lost, and can never be sold. Furthermore, a minimum of 5% of bitcoin is stolen, and due to the transparent nature of bitcoin, can’t really be spent.

This means that far from there being ~16 million bitcoins in circulation, there may be less than 10 million. And if it’s market cap should still be $100 billion, then it would suggest each coin should be worth nearer $10,000. But it’s academic - the point is bitcoin’s market cap is not $100 billion.

Do we really mean that bitcoin is worth $100 billion? No, probably not. The majority of bitcoin (that isn’t lost or stolen) isn’t even for sale. They are held as long term investments by individuals that offering even a 100% premium to the current market price would not be enough for them to sell. The technical term is: HODL.

All we can say is: right now, a bitcoin can be bought or sold for ~$6,000. As for the total value of bitcoin - whether that’s market cap, enterprise value, or some other measure - I can’t tell you - but I just know it isn’t $100 billion.

// MUST READS

- Mangrove Capital Partners’ report on the disruption of venture capital

- An overview of decentralised blockchain-based projects

- Top tier VCs are investing heavily in blockchain companies

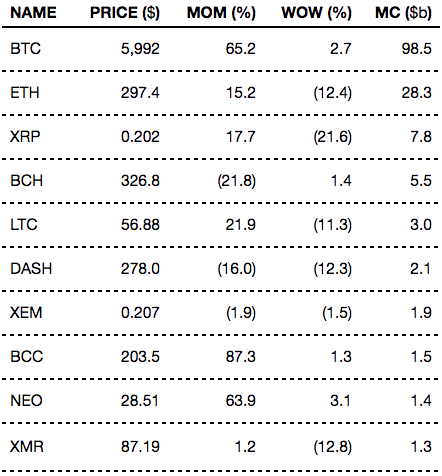

// PRICING SUMMARY

// DISASTER OF THE WEEK

Three months after Tezos raised $232m, Reuters broke the news that the founders are now fighting a battle with the foundation that controls the funds. In the founders’ own words, development and progress on the blockchain has all but stopped. The irony should not be lost that Tezos was touted as a ‘self-governing’ blockchain, deliberately built to avoid the governance issues of bitcoin.

Tezos - although the token is not yet created or tradable - futures were down as much as 60% in the wake of the news, and the lawsuits have already begun.

// TRACTION

- Mastercard is starting to process payments on it’s own blockchain.

- JPMorgan launches a new payment process that uses blockchain technology.

- A new blockchain based banking process lead by IBM will enable near instant cross-border payments.

- Russia will launch its own cryptocurrency called the CryptoRuble.

- Kazakhstan first digital currency backed by fiat and bonds.

- Massachusetts Institute of Technology issued the first digital diplomasusing blockchain technology.

// ROAD TO REGULATION

- Spanish banks, telcos and utilities companies have established ablockchain consortium called Alastria.

- The head of the committee on financial policy and banking in Ukraine proposed to recognise cryptocurrencies as a financial asset.

- The Association of Entrepreneurs of Russia asked the Federation Council and the State of Duma to only allow local cryptocurrencies to operate in the territory.

- Australia looks to bring Bitcoin into AML and terrorism financing regulations.

// ICOS

Last week highlights:

- Change Bank raised $15.7m for a decentralised cryptobank

- Chainlink has raised $32m for a fully decentralised oracle network

- Eidoo raised $25m to improve blockchain user-experiences

Upcoming:

- Boulé - October 25, 2017 - Voting technology based on the blockchain

- Cash Poker Pro - October 26, 2017 - Decentralized poker room

- Lockchain - October 29, 2017 - 0% commission blockchain based hotel booking

- Gatcoin - October 28, 2017 - Blockchain Based Customer Rewards

// OTHER

Ways that cities might build their future on a blockchain framework. Google & Goldman Sachs are top investors in the Blockchain space. Vitalik Buterin thoughts about Central banks and their inability to build cryptocurrencies. Five ways banks might use blockchain.

// EVENTS

Trading the future: Investing in Cryptocurrency - London, UK - October 23, 2017

IoT Security Summit - New York, U.S.A - October 23-24, 2017

Blockchain 360: Scalling Blockchain for IoT - New York, U.S.A - October 23-24, 2017

World Blockchain Summit - Dubai, UAE - October 24-25, 2017

CoinAgenda Global: Bitcoin & Digital Currency - Las Vegas, U.S.A - October 24-26, 2017

Ethereal SF - San Francisco, U.S.A - October 27, 2017

BlockBali - Bali, ID - October 27, 2017

BitBrighton - Brighton, UK - October 28, 2017

Texas Bitcoin Conference - Texas, U.S.A - October 28-29, 2017

FOLLOW US : https://steemit.com/@the-reserve

really great newsletter, been following it since the beginning. Keep up the good work!

Excellent resume, I re-blogged it !

thanks :), appreciate it